Have you heard of Net 30 terms and wondered whether this could benefit your business? Great! You are in the right spot! In terms of the world of business credit and payment terms, Net 30 has become a trendy concept. Basically, Net 30 means that clients have a full 30 days from the invoice date to pay. While this appears to be simple, there are many factors to consider before you can decide if either you will offer Net 30 terms to your clients, or be able to accept Net 30 payment terms from your supplier. It is very important to look at the impact this can have on your cash flow and your client relationships. Let’s see what works best for you!

What Are Net 30 Terms? — A Clear Explanation

Definition and Basics of Net 30

Net 30 terms essentially is a payment structure in which the buyer agrees to pay for a vendor’s goods or services in 30 days after receiving either. It is widely used when developing a financial relationship, because this gives the buyer more flexibility to manage cashflow. In a 30-day payment structure, businesses will be able to manage their cash flow better than in a cash-on-delivery situation and keep their suppliers happy.

Common Industries Utilizing Net 30

Net 30 terms are common in areas where companies frequently buy or sell large amounts of goods and services. For example, in manufacturing, it is common for the company to rely on Net 30 terms, because of regularly needing to produce goods and large orders. Similarly, the construction industry regularly uses Net 30 payment terms, so the payment aligns with project implementation. In creative industries such as marketing or design agencies, Net 30 terms may be heavily utilized so that project completions and payments align.

How Net 30 Terms Apply Specifically to Office Supply Purchasing

Office supplies represent another sector in which net-30 terms really shine. Businesses are frequently going to need supplies to ensure their operations remain successful, but the business perhaps does not have cash on hand to purchase supplies right away. Net 30 terms allow companies to buy items they need upfront (such as printing paper or office swivel chairs) without impeding the company’s cash flow. This process allows a company to get an item needed for the workplace and to build an environment of trust and reliability in business.

Benefits of Using Net 30 Terms for Your Business

Enhanced Client Relationships

Providing Net 30 payment terms can greatly improve relationships with clients. As your business allows clients to pay under a certain payment period, you may be perceived as more accommodating and considerate, which can elevate customer satisfaction. Satisfied clients will likely remain clients and may make referrals to new clients who are looking to pay under these types of terms.

Increased Sales Opportunities

When customers understand they have the option to pay at a later date, they may feel more inclined to purchase more often or larger amounts. The idea of immediate outlay is typically overwhelming. Thus, I think Net 30 terms can create more opportunities for sales by making the convenience of payment more appealing to your customers.

Competitive Advantage

In an increasingly crowded marketplace, it is crucial to ensure you are ahead of your competition. Offering Net 30 terms could be the strategic advantage that differentiates your company from others. Competitors in your industry – those who don’t offer Net 30 terms – may lose potential future clients who require or prefer such financial flexibility. Not only can Net 30 terms reinforce your reputation as a business that values client conveniences, but may potentially attract a larger consumer base looking for flexibility.

Potential Drawbacks or Risks of Net 30 Terms

While Net 30 terms can sound like a great way to enhance your business relationships, it’s important to be aware of the potential drawbacks and risks that come with them. Let’s take a deeper look into some of the key concerns.

Impact on Cash Flow

By offering Net 30 terms you are essentially allowing your clients to not pay you for a month for the goods or services you have provided to them. Although this may be appealing to your customers, it could cause trouble for your cash flow. It is not uncommon to have to wait the full 30 days for payment and you may have to manage your finances to make sure you are able to pay your operational expenses, payroll, or replace inventory during that time.

Risk of Late Payments

Another major risk is the risk of late payments or even worse, non-payment. Your client might have a contract requiring payment within 30 days, but there’s no guarantee your client will pay even within that timeframe. Late payments can have a “ripple effect” in the form of delayed revenue, which might even have a negative effect your ability to pay suppliers, and further delay future financial obligations!

Potential for Financial Strain

If cash flow issues arise due to Net 30 terms, your business might face financial strain. This strain could lead you to rely on credit lines or loans to maintain day-to-day operations. Over time, this borrowing can result in increased debt, adding pressure on your financial health.

Who Should Consider Using Net 30 Terms?

Net 30 terms can entail risk, but can also be an intentional decision for certain businesses. What clients will find beneficial about Net 30 is that it is particularly useful for businesses with stable and well-supported cash flow, or for businesses in industries where this is a common payment structure. Additionally, businesses wanting to build lasting relationships and trust with their clients may elect to utilize Net 30 terms in order to offer convenience, while also creating a solid foundation for client loyalty. And finally, businesses that trust their client’s creditworthiness or are very confident with their client’s payment reliability may expand Net 30’s to provide immense customer satisfaction without giving much consideration, worry, or thought to payment.

How to Get Approved for a Net 30 Account with Us

Getting approved for a Net 30 account with us is easier than most believe! We support businesses with flexible payment terms! Here is a quick guide on how to apply:

1. Complete Our Application: Start by filling out a simple application form we have available online. This will require some basic information about your business like your business name, address and contact information.

2. Provide Business Credentials: We may request specific credentials such as your business license or tax ID number to confirm your legitimacy so we can get you back in business!

3. Check Your Business Credit: We try to accommodate all businesses, however a good business credit score will make your application stronger. I would recommend checking your score before applying.

4. Application Review: After you submit your application, our team will review it. They will determine whether you qualify for Net 30 terms based on the information you provided.

5. Notice of Decision: If you are approved, you will receive an email confirmation with your account details. You will then be ready to take advantage of the benefits of 30 days to pay!

Why Choose Us for Your Office Supplies on Net 30 Terms?

There are a bunch of reasons that being your supplier provides you with a ton of benefits. Here are a few of the reasons working with us is beneficial to your business:

– Quality Product: We have a complete line of office supplies. From paper and pens, to technology, we have everything your office needs.

– Pricing: Our pricing is highly competitive, so you’re going to get the best bang for your buck every time you make a purchase.

– Customer Service: Our customer service is reliable and responsive. Whether you’re inquiring about a product, or need assistance with your account, we can help.

– Ease of Ordering: Working with us is simple. Our online portal is rightly organized, making shoping easy and seamless for you.

When you choose us as a supplier, you don’t only ensure your office recieves the supplies it needs, but you also have the financial flexiblity that comes along with Net 30 terms. Let’s grow together!

Tips to Maximize the Benefits of Your Net 30 Account

Are you thinking about using Net 30 terms for your business? It’s a great way of managing cash flow, but to leverage it’s full potential requires some thought. I have been doing Net 30 terms for a while, so I’ve got some handy little tips for you to make the most of it.

– Be Efficient With Your Billing Process: An efficient invoicing system is essential for successful net-30 transactions. Make sure all your invoices are accurate and have the payment terms and due date clearly stated on the bill. Send all invoices promptly. The more convenient the process for your clients, the better your cash flow.

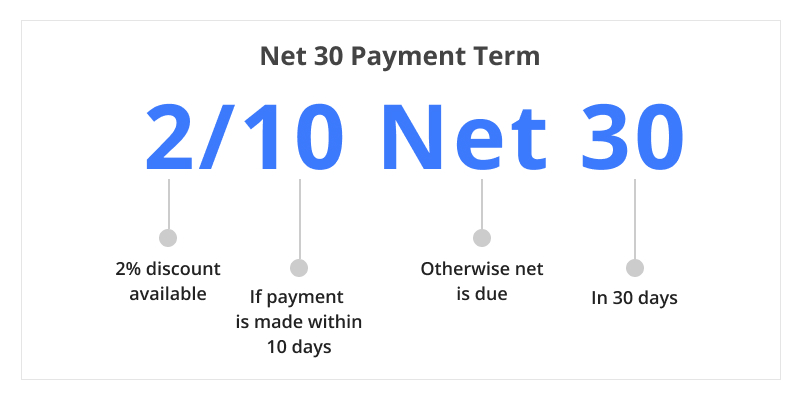

– Offer Early Payment Discounts: The perfect incentive to motivate your clients to pay before the 30-day mark is to offer them a small discount for early payment. I know this seems like you are giving something up, but it can improve your cash flow, and it also creates a good relationship with them.

– Communicate Better with Clients: You should keep a line of communication open. This could mean just checking in with your clients regularly to see if they like your services, but also to remind them there’s a payment due soon. You could be surprised how much trust is gained by these personal communications with clients.

– Track Your Cash Flow Periodically: You should track your cash flow every once in a while to recognize trends or any setbacks you face. This way, if/when things start going downhill, you can make changes up front and you can plan for those situations which can sometimes be better than an unpleasant surprise.

Frequently Asked Questions About Net 30 Terms and Office Supplies

Understanding Net 30 terms can be complicated, especially when it comes to buying office supplies. Below are some frequently asked questions and answers that can help:

-Are Net 30 terms available for all of my office supply purchases?

In general, many suppliers actually do have Net 30 terms for office supplies. However, even if a vendor lists Net 30 terms, each vendor may have its own rules that apply based on the size of your purchase, as well as your payment and credit history.

-What do Net 30 terms mean for my business credit?

If you pay invoices promptly, within the terms period of Net 30, you can build a positive credit score for your business. This will show vendors and lenders that your business is reliable and that you can be trusted to manage your finances.

-What do I do if a client misses the Net 30 deadline?

Start with a friendly reminder, to be considerate of unforeseen circumstances. If payments are consistently late, it may be time to evaluate your payment terms or rethink your working relationship with that client. Remember, communication with clients is essential.

While the difference between 30 days and 45 days may seem nominal, they can have an impact on your financial strategy and operations. Whether you are studying office supplies, or any other industry, it helps to know how to handle Net 30 or Net 60 terms!

Apply Now

If you’re considering offering Net 30 terms to your clients but aren’t sure how to start, the good news is the process isn’t terribly tricky. Here’s a simple pathway to help you leap into action:

– Assess Your Business Needs: Understand if your cash flow is stable enough to support delayed payments. Can you financially manage a month without payment from clients?

– Create Comprehensive Agreements: Draft clear invoices that outline payment terms. Make sure to communicate Net 30 specifics—like due dates—well in advance.

– Evaluate Clients’ Creditworthiness: Conduct credit checks to ensure your clients have the financial capacity to meet their obligations promptly.

– Trial Period: Consider starting with a select few trusted clients to test how Net 30 works for your business structure.

Finally, ensure consistent monitoring of your finances to identify any issues early. Ready to try this out? Take the plunge and watch your business adaptability grow!

Conclusion

Ultimately, it’s a choice to decide on how to implement Net 30 terms for your business. If cash flow allows for delayed payment, it could be an advantageous way to solidify strong relationships with clients and possibly obtain more business. However, if cash flow does not allow, it may be best to consider other options. Take the time to consider:

– Considering cash flow.

– Having an open dialogue with clients about payment terms.

– Planning for a built-in cash reserve.

Essentially weighing the risks and advantages is the game! By taking all of these aspects into consideration, you will be able to decide if Net 30 terms are good or bad for your business.