Every smart business owner understands that handling cash flow can be tricky, almost like a dance. But what if you could improve your approach with a clever idea? That’s where Net 30 payment terms come in. By giving your customers 30 days to pay, you can improve your cash flow and keep your clients satisfied. This guide explores how using Net 30 terms can be a smart strategy for optimizing cash flow and benefiting both you and your business.

Optimizing Cash Flow with Net 30 Payment Terms

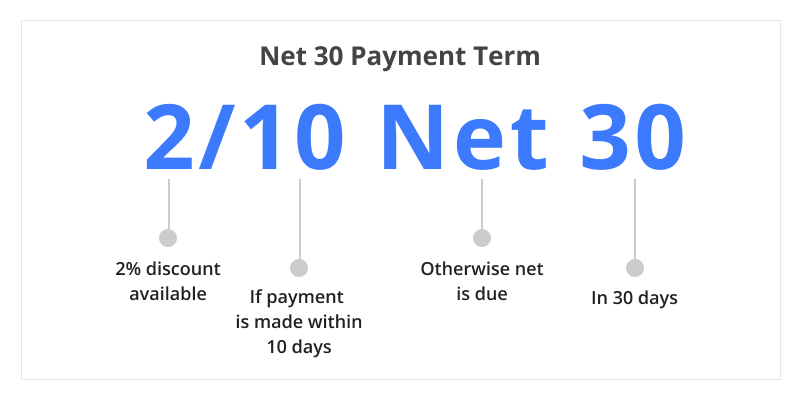

Net 30 payment terms might seem like just another finance term, but they can really help your business money situation. Let’s look at what they mean, why they’re useful, and clear up some common misunderstandings.

Definition and Overview of Net 30 Payment Terms

Net 30 payment terms mean the customer has 30 days to pay the full invoice amount after getting the goods or services. This is a common payment method in business because it gives customers some flexibility while keeping cash flow steady for businesses. Whether you’re sending or receiving invoices, knowing how this works can make invoicing smoother and help with better financial planning.

Advantages for Businesses

Here are some important benefits for businesses that offer Net 30 payment terms:

– Stronger Customer Relationships: Giving your customers 30 days to pay their bills shows that you’re flexible and trust them. This can improve your relationship with them, making them more likely to come back and recommend your business to others.

– Higher Chance of Sales: Offering Net 30 terms can help you attract more customers. Many customers like having time to manage their money, so they may choose your products or services over competitors who require faster payments.

– Easier Cash Flow Planning: With clear payment terms, it’s easier to predict when money will come in. This helps you plan your expenses and investments more effectively.

Common Misconceptions

Even though Net 30 terms are widely used, there are some misunderstandings about them:

– Net 30 Doesn’t Always Mean Payment Exactly on Day 30: Some people think that clients will always pay on the 30th day. But payments can happen anytime within those 30 days. If you don’t set reminders, you might end up with late payments.

– Net 30 Isn’t Right for Every Business: While many businesses find Net 30 helpful, it’s not a good fit for all industries. For example, businesses that need quick cash, like retail stores, might not benefit from it.

– Clients Might Not Fully Understand Net 30: Don’t assume your clients know what Net 30 means. Make sure to explain the payment terms clearly from the start to avoid confusion and delays in payments.

Effective Cash Flow Management Techniques

To get the best out of Net 30 terms, it’s important to know how to handle your money wisely. Here are some tips to help you manage your income and expenses without any trouble.

Forecasting Cash Inflows and Outflows

Forecasting means predicting how much money will come in and go out over a certain time. This helps you plan ahead, so you can prepare for times when you might have too little or too much money.

– Look at Past Data: Use your previous financial records to spot patterns in your cash flow. This can help you guess future income and expenses more accurately.

– Be Cautious with Estimates: When forecasting, assume you’ll earn less money than you might expect and plan for realistic expenses. This creates a safety net for unexpected costs or late payments.

– Think About Seasons: Consider how your business changes with the seasons. Plan for busy times when you earn more and slower times when income might drop.

Creating a Cash Flow Budget

Having a cash flow budget is like having a money plan that helps you manage your business. It shows you how much money you have, what you plan to spend, and how much you expect to earn.

– Focus on Important Costs: Separate the costs you really need from the ones you don’t. This way, you make sure the important expenses are paid first before spending on other things.

– Check and Update: Look at your budget often and compare it to your actual money situation. This helps you make changes on time and avoid money problems.

– Stay Flexible: It’s good to follow your budget, but being too strict can cause issues if something unexpected happens. Leave some room in your budget to handle surprises or new opportunities.

Offering Early Payment Discounts

Encouraging early payments is a clever way to increase your cash flow. By giving discounts to customers who pay before the 30-day due date, you can speed up payments and improve your relationship with them.

– Offer Attractive Discounts: Make sure the discounts are appealing enough to encourage early payment, but not so big that they hurt your profits too much.

– Be Clear About Terms: Clearly explain the early payment discount terms in your contracts or invoices. This honesty helps customers feel more secure about their financial dealings with your business.

– Check How Well It Works: Keep an eye on how many customers take advantage of the early payment discounts. If needed, adjust the discount rates to find the right balance between getting paid quickly and keeping your profits healthy.

Setting Clear Payment Terms and Due Dates

It’s important to clearly explain your payment terms and deadlines to keep your cash flow running smoothly. If things are unclear, it can cause confusion and late payments.

– Clear Invoices: Make sure your invoices are easy to understand. Include all the important details like the amount to pay, the due date, and how to pay. This helps avoid mistakes or confusion.

– Regular Reminders: Create a system to remind customers as the due date gets closer. You can send a friendly email or make a quick call. This makes it less likely for payments to be forgotten.

– Late Fees: While it’s best to get paid on time, sometimes delays happen. To encourage timely payments and cover any costs from late payments, you can add late fees.

Using these cash flow management methods along with Net 30 payment terms can help your business run more smoothly and stay financially stable. This ensures your business keeps a good cash flow and supports long-term growth. Whether you run a small business or manage a bigger one, knowing how to use Net 30 payment terms strategically can give you the advantage you need to succeed.

Leveraging Technology for Cash Flow Management

In today’s busy business world, managing your money and cash flow can feel like trying to juggle fire while riding a unicycle. It’s exciting, but it’s also really tough. Luckily, technology can help take some of that stress away. Using the right tools can make a big difference in optimizing your cash flow, especially when you use strategies like Net 30 payment terms. Let’s look at how certain technologies can help you with this.

Invoicing Software: Automation and Efficiency

Are you still mailing invoices the old-fashioned way? Or maybe you’re stuck managing multiple spreadsheets to track who owes you money? It’s time for a big change! Meet billing and invoicing software—your new go-to tool. These programs are made to simplify your billing tasks and help you get paid faster with less work. Here’s how they can help your business:

– Automatic Invoicing: Set it up once and let it run! Invoicing software can send out invoices on its own, saving you time and reducing mistakes or missed payments.

– Quick Financial Overview: Many invoicing tools come with dashboards that show you a clear picture of unpaid invoices, upcoming payments, and overdue accounts. This helps you stay on top of your business finances easily.

– Payment Reminders: Constantly reminding customers to pay can be stressful, but invoice software takes care of that for you. Set up automatic reminders to notify customers when their payments are due or late.

– Integrations: Most invoicing software works smoothly with your accounting software, making it easy to link sales and bookkeeping tasks.

In short? Invoicing software can turn your billing process from a complicated mess into a smooth and efficient system. With these tools, managing Net 30 payment terms becomes much easier and more organized.

Expense Tracking Tools: Gaining Control of Spending

Let’s be honest—keeping track of your spending can feel like trying to control a bunch of wild animals. But using the right tools to monitor your expenses can make things clearer, giving you a better understanding and more control over your money. Here’s how these tools can improve your financial plan:

– Instant Updates: Expense tracking tools let you see your spending as it happens. You can track where every dollar goes, spot patterns, and organize your expenses into categories.

– Budget Help: Many of these tools come with strong budgeting features. This makes it easier to plan and manage your money, keeping your spending in check.

– Receipt Organization: No more stuffing receipts into a box! With expense tracking apps, you can just take a photo of your receipt and save it digitally—making it simple to find later.

– Customizable Reports: Need a special report to help with decisions? No issue. Create detailed reports that show your expenses by category, project, or time period easily and quickly.

By using expense tracking tools, you can clearly see your spending habits and make smart decisions based on data to manage your cash flow better. This not only helps you handle Net 30 payment terms more efficiently but also allows you to leverage the benefits of using Net 30 payment terms to adapt your business to financial changes quickly.

The Importance of Cash Flow Management

You’ve likely heard the phrase, “Cash is king.” But do you know why? Handling cash flow is one of the most crucial parts of running a business. A business with plenty of cash can grab opportunities, handle tough times, and plan ahead with ease. The next sections will explain why managing cash flow is important and how it can make a big difference for your business.

Maintaining Financial Stability and Avoiding Shortfalls

Financial stability is the foundation of any successful business. Without proper management of your money, you could face serious problems and struggle to meet your responsibilities. Here’s why it’s so important:

– Predictability and Planning: Managing your cash flow well helps you predict your expenses and income accurately. This allows you to plan ahead and make sure you have enough money to keep your business running smoothly.

– Avoiding Debt: If you don’t manage your cash flow, you might have to borrow money to cover gaps, which can lead to growing debt and financial trouble.

– Staying on Track: Good cash flow ensures you can pay your bills, salaries, and buy supplies on time. Late payments can lead to fines and damage your reputation with suppliers.

In simple terms, managing your cash flow effectively keeps your business running smoothly and helps you avoid unexpected financial problems. It’s like having a safety net to protect you from falling.

Funding Growth and Expansion Opportunities

Who doesn’t enjoy the exciting feeling of growing a business? Growth often needs money, and if you don’t manage your cash flow well, you might miss out on great chances. Here’s why cash flow is so important for funding growth:

– Reinvesting in Your Business: Good cash flow means you have money ready to spend on things like new tools, hiring more people, or starting new projects.

– Being Ready for Opportunities: To act fast when a good chance comes up, you need money available. Strong cash flow lets you grab those opportunities without delay.

– Getting Better Deals: When you have steady cash flow, you can pay suppliers early for discounts, buy more at once to save money, or negotiate better terms because you’re reliable.

In simple terms, managing cash flow isn’t just about staying afloat. It’s about being proactive and taking advantage of opportunities that help your business grow. By closely monitoring your cash flow using tools and strategies, you not only keep your business running but also create chances for expansion and success.

Using smart technology along with good cash flow management sets the foundation for a successful business. Tools like invoicing software and expense trackers can automate and simplify your financial tasks. When combined with a well-organized Net 30 payment plan, these elements create a strong strategy to improve cash flow, ensure financial stability, and support business growth. So, are you ready to take your financial planning to the next level? Now you have the plan to make it happen!

How Net 30 Terms Affect Cash Flow

Using Net-30 payment terms can really help your business manage its money better. At first glance, it seems simple: you give your customers goods or services, and they have 30 days to pay you. However, there are more details to consider that can greatly affect how money moves in and out of your business.

Balancing Extended Payment Terms with Timely Collections

The beauty of Net 30 terms is in finding the right balance. Giving your customers the choice to pay within 30 days can make your business more appealing by giving them some extra time to manage their finances. However, this delay in payment can also create pressure on your own cash flow if you’re not careful. To find the perfect balance, here are some tips to keep in mind:

– Stay on Top of Payments: Set reminders to check in with your clients before and after the 30-day period. This helps avoid late payments and keeps your cash flow smooth.

– Reward Early Payments: Give small discounts to customers who pay their invoices early. This benefits both sides—they save money, and you get paid faster.

– Be Clear About Terms: Make sure everyone understands the payment rules from the start. Clear communication avoids confusion and helps ensure payments are made on time.

Managing Customer Credit Risk

Offering Net 30 terms means you’re letting your customers pay you 30 days after receiving an invoice. This can be risky because you’re giving them credit, and it might affect your cash flow. Here’s how you can reduce the risk:

– Check Their Credit History: Before giving Net 30 terms to a new customer, check their credit to see if they’re likely to pay on time.

– Set a Credit Limit: Decide the maximum amount you’re comfortable lending based on their credit score and how they’ve paid you in the past.

– Monitor Their Payments: Keep an eye on how they pay. Are they often late? Are their unpaid invoices increasing? This will help you manage the credit you give them better.

Keeping track of these factors helps you adjust your Net 30 terms to fit both your business’s ability and your customers’ trustworthiness. This way, you can avoid problems caused by late payments.

Common Cash Flow Mistakes to Avoid

Managing a business requires carefully balancing money coming in and money going out. Even with tools like Net 30 payment terms, some errors can disrupt your finances and cause cash flow problems. Knowing these common mistakes can help your business stay financially stable.

Overestimating Revenue and Underestimating Expenses

One of the most frequent mistakes in managing cash flow is being too hopeful about how much money you’ll make while ignoring or underestimating your costs. This can make you feel more secure than you should and lead to unexpected money problems. Here’s how to avoid this mistake:

– Be Realistic with Your Predictions: When estimating how much money you’ll earn, use past data and think about possible challenges, like changes in the market or a weak economy.

– Plan for Unexpected Costs: Some expenses, like fixing equipment, paying for utilities, or giving bonuses to employees, are often forgotten when planning. Make sure to include these in your budget so you’re not caught off guard.

– Update Your Budget Often: Treat your budget as something that can change. Review and adjust it every month to make sure it matches your current situation and covers any unexpected costs.

Ignoring Seasonal Trends

Not all businesses make the same amount of money every month. If you don’t plan for busy and slow seasons, you might face money problems, especially when income drops during quieter months. To handle this well:

– Look at Past Data: Check your old financial records to spot trends and figure out when your business is usually busy or slow.

– Save for Slow Times: When you’re making more money, save some of it to help cover costs during quieter months. This way, you won’t feel stressed when income is lower.

– Adjust Marketing and Stock: Change your advertising and how much stock you keep based on the season. This helps you make the most money during busy times and avoid losses during slow times.

Neglecting Regular Monitoring

Cash flow is always changing, and not keeping an eye on it regularly is like flying without a map. If you don’t check it often, you might miss important details that could affect your decisions.

– Plan Ahead with Cash Flow Forecasting: Make predictions about your future cash flow to see where your finances might be headed. This helps you prepare for any shortages before they happen.

– Use Financial Tools: Get good accounting software that tracks your cash flow and gives you clear reports and insights into your money.

– Check Often: Take time every week or every two weeks to review your cash flow. Doing this regularly helps you spot and fix any problems early.

By steering clear of these errors and understanding the nuances of different types of business financing, you’ll be better prepared to keep a stable cash flow that helps your business grow and reduces money worries. Keep in mind, the secret to optimizing cash flow is making regular changes and always keeping an eye on your financial reports and the overall market situation.

Conclusion

Using Net 30 payment terms in your business can be a smart way to optimize your cash flow. By knowing how your company’s finances work and carefully managing payment terms, you can keep your money flowing smoothly and build good relationships with your clients. Don’t forget to:

– Explain the payment terms clearly to your clients.

– Keep a close eye on the money you’re owed.

– Change your plans if needed, based on how your cash flow looks.

By following these steps, you’ll manage your cash flow better and feel more confident!

![Optimizing Cash Flow with Net 30 Payment Terms [A Strategic Guide]](https://theceocreative.com/wp-content/uploads/2024/12/Optimizing-Cash-Flow-with-Net-30-Payment-Terms-A-Strategic-Guide.jpg)