Introduction to Net 30 Invoicing

Net 30 terms are a common way for businesses to handle payments. They give customers time to pay while also helping the business get money in quickly. However, simply adding “Net 30” to an invoice isn’t enough. Here are some tips to make sure your Net 30 invoicing is clear, professional, and helps you get paid on time.

How to Clearly State Net 30 on an Invoice?

When extending Net 30 payment terms, clarity is key to avoid confusion and potential delays in payment. Here’s how to make sure your invoice leaves no room for misunderstanding:

Using Clear and Concise Language to Avoid Ambiguity

Although “Net 30” is a common term, it’s important to make sure there’s no confusion, especially when working with new clients or those who might not know about typical billing practices. Instead of simply saying “Net 30,” try using clearer words that explain when payment is expected. For instance:

- “Payment is due in full within 30 days of the invoice date.”

- “This invoice is payable within 30 days from the date of issue.”

Using full sentences and avoiding short forms or technical language will help all clients, no matter their accounting knowledge, clearly understand your payment terms.

Specifying the Due Date to Eliminate Confusion and Encourage Timely Payments

When you say “Net 30,” it gives a general idea of when payment is due, but it’s better to include the exact due date. This makes it clear when the payment should be made and helps clients remember to pay on time. To find the due date, just add 30 days to the date on the invoice and write it clearly on the invoice. For example:

- “Invoice Date: 2023-12-12”

- “Payment Due Date: 2024-01-11”

Offering both Net 30 terms and the exact due date shows openness and professionalism, which helps clients manage their payments better and lowers the chance of late payments.

What are the Benefits of Using a Premade Net 30 Invoice Template?

In today’s busy business world, being efficient is very important. Using a ready-made Net 30 invoice template can help a lot by making your invoicing process faster and more accurate.

Ensuring Professionalism and Consistency

A good invoice design makes your business look neat and professional. Ready-made templates usually have important parts like your company logo, contact details, and a simple way to show what you’re charging for and the total amount. This helps keep your invoices looking the same, which makes your business look more professional to customers.

Also, using a template means you always include everything needed on the invoice, so you don’t forget anything or make mistakes. This helps avoid problems with getting paid on time.

Reducing Errors and Saving Time

Making invoices by hand can take a lot of time and may lead to mistakes. Using a ready-made template means you don’t have to type the same information over and over, like your business details or common items. This saves you time and lowers the risk of typos or math errors, which can cause misunderstandings and delay payments.

Many invoice templates come with helpful features, such as automatic math, pre-filled fields for common terms (like “Net 30”), and options to adjust the invoice for different clients. These tools make the invoicing process faster and let you focus on other important parts of your business.

How to Incentivize Clients to Pay Earlier than the Requested Date?

Net 30 terms give you 30 days to pay, but getting paid early can help your money flow better and lower the chance of late payments. Here are some ways to encourage your clients to pay faster

Offering Early Payment Discounts

A common way to encourage early payment is by giving a small discount. For instance, you could offer a 2% discount if the bill is paid within 10 days (2/10 Net 30). This can be appealing to clients, particularly those who want to manage their money well. Make sure to clearly write the discount details on your bill so clients can see them and are more likely to pay quickly.

Example:

- “2% discount if paid within 10 days, otherwise full payment due within 30 days.”

Building Strong Customer Relationships

Having good relationships with your clients can help them pay you on time. Talk clearly and be ready to answer questions during the billing process. Make sure your clients know the payment rules and feel comfortable asking questions if they have any.

Building trust and a good connection can lead to both sides respecting and helping each other, which makes clients more likely to pay quickly. Try these ways to build better relationships:

- Personalized messages: Use their name and adjust your talk to their needs.

- Early reminders: Send a kind note a few days before the payment is due.

- Thank-you notes: Show thanks for paying on time to encourage this good behavior.

By using clear talk, strong relationships, and nice rewards, you can make a good payment situation that helps both you and your clients.

Establishing Clear Payment Terms for Net 30 Invoices

To make sure payments go smoothly and avoid delays, it’s important to set clear payment rules at the start. This helps both you and your clients know what to expect and keeps things organized when handling money.

Communicating Payment Expectations Upfront

Before starting any work or sending goods, let your clients know your payment terms clearly. You can do this in your first proposals, contracts, or even on your website. By explaining your terms early, you prevent any unexpected issues and make sure clients understand your Net 30 policy before they owe you any money.

When discussing payment terms, be sure to:

- Clearly explain the 30-day payment term: “Payments must be made 30 days after the invoice is issued.”

- List the available payment options: Show the methods clients can use to pay (like checks, credit cards, or online transfers).

- Give contact details for billing questions: Make it simple for clients to ask questions about their bills.

Setting Consequences for Late Payments

When you want to get paid on time, it’s smart to set rules for what happens if someone pays late. This helps keep your business safe from money problems and reminds clients to follow the payment plan you both agreed on. Make sure to explain these rules clearly when you first talk to clients and on your bills.

Common consequences for late payments include:

- Late payment fees: A set amount or a part of the unpaid money added to the bill after the due date.

- Interest charges: Charging extra money based on the overdue amount, calculated each day or month.

- Suspension of services: For ongoing services, you may stop providing them until the unpaid amount is paid.

By clearly explaining your payment terms and setting rules for late payments, you make a clear and professional payment process. This helps ensure payments are made on time and keeps your business financially secure.

Maintaining Good Communication with Suppliers Regarding Net 30 Invoices

Good communication is very important for having strong relationships with your suppliers, especially when you use Net 30 payment terms. Clear and helpful communication helps build trust, avoids confusion, and makes sure everything goes well.

Providing Updates and Addressing Concerns Promptly

Let your suppliers know how their invoices are doing. If there’s a hold-up in paying them or if you think you’ll need more time, tell them ahead of time. Don’t keep them guessing.

Answer their questions quickly and help with any worries they have about payment terms, invoice information, or how they’ll get paid. Clear and fast communication shows you value their time and builds trust.

Building Trust and Collaboration

Think of your suppliers as part of your team that helps your business succeed. Build good relationships with them by talking openly and working together.

- Tell them when you pay: If you pay on a certain day each month, let your suppliers know so they can plan when to expect their money.

- Listen to their ideas: Ask your suppliers for any thoughts or suggestions they have about how you handle invoices and payments.

- Say thank you: Show your appreciation for the work they do and for delivering on time, recognizing how important they are to your business.

By keeping in touch and working together, you can create strong, helpful relationships with your suppliers. This makes sure everything runs smoothly and you always have what you need.

Utilizing Invoicing Software for Net 30

In today’s digital world, using invoicing software can make your Net 30 invoicing process much easier. These tools handle tasks automatically, save time, and give you useful information about your money flow.

Automating Invoices and Payment Reminders

Invoicing software helps you make professional invoices fast and simple. Many programs have ready-made designs with options to change the details, so your invoices look the same and have the right information. You can set up the software to create invoices, send them to customers, and remind them about payments automatically.

This makes the process faster and less likely to have mistakes, so your invoices go out on time and customers get reminders when they need to pay.

Tracking and Managing Invoices Efficiently

Invoicing software gives you a single place to keep track of all your invoices, including ones with Net 30 terms. You can check which invoices haven’t been paid, see the payment status, and create reports to understand your money flow.

Some software also lets clients pay their invoices online, right through the platform. This makes paying easier and can speed up payments, helping your money flow better.

Using invoicing software helps you handle Net 30 invoices more smoothly, saves time on manual work, and gives you useful information about your finances. This lets you focus on your main business tasks while making sure you get paid on time and manage your money well.

Monitoring Credit Scores When Using Net 30 for Invoicing

Offering Net 30 terms can be good for both you and your business cash flow, but it’s important to know that how well you pay your bills affects your business credit score. Keeping an eye on your credit score and making sure it stays good is very important for your business to grow and stay strong in the long run.

Understanding the Impact of Payment History on Credit

Your business credit score shows how reliable you are when it comes to borrowing money. One important part of this score is your payment history. Always paying your bills on time, even those with Net 30 terms, shows that you’re responsible with money and helps build a good credit record.

On the other hand, missing payments, being late, or not paying at all can hurt your credit score. This can make it harder to get loans, better credit terms, or even interest from investors.

Maintaining a Good Credit Score for Business Growth

A strong credit score is very important for any business. It helps in many ways, like:

- Getting loans: Banks look at credit scores to decide if they should lend money. If your score is good, you’re more likely to get a loan with low interest rates and good conditions.

- Working with suppliers: Companies that sell you things might give you better prices or let you pay later if you have a good credit score.

- Bringing in investors: People who give money to businesses often check credit scores before deciding to invest.

To keep a good credit score:

- Pay bills on time: Always pay all your bills, even if you have 30 days to do it, by the due date.

- Check your credit report: Look at your business credit report often to make sure there are no mistakes, and fix any problems quickly.

- Use credit wisely: Don’t use up all your credit limit, because using too much credit can hurt your score.

By actively monitoring your credit score and maintaining a strong credit history, you position your business for financial success and sustainable growth.

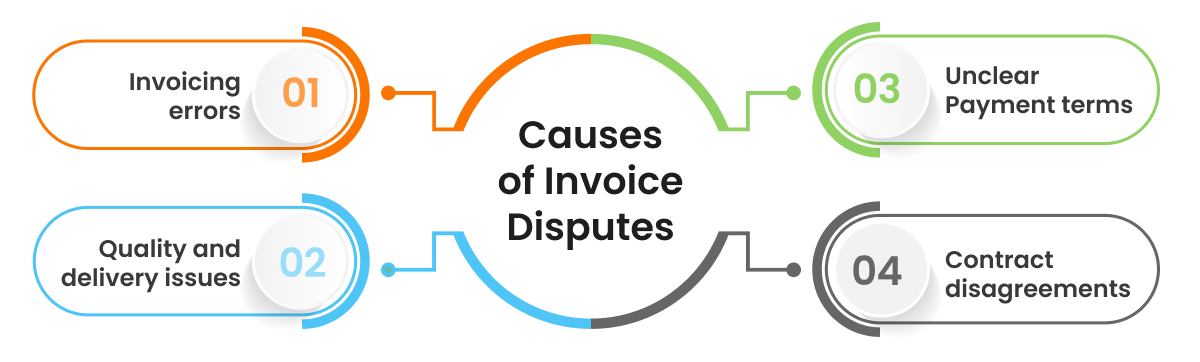

Managing Disputes Related to Net 30 Invoices

Even with good intentions and clear communication, disagreements about Net 30 invoices can sometimes happen. It’s important to handle these situations well to keep good customer relationships and protect your business’s reputation.

Addressing Customer Concerns and Complaints

If a customer has a problem or complaint about a Net 30 invoice, it’s important to handle it quickly and in a professional way. Pay close attention to what they’re saying, whether they’re asking about the invoice amount, noticing a mistake in the billing details, or disagreeing about the goods or services they received.

Stay calm and understanding, even if the customer is upset. Show them that you understand their concerns and that you’re dedicated to solving the problem.

Look into the issue carefully and collect all the important information, like the original invoice, payment records, and any extra documents. If the customer’s concern is correct, take the right steps to fix the situation, such as sending a new invoice or giving a partial refund.

Resolving Payment Issues Professionally

If a customer doesn’t pay within 30 days, contact them right away. Begin with a polite reminder, assuming they forgot. If they still haven’t paid, send a more formal message, clearly stating how much is owed and any extra fees for late payments.

If the customer keeps delaying or disagrees with the bill, try these steps:

- Offer a payment plan: Let them pay in smaller amounts over time.

- Use a mediator: Bring in someone neutral to help both sides find a solution.

- Get legal help: If nothing else works, talk to a lawyer about your options.

Always stay professional and keep talking openly during this process. This helps keep good customer relationships and protects your business.

Conclusion

Understanding Net 30 invoicing can be tricky at first, but by following good practices and staying in touch with clients, it can help you manage your money better and build better relationships with your customers.

Keep in mind, being clear is very important. Make sure every invoice shows your Net 30 terms, including the payment time and exact due date. Use ready-made templates to keep things professional and consistent, while reducing mistakes and saving time.

Encourage early payments by offering discounts and strengthen your client relationships by staying in touch and showing appreciation. Set clear payment rules from the start, including what happens if payments are late, to keep your finances in good shape.

Remember to keep strong communication with your suppliers and see them as part of your team. Use invoicing tools to make tasks easier, keep track of payments, and understand your finances better.

Pay attention to your business credit score because your payment history affects your chances for future opportunities. If any problems come up, handle them quickly and politely, trying to find solutions that work for both sides.

By following these tips, you can handle Net 30 invoicing well, get paid on time, build good business relationships, and help your business grow and succeed.

Happy invoicing!