| Summary:

The right payment terms choice, whether it is Net 15, Net 30, Net 45, or Net 60, affects your business’s cash flow and relationships. Make sure to consider your business needs and industry norms to pick the best option for smooth financial management. |

Are you struggling to keep your cash flow stable?

Then you should consider business payment terms. Payment terms define when and how you will receive payment from clients or pay suppliers. They help you manage your cash flow.

The right terms can help you avoid delays, reduce financial stress, and ensure that your business operations run smoothly. There are several types of payment terms used in business today, from Net 30, Net 15, Net 45, to Net 60.

Each of these terms has distinct advantages and considerations depending on your cash flow needs and business models.

Here we will compare each payment term and help you decide which one best aligns with your financial strategy.

Understanding Net 30 Payment Terms

Definition and Explanation

“Net 30” on an invoice means that, as a buyer, you’ve got 30 calendar days from the invoice date to pay up. It’s like getting a 30-day grace period to sort out your finances before paying the seller. This term isn’t just a random business jargon; it’s recognized across many industries and is all about building trust between buyers and sellers. It’s a win-win where buyers get to use what they purchased straight away and sellers have the assurance that payment will come soon.

Advantages for Buyers and Sellers

Net 30 is a balanced choice for both parties involved in a transaction. For buyers, it offers breathing room to manage their cash flow better. Imagine having a 30-day window to gather the payment amount; that’s a big help! It allows businesses to focus on generating revenue from the goods or services they purchase before they need to settle their invoices. On the flip side, sellers benefit from Net 30 because it helps ensure a predictable cash flow. When sellers know they’ll be receiving payments in a set timeframe, they can better manage their finances, which is crucial for maintaining business operations. Additionally, timely payments under Net 30 terms can help build positive credit history for buyers, making them more attractive for future dealings.

Exploring Alternative Payment Terms: Net 30 vs. Net 15, Net 45, and Net 60

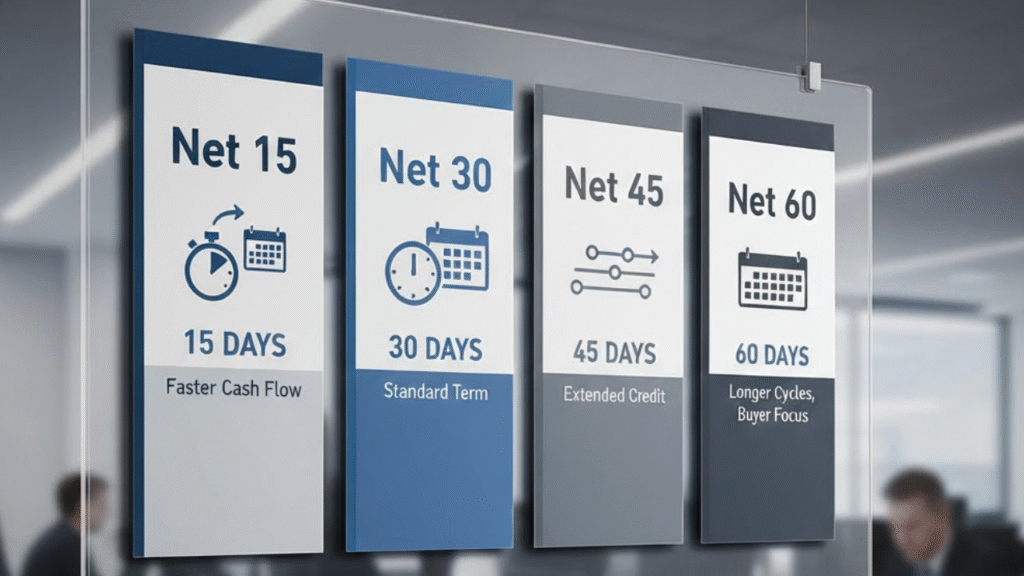

Let’s take a look at some alternative payment terms: Net 15, Net 45, and Net 60.

Net 15: Quick Cash Flow Management

Net 15 payment term is like the sprinter of payment terms. It requires that payments be made within 15 calendar days from the invoice date. This shorter cycle is generally preferred by sellers who are eager to boost their cash flow quickly and reduce the risk of late payments. For buyers, it’s a bit like being on a financial treadmill; it demands tight cash management and swift payment arrangements. This term is particularly helpful for businesses that can absorb quicker payment cycles or want to maintain an edge by demonstrating strong, prompt financial discipline.

Net 45: Extended Payment Flexibility

Net 45 payment term is like the middle-ground marathon. It provides buyers with 45 days to pay, offering a bit more breathing room than Net 30. It’s suitable for businesses that have longer sales cycles or those in industries where extended payments are the norm. For sellers, however, this can mean facing a moderate risk of delayed payments and potential cash flow strains. It might require sellers to adopt strategies to ensure payments are made within this period.

Net 60: Maximum Credit Period Challengers

Net 60 is considered the heavyweight champion of payment terms. It gives buyers a 60-day window to settle their invoices. It’s perfect for businesses facing seasonal fluctuations or heavy upfront expenses. With two full months to pay, buyers have maximum flexibility.

However, sellers must exercise caution here. This term poses the highest risk of late payments and potential bad debts. Sellers relying on this extended term must undertake thorough credit assessments and adopt proactive collection strategies to mitigate these risks.

Whether you’re the buyer who needs a little time to gather resources or a seller looking to secure timely payments, understanding these payment terms can help you make informed decisions and forge better business relationships. So, take a minute to evaluate which payment term aligns with your business model and financial goals!

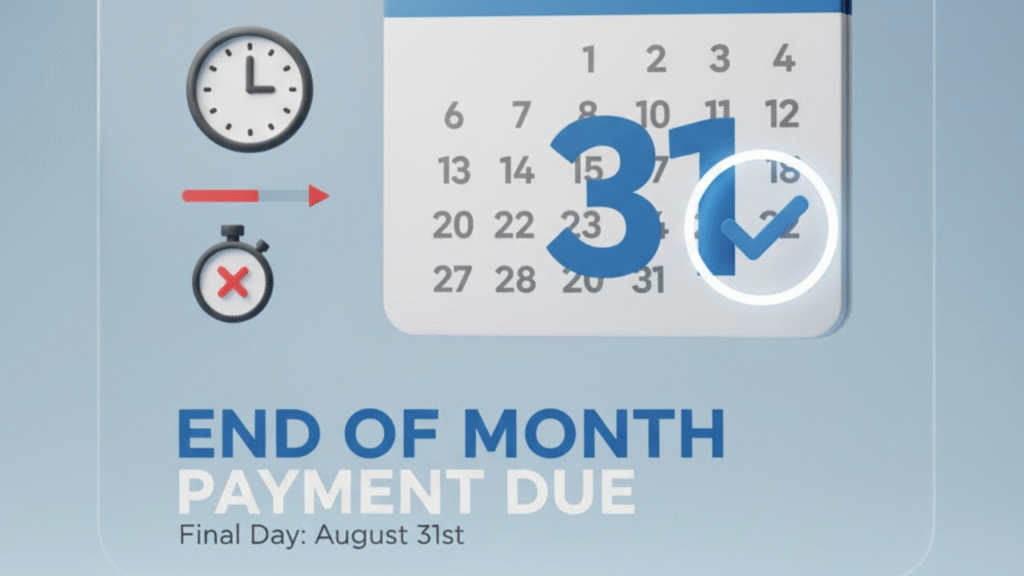

The End of Month (EOM) Option

Structured Payment Schedule

Imagine you’re juggling multiple invoices, and the chaos of varying due dates adds an extra layer of stress to your monthly financial routine. Well, this is exactly where the EOM or End of Month option saves the day.

It offers businesses a structured payment schedule by standardizing payments to be due at the end of the month following the invoice date. This systematic approach is particularly helpful for businesses that prefer predictability in managing their financial commitments.

The beauty of an EOM schedule lies in its simplicity. By setting a uniform payment deadline, businesses can align their payment schedules, making cash flow management far more straightforward. This clarity enables buyers to focus on other pressing business matters, rather than fretting over a scattered due date calendar. Plus, it offers sellers a clear-cut cycle for expecting payments, streamlining the tracking and reconciliation process.

Alignment with Monthly Accounting Cycles

An often understated benefit of EOM terms is their natural alignment with monthly accounting cycles. Most businesses operate on a monthly accounting schedule, where financial statements, expense reports, and other critical documents are compiled at the end of each month. EOM terms dovetail seamlessly with these payment cycles, simplifying the accounting process.

By aligning payment terms with accounting cycles, companies can ensure a more accurate reflection of their financial status at the month’s end. This harmonization minimizes discrepancies in reporting and reduces the chances of overlooking pending payments, ultimately contributing to more efficient and error-free financial management.

Comparing Payment Terms

Industry Acceptance and Practices

Let’s face it: every industry has its unique payment term preferences. Some look at Net 15 as the speed demon of payment terms, while others lean towards the leisurely pace of Net 60.

Industry acceptance often dictates which terms become the norm within a given sector. For instance, industries with rapid transaction turnover, like retail or fashion, might prefer shorter terms like Net 15 to maintain a brisk cash flow. Alternatively, sectors with longer sales cycles, such as manufacturing, might find Net 45 or even Net 60 more fitting.

Being aware of these common practices allows businesses to match the standard, ensuring smoother interactions and fewer surprises while negotiating payment terms with partners.

Cash Flow Implications

Just as a puzzle needs each piece to fit perfectly, your choice of payment terms affects the cash flow puzzle within your business. A Net 15 term could boost your cash inflow quickly, yet the pressure it puts on buyers might strain relationships. On the flip side, Net 60 allows buyers breathing space but can put sellers in a cash crunch, delaying their ability to meet their own financial obligations.

Balancing between receiving payments on time and offering reasonable terms to clients is crucial. A perfect cash flow strategy hinges on picking a term that aligns with the business’s financial rhythm, ensuring liquidity and operational flexibility.

Credit Building and Financial Strategy

Payment terms do more than just affect when money exchanges hands—they’re also a tool for building creditworthiness and refining your financial strategy. Consistently adhering to terms like Net 30 can bolster a company’s credit reputation by demonstrating reliability and financial discipline. This positive track record could lead to favorable borrowing terms and more business opportunities in the future.

Strategically selecting payment terms can even be used to support a company’s financial health, cushion unexpected expenses, and prepare for growth. Whether aligning payment terms with seasonal business peaks or utilizing them to maintain steady financial health, they are an integral part of sound financial planning.

Partnering with The CEO Creative

Choosing the right business partner can make a world of difference, especially when it comes to flexibility in financial management. Enter The CEO Creative, a company that not only offers stellar marketing, branding, and creative solutions but also extends an attractive Net 30 payment term option to its clientele. Their understanding of financial needs in the business landscape is evident in their offerings, which are designed to support businesses of all sizes.

Features of Their Net 30 Offerings

The CEO Creative stands out with several noteworthy features in its Net 30 offerings:

- Generous Credit Limit: They provide a credit limit of up to $5500, which allows businesses to engage in valuable services without the immediate pressure of a hefty financial outlay.

- Affordable Membership: With an annual membership fee of just $39, businesses can take advantage of Net 30 terms without breaking the bank.

- Easy Approval Process: They have simplified the approval process, which doesn’t require a minimum limit or a personal guarantee, enabling businesses to quickly and easily access needed services.

Benefits for Businesses of All Sizes

The CEO Creative’s Net 30 terms are designed with flexibility and accessibility in mind, offering numerous benefits.

- Financial Flexibility: Businesses can allocate their resources more effectively by having the leeway to pay for services over time. This is exceptionally beneficial for managing cash flow, especially in growing businesses.

- Trust and Growth: By associating with a trusted partner that offers easy credit terms, companies can focus on their growth and improving their brand standing.

- Empowerment: Whether you’re a startup laying the foundation for future success or an established business looking to streamline your operations, The CEO Creative’s Net 30 terms can empower you to achieve your business goals.

Factors to Consider When Choosing Payment Terms

Selecting the right payment terms isn’t just about what’s being offered; it’s about what’s right for your business. Here are key factors to consider when choosing a payment term:

Industry Standards and Creditworthiness

Understanding industry standards is a critical first step. Each industry has its own norms when it comes to payment terms—some align naturally with shorter terms like Net 15, while others typically extend to Net 45 or even longer. Aligning your terms with the common practices in your industry can smooth out transactions and establish a reliable rapport with both vendors and customers.

Additionally, if you’re considering offering payment terms, assess the creditworthiness of your potential clients. Conduct credit checks and review financial histories to make informed decisions and mitigate the risk of late payments or default.

Cash Flow Needs and Negotiation Strategies

Both buyers and sellers must consider their cash flow requirements. Buyers need to ensure they can sustain their operations while meeting their obligations within the established terms. Sellers, on the other hand, should opt for terms that maintain their cash flow sufficiently to support business operations.

Remember, negotiation is a potent tool. Communicate openly with vendors and customers to devise payment arrangements that align with both parties’ needs. This can lead to customized solutions that support longer-term business relationships and financial health.

Navigating the realm of payment terms successfully can lead to smoother financial operations and can fortify your business against cash flow disruptions. Think strategically and choose partners like The CEO Creative who understand and support your financial dynamics.

Conclusion

Choosing the right payment terms is crucial for your business’s financial health and relationships with partners. While all options—Net 15, Net 30, Net 45, and Net 60—have their own advantages, Net 30 strikes a balance that often fits most business needs. It gives buyers a fair amount of time to settle invoices without stretching sellers too thin on cash flow, creating a win-win for both parties.

To make the best choice, always consider your industry standards, your specific cash flow needs, and the creditworthiness of your partners. Remember, in many cases, payment terms can be negotiated to find a solution that works well for everyone involved. Harnessing technology by using accounting software can also streamline your process, ensuring you stay on top of your payment schedules and cash flow.

By partnering with supportive vendors like The CEO Creative, who offer flexible Net 30 terms, businesses not only gain financial breathing space but also foster lasting, trustworthy partnerships. This approach ensures you’re not just surviving in today’s business climate but thriving with a robust, financially sound strategy.

Frequently Asked Questions (FAQs)

1. How do payment terms like Net 15, Net 30, etc., impact your business’s credit score?

Payment terms like Net 15 or Net 30 tell how soon you need to pay bills. Paying on time helps your business build a good credit score, showing lenders and suppliers you are reliable. Late payments hurt your credit and limit borrowing options.

2. How do payment terms vary across industries?

Payment terms vary by industry due to different business models and cash flow needs. For example, retail and food industries often require quick payments, construction and government projects use longer terms (30-90 days), and professional services usually follow net 30 terms. High-risk industries may require payment in advance.

3. How can businesses with seasonal revenue cycles benefit from Net 60 payment terms?

Businesses with seasonal revenue cycles benefit from Net 60 payment terms because they get extra time to collect income during busy periods before paying invoices. This helps manage cash flow better, align payments with revenue cycles, and reduce financial stress during slow months. Offering Net 60 can also build stronger client trust and attract larger orders.

4. How do payment terms impact my ability to forecast revenue and expenses?

Payment terms help you know when money will come in from customers and when you need to pay your bills. Short payment terms mean you get money faster, making it easier to plan your spending. Longer terms delay cash coming in, making it harder to predict, and could cause money shortages. Matching payment terms to your business cycle helps you plan your budget better and avoid surprises.

5. What are some common mistakes businesses make when selecting payment terms?

Common mistakes businesses make when choosing payment terms include unclear terms causing confusion, offering overly long payment periods harming cash flow, failing to communicate terms clearly, not providing multiple payment options, and sending invoices late or with errors, leading to payment delays. These mistakes hurt cash flow and customer relationships.