In terms of budgeting the office, there may be some questions, such as:

“What goes into the office supplies category versus what goes into the janitorial expenses category?”

This may be an important point of clarity as you look to budget your workplace properly.

Should the mop in the cleaning closet simply be placed into the budget category labeled “office supplies,” or should this be considered a janitorial expense?

Understanding these categories not only helps in planning your budget but also ensures that financial management within your working space proceeds without hitches.

Now, let’s look at these categories that are interchangeably used and see how they could have some sort of impact on your decisions about budgets!

Why Is It Important To Categorize Office And Janitorial Supplies?

Why does it matter if a pen gets lumped in with floor wax?

Accurate categorization of office supplies isn’t just about keeping your asset list neat. It’s fundamental for a handful of reasons:

1. Budget Management: Proper classification helps track spending and forecast future needs better. It aids in setting realistic budgets and prevents overspending.

2. Tax Deductions: In many regions, office supplies can be tax-deductible. Correct categorization ensures you don’t miss out on potential deductions.

3. Inventory Control: Keeping track of office supplies can prevent stock shortages or overspending on items you don’t need.

4. Financial Reporting: Ensures clarity in financial statements, which is essential for both management and investors.

Financial health and clarity rely heavily on being meticulous in budgeting for commercial cleaning supplies or janitorial supplies. Misclassification can lead to skewed data, which in turn affects how well an office functions and manages its finances.

| Global Market Context

Understanding the broader janitorial office supply market provides perspective on industry trends and spending patterns. In the United States, the janitorial services market reached $312.5 billion in 2024 and is projected to reach $485.3 billion by 2034, growing at a 4.5% CAGR. This growth is driven by increased awareness of workplace hygiene and sanitation, expanding commercial establishments, and growing concerns about disease prevention. On the other hand, the US office supplies market was valued at $17.92 billion in 2024 and is projected to reach $20.01 billion by 2033, growing at a CAGR of 1.2% from 2025 to 2033. This reflects ongoing demand for essential office products, both in traditional workplaces and home offices. |

What Comes Under Office Supplies?

Managing office finances can sometimes feel like attempting to paint with a palette of gray. It might not be the most exciting task, but it’s definitely a crucial one. One area that often trips people up is determining what exactly falls under the umbrella of office supplies. Knowing the ins and outs can make budget management a breeze!

What Truly Defines The Office Supplies?

In the corporate world, office supplies refer to items that are specifically used for the daily operations of an office environment. These are the tools that can be found in most workspaces to ensure productivity. So what exactly makes the cut?

Common office supplies include:

- Pens and Pencils: The unsung heroes of note-taking.

- Paper Products: Think about the endless stacks of copy paper, notebooks, sticky notes, and file folders.

- Printers and Accessories: Printers themselves might fall into another category, but things like ink cartridges and toner are considered office supplies.

- Organizational Tools: Staplers, paper clips, binders, and document trays keep chaos at bay.

- Technology Supports: Computer mouse, keyboards, USB drives—small techy items that keep our digital world running smoothly.

All these items share something in common. They’re used to carry out work tasks and support day-to-day operations.

What Comes Under Janitorial Expenses?

Now that we’ve got a grasp on office supplies, let’s understand the meaning of janitorial expenses. Are these items cozying up with the staplers, or do they dance to a different accounting tune?

What Defines Janitorial Expenses?

Unlike office supplies, janitorial expenses are tied directly to maintaining and cleaning the office space. They don’t directly facilitate work tasks but ensure the environment is usable and pleasant:

- Cleaning Products: Floor cleaners, window sprays, mops, brooms, and vacuum bags.

- Restroom Supplies: Toilet paper, hand soap, paper towels, and air fresheners.

- Waste Management Supplies: Trash bags, recycling bins, and sanitizer.

These items play a pivotal role in ensuring the cleanliness and upkeep of the office environment. They may not contribute directly to productivity in the way ink does for a printer, but they keep the workspace functioning smoothly overall.

Janitorial Vs Office Supplies At A Glance

While they may both come under ‘supplies’ in the general sense, office supplies and janitorial expenses are fundamentally varying categories in many respects:

| Aspect | Office Supplies | Janitorial Expenses |

| Primary Purpose | Direct work support and productivity | Workplace maintenance and cleanliness |

| Usage Pattern | Ongoing for business operations | Regular maintenance schedules |

| Tax Treatment | Generally fully deductible as supplies | May have different tax implications |

| Consumption Rate | Varies with business activity | More predictable and consistent |

| Budget Impact | Directly affects operational efficiency | Ensures workplace safety and compliance |

How To Classify Cleaning Supplies In Your Office Budget

Proper classification of cleaning supplies requires understanding their specific use and purchasing patterns. This approach helps ensure that your office cleaning expenses are accurately reflected in your accounting records. We can categorize it as:

- Usage and Purpose of Cleaning Supplies

- Frequency and Volume of Purchase

- Departmental Needs and Allocation

1. Usage And Purpose Of Cleaning Supplies:

The first thing to consider is: What are your cleaning supplies actually used for?

It may sound like an easy question, but it has deep repercussions for classification. Cleaning supplies often serve different purposes depending on where they’re used in the office.

General Office Maintenance:

Surface cleaners, cloths, and dusters are used for general office cleaning and maintenance, and are needed daily. So they can be considered within the rubric of office supplies.

Specialized Office cleaning:

Specialised cleaning needs, such as industrial floor cleaners or heavy-duty sanitisers, are not used continuously but rather for specific purposes in the kitchen or bathroom, and therefore fall under janitorial expenses.

Emergency Cleaning Situations:

Supplies used for sudden spillages or accidents are not typically included in the budget of purchases. They can therefore be included in the general armamentarium of readiness supplies.

2. Frequency And Volume Of Purchase

Another important factor in classifying cleaning supplies is analyzing how often and in what quantities they are bought. This ties directly into budget allocation and resource planning:

Routine Purchases:

Items that are regularly restocked, such as hand soap and paper towels, can fit under office supplies due to their consistent presence in the budget. These are predictable, recurring expenses and tend to be bought in bulk.

Bulk Or Wholesale Buying:

If you purchase a high volume of specific cleaning products at once to take advantage of discounts, these might be better tracked separately as they impact the budget differently than regular purchases.

One-Off Needs:

Occasionally, you might need specific products for one-off events, like a big office cleanup. It might make sense to categorize these as janitorial expenses due to their sporadic nature.

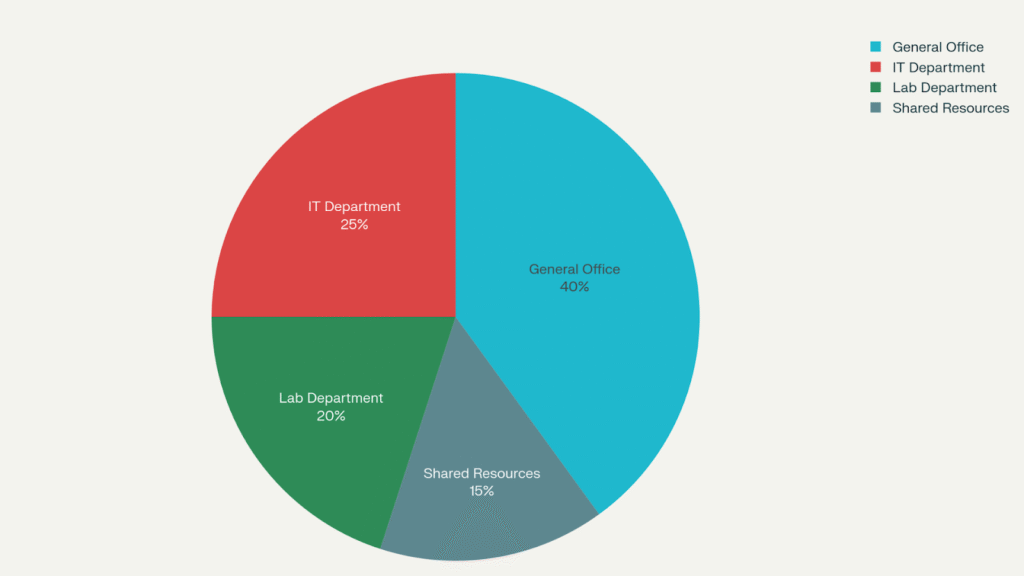

3. Departmental Needs And Allocation

Different departments might have varying needs for cleaning supplies, which could affect how these expenses are classified. Understanding these requirements can ensure that supplies are both appropriately used and budgeted:

General Office Areas:

Supplies needed for standard areas like hallways and cafeterias can usually be listed under common office supplies due to shared usage across departments.

Specific Department Requests:

Departments like IT or Labs may require particular cleaning products for equipment or sensitive machinery. These products can be categorized under janitorial expenses, given their technical and specialized nature.

Shared Resources:

Consider items shared across departments, such as sanitizers or disinfectants, which should be accounted for in a generalized office supply budget. Proper coordination ensures that these are easily accessible without being tied exclusively to one department’s finances.

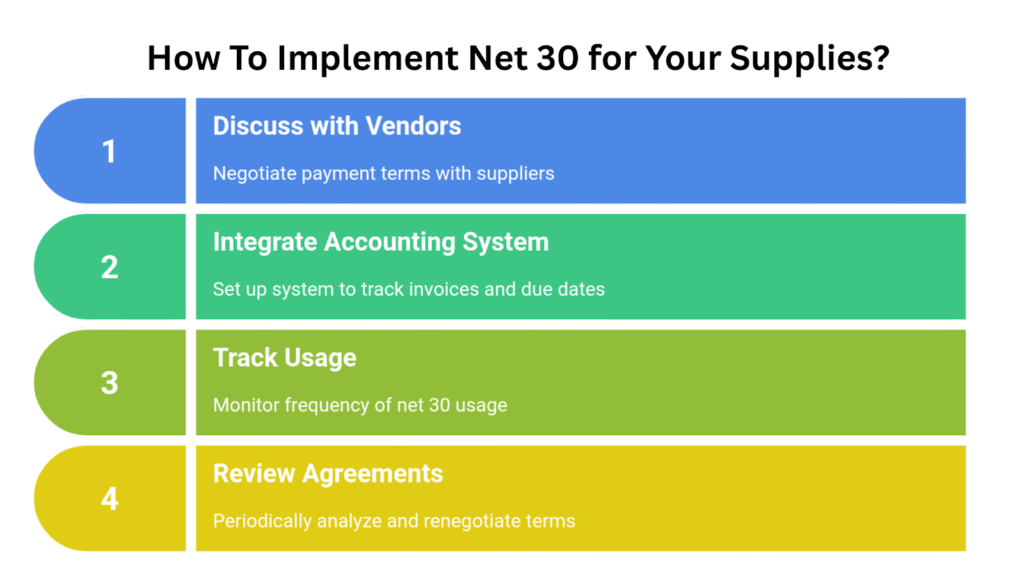

Why Use Net 30 For Office Cleaning Supplies?

Beyond categorization, managing payment terms for cleaning supplies can significantly improve your cash flow and vendor relationships. One such example is: net 30 payment terms. But what does this really mean?

Net 30 is a form of credit arrangement where you have 30 days to pay your supplier from the date of your invoice.

Net 30 is an excellent tool in managing office cleaning supply purchases because it offers:

- Cash Flow Flexibility: With Net 30, your company gets 30 days to pay for the office needs. It means your company can maintain a more stable cash flow.

- Building Vendor Relationships: Consistently using net 30 terms strengthens your relationships with suppliers and opens doors to future discounts, better terms, or priority services.

- Improved Financial Planning: Having a 30-day period to settle invoices allows you to align your supply expenses with monthly budgets and manage sudden purchases more efficiently.

Financial Implications Of Office And Janitorial Supplies Misclassification

It’s surprising how a small bookkeeping error like misclassifying cleaning supplies can spiral into bigger financial headaches for your business. It can cause issues like:

- Inaccurate Budget Analysis:

Even if you miss a few of the cleaning supplies in accounting, the budget analysis may not accurately assess their expense.

- Tax Compliance Issues:

Different expense categories may have different tax treatments. Expenses that land in the wrong bucket may miss out on deductions or, even worse, raise compliance flags with tax authorities.

- Weak Financial Trust:

Systemic classification errors start to erode trust in an organization. Teams may worry about budget transparency, wonder if job security could be affected, or feel discouraged about how resources are managed day to day.

- Resource Allocation Errors:

Inaccurate categorization prevents you from accurately assessing departmental spending. This can lead to poor resource allocation decisions and missed opportunities for cost optimization.

Tips To Track And Report Expenses Effectively

Implementing a robust tracking system can prevent the confusion that arises from misclassifying costs. Use detailed spreadsheets or budgeting software that allows you to have separate categories and subcategories for janitorial and office cleaning expenses accounting.

- Create clear categories: Make sure your janitorial and office supplies accounting system has distinct categories. Scanning and filing receipts in the right place from the get-go will save everyone time and stress down the line.

- Regular reviews: Set up a schedule for regular financial reviews. Monthly or quarterly checks can help spot misclassifications early. This way, you’re not stuck with a budget that doesn’t reflect reality.

- Encourage communication: Often, budget mismanagement is a result of poor communication. Keep an open line between departments about what constitutes an office supply versus a janitorial item.

Conclusion

Whether cleaning supplies go under office supplies or janitorial expenses may seem inconsequential, but it does matter when setting a budget for your company. Consider whether you buy them frequently and what kind of use they have, and hence classify them appropriately. This mere difference in classification might lead to correct financial recording and hence proper deployment of resources. Keep in mind that clarity in the books smooths the way not just for budgeting but also in many other facets of your office work. A little attention to detail goes a long way!

Frequently Asked Questions (FAQs)

1. What is the difference between office supplies and janitorial expenses?

Office supplies help with daily work tasks, like pens and paper. Janitorial expenses are for cleaning and maintaining the office, like mops and disinfectants.

2. Can I use net 30 terms for cleaning supplies?

Yes, net 30 terms let you pay for cleaning supplies 30 days after purchase, helping with cash flow and budgeting

3. How do I categorize cleaning supplies in my budget?

Regular cleaning supplies like soap and paper towels go under office supplies. Specialized items like industrial cleaners are janitorial expenses.

4. Are cleaning supplies tax-deductible?

Yes, cleaning supplies are usually tax-deductible as long as they are used for business purposes.

5. What happens if I misclassify cleaning supplies?

Misclassifying can lead to budget errors, tax issues, and confusion about department spending.

6. Should I buy cleaning supplies in bulk?

Buying in bulk can save money, but make sure your storage and usage match your needs to avoid waste.