The Importance of Optimizing Days Sales Outstanding (DSO)

In the fast-paced world of business, cash flow management is critical for maintaining a company’s health and driving its growth. One key metric that businesses closely monitor and strive to optimize is Days Sales Outstanding (DSO).

DSO is a vital financial indicator that measures how quickly a company can collect payments from its customers after a sale is made on credit. It not only reflects the efficiency of a company’s collection processes but also its overall financial stability.

Lowering DSO can significantly improve a company’s liquidity, providing it with crucial capital to reinvest in operations, reduce debt, and seize new market opportunities. This blog explores how strategic management of Net 30 accounts and effective vendor relationships can enhance DSO, ultimately leading to improved business performance.

Understanding the Foundations of Days Sales Outstanding (DSO)

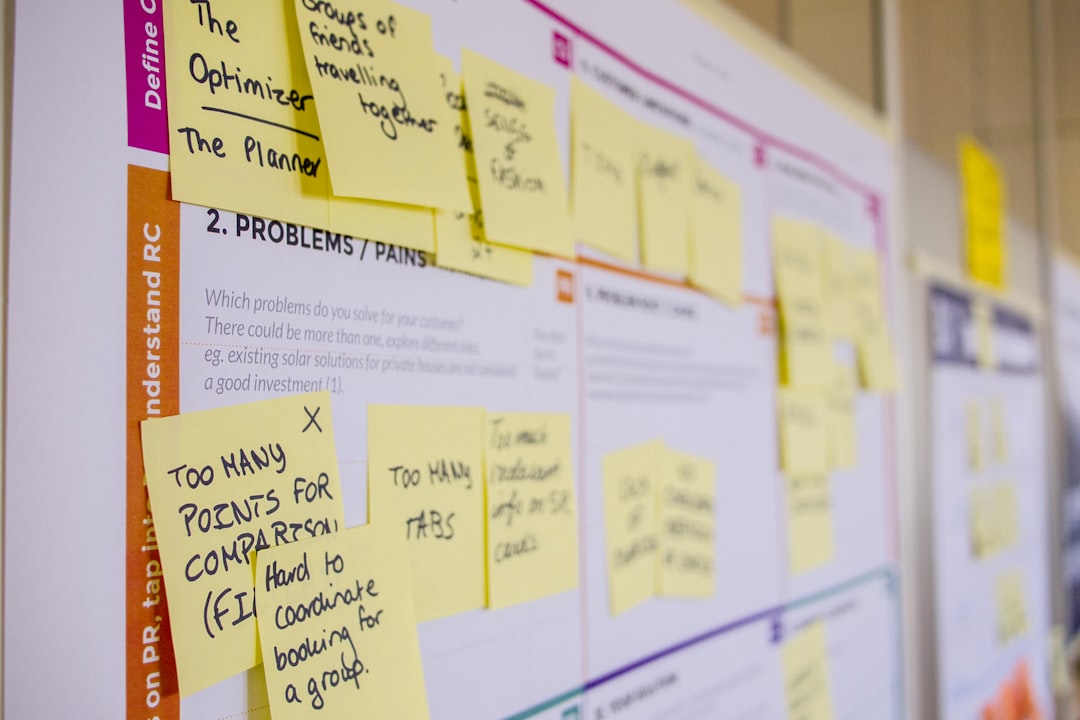

Image courtesy: Unsplash

Image courtesy: Unsplash

Definition and Significance of DSO in Business

Days Sales Outstanding (DSO) is a crucial financial metric used to measure the average number of days a company takes to collect payments after making a sale on credit.

Its primary significance lies in assessing a company’s liquidity and operational efficiency, providing insights into how quickly revenue can be converted into cash.

A lower DSO not only signifies efficient accounts receivable collection and improved cash flow, but it also positively impacts a company’s business credit. This efficiency enables businesses to reinvest in operations, pay down debt, and fund new ventures more effectively.

The Relationship between DSO, Cash Flow, and Business Liquidity

DSO has a direct impact on a company’s cash flow and liquidity. Cash flow, representing the net amount of cash being transferred into and out of a business, can be severely stifled by a high DSO. When customers delay payments, businesses may struggle to cover their expenses or reinvest in growth opportunities.

Additionally, improved DSO enhances business liquidity, ensuring that firms have enough liquid assets to meet short-term obligations. Managing DSO effectively is therefore paramount for maintaining sufficient cash flow and ensuring overall financial health.

The Critical Role of Net 30 Accounts in Managing DSO

Benefits of Implementing Net 30 Payment Terms

Implementing Net 30 payment terms, where customers have 30 days to pay their invoices, offers significant benefits. It encourages sales growth by making purchases more attractive and manageable for customers.

Furthermore, by setting a standard payment period, companies can streamline billing cycles and improve cash flow forecasting. Offering these terms can also foster stronger customer relations and loyalty by offering financial flexibility, vital for sustained business partnerships.

Potential Risks and Challenges of Net 30 Accounts

However, Net 30 accounts also come with inherent risks, primarily revolving around payment delays and the possibility of bad debt.

Extending credit to customers can result in a higher DSO if the payment collection process is inefficient or if customers fail to pay within the stipulated time.

Such situations can tie up capital in receivables rather than allowing it to be used for operational needs or growth investments. Carefully managing these accounts and assessing customer creditworthiness becomes crucial to mitigating these risks.

Balancing Opportunities and Risks with Strategic Account Management

To effectively balance the opportunities and risks presented by Net 30 accounts, businesses should adopt strategic account management practices:

– Creditworthiness Assessment: Evaluate the financial health of customers before offering Net 30 terms to minimize the risk of non-payment.

– Clear Communication: Ensure that payment terms, conditions, and due dates are clearly communicated and understood by the customer to avoid any confusion or disputes that could delay payments.

– Prompt Invoicing: Send invoices immediately upon delivery of goods or services to reduce the duration of the payment cycle.

– Incentives for Early Payment: Offer discounts or other benefits to customers who pay their invoices early to encourage timely payments and reduce DSO.

– Regular Review and Adjustments: Continuously monitor the DSO and make necessary adjustments in credit terms or customer management strategies based on evolving financial trends and customer payment behaviors.

Through such strategic measures, businesses can maximize the advantages of Net 30 accounts while keeping the potential financial hazards under control. This balance is essential for maintaining healthy cash flows and achieving long-term business success.

Strategic Vendor Management Using The CEO Creative’s Net 30 Program

Image courtesy: Unsplash

Image courtesy: Unsplash

Enhancing Business Purchasing Power

The CEO Creative’s Net 30 program significantly amplifies a business’s purchasing capabilities by allowing companies to acquire necessary goods and services while deferring payment for 30 days. This advantageous arrangement equips businesses with the ability to manage cash flow more effectively, as immediate cash outlays are reduced.

Businesses can leverage this additional purchasing power to invest in other crucial areas such as research and development, marketing strategies, and inventory expansion, ensuring they stay competitive and responsive to market demands without compromising their liquidity.

Simplifying Vendor Payments to Improve Cash Flow

By adopting The CEO Creative’s innovative Net 30 program, businesses can streamline their vendor payments process, which directly contributes to better cash flow management. This program simplifies the reconciliation process as it aligns payment cycles more synchronously with revenue inflows, reducing the time and effort typically spent on managing disparate financial schedules.

Moreover, businesses can take advantage of the 30-day grace period to better organize their financial obligations, ensuring timely payments without incurring late fees or disrupting relationships with key suppliers.

Case Studies: Success Stories from Implementing Net 30 Programs

Many businesses have reaped significant benefits from implementing Net 30 accounts. For instance, a medium-sized manufacturing company implemented the Net 30 program and saw its DSO decrease by 15 days, thereby enhancing its liquidity to fund an expansion.

Similarly, a retail enterprise used the flexibility of the Net 30 terms to optimize its inventory before peak season without straining its cash reserves. These success stories underscore the practical benefits of integrating strategic vendor management through Net 30 programs in various business settings, highlighting improvements in cash flow management and operational efficiencies.

Innovative Strategies to Optimize DSO

Integrating Robust Billing and Collection Processes

To effectively reduce Days Sales Outstanding (DSO), businesses must integrate robust invoicing and collection processes. This entails automating billing systems to ensure invoices are delivered immediately upon delivery of goods or completion of services, thus avoiding delays in payment starts. Employing digital payment systems that facilitate easier and faster payment methods for customers is also crucial. Additionally, regular follow-ups and courteous reminders can be set up to prompt customers about upcoming and overdue payments, helping to maintain a healthy cash flow.

Developing Effective Credit Policies to Mitigate Risks

Strategically formulated credit policies are essential for managing credit risk and minimizing DSO. These policies should include thorough credit checks, setting appropriate credit limits, and defining clear payment terms upfront. Transparent policies not only protect the business from potential bad debt but also provide clarity and security for customers, fostering a trusted business environment. Adapting these policies based on ongoing credit evaluations and market conditions will also help in mitigating risks associated with extending credit.

Fostering Strong Customer and Vendor Relationships

A key component in optimizing DSO involves cultivating robust relationships with both customers and vendors. For customers, consistent and transparent communication, coupled with excellent customer service, encourages timely payments.

On the vendor side, maintaining open lines of communication about expectations and terms can prevent misunderstandings and foster mutual respect.

Engaging with vendors through programs like The CEO Creative’s Net 30 can also demonstrate financial diligence and operational integrity, which are essential for long-term partnerships.

In conclusion, strategic vendor management, particularly through programs like Net 30 accounts, plays a vital role in optimizing Days Sales Outstanding. By enhancing purchasing power, simplifying payment processes, and fostering strong relationships, businesses can greatly improve their operational and financial performance. Implementing these strategies not only maximizes cash flow but also positions companies for sustainable growth and success.

Implementing Continuous Improvement and Monitoring for DSO

Image courtesy: Unsplash

Image courtesy: Unsplash

The Importance of Regular DSO Review and Analysis

To maintain an optimal Days Sales Outstanding (DSO), it’s crucial for businesses to engage in regular review and analysis of their DSO metrics. This continuous monitoring enables businesses to identify trends, pinpoint inefficiencies, and make data-driven decisions to improve financial health. Regular DSO review facilitates a better understanding of how quickly the company is converting its receivables into cash and can be a significant indicator of underlying operational issues such as delays in invoice processing or poor credit control practices. Additionally, it helps in assessing the impact of current credit policies and collections processes on cash flow. By spotlighting areas that need improvement, businesses can implement targeted strategies to reduce DSO and enhance cash availability for reinvestment and operational expenses.

Utilizing Technology and Automation for DSO Management

Leveraging technology and automation is a transformative approach to managing Days Sales Outstanding (DSO). Advanced software solutions can automate invoicing processes, enabling faster, error-free billing which significantly reduces the cycle from billing to payment collection. Automation tools can also send timely payment reminders to customers and escalate notifications for overdue accounts, thus ensuring consistent follow-ups. Moreover, integrating artificial intelligence and machine learning can help in predicting customer payment behaviors, thereby allowing tailored collection strategies that suit different customer segments. This proactive approach not only optimizes DSO but also facilitates a more strategic allocation of resources in the finance department, ultimately leading to improved operational efficiency and reduced overhead costs.

Adapting Strategies Based on Market Conditions and Business Needs

Dynamic market conditions require businesses to be adaptable in their financial strategies, including the management of DSO. During economic downturns, customers might delay payments due to cash flow issues, which can adversely affect DSO. In such scenarios, businesses might consider revising their credit terms, offering discounts for early payments, or setting up installment payment plans to facilitate easier customer payments.

Conversely, in a booming economic environment, tightening credit terms might be feasible to reduce DSO and enhance cash flow. Furthermore, businesses should continuously assess their customer portfolio and adjust credit limits and terms based on individual customer performance and risk. Adapting DSO management strategies to align with both market conditions and specific business needs ensures not only steady cash flow but also supports sustainable business growth.

Conclusion: Achieving Business Success through Optimized DSO Management

Effective management of Days Sales Outstanding (DSO) is more than just a financial obligation; it is a strategic endeavor that can dictate the overall health and agility of a business. Through streamlined billing processes, robust credit policies, and vigorous vendor relationships, businesses can transform DSO from a routine metric into a critical success factor.

DSO optimization requires an understanding of both the nuances of customer behavior and the dynamics within vendor relations. Successfully managing net 30 accounts while minimizing the DSO impact is not solely about enforcing stricter payment terms but also about nurturing customer relationships and offering flexible, yet strategic, payment solutions that benefit both parties.

As businesses strive for growth and stability, the role of innovative solutions like The CEO Creative’s Net 30 program becomes increasingly pertinent. By allowing businesses to maintain a healthier cash flow and manage their payables and receivables more effectively, such solutions not only enhance DSO but also strengthen business resilience against economic fluctuations.

In conclusion, mastering DSO is an indispensable part of achieving long-lasting business success. By adopting a comprehensive and proactive approach toward DSO management, businesses can ensure more predictable cash flows, better financial health, and ultimately a stronger marketplace position. Remember, a well-managed DSO not only improves liquidity but also enhances the company’s reputation and relationship with stakeholders, paving the way for sustainable growth and profitability.