Navigating the landscape of business credit can seem daunting for many entrepreneurs and established businesses alike. However, understanding and utilizing Net 30 vendors that report to Equifax can significantly ease this journey. These vendors are not only beneficial in managing cash flow by allowing businesses 30 days to pay invoices, but they also play a crucial role in building a robust business credit profile.

Reporting to credit bureaus like Equifax, these vendors provide invaluable data that enhances your credit visibility and credibility. This guide aims to explore the advantages of using Net 30 vendors, identify some leading providers, and offer insights on how best to leverage these relationships for optimal credit building.

Whether you’re just starting out or looking to strengthen your business’s financial standing, the strategic use of Net 30 accounts offers a pathway to enhanced credit opportunities and long-term business success.

Understanding Net 30 Vendors

Definition and Basic Function of Net 30 Vendors

Net 30 vendors provide a specific type of trade credit where businesses buy now and are allowed to pay the invoice within 30 days. This form of transaction is crucial for companies that need to manage cash flow more effectively. By using a Net 30 account, businesses can stock up on necessary goods and services without an immediate cash outlay, thereby preserving liquidity for other operational needs. This setup benefits small and medium enterprises (SMEs) particularly during their growth phase, where cash flow management is vital.

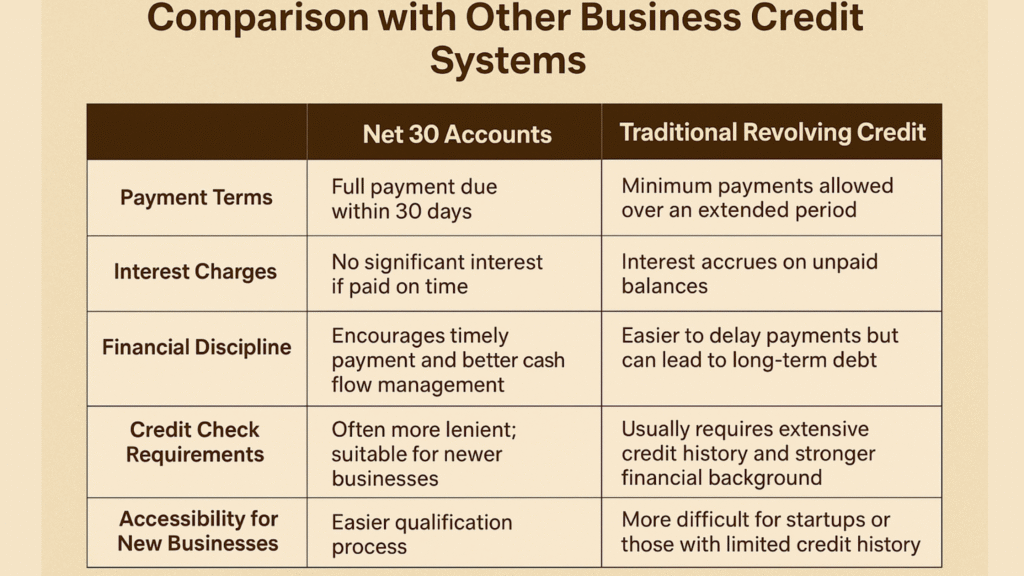

Comparison with Other Business Credit Systems

Traditional revolving credit lines, such as business credit cards, require you to make minimal payments over an extended period. In the case of Net 30, paying the balance within 30 days encourages businesses to maintain discipline in managing their finances without accruing significant interest fees that typically come with credit cards.

Additionally, while lines of credit often require extensive credit checks, some Net 30 vendors offer more lenient approval processes, making it easier for newer businesses with less established financial histories to qualify.

Advantages of Using Net 30 Vendors That Report to Equifax

Building and Enhancing Business Credit

Net 30 companies that report to Equifax help improve your business credit score. A solid business credit score garners trust among prospective lenders, suppliers, and partners, reflecting your business’s reliability and financial health.

Unlocking Financial Opportunities

A positive credit history with Equifax leads to broader financial opportunities. Enhanced business credit scores, obtained through consistent and timely payments to Net 30 vendors, allow companies to access better loan terms, higher lines of credit, and more favorable repayment conditions. This can be instrumental in scaling operations, investing in new projects, or expanding market reach.

Safeguarding Personal Finances

For many small business owners, personal and business finances are deeply intertwined. Using Net 30 vendors helps establish a separate credit history for your business, thereby protecting your personal credit scores from potential negative impacts resulting from business-related financial risks. This separation is crucial for personal financial security and can make personal financing, like mortgages or car loans, less complicated.

Fostering Strong Vendor Relationships

Regular interactions with Net 30 vendors and consistent payment practices help forge strong, lasting relationships. These positive business relationships can lead to benefits such as negotiating power, bulk purchase discounts, or more flexible future credit terms. Establishing trust with vendors can lead to partnerships and collaborations that offer strategic advantages in the market.

Key Considerations When Choosing Net 30 Vendors

Interest Rates and Fees

When selecting Net 30 vendors, it’s crucial to understand the potential costs involved beyond the credit itself. Some vendors might charge interest or late fees if balances aren’t cleared within 30 days. These fees can accumulate, making the cost of borrowing higher than anticipated.

Always review the terms and conditions of each vendor’s Net 30 offering to ensure you are aware of any additional charges that may apply. This will help you manage your finances more effectively and prevent any detrimental impacts on your cash flow.

Reporting Practices to Credit Bureaus

Make sure to verify which credit bureaus a vendor reports to before establishing a Net 30 account with them. It’s essential to choose vendors that report to major credit bureaus, such as Equifax. Reporting to Equifax ensures that your timely payments are reflected in your business credit score.

Vendor Reputation and Reliability

A vendor’s reputation and reliability are pivotal in ensuring that your business operations run smoothly. Research potential vendors thoroughly by reading reviews, checking ratings, and, if necessary, contacting existing customers to gather more information. Reliable vendors have a proven track record of providing timely and accurate credit reporting, fair dispute resolution, and consistent customer service.

Alignment with Business Needs

Lastly, ensure that the products or services offered by the vendor align with your business needs. Utilizing Net 30 accounts to purchase unnecessary items can lead to unwarranted debt, which might hurt your business financially rather than helping it grow. Identify vendors whose offerings are essential to your business operations

Notable Net 30 Vendors That Report to Equifax

Uline: Packaging and Industrial Supplies

Uline is a prominent supplier of packaging, shipping, and industrial materials, offering a Net 30 account that reports to Equifax. They provide a wide array of products necessary for daily business operations, making them a valuable vendor for companies in need of consistent supply deliveries.

The CEO Creative: Creative Services and Office Supplies

The CEO Creative offers more than just office supplies; they also provide a platform for businesses to access creative services. This vendor stands out because it combines the provision of essential office products and creative marketing services under a Net 30 account.

Their unique business model not only helps establish and enhance business credit but also supports businesses in improving their brand presence. Most importantly, they report to Equifax, helping businesses build a robust credit portfolio.

Strategic Network Solutions: IT Services

For businesses in need of IT and tech support, Strategic Network Solutions provides a comprehensive suite of services, ranging from hardware to software solutions. This vendor offers Net 30 credit terms and reports to Equifax, enabling businesses to maintain or upgrade their technology while establishing or improving their credit.

Strategic Network Solutions net 30 application is simple. Their tailored IT solutions ensure you get exactly what your business needs while also contributing positively to your credit rating.

The CEO Creative: Beyond Traditional Supplies

Unique Features of The CEO Creative

The CEO Creative distinguishes itself in the marketplace by offering products that go beyond the usual office supplies, focusing on the integration of creative solutions tailored to businesses’ branding needs.

This includes customized products and design services, which are crucial for businesses seeking to enhance their market presence.

Business and Creative Services Offered

The CEO Creative offers a mix of traditional and innovative services that are beneficial for any business looking to make a lasting impression. They supply essential office and technology products, along with specialized creative services such as graphic design, website development, and custom-branded merchandise.

These services are designed to enhance not only the functionality of a business but also its aesthetic appeal, thereby aiding in the development of a coherent and appealing brand identity.

Terms and Conditions of Their Net 30 Program

The CEO Creative’s Net 30 account offers favorable terms for businesses seeking to manage their cash flow without compromising their marketing and operational needs. They have a straightforward qualification process, requiring minimal credit history checks and no personal guarantees, making it accessible for startups and small businesses.

The program offers a credit limit of up to $5,500, accompanied by a modest annual membership fee of $49, making it both affordable and practical for small businesses.

Monthly Reporting Benefits to Equifax

One of the significant advantages of The CEO Creative’s Net 30 program is its systematic monthly reporting to Equifax. This consistent and frequent reporting is vital as it helps businesses build their credit scores quickly. Regular updates to a business’s credit file can lead to improved creditworthiness, opening up more opportunities for larger loans, better interest rates, and increased credit limits.

Making the Most of Net 30 Vendors

Best Practices for Using Net 30 Accounts

To fully benefit from Net 30 accounts, businesses should ensure timely payments, as this is critical for building a positive credit history. It’s advisable to set up automated reminders or payments to avoid missing deadlines.

Additionally, businesses should use these accounts for strategic purchases that align with their operational needs, thereby effectively managing their financial resources without unnecessary expenditure.

Managing Credit and Payments Effectively

Effective management of Net 30 accounts involves regular monitoring of balances and upcoming payment dates. Businesses should strive to keep their utilization low and avoid maxing out their limits, as this can be perceived as a sign of financial distress.

It is also prudent to vary the use of credit sources to demonstrate to credit bureaus the ability to manage multiple lines of credit responsibly.

Strategic Purchasing and Credit Building

Choose purchases that spread out costs effectively over time, such as bulk buying of essential supplies, thereby smoothing out cash flow and demonstrating financial stability, which is essential for credit building.

Monitoring and Adjusting Business Credit Strategy

Continuous monitoring of your business credit report is essential for understanding how your financial activities impact your credit score. Regular check-ups help identify areas for improvement or discrepancies that need correction. Adjustments to your strategy, such as increasing the frequency of payments or diversifying your vendors, can be made to optimize credit building.

Conclusion

In conclusion, the strategic use of Net 30 vendors that report to Equifax can be a game-changer for businesses seeking to establish and enhance their creditworthiness. By leveraging the benefits of delayed payment terms and responsible financial practices, businesses can not only acquire essential goods and services but also build a solid foundation for future growth and financial opportunities.

Frequently Asked Questions (FAQs)

1. How long does it take for Net 30 vendor payments to reflect on my Equifax business credit report?

It depends on the vendor’s reporting cycle. You may start seeing the impact on your credit profile after one or two billing cycles. Vendors typically update data every 30 to 45 days.

2. Can new or small businesses obtain Net 30 accounts that are reported to Equifax?

Many Net 30 vendors specifically serve startups and small businesses. They don’t need an extensive credit history, but you need to show basic documentation such as an EIN, business email, and business address.

3. Do Net 30 vendors perform hard or soft credit checks during the approval process?

Most vendors simply verify your business details and perform only a soft credit check.

4. How many Net 30 accounts should I open to establish a strong business credit history?

Opening two or three Net 30 accounts with vendors that report to Equifax is enough to establish a solid foundation.

5. What happens if I miss a Net 30 payment or pay late?

You will be charged a late fee. This will negatively affect your business credit score and also the relationship with the vendor. It may result in a reduced credit limit or even account suspension.

6. Can I build business credit faster by using multiple Net 30 vendors at the same time?

Yes. Using multiple Net 30 vendors that report to Equifax can speed up your credit-building process, as each on-time payment adds a positive entry to your business credit file.