Think your business doesn’t need credit? Think again.

In 2025, 36% of small businesses either got denied or only partially approved for financing, often because their business credit wasn’t strong enough.

Only 41% got everything they asked for, while 24% got nothing at all.

Smart businesses don’t leave their credit to chance — they grow it intentionally by partnering with Tier 3 Net 30 vendors that report to major bureaus like D&B, Experian, and Equifax.

One of the fastest, most strategic ways to build your business credit profile in 2025 starts with understanding where most businesses fall short:

Smart businesses don’t leave their credit to chance — they grow it intentionally by partnering with Tier 3 Net 30 vendors that report to major bureaus like Dun & Bradstreet (D&B), Experian Business, and Equifax Business.

What Are Tier 3 Net 30 Vendors?

Tier 3 Net 30 vendors are businesses that offer trade credit with 30-day terms and report to at least one — often multiple — major business credit bureaus like Dun & Bradstreet (D&B), Experian Business, and Equifax Business.

Unlike Tier 1 Net 30 vendors that primarily serve brand-new businesses, Tier 3 vendors expect:

- Verified business presence (website, business phone, email)

- Positive payment history with Tier 1 and Tier 2 vendors

- Established EIN and DUNS Number

| Tier | Typical Business Stage | Credit Bureau Reporting | Vendor Type |

| Tier 1 Net 30 Vendors | Brand-new startups | 1 bureau, sometimes slow reporting | Office supplies, digital services |

| Tier 2 Vendors | Early-stage businesses (6–12 months) | 1–2 bureaus | Marketing, IT, office solutions |

| Tier 3 Net 30 Vendors | Scaling businesses (12+ months) | 2–3 major bureaus | Specialized supplies, equipment, services |

Why Choose Tier 3 Net 30 Vendors?

Tier 3 Net 30 vendors are an excellent choice for startups and small businesses looking to build credit without stringent requirements. Here’s why they stand out:

- Accessible Approval Process: No personal credit checks, making them ideal for new businesses.

- Builds Trade Lines: Establishes a payment history that can later serve as trade references.

- Improves Cash Flow: Offers 30-day payment terms, helping businesses manage expenses effectively.

- Stepping Stone to Bigger Opportunities: By building a solid payment history with Tier 3 vendors, businesses can qualify for higher-tier vendor accounts or secure loans with better terms.

By leveraging Tier 3 vendors, businesses can lay a strong foundation for financial growth while avoiding the barriers of traditional credit systems.

Why Tier 3 Business Credit Vendors Are Crucial for Growth

Building relationships with Tier 3 vendors is a powerful move, but why are Tier 3 Net 30 vendors important for business credit building exactly?

Here’s what Tier 3 vendors unlock for your business:

Gateway to Business Lines of Credit and Loans: Larger funding approvals and better financial terms.

How Tier 3 Net 30 Vendors Strengthen Your Business Credit Profile

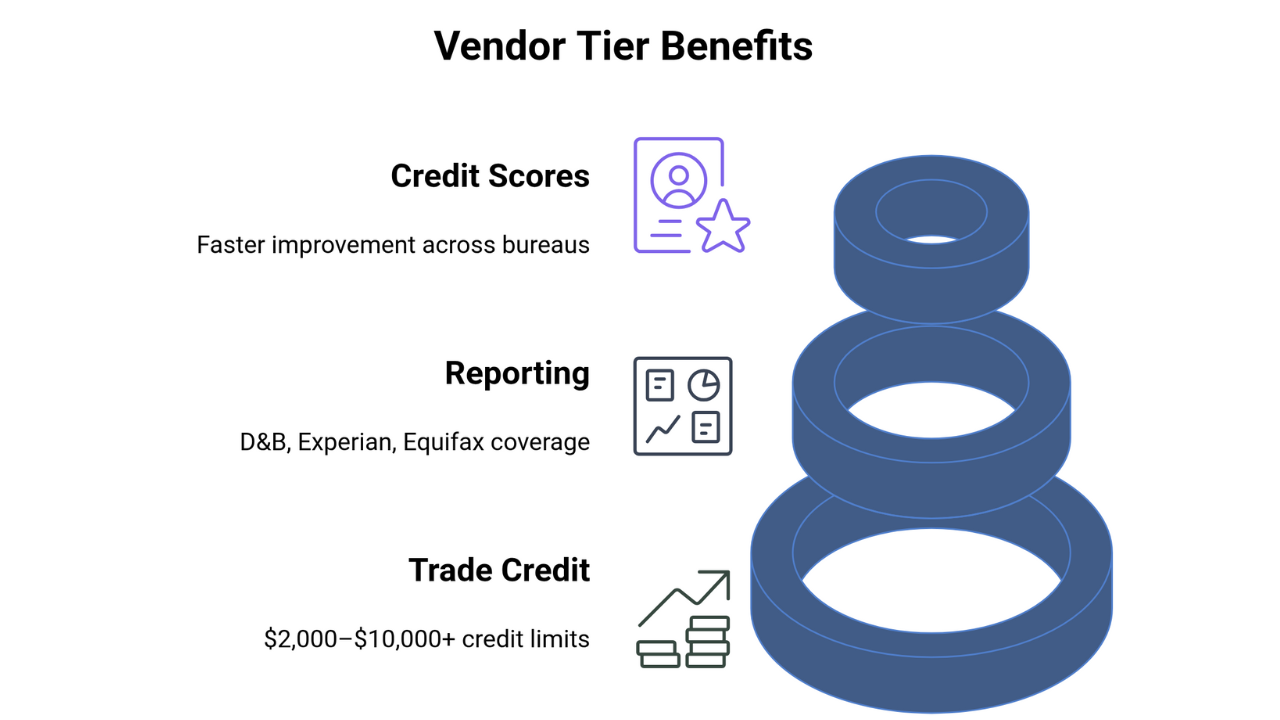

Tier 3 Net 30 vendors play a critical role in moving your business beyond beginner credit-building steps. Here’s exactly how they contribute to stronger, more credible business credit:

- Multi-Bureau Reporting:

Tier 3 vendors typically report to major credit bureaus like Dun & Bradstreet (D&B), Experian Business, and Equifax Business, helping you build a well-rounded credit profile across platforms. - Higher Credit Limits:

Unlike Tier 1 vendors, Tier 3 vendors often extend larger credit lines — sometimes $5,000 to $10,000 or more — which improves your business’s credit utilization ratio and score. - Faster Paydex Score Development:

On-time payments to Tier 3 Net 30 vendors directly impact your Paydex score, a key indicator of business creditworthiness monitored by lenders and suppliers. - Credit Mix and Depth:

Working with Tier 3 vendors diversifies your tradeline portfolio, a factor that strengthens your overall credit profile and signals financial stability to lenders.

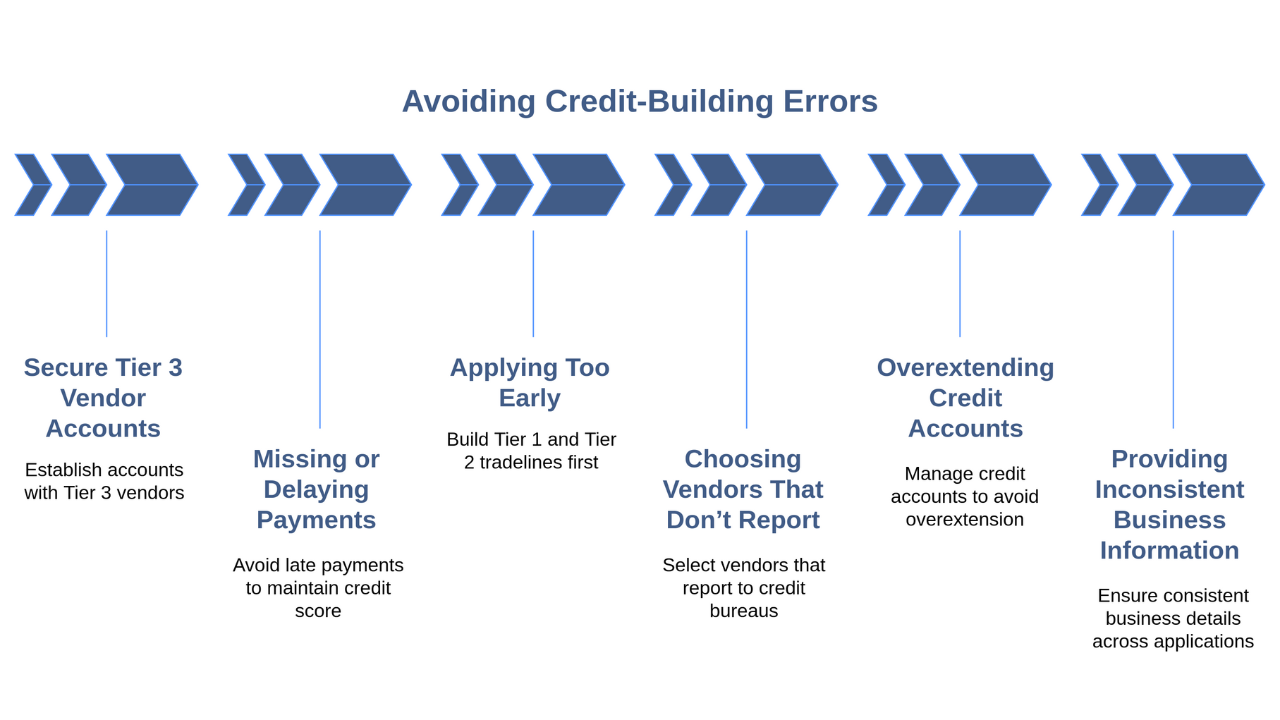

Common Mistakes to Avoid When Using Tier 3 Net 30 Vendors

Even after securing Tier 3 Net 30 vendor accounts, many businesses make critical errors that slow down or even damage their credit-building progress. Here’s what you must avoid:

Pro Tip:

Always confirm that the vendor reports to major bureaus before opening an account, and ensure your business information is 100% consistent across all platforms.

How to Leverage Tier 3 Net 30 Vendors Effectively

To maximize the benefits of Tier 3 Net 30 vendors, follow these steps:

Step 1: Research and Select Reputable Vendors

Look for vendors that align with your business needs. Examples include:

- Office supply stores (e.g., Staples, Office Depot).

- Marketing agencies offering Net 30 terms.

- IT service providers like Strategic Network Solutions.

Step 2: Apply for Accounts

Most Tier 3 vendors require minimal documentation. Be prepared to provide:

- Business name and address.

- Employer Identification Number (EIN).

- Basic financial information.

Step 3: Make Timely Payments

Set reminders to ensure payments are made on or before the due date. Late payments can harm your credit-building efforts.

Step 4: Use Vendor Accounts as Trade References

When applying for loans or higher-tier vendor accounts, list your Tier 3 vendors as trade references. This demonstrates your ability to manage credit responsibly.

Tier 1 vs. Tier 3 Net 30 Vendors: Which Should You Choose?

While Tier 1 vendors offer direct reporting to credit bureaus, they often require an established credit history. For new businesses, Tier 3 vendors are the perfect starting point.

Once you’ve built a solid payment history, you can transition to Tier 1 vendors for greater impact on your credit score.

Conclusion

Understanding invoice terms like “1/10 Net 30” is more than just reading numbers—it’s about improving cash flow, building trust with vendors, and making smarter financial choices. Whether you’re a supplier setting terms or a buyer managing expenses, these structured terms can give your business an edge.

By mastering payment terms, you set the stage for professionalism, financial discipline, and long-term growth. Ready to simplify your business finances?

Explore our collection of easy-to-use invoice templates, financial planners, and business tools designed to help you streamline operations, stay organized, and get paid faster.

Shop business tools at The CEO Creative

Empower your small business with the resources built for entrepreneurs like you.

Frequently Asked Questions (FAQs)

1. How Do Net 30 Vendors Help Build Business Credit?

Net 30 vendors allow businesses to make purchases on credit and pay within 30 days. By consistently paying on time, businesses can:

- Build a positive payment history.

- Use vendor accounts as trade references for larger loans or credit lines.

- Gradually qualify for Tier 1 and Tier 2 vendors.

2. What Is the Difference Between Tier 1, Tier 2, and Tier 3 Net 30 Vendors?

Tier 1 vendors report to all credit bureaus and require strong credit, ideal for established businesses. Tier 2 vendors report to one or two bureaus with moderate requirements, suiting growing businesses. Tier 3 vendors rarely report but have minimal requirements, making them perfect for startups.

3. Can Tier 3 Vendors Improve My Business Credit Score?

Yes, indirectly. While Tier 3 vendors may not report to credit bureaus, they help build payment history and trade lines, which can later serve as references to boost your credit profile.

4. Can you get business credit with a new business?

Yes. New businesses can start building credit by obtaining an EIN, DUNS Number, and business bank account, then using Net 30 vendors that report payments to credit bureaus. Positive tradeline reporting establishes your credit profile.

5. How to establish business credit for LLC?

To build business credit for an LLC, get an EIN, open a business bank account, and obtain a DUNS Number. Use Net 30 vendors that report payments, pay on time, and monitor your credit reports.