Hey everyone! Ever feel like your money is all over the place? You’re not the only one. Handling money can be tricky. But, what if you could get a better handle on your monthly spending? Try using a cash flow forecast! Using Net 30 terms when you budget can assist you plan your money better. Keep watching as we check out how to do it!

What is a Cash Flow Forecast and How to Create One

Think of a cash flow forecast as a sneak peek at your business’s money situation. It helps you guess how much cash you’ll get and spend, usually each month. This lets you plan things out since no one likes money surprises.

Making a cash flow forecast is simpler than you might think. First, use last year’s financial reports as a guide. Break them down into things like income, costs, and other earnings. Once you have these numbers, you’re ready to forecast.

1. Guess Your Income: Start by writing down where the money will come from, like sales, investments, or loans. Note any season changes or deals that might change your numbers.

2. Figure Out Costs: List regular bills like rent and utilities, costs like staffing and inventory, and one-time costs like new equipment. Knowing these costs can help you avoid surprises.

3. Start the Forecast: With these numbers, plan them out month by month. The good thing about a cash flow forecast is that you can see possible money problems ahead of time, giving you time to adjust.

Keep updating your forecast because things change as a business grows. The numbers need to show what’s really going on.

Understanding Cash Flow and Its Importance

Cash flow is super important for your business—think of it as the thing that keeps it alive. Basically, you want to make sure you have enough money to pay your bills when they’re due. If you handle it well, you won’t have money problems and you might even be able to grow your business. Net 30 payment terms can be useful here. They let you handle your money predictably and can help you build good relationships with other businesses.

What are the Main Challenges When Creating a Cash Flow Forecast Using Net 30?

Net 30 can be a handy part of your money plan, but it isn’t without its problems. One issue is late payments. Even with Net 30 terms, clients might miss the deadline, which means you spend time chasing money resulting in forecast problems.

– Payment Issues: Net 30 sets payment expectations, but buyers don’t always keep to them. Buyers might push payment dates, messing with your cash flow predictions.

– Seasonality: Things get tricky if your sales change depending on the time of year. Busy and slow times might not line up with your Net 30 payments, so you have to make adjustments.

– Invoice Oversight: Keep close tabs on unpaid invoices so that your forecasts stay exact. You might face cash problems or miss chances to invest if you don’t follow up

To handle these issues, plan in advance. Consider accounting software to track invoices and set alerts for late payments. It’s also a good idea to build some extra padding into your cash forecast to handle late payments. That way, late payments don’t mess up your cash flow.

The Role of Net 30 in Enhancing Cash Flow Forecasting

Knowing how things work together in your biz finances can really change things. One piece of that puzzle is using Net 30 payment terms when you plan your cash flow. Keep reading to find out how Net 30 can help you handle money better and make your budget more accurate.

Understanding Net 30 Payment Terms

So, you’ve probably heard of Net 30 if you do any invoicing. Basically, it means your customer has a month to pay you after they get the bill. It’s a pretty common thing, and it gives them some time to sort things out.

For businesses, it’s great because you know when the money is coming. This helps you plan your finances and avoid nasty surprises. Pretty cool, huh?

How Net 30 Affects Your Cash Flow Forecast

Net 30 terms let you figure out when you’ll get paid. This means smoother, more predictable cash flow. Here’s how it helps with your forecasts:

– Know When the Money’s Coming: Because payments usually arrive in 30 days, you can better guess your cash flow.

– Pay on Time: Get ready to pay your bills and vendors when you should. You might even get some good karma or a discount for paying early.

– Smart Choices: If you know your cash flow, you can plan investments or expenses without worrying about the money being there.

How to Enhance Budget Accuracy Through Net 30

Integrating Net 30 terms doesn’t just end with cash flow forecasts; it can also significantly enhance budgeting accuracy. Here are two effective strategies:

Balancing Outflows with Inflows

To keep your bank account happy, make sure money’s coming in as much as it’s going out. Here’s what you can do:

– Try to plan big buys around when you know you’re getting paid.

– Keep an eye on when customers pay you, so you don’t get shorted.

– Check out some apps or software that help you line up when you get paid with when bills are due.

Building Buffer Zones into Your Budget

Life can be unpredictable, and surprise costs pop up. If you add safety nets to your budget, you can protect yourself from money problems:

– Set aside some cash in your budget for surprise costs.

– Make sure this cushion can cover at least one payment.

– Check this cushion often using past info and change it if you need to.

If you do these things, businesses can guess future cash flow and create budgets that hold up. So, try Net 30 and get better financial planning!

Benefits of Using Net 30 for Cash Flow Management

When it comes to managing your business’s cash flow, utilizing Net 30 terms can be a game changer. Let’s dive into some of the compelling benefits it offers.

Improved Financial Forecasting Accuracy

One cool thing about using Net 30 terms is that it makes it easier to guess how much money you’ll have. Basically, Net 30 tells you exactly when payments are due, so you can predict your income and handle your money better. If you know when the money is coming, you can match incoming cash with what you need to pay out, which means fewer surprises. Because things are easier to predict, you can plan your budget more accurately, put money where it needs to go, and plan how to grow later.

Cash Flow Stability and Predictability

One big plus of using Net 30 is that it makes managing your money way easier and more reliable. When you set up a 30-day payment period for invoices, everyone knows what to expect. This not only cuts down on guessing games but also helps build good relationships with the folks you work with. Steady cash flow means you’re in a better spot to deal with surprise costs or problems without messing up your money situation. When your cash flow is consistent, your business stays on track, and you have less to worry about when it comes to keeping your finances in order.

Common Pitfalls in Cash Flow Forecasting and How to Avoid Them

Despite the benefits, cash flow forecasting isn’t always a walk in the park. Let’s explore some common pitfalls and how you can avoid them.

Overestimating or Underestimating Receivables

Guessing wrong on how much money you’ll get paid is a common mistake. It can cause you to run out of cash or miss chances to grow your business. To avoid this, be careful and realistic:

– Look at past records to predict future payments.

– Keep checking and updating your predictions when you get new info.

– Talk to your customers to see if they expect any payment issues.

Neglecting to Factor in Expenses

A pretty normal mistake people make is forgetting to think about all their costs. If you miss some, more so if they don’t happen all the time, it can mess things up when you guess how much money you’ll have. Here’s how not to do that:

– Make a list of everything, from what you pay every month to those random costs.

– Keep the list up to date so there are no surprises.

– Watch how you’re spending and guess how much money you’ll have accordingly.

If you remember all this, it will be easier to keep your handle on the money that comes in and goes out, which is good for your business.

Adjusting Your Cash Flow Forecast for Uncertainty

Financial planning? It’s all about dealing with the unknown. No matter how organized you are with your money, surprises happen. Changing your spending plan to account for those surprises can save you trouble later. Planning for the unexpected means it’s part of how you handle your money.

Planning for Payment Delays

Payment delays? Yeah, they mess things up for businesses all the time. If you don’t see them coming, your money plan can go sideways. Here’s how to handle it:

– Know Your Clients: See who pays on time and who doesn’t. That way, you can guess when payments might be late.

– Clear Terms: Put your payment terms on your invoices, so there are no questions.

– Talk Regularly: Check in with clients now and then. A simple nudge can get those payments in on time.

If you know these delays will happen, tweak your plan so you don’t freak out when payments are late.

Using Net 30 to Adjust for Delays

Offering Net 30 terms can be a good way to deal with late payments. Basically, Net 30 means your clients have a month to pay their bills. This gives you some time to figure out your finances and prepare for possible delays. Here’s why it’s helpful:

– Better Money Handling: You get a clearer picture of when money will be coming in, so you can plan your spending.

– Happy Clients: Giving clients 30 days to pay can make them happier and more trusting, without messing up your own money flow.

– Time to Adjust: If payment is late, it won’t wreck your business right away. You have some breathing room to think about what to do.

With Net 30, you’re not just reacting to problems, you’re getting ahead of them. You’re giving clients time to pay, but also keeping an eye on your cash flow.

Conclusion

Putting some wiggle room in your cash flow forecast? Gotta do it. Stuff like Net 30 terms gives you some power to make your budget solid, even when things go sideways. If you see late payments coming and plan for it, you not only get better at financial planning, but you also handle your cash a lot better overall. Sounds like a good move for handling your business cash, right?

Frequently Asked Questions

What is the formula for forecasting cash flow?

The basic formula for forecasting cash flow involves adding cash payments to cash inflows and then subtracting cash outflows. It looks something like this:

Cash Flow Forecast = Beginning Cash + Cash Receipts – Cash Disbursements

What is a 3-way cashflow forecast?

A 3-way cashflow forecast brings your profit and loss statement, balance sheet, and cash flow statement all together. When these three things are linked, you get a good look at your finances and can guess future results better.

What are the key benefits of using Net 30 payment terms in cash flow forecasting?

Using Net 30 payment terms can really help you manage your money better by giving you a clear idea of when cash is coming in. It’s good for:

– Keeping a stable cash flow.

– Getting along better with your suppliers.

– Making your budget more accurate overall.

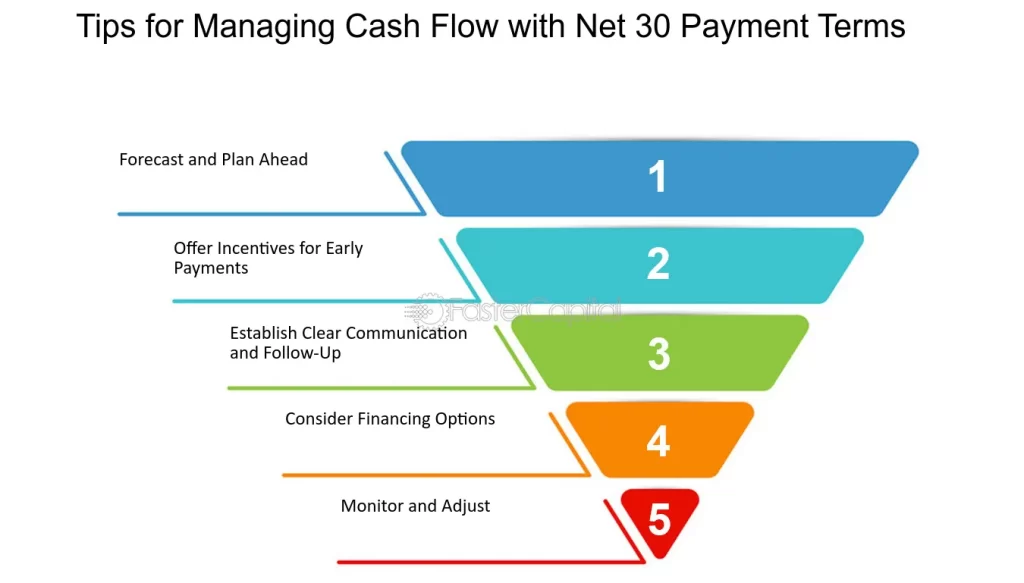

How can I manage late payments when forecasting cash flow with Net 30 terms?

Dealing with late payments is tough, but here’s what you can do:

– Give people a heads-up before payment is due.

– Give a tiny price cut for paying early.

– Only charge late fees sometimes to get people to pay on time.

How often should a cash flow forecast be updated to reflect changing business conditions?

It’s a good idea to update your cash flow forecast every month. But when things are changing a lot in your business, check it every week to be sure your plans still make sense.

Can Net 30 terms affect my business’s overall financial stability?

Yeah, giving Net 30 terms changes when you get paid, which hits your financial stability. It means you know when money’s coming in, but you gotta keep a close eye on things so you don’t run out of cash.

What are the best practices for improving the accuracy of my cash flow forecast?

Want to make your forecasts more on point? Give these tips a shot:

– Keep your forecast up-to-date with the real numbers.

– Plan for what-if situations to prepare for surprises.

– Talk regularly with clients and suppliers, so you can see any payment changes coming.