Introduction

Hey there, fellow business aficionados! Ever considered that those intimidating “Net 30” payment terms might just be your hidden advantage? Indeed, we’re discussing how to turn that 30-day payment period into a revolutionary cost-saving strategy and propel your business towards remarkable financial efficiency. As we explore the clever tactics that leading CEOs are implementing, you’ll see how embracing The CEO Creative’s methods could be the pivotal change your business is looking for.

Understanding Net 30 Terms

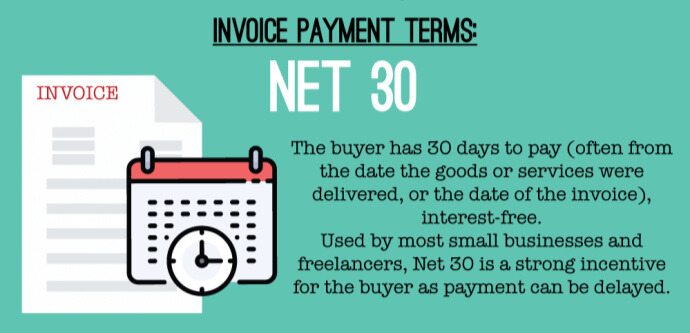

“Net 30” might seem like some kind of insider lingo, but it’s really just a simple idea that’s super important in the business world. Knowing what “Net 30” means and how it works can really help you out, especially if you’re trying to get better at managing your company’s money. Let’s take a closer look at what it means, how it’s usually used, and how you can make it work for you.

Definition and Common Use

Net 30 is a credit arrangement where you get a 30-day window to pay your invoice after you receive it. It’s like making a purchase on credit – you obtain the goods or services immediately but don’t need to pay for them until a later date. It’s a mutual benefit! This is a widespread practice in B2B transactions and is favored by companies of all sizes as it aids in managing cash flow efficiently. Suppliers and vendors provide these terms to foster lasting relationships and secure steady sales.

Consider a small business purchasing office supplies; they might receive an invoice with Net 30 terms, granting them time to utilize those supplies and earn revenue before settling the payment. This grace period is especially helpful for businesses looking to keep their cash liquid and reinvest it in other areas.

Benefits and Challenges

Why is everyone talking about Net 30? It’s really quite straightforward. These terms let businesses boost their cash flow by putting off payments. This extra time lets them earn money from their investments or handle other pressing bills that need attention first. The added flexibility also makes financial planning easier and, when handled right, can lead to some smart cost savings.

But it’s not all sunshine and roses. Miss those payment deadlines, and you could be looking at late fees and strained relationships with your suppliers. Plus, keeping track of all those different payment timelines from various vendors can feel like a real headache, particularly for smaller businesses that don’t have a specialized finance team. And to add to that, some suppliers might charge extra interest if you use credit, which eats into those potential cost savings.

Strategies for Transforming Net 30 into a Cost-Saving Tool

![]()

Now that we have a good grasp of what Net 30 is all about, let’s switch gears and explore how it can be transformed from a simple credit term into a powerful cost-saving ally. It’s all about strategy, finesse, and keeping your eyes on the prize!

Negotiating Better Terms with Suppliers

Let’s start with the big one: negotiation. I know, asking for better terms might feel intimidating, but trust me, it’s totally worth it for all the perks you’ll get down the line. If you approach your suppliers with a smile and an open mind, you’d be surprised how willing they are to work out sweet deals for your business.

Here’s how to make it happen:

– Become Best Friends (Okay, Maybe Not, but You Get It): The first step is to build a rock-solid working relationship based on trust and crystal-clear communication. If you’ve got a good vibe going with your suppliers, you’re already halfway there when it comes to striking a great deal.

– Tell Them What You Need: Don’t beat around the bush—lay out exactly what you’re aiming for with those Net 30 terms. Whether you need more time to pay or want a discount for ponying up early, being upfront helps your suppliers tailor the perfect offer for both of you.

– Show Them You’re a Keeper: If you’re known for paying on time and being a reliable customer, use that to your advantage! Let them know how much you value their service and see if they offer any rewards for being such a great customer.

Keep in mind that negotiation is all about give and take. Be ready to meet them in the middle and really listen to what your suppliers need too. Good luck!

Implementing Technology for Payment Management

In the fast-paced world of technology we live in, leveraging tech can seriously revolutionize how you handle Net 30 payment terms. If you’re not already on board with a payment management system, now might be the perfect moment to jump in.

– Automated Payment Systems: Bringing in automated payment systems can significantly lower the chances of missed payments. These systems are great at giving you a heads-up about impending due dates, making sure you pay on time.

– Accounting Software: An accounting tool can be a lifesaver for keeping tabs on what you owe. Find software that plays nice with your bank and supplier accounts for a smooth-sailing experience.

– Data Analytics Tools: Dive into data analytics to get the lowdown on your spending habits. Getting a grip on your financial behavior can provide those “aha!” moments necessary for smart choices about cash flow and when to pay.

These digital aids not only boost efficiency but also liberate precious time for your team to focus on other business essentials.

Analyzing Cash Flow and Budgeting

To really take advantage of Net 30 payment terms, you need to be on top of your cash flow and have a solid budgeting plan in place. Think of it as having a complete picture of your money—where it’s coming from and where it’s going—and using that knowledge to plan ahead.

– Keep a Close Eye on Your Cash Flow: Make it a habit to regularly check your cash flow. This will give you a crystal-clear view of your financial health and help you spot any trends or potential issues that need your attention.

– Build a Budget Safety Net: Always add a little extra padding to your budget for those unexpected costs that always seem to pop up. This buffer acts as a safety net, protecting your business from cash flow headaches.

– Figure Out What Needs to Be Paid First: Not all payments are created equal. Figure out which ones are most important and make those a priority in your budget. If you have several Net 30 deals, be strategic about how you manage them to avoid any cash crunches.

By staying on top of your cash flow and having a solid budget, your business can turn the potential challenges of Net 30 terms into chances to grow and save. It’s all about being smart and proactive with your finances.

To wrap things up, Net 30 isn’t simply a credit term; it’s a flexible instrument that, if utilized adeptly, can evolve into a crucial element of your financial game plan. Whether you’re hashing out sweet deals with suppliers or cleverly leveraging technology and conducting thorough cash flow checks, mastering Net 30 can unlock doors to unprecedented financial nimbleness. Dive into this robust financial approach and seize the opportunity to save big. Here’s to streamlined finances and a thriving business!

The CEO Creative’s Perspective

Rethinking Traditional Payment Terms

In today’s fast-paced business world, CEOs and finance chiefs are always on the hunt for an advantage and smarter cash flow. They’ve long relied on Net 30 payment terms – basically, a deal where buyers pay sellers within 30 days of getting an invoice. It sounds simple enough, but the forward-thinking team at The CEO Creative sees these terms in a whole new light.

To them, Net 30 isn’t just a due date; it’s a powerful tool for fine-tuning various parts of a company’s financial strategy. The CEO Creative thinks that by reimagining standard payment setups, businesses can boost their cash flow, build stronger ties with suppliers, ease money worries, and even find ways to grow their wealth with extra cash. The secret lies in how they cleverly use and deeply understand these terms, making sure they fit perfectly with the company’s big-picture plans and aims.

Instead of viewing Net 30 as merely a due date, companies can get imaginative and use fresh ideas to turn it into a strategic tool that genuinely boosts their financial health. Businesses can shift from simply making payments on time to carefully planning their accounts payable, cleverly balancing timely payments with smart use of their funds to achieve stronger business results.

Aligning Financial Strategy with Business Goals

The brilliance of The CEO Creative’s method is how it syncs up financial plans with the bigger picture of what a company’s trying to achieve. Every business has its own set of aspirations, be it breaking into fresh markets, rolling out cool new products, or boosting the worth for its shareholders. Things like Net 30 payment terms aren’t just add-ons; they’re actually crucial pieces of the puzzle for hitting those targets.

To really make Net 30 work as a way to save some dough, businesses gotta first nail down what they’re aiming for. Are they trying to supercharge their short-term financial fitness to fuel a new venture, or are they more about nurturing enduring ties with their core suppliers? Once those goals are crystal clear, companies can craft a payment game plan that leverages Net 30 terms to give them an edge.

For example, if a company is looking to boost its short-term profits, it might decide to push back payment deadlines to suppliers, as long as those suppliers are okay with it, of course. This way, they can keep their cash for a bit longer. That extra cash on hand can then be used to invest in other important areas or projects. On the flip side, if a company really wants to build strong relationships with its suppliers, it might choose to pay those invoices a bit faster, even within the standard Net 30 payment window. This shows suppliers they’re valued partners and helps the company become a preferred customer.

Basically, when a company matches its financial moves with its overall goals, things tend to run smoother and more effectively. And using those Net 30 payment terms smartly can really help make that overall plan work even better.

Leveraging Payment Timelines for Efficiency

The CEO Creative’s strategy really drives home the idea of using payment schedules to make your business run smoother. It’s not just about saving money, but about making each dollar work as hard as it can. The smart use of Net 30 is key to simplifying things, getting rid of roadblocks, and helping the business grow.

– Make the Most of Your Money: Handling the Net 30 timeline right means having more cash on hand. This lets you pay for what you need to run your business, put money into growing, and have a safety net for surprises.

– Save Money: Using these payment terms well can also give you an edge when dealing with suppliers. If suppliers know you pay on time, they’re often happier to give you some discounts or easier payment terms.

– Boost Your Bargaining Ability: Companies that stick to their strategic payment schedules are better equipped to negotiate better deals down the line. It’s a straightforward but powerful method to give your company an edge without coming across as overly pushy.

– Encourage Long-Term Success: Regularly revisiting and fine-tuning your payment procedures can pave the way for lasting growth by making sure your financial plan remains flexible in the face of emerging challenges and opportunities.

By thinking outside the box when it comes to payment timelines, businesses can transform Net 30 from just a way to save money into a powerful instrument for improving overall efficiency. This approach nurtures an environment conducive to sustainable expansion and solid financial well-being.

Apply NOW!

It’s like a lightbulb going off when you see how The CEO Creative views the possibilities of Net 30; it can make you want to jump right in and use these tactics in your own business. However, realizing the potential is just the beginning. Effectively using these ideas and changing your financial approach can really boost your company’s profits.

1. Evaluate Your Current Methods: Take a look at how your company deals with payment deadlines right now. Are you really making the most of the payment schedule? Or are payments being made as invoices come in without any real planning?

2. Establish Specific Financial Targets: Figure out what you ultimately want to accomplish with your payment methods. Setting clear goals will steer all the following actions and make sure your payment terms match your main business aims.

3. Get Your Team On Board: Share this fresh perspective with everyone in your company. Make sure your team grasps why managing payments strategically is so important and how it helps your business reach its goals. When everyone’s on the same page, you’ll see more innovative and successful solutions emerging.

4. Build Strong Bonds with Vendors: Keep the lines of communication wide open with your suppliers. Having frank conversations about payment terms from the get-go can open doors to better deals and stronger partnerships. Building these relationships builds trust and can result in terms that are a win-win for everyone involved.

5. Keep Checking In and Stay Flexible: Finally, remember these strategies aren’t set in stone. Your business needs and the overall market are constantly changing, so it’s vital to frequently assess your internal processes and fine-tune your strategies to match your evolving goals and the current business climate.

Conclusion

Turning Net 30 terms into a strong tool for saving money isn’t just about putting off payments. It’s about making a smart financial plan that makes your business work better. By doing things like getting better payment terms, handling your cash flow well, and keeping good relationships with your suppliers, CEOs can find new ways to grow. It’s important to talk to your suppliers, so don’t be afraid to discuss how both of you can benefit. If done right, Net 30 can be a key part of your business’s financial plan.