Business owners, sellers, and entrepreneurs are always looking for ways to streamline their finances and make managing cash flow easier, and “ Net 30” is one effective strategy to help achieve this.

A Net 30 account allows businesses to buy goods or services and pay for them within 30 days, providing a financial cushion that helps smooth out cash flow. This flexibility can be very helpful for businesses looking to balance immediate costs with incoming revenue.

If you are wondering, ✅ What is a Net 30 account? ✅ How does it work? ✅ How can it benefit your business?

You have come to the right place!

We are here to help you understand all these terms and explain why Net 30 could be the perfect fit for your business. Take a cup of coffee, sit down, and let’s begin!

What Is A Net 30 Account And How Does It Work?

A net 30 account is a trade credit agreement in which a supplier allows a business to purchase goods or services and pay for them within 30 days. It is a simple way to manage cash flow without needing to pay immediately, and it can be a helpful tool for businesses needing more time to cover costs.

Here is an example to help you understand how Net 30 works:

| Imagine you run a small retail business selling electronics and need inventory without draining cash reserves. You partner with a supplier offering Net 30 for electronics.

Scenario: On June 10, 2025, you order $6,000 in electronics (e.g., wireless earbuds and tablets). The supplier approves your Net 30 account and delivers the same day. Payment Terms: The supplier issues an invoice with Net 30 payment terms, meaning you have until July 10, 2025—30 calendar days, to pay the $6,000 without interest. Business Benefit: You sell the electronics and earn $8,500 in 30 days. You pay the $6,000 on time and keep a $2,500 profit without using upfront cash, freeing funds for marketing or payroll. Credit Building: Timely payment is reported to credit bureaus, boosting your business credit score and unlocking better supplier terms or loans. Interest Note: Miss the July 10 deadline, and a 1.5% late fee ($90) may apply. Track due dates to avoid penalties. |

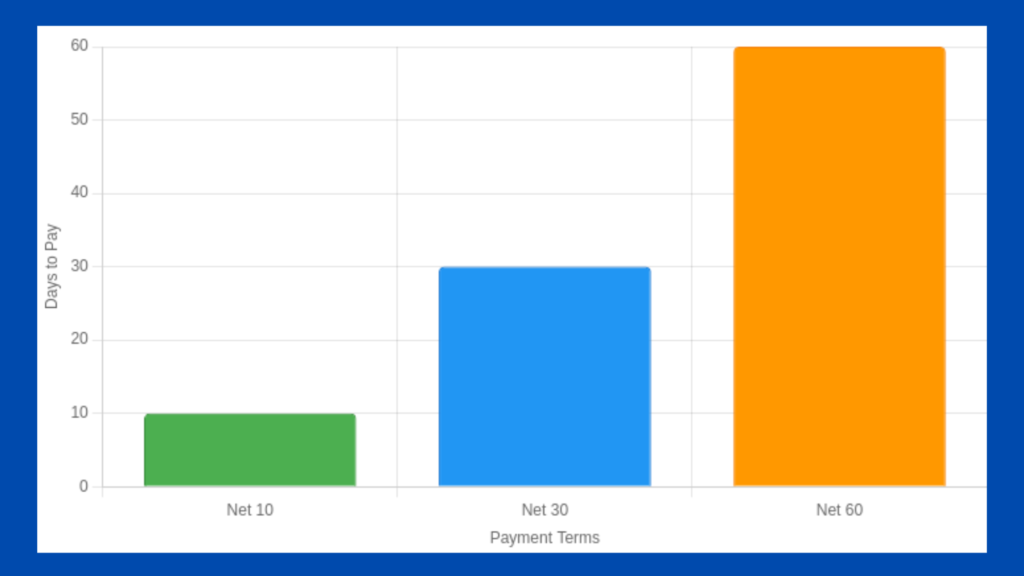

Comparison Of Net 30 With Other Net Terms

Suppliers offer various payment terms to suit different needs. Here’s a comparison:

| Term | Payment Due | Best For |

| Net 10 | Within 10 days | Quick-turnaround transactions |

| Net 30 | Within 30 days | Most small and medium businesses |

| Net 60 | Within 60 days | Established buyer-supplier relationships |

| Net 90 | Within 90 days | Long-term, trusted partnerships |

| Note: Some suppliers offer discounts for early payments, like 2/10 Net 30, which means a 2% discount if paid within 10 days; otherwise, the full amount is due in 30 days. |

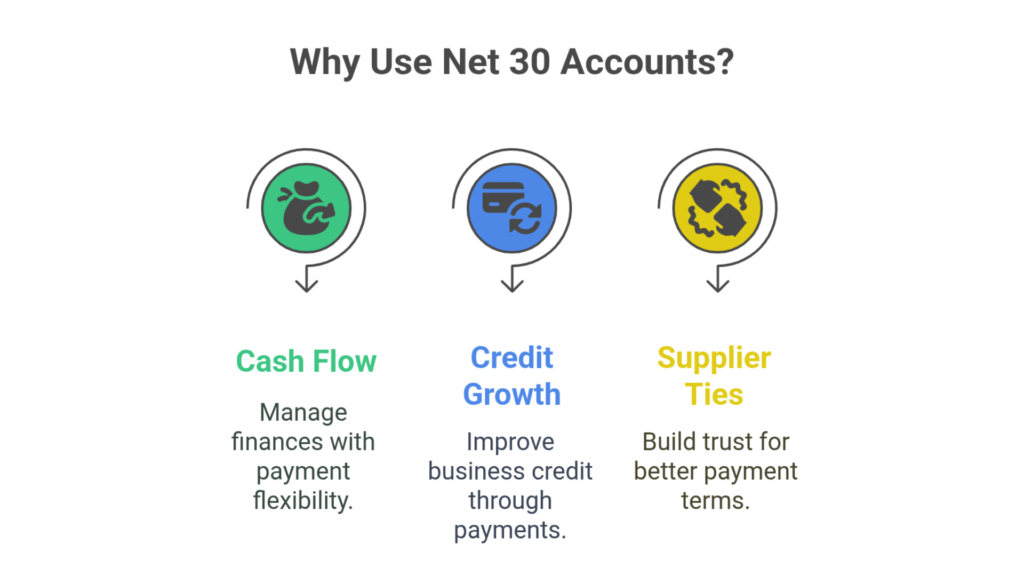

Benefits Of Net 30 Accounts

Net 30 accounts enhance our business’s financial framework. Let’s explore some of the remarkable benefits they offer:

- Enhanced Cash Flow: Delay payments for 30 days to fund immediate needs or growth initiatives.

- Improved Credit Profile: On-time payments are reported to credit bureaus, strengthening your business credit score.

- Stronger Supplier Relationships: Reliable payments foster trust, potentially unlocking discounts or extended terms like Net 30 to Net 60.

- Growth Support: Ideal for small businesses or startups scaling without cash flow strain.

- Cost Savings: Early payment discounts (e.g., 2/10 Net 30) reduce expenses, increasing profitability when you pay within the discount window.

- Inventory Flexibility: Purchase goods like electronics or office supplies without upfront costs, enabling you to meet demand during peak seasons.

- Financial Predictability: Fixed 30-day payment terms simplify budgeting, helping you align expenses with revenue cycles.

How To Find The Right Net 30 Vendor?

To get a Net 30 account, you first need to find companies offering this option. Here’s how you can find them:

- Look for information: Start by looking for companies selling products or services your business uses. Check their websites or rules to see if they offer Net 30 terms.

- Talk to others: Ask people in your industry or attend events where businesses meet to find companies offering Net 30 terms. Sometimes, hearing from others can help you find good companies.

- Checklists: Use websites or books that have lists of companies known for offering Net 30 terms. Some examples are Dun & Bradstreet, Nav, or other websites that help businesses build credit.

How To Qualify For Net 30 Terms?

After you find some companies, you must ensure you qualify for these payment terms. Usually, these include:

- Business Registration: Ensure your company is legally registered.

- Business Credit Profile: Some suppliers require a credit history; check your business credit status.

- Operational History: Established businesses are often preferred, showing payment reliability.

- Financial Documentation: Provide financial statements to prove your ability to pay invoices on time.

Meeting these requirements streamlines the application process and boosts your chances of getting approved.

How To Create A Net 30 Account?

Getting a Net 30 account is simple with the right steps. Here are your steps to apply for a Net 30 Account:

Step 1: Find Suppliers: Look for vendors that offer Net 30 terms for small businesses, such as those selling office supplies or electronics.

Step 2: Complete Application: Fill out the application with your business details, including your name, tax ID, and financial information.

Step 3: Provide Documentation: Include necessary documents, like your business registration, tax ID, or financial statements.

Step 4: Review Terms: Make sure you understand payment deadlines, late fees, and early payment discounts.

Step 5: Wait for Approval: Suppliers will check your business details and creditworthiness.

Step 6: Start Ordering: Once approved, you can begin purchasing on credit.

Tips For Managing Net 30 Accounts

- Use accounting tools to track due dates and avoid late fees.

- After building trust, request extended terms (e.g., Net 30 to Net 60) or discounts.

- Take advantage of discounts like 1/10 Net 30 to reduce costs.

- If delays occur, inform suppliers early to maintain strong relationships.

Is Credit Check An Important Requirement Of Net 30?

A big part of getting a Net 30 account is having your credit checked. This is different from personal credit checks. Business credit checks look at how well your company can handle credit. However, there is nothing to worry about; even new businesses with little credit history can get a Net 30 account, especially if they start by working with suppliers who help new companies.

Here’s what suppliers usually look at:

- Business Credit Scores: To assess your credit reliability, they might look at your business credit report from companies like Dun & Bradstreet, Experian, or Equifax.

- Trade References: Suppliers could ask for recommendations from other sellers you work with under terms like Net-30 to understand how you manage credit.

- Financial Statements: Some suppliers may want to see your business’s

financial records to assess its financial health.

Conclusion

Net 30 accounts empower small businesses, startups, and established companies to manage cash flow, build credit, and strengthen supplier relationships. By following the application process, paying on time, and leveraging strategic tips, you can maximize the benefits of Net 30 terms. Start exploring suppliers today to unlock financial flexibility for your business!

Frequently Asked Questions

Q1 What does Net 30 mean?

A1 Payment is due within 30 calendar days from the invoice date, unless specified as business days.

Q2 What does 1/10 Net 30 mean for an $800 invoice?

A2 You can take a 1% discount ($8) if paid within 10 days; otherwise, pay $800 within 30 days. If settled by day 10, the payment would be $792.

Q3 How do you qualify for Net 30?

A3 You need a registered business, good standing, and sometimes a basic credit profile. Startups can target suppliers with lenient requirements.

Q4 Is Net 30 a line of credit?

A4 Yes, it’s a form of trade credit that allows purchases up to a set limit. Payment is due in 30 days.

Q5 How do I get paid with Net 30?

A5 As a buyer, you pay the supplier within 30 days. As a vendor, you invoice clients and receive payment by the due date.

Q6 When should you pay Net 30 accounts?

A6 Pay by the 30th day to avoid penalties. Pay early (e.g., within 10 days) to claim discounts like 2/10 Net 30.

Q7 How to calculate 1/10 Net 30 for $800?

A7 Calculate 1% of $800 ($8). Pay $792 within 10 days or $800 within 30 days.

Q8 What are the best payment terms for a small business?

A8 Net 30 is ideal for most small businesses, balancing flexibility with manageable deadlines.