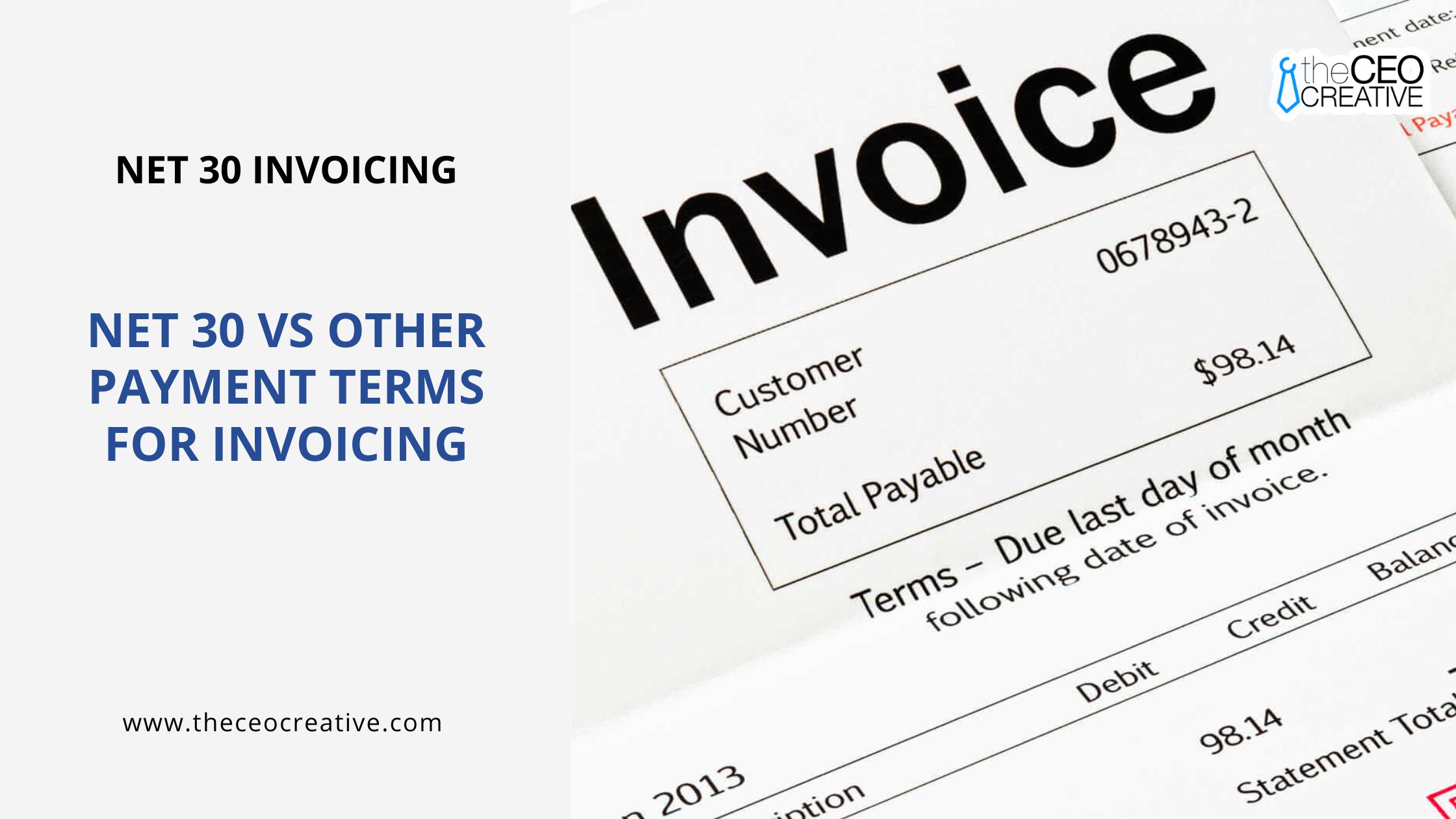

Introduction to Net 30 vs Other Payment Terms

Hi everyone! If you’re running a business or considering starting one, you might have heard the term “Net 30.” It might seem a bit confusing at first, but it’s actually quite simple. Essentially, it’s about when you get paid for the work you do.

In this blog post, we’ll explain what Net 30 means and compare it to other common payment methods, so you can decide what’s best for your business. Let’s get started!

Net 30 vs Net 10: A Closer Look at Shorter Payment Cycles

Understanding the Timeframes for Payment: Decoding Net 30 and Net 10 Invoicing Terms

Okay, let’s begin with the basics. When you see “Net 30” on an invoice, it means your client has 30 days from the invoice date to pay you. Think of it as a time allowance. You’ve provided your goods or services, sent the invoice, and now your client has 30 days to pay the bill. So, if you send an invoice on October 1st with Net 30 terms, your client must pay by October 31st.

“Net 10” works similarly, but with a much shorter time frame. Here, your client has only 10 days from the invoice date to make the payment. This can be good for businesses that need money faster, but it might also push clients to pay more quickly.

Remember, the “invoice date” is when the payment period starts. This is usually the date the invoice is created, so it’s helpful to clearly mark the invoice date on the document to prevent any misunderstandings.

Impact on Cash Flow and Business Operations: Analyzing the Financial Implications for Your Company

Choosing between Net 30 and Net 10 can greatly affect your business’s cash flow and overall financial well-being. Think of your business’s cash flow as a river – you need a steady and predictable income to keep everything running smoothly.

Net 30 provides a more flexible payment plan, giving your clients extra time to handle their own finances and pay their bills. This can build goodwill and strengthen client relationships, especially with bigger businesses or those with complicated payment systems. However, the longer payment period means you’ll need to plan carefully to manage your finances with a delayed income. This might involve careful budgeting, getting credit lines, or having enough cash saved to cover expenses while waiting for payments.

On the other hand, Net 10 offers a faster way to get paid. This can be very helpful for companies that need quick cash to pay for things like salaries, rent, or buying stock. The sooner you get paid, the sooner you can use that money to grow and expand your business. But, asking for faster payments might not work well with all customers, which could cause problems or even make some customers decide not to work with you.

In the end, choosing between Net 30 and Net 10 depends on many things, like your industry, the size of your business, your customers, and your overall financial plan. Think carefully about the good and bad points of each choice to find the best option for your business.

Net 30 vs Net 60: Navigating Longer Payment Cycles

Advantages and Disadvantages of Each Payment Term: Weighing the Pros and Cons for Your Business

Let’s move on and look at the differences between Net 30 and Net 60. Net 60 means your clients have 60 days to pay their bills. This longer time can be both good and bad, so let’s talk about the pros and cons.

Net 30

- Advantages:

- Quicker payment processing than Net 60.

- Better cash flow to handle costs and invest again.

- Lower chance of delayed payments or unpaid debts.

- Disadvantages:

- Might not attract some clients who like longer payment periods.

- Could possibly harm relationships with clients needing more financial freedom.

Net 60

- Advantages:

- More appealing to customers who need longer time to pay.

- Helps in winning new customers over competitors.

- May build better customer relationships by providing more financial options.

- Disadvantages:

- Takes much longer to get paid compared to Net 30.

- Can cause cash flow problems, especially for companies with high costs.

- Increases the chance of delayed payments or unpaid debts.

Choosing the Right Term Based on Business Needs: Finding the Perfect Fit for Your Invoicing Strategy

Choosing between Net 30 and Net 60 involves thinking about your business needs and what your clients expect. Here are some important points to consider:

- Your Industry: Different industries have different payment habits. Some prefer longer payment periods, while others like shorter ones. Look into what is usual in your field.

- Your Clients: Think about the size and financial health of your clients. Bigger companies might like Net 60, but smaller businesses or individuals might prefer the quicker Net 30.

- Your Cash Flow: Be honest about your business’s financial health. If you need quick payments to cover costs, Net 30 could be better. If you have more financial room, Net 60 might work.

- Your Growth Plan: If you want to grow quickly, faster payments (Net 30) can help. If you focus on long-term client relationships, the flexibility of Net 60 might be more suitable.

In the end, the best payment term is the one that matches your business goals and helps keep your finances steady. Don’t hesitate to try different methods and make changes as your business grows.

Pros and Cons of Using Net 30 for Invoicing: A Balanced Perspective

Benefits for Buyers and Sellers: Exploring the Advantages of Net 30 Payment Terms

Net 30 is a common practice in many industries, and it makes sense. It gives buyers some time to pay while making sure sellers get their money on time. Here are the main advantages for both sides:

Benefits for Buyers:

- Better Cash Flow Control: Net 30 gives customers 30 days to handle their money and set aside funds for paying bills. This is very useful for companies with limited budgets or those needing to match payments with their income.

- Improved Financial Planning: The clear payment schedule helps customers predict their expenses more accurately and keep a steady cash flow.

- Stronger Vendor Connections: By following Net 30 rules, customers show they are responsible with money and build trust with their suppliers. This could lead to better terms or discounts in the future.

Benefits for Sellers:

- Quick Payments: Net 30 helps you get paid faster than longer terms, which helps manage your money better.

- Fewer Delays: With Net 30, there’s less chance of late payments or not getting paid at all, which makes your business more stable.

- Common Practice: Net 30 is used a lot and is easy to explain to customers, so you don’t need to spend much time discussing it.

Potential Challenges and Considerations: Navigating the Drawbacks of Net 30

Net 30 has many benefits, but it’s important to know about some possible issues and things to think about:

- Waiting for Money: If your business needs money right away, waiting 30 days to get paid can be hard, especially if you need the money for daily costs or to grow your business.

- Risk of Slow Payments: Even though 30 days is a short time, there’s still a chance that customers might pay late. This can mess up your plans for money and need extra work to remind customers to pay.

- Not Good for Everyone: Net 30 might not work well for businesses with small profits or those in fields where people take longer to pay.

To solve these problems, sellers can try methods like giving discounts for early payments to encourage quick payment, explaining payment rules clearly from the start, and using accounting tools to handle invoices and track payments automatically.

Net 30 vs 2/10 Net 30: Decoding Early Payment Discounts

Understanding Discount Terms and Their Impact: Incentivizing Prompt Payment

Let’s make things a little more interesting by looking at a version of Net 30 that offers a nice bonus: early payment discounts. “2/10 Net 30” might look confusing at first, but it’s really straightforward. It means that the full payment is due in 30 days, but the buyer can save 2% if they pay within 10 days.

This is like a win-win situation. The buyer gets a small savings for paying early, and the seller gets their money faster, which helps with their cash flow. But how does this affect your business choices?

Impact on Buyers:

- Saving Money: Using the discount can lead to big savings, especially for bigger bills.

- Better Vendor Relationships: Paying early shows you’re financially responsible and helps build trust with your suppliers.

Impact on Sellers:

- Faster Cash Flow: Getting paid earlier helps improve cash flow, letting you invest or cover expenses more quickly.

- Lower Chance of Delayed Payments: Giving discounts encourages customers to pay on time, reducing the risk of late payments or unpaid bills.

- Chance to Boost Sales: Offering early payment discounts can make your business more attractive, bringing in new customers and encouraging bigger orders.

Making Informed Decisions Based on Financial Goals: Is an Early Payment Discount Right for You?

Deciding whether to offer a 2/10 Net 30 discount or stick with standard Net 30 terms depends on your specific financial goals and priorities.

For Buyers:

- Check the Discount: Figure out how much you’ll save with the discount and think about your money situation. Should you take the discount or keep your money for other things?

- Check Payment Ability: Make sure you have enough money to pay within the 10 days to get the discount.

For Sellers:

- Check Profit Margins: See if giving a 2% discount is possible without hurting your profits too much.

- Predict Cash Flow: Estimate how early payments might affect your cash flow and check if it meets your financial goals.

- Think About Customer Relationships: Giving discounts can improve customer loyalty, but make sure it works for your business over time.

By thinking about these points, you can decide if offering early payment discounts is a good idea for your invoicing plan.

Choosing the Right Payment Terms for Your Business Invoicing: A Customized Approach

Factors to Consider When Setting Payment Terms: Tailoring Your Invoicing Strategy

We’ve looked at different payment options, like Net 30, Net 60, and the attractive 2/10 Net 30. Now, let’s combine all this information and talk about how to pick the best payment terms for your specific business needs.

There isn’t a single solution that works for everyone, so it’s important to think about several things:

- Industry Standards: Find out what’s usual in your field. Some industries, such as construction, commonly use longer payment periods, while others, like retail, might like shorter ones.

- Business Size and Type: Small businesses or new companies might need faster payments to handle their money flow, while bigger, more established businesses might have more freedom with longer payment times.

- Building Good Client Relationships: Think about what your clients can afford and what they prefer. Giving them options for paying over time can help you connect better with them and make them more loyal.

- Managing Your Money: Look at your business’s money situation honestly. If you need quick payments to pay your bills, you should ask for shorter payment times. If you have extra money, you could allow longer payment times.

- Handling Risk: Think about how much you can handle if clients pay late or don’t pay at all. Shorter payment times lower the risk, while longer times raise it.

- Staying Ahead of Competitors: Check what payment options your competitors offer. Giving your clients better payment terms can help you stand out.

Balancing Customer Needs with Business Objectives: Finding the Sweet Spot

Deciding on payment terms requires careful thought. You need to satisfy your customers and keep good relationships, but also protect your business’s money. Here are some suggestions to use Net 30 Effectively:

- Be Clear: Make sure your payment terms are easy to understand on invoices and in contracts. Being open helps build trust and prevents confusion.

- Provide Choices: Offer various payment methods, like credit cards, online payments, or payment plans, to suit different customer needs.

- Stay Adaptable: Be ready to discuss and change payment terms for each situation, especially for important clients or big projects.

- Use Tools: Use accounting software to handle invoicing, payment reminders, and late payment follow-ups automatically. This makes things easier and saves time.

- Keep Checking: Regularly look at your payment terms and update them as your business changes and grows.

By thinking about these things and keeping good communication with your clients, you can set up payment rules that help build strong connections and support your business’s future growth.

Conclusion

Throughout this blog post, we’ve talked about how important it is for any business, no matter the size, to understand and use the right payment terms. You can choose from options like Net 30, Net 10, Net 60, or 2/10 Net 30. The main thing is to pick the one that works best for your business and its goals.

Keep in mind that how you handle invoicing is very important for keeping a steady cash flow, building good relationships with clients, and helping your business grow. By thinking about things like what’s common in your industry, what your clients prefer, and your own financial needs, you can set up a payment system that helps everyone and makes things run smoothly.

Feel free to try new things, adjust, and improve your methods as your business grows. Stay in touch with your clients, use technology to make your work easier, and try to find a good mix of keeping customers happy and making sure your business stays financially healthy.

By carefully planning and thinking ahead about payment options, you can make your business run more smoothly and be more successful. Here’s hoping for easy invoicing and strong business connections!