When a company buys office supplies on credit, it must keep track of them as supplies on hand. Because the goods on hand are often consumed within a year, they are represented as a current asset on the company’s balance sheet. Office supplies are costs that are incurred throughout the course of business activities. In reality, it can be observed that there are a variety of distinct demands in daily office work that must be met by the company.

These expenses, while not large on their own, become enormous when added together in yearly totals. As a result, they are primitive in terms of accounting and must be dealt appropriately in accordance with accounting rules.

To comprehend the bifurcation of office supplies and the corresponding categorization, it is necessary to first comprehend the types of office supplies and their applications.

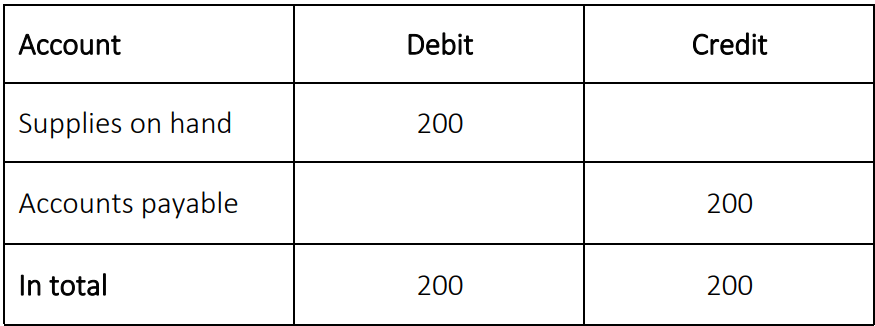

Example of a Purchase Office Supplies on Account Journal Entry

Assume a company spends $200 on pens, stationery, and other office supplies and receives credit terms from the supplier.

On account journal entry, the accounting records will indicate the following bought supplies:

Explanation of Bookkeeping

Debit

Consumable office goods (pens, stationery, etc.) have been received by the company and are being held as a current asset as supplies on hand.

Credit

The credit entry indicates the obligation to pay the provider for the products provided in the future.

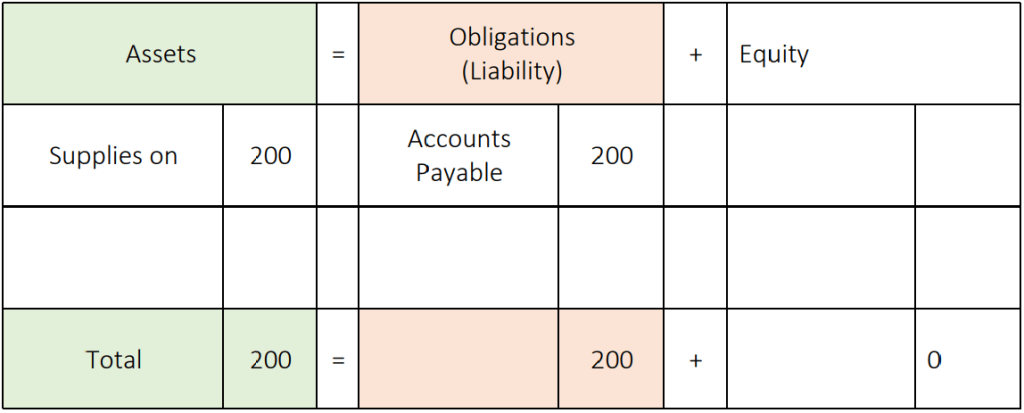

Accounting Equation for Purchasing Office Supplies

Assets = Obligations + Owners Equity is an accounting equation that states that a company’s total assets are always equal to its total liabilities(obligations) plus its total equity. This holds true at all times and for all transactions. The accounting equation for this transaction is presented in the table below.

In this example, an asset (supply on hand) grows, indicating that the company has office consumables on hand for immediate use. The responsibility to pay the supplier for the products (accounts payable) at a later period is the opposite side of the accounting equation.

It is necessary to divide time into the following subcategories in order to comprehend the proper accounting method.

Supplies at the Start of the Year: Some supplies may be carried over from the previous year at the start of the financial year. They would be included under Current Assets on the prior year’s Balance Sheet. Another way to look at it is that they were Prepaid Expenses that had been paid in advance, but the value of the goods had yet to be determined.

Other Supplies Utilized Throughout the Year: A few additional supplies are used throughout the year. It’s critical to guarantee that they are supplies-related expenditures, just like every other expense the firm incurs during the year. The used office supplies are recorded as costs in the company’s profit and loss account.

Unused supplies at the end of the year: Supplies that are left unutilized at the end of the year are meant to be classified as Current Assets since the firm has already paid for them in advance but has yet to extract the utility from them. As a result, they are recorded on the balance sheet as current assets.

Final thoughts

To summarize, the table shown above demonstrates that office supplies are commodities utilized by a firm to perform essential activities. Stationery, fittings, documents, and other miscellaneous things required in everyday operations are examples of office supplies.

They are classified as non-capital or operational costs since they do not represent a major financial investment. In reality, these costs are deducted from earnings with each passing year, and the balance is considered as a Current Asset if paid in advance, and as a Current Liability(Obligation) if not.