| Summary:

When purchased, office supplies are tracked as current assets. The journal entry involves debiting supplies (asset) and crediting accounts payable (liability). Supplies are categorized as current assets or expenses based on usage. Proper classification ensures accurate financial reporting and efficient expense management for your business. |

When a company buys office supplies on credit, it must keep track of them as supplies on hand. Because the goods on hand are often consumed within a year, they are represented as a current asset on the company’s balance sheet.

Office supplies are costs that are incurred throughout the course of business activities. In reality, it can be observed that there are a variety of distinct demands in daily office work that must be met by the company.

These expenses, while not large on their own, become enormous when added together in yearly totals. As a result, they are primitive in terms of accounting and must be dealt with appropriately in accordance with accounting rules. Hence, proper accounting treatment of office supplies on hand is important to ensure accurate financial reporting.

To comprehend the bifurcation of office supplies and the corresponding categorization, it is necessary to first comprehend the types of office supplies and their applications.

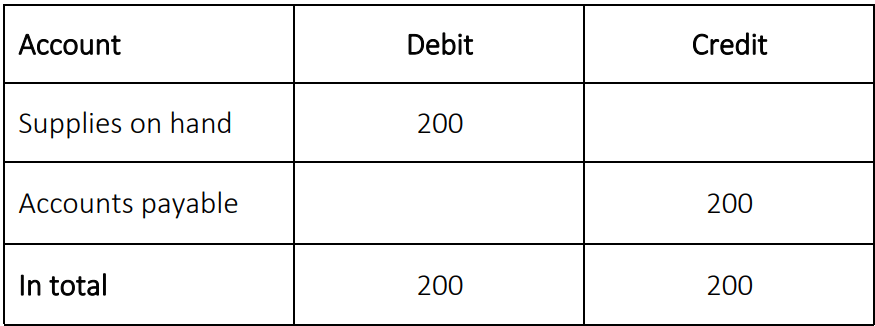

Example of a Purchase Office Supplies on Account Journal Entry

Assume a company spends $200 on pens, stationery, and other office supplies and receives credit terms from the supplier, and purchases office supplies on account with credit terms from the supplier. On account journal entry, the accounting records will indicate the following bought supplies.

Explanation of Bookkeeping

Debit

Consumable office goods (pens, stationery, etc.) have been received by the company and are being held as a current asset as supplies on hand.

Credit

The credit entry indicates the obligation to pay the provider for the products provided in the future.

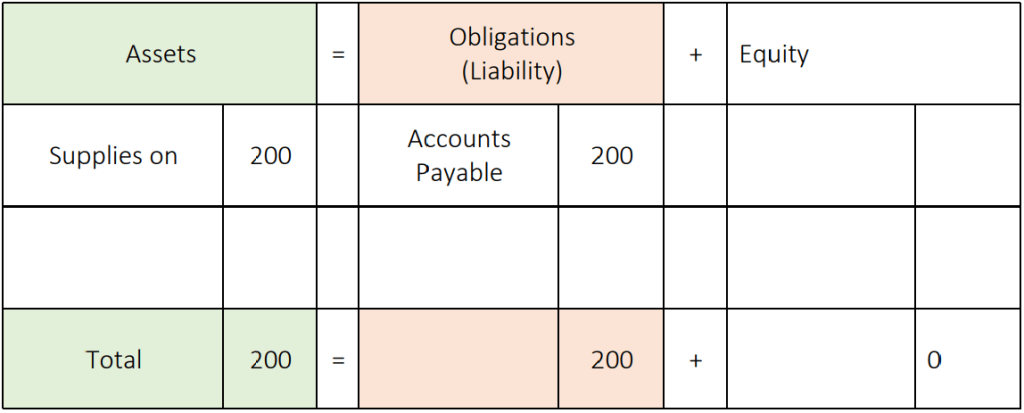

Accounting Equation for Purchasing Office Supplies

The accounting equation states that:

Assets = Obligations + Owners’ Equity

This is an accounting equation that states that a company’s total assets are always equal to its total liabilities(obligations) plus its total equity. This holds true at all times and for all transactions. The accounting equation for this transaction is presented in the table below.

In this example, when the company purchases office supplies on account, the supplies on hand (asset) increase, while the liability to pay the supplier in the future (accounts payable) also increases.

Categories of Office Supplies

It is necessary to divide time into the following subcategories in order to comprehend the proper accounting method.

1. Supplies at the Start of the Year

Some supplies may be carried over from the previous year at the start of the financial year. These would be included as supplies on the balance sheet under current assets. Another way to look at it is that they were Prepaid Expenses that had been paid in advance, but the value of the goods had yet to be determined.

2. Other Supplies Utilized Throughout the Year

When a company purchases office supplies on credit, the journal entry records a debit to the supplies account, increasing the assets, and a credit to accounts payable, reflecting the obligation to pay the supplier later.

3. Unused Supplies at the End of the Year

Supplies that are left unutilized at the end of the year are meant to be classified as Current Assets since the firm has already paid for them in advance, but has yet to extract the utility from them. As a result, they are recorded on the balance sheet as current assets.

Final Thoughts

To summarize, office supplies are commodities utilized by a firm to perform essential activities. Stationery, fittings, documents, and other miscellaneous things required in everyday operations are examples of office supplies.

They are classified as non-capital or operational costs since they do not represent a major financial investment. In reality, these costs are deducted from earnings with each passing year, and the balance is considered as a Current Asset if paid in advance, and as a Current Liability(Obligation) if not.

Frequently Asked Questions (FAQs)

1. What is the difference between office expenses and supplies?

- Office expenses are ongoing costs for running your business, like website services, software, merchant fees, domain names, and office phone systems. Expensive items like computers and smartphones are considered assets and can be depreciated over time.

- Office Supplies are everyday items that are used up quickly and need to be replaced often, such as printer ink, paper, pens, staples, and janitorial or break room supplies. These are usually small costs that help your business run day-to-day.

2. How do you record office supplies in accounting?

Office supplies are recorded as operating expenses in accounting as they are consumed during normal business operations, usually within a year. They are recorded in an expense account, such as:

- Office Supplies Expense: This is the most direct and common way to record office supplies. When supplies are purchased, they are immediately categorized as expenses.

- Office Expense: A broader category that can include office supplies and other related costs such as utilities or repairs.

- General and Administrative Expenses: In some cases, office supplies might fall under G&A expenses, particularly in companies that group general office costs together.

3. What is a journal entry for a purchase?

A purchase journal entry records a business’s acquisition of goods or services. It involves a debit to an asset or expense account and a credit to Cash or Accounts Payable, ensuring that debits equal credits.

4. How to record the purchase of office supplies?

Follow these steps to record the purchase of office supplies:

- Debit the Supplies Account: This increases your supplies (asset) account, showing that you now have more supplies.

- Credit Cash or Accounts Payable: If you paid for the supplies right away, credit your Cash account to show the money spent. If you bought the supplies on credit, credit Accounts Payable to show the amount you owe.

5. Is the office supply debit or credit?

When you buy office supplies, you debit the supplies account because you are increasing the value of your supplies (an asset or expense). The other side of the entry is a credit to either Cash (if you paid immediately) or Accounts Payable (if you bought on credit).