Running a hospitality business can be tough, especially when it comes to managing money. Seasonal changes, unexpected costs, and the need to constantly restock can make it hard to keep things steady. That’s where Net 30 vendors come in.

According to the U.S. Small Business Administration (SBA), cash flow is the #1 concern for small business owners. Hospitality businesses face unique challenges due to seasonal revenue patterns and OTA payment delays. Net 30 vendor payment terms can improve working capital by aligning payment timing with revenue collection, freeing up thousands of dollars monthly.

With Net 30, you buy what you need now and pay in 30 days. This gives time to bring in money before paying the bill, helping you run smoothly and grow without upfront cost stress.

Don’t wait—enroll now and take control of your cash flow!

What is Cash Flow in the Hospitality Industry?

Cash flow is the money that comes in and goes out of your business. In hospitality, managing cash flow is critical because you’re constantly buying supplies while waiting for guest payments.

Real Example: Your hotel might generate $200,000 in weekly revenue, but 40-60% arrives 15-30 days later from booking platforms like Booking.com and Expedia. Meanwhile, suppliers demand immediate payment. Your staff needs Friday paychecks. Utilities are due today. This timing mismatch is the core problem.

Still handling cash flow the old way? Join countless hospitality businesses transforming their finances with Net 30 vendors. Enroll now to improve your working capital and stabilize operations.

Why Cash Flow Is Critical for Hospitality

Seasonality creates dramatic fluctuations. Peak season generates 60-80% of annual revenue in 3-4 months, yet fixed costs—payroll, taxes, insurance, utilities—stay constant year-round at 100%. When occupancy drops from 80% to 25%, revenue plummets 70% while fixed costs don’t decrease. This creates $50,000-$100,000+ monthly shortfalls.

OTA payment delays compound this. When guests book through Expedia, you provide service immediately, but wait 15-30 days for payment. For hotels with 60% OTA bookings, this means financing the OTA’s working capital. You’ve provided service; the money belongs to you, yet you must cover costs from your reserves.

Fixed costs don’t scale. Labor (25-35% of revenue), utilities, insurance, and taxes can’t be reduced proportionally with occupancy. A 10% occupancy drop triggers a 30-40% profit decrease because fixed costs consume more of the revenue.

According to the U.S. SBA, cash flow management is the #1 operational challenge for hospitality businesses. This isn’t poor management—it’s a structural reality that Net 30 vendors address.

What is Net 30?

Net 30 means you can buy goods or services now and pay for them 30 days later. In the hospitality industry, this is particularly useful because it allows you to utilize the items you’ve purchased to generate revenue before you need to settle the bill.

How to Calculate Your Net 30 Payment Due Date

1. Simple Method: Take the invoice date and add 30 calendar days.

Examples:

- Invoice January 15 → Payment Due February 14

- Invoice June 1 → Payment Due July 1

- Invoice December 5 → Payment Due January 4

2. Automated Solution: Use our Net 30 Days from Invoice Date Calculator to automatically calculate due dates and set payment reminders. [Try our calculator →]

Why It Matters: Missed deadlines damage vendor relationships, incur $50-$150 late fees, and lower business credit scores. Automation ensures perfect timing.

Benefits of Net 30 Vendors for the Hospitality Industry

Net 30 vendors offer a lot of benefits for your business:

- Cash Flow Help: Buy goods without paying right away. For example, a hotel can get new linens or a restaurant can buy fresh produce, and you won’t have to pay immediately. This is great during slow months or when unexpected costs come up.

- Inventory Flexibility: Net 30 lets you try new products or upgrade your services without worrying about paying right away. You have time to see if they work for your business.

- Building Credit: Paying on time can help improve your credit score. This makes it easier to get better deals and terms from suppliers in the future.

- Better Supplier Relationships: Paying on time helps you build trust with suppliers, and that can lead to discounts or better service.

How Does Cash Flow Impact the Hospitality Industry?

Cash flow can be unpredictable in the hospitality business. Net 30 vendors help by allowing you to purchase supplies as needed without immediate payment. This gives you time to bring in money before paying the bill, helping you stay flexible during slow periods or when unexpected events occur.

The Cash Flow Challenge: Why Hospitality Businesses Struggle

Seasonality Creates Revenue Extremes

Hospitality businesses face sharp seasonal demand swings, with most revenue earned during peak months while fixed costs remain constant year-round. This imbalance creates significant cash flow pressure during slower periods.

OTA and Tour Operator Payment Delays

Booking platforms like OTAs make payments 15-30 days after services are rendered, forcing hotels to cover operational costs upfront and manage working capital gaps.

Cash Flow Hotel Example: Managing Seasonal Demands with Net 30 Terms

A hotel preparing for the busy season may need to stock up on more linens or toiletries. By using Net 30, they can get these supplies now and pay 30 days later, after the guests start coming in and paying. This gives them the time they need to get ready for the busy season without worrying about paying upfront.

A hotel preparing for the busy season needs $30,000 in linens and toiletries. Traditional terms require immediate payment, depleting reserves before peak season revenue arrives.

With Net 30:

- Order supplies for August

- Receive immediately, use them

- Pay September 1st (30 days later)

- September peak season guests arrive and pay

- Their revenue covers the August supply invoice

- No cash reserve depletion

- Smooth transition into peak season

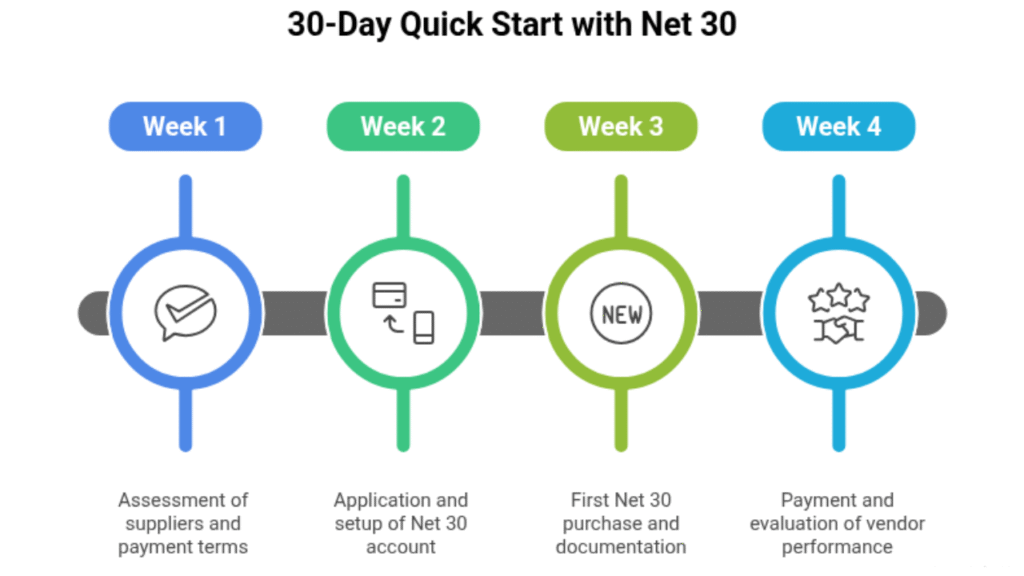

Your 30-Day Quick Start with Net 30

Week 1: Assessment

- List the top 10 suppliers by monthly spend

- Document current payment terms

- Calculate total monthly obligations

- Identify products for Net 30

Week 2: Application and Setup

- Apply for a Net 30 account

- Receive approval (48 hours typically)

- Set up automated payment reminders

- Create a payment calendar

Week 3: First Purchase

- Make the first Net 30 purchase

- Confirm receipt and condition

- Document due date

- Set a reminder (5 days before the due date)

Week 4: Payment and Evaluation

- Make the first payment on time

- Calculate cash flow impact

- Evaluate vendor performance

- Plan additional suppliers

What is the Role of Net 30 Restaurant Supplies?

Whether you’re starting a new restaurant or running an established one, Net 30 restaurant supplies help you get what you need without paying right away. This is especially useful when business is slower, as it lets you buy better ingredients or change your menu without stressing about money.

Net 30 Accounts for Food Vendors: Supporting Operational Flexibility

Net 30 accounts help restaurants buy food in bulk while keeping cash flow steady. This system ensures you can obtain fresh ingredients and beverages without paying upfront, which is particularly helpful when business is busy or unexpected events arise.

Improving Inventory Management in the Hospitality Industry with Net 30

Good inventory management is important for your business. Net 30 lets you stock up on popular items, try new products, or upgrade your facilities without tying up cash. This helps you keep up with trends, improve guest experience, and boost sales.

Building Business Credit and Strengthening Vendor Relationships

Using Net 30 regularly can help build your credit and improve your relationship with suppliers. Paying on time shows that you’re reliable, which leads to better deals, exclusive products, and easier access to payment terms in the future.

Building Business Credit with Net 30

- Months 1-6: Establish foundation—open 1-3 Net 30 accounts, make on-time payments.

- Months 7-12: Build momentum—add 2-3 accounts, maintain perfect history, score improving visibly.

- Months 13-18: Strong credit achieved—5-7 accounts with perfect history, reach “good” range, financing options available.

Financial Impact at 18 Months:

- Better loan terms: 2-4% lower rates

- On $100,000 loan: $2,000-$4,000 annual savings

- 5-year savings: $10,000-$20,000

- Higher credit limits

- Faster SBA loan approvals

How to Find the Ideal Net 30 Vendors for Your Hospitality Business

- Service Quality: Choose vendors who help improve your customer experience.

- Cash Flow Support: Find vendors that offer flexible Net 30 terms to help with money management.

- Operational Efficiency: Work with vendors that keep your business running smoothly.

- Product Quality: Pick vendors who offer the right products for your business.

- Vendor Reliability: Choose vendors who are dependable and deliver on time.

- Flexible Payment Terms: Look for vendors who offer Net 30 terms for easier planning.

Look For:

- Service quality that improves customer experience

- Flexible Net 30 terms with hospitality understanding

- Operational efficiency and consistent delivery

- High product quality

- Vendor reliability and on-time delivery

- Willingness to negotiate seasonal terms

Red Flags to Avoid:

- Not reporting to credit bureaus (no credit benefit)

- Hidden fees or surprise charges

- Inflexible payment terms, no negotiation

- Poor communication, slow responses

Conclusion

Net 30 vendors are a great tool for hospitality businesses. They help you manage cash flow, stay flexible with inventory, and make upgrades when you need to. By using these vendors, you can build better relationships with suppliers, improve your credit, and set your business up for growth.

when needed. Cash flow problems aren’t poor management—they’re a structural reality of hospitality created by seasonality, OTA delays, and fixed costs.

Ready to Transform Your Hospitality Cash Flow?

You shouldn’t waste energy worrying about cash flow timing. Net 30 vendor terms free up monthly operating capital—without borrowing, interest, or complexity.

Frequently Asked Questions (FAQs)

1. How can Net 30 help during off-seasons?

Net 30 lets you buy supplies without paying immediately, making it easier to manage cash flow during slower months.

2. Can Net 30 improve the guest experience?

Yes. Improved cash flow lets you invest in upgrades, amenities, equipment, and staff training—all enhancing guest experience. Better inventory flexibility means responding to guest feedback without financial stress.

3.What happens if I pay my Net 30 bills on time?

On-time payment improves business credit and builds supplier trust, leading to better deals and terms. Payment history reported to credit bureaus helps build strong business credit.