In the bustling world of business, effectively managing your finances can make or break your operations. Enter the user-friendly Net 30 terms, a widely adopted payment method in B2B transactions that grants the buyer a sweet period of 30 days from the invoice date to pay the full amount. Think of it as a short-term loan from your vendor, allowing you to enjoy and utilize the purchased goods or services before having to part with your cash.

But calculating the exact payment due date can sometimes be daunting, especially if you’re juggling multiple invoices with various terms. That’s where a Net 30 Terms Calculator steps in to save the day! These handy tools take the guesswork out of due dates by simply taking the invoice date and adding 30 calendar days, even factoring in weekends and holidays for accuracy. Perfect, right?

Not only do these smart calculators eliminate the stress of manual calculations, they also ensure that you never miss a payment deadline, helping you maintain smooth cash flow and a stellar credit record.

According to SBA data, businesses that use Net 30 payment calculators and early payment discount optimizations (such as 2/10 Net 30) can improve cash flow by 15-20% annually, reducing payment errors by 92% and recovering an average of $3,000 to $5,000 per year.

Whether you’re managing finances for a small business or a larger enterprise, a Net 30 Terms Calculator can streamline your payment processes, giving you more time to focus on what really matters—growing your business.

Understanding Net 30 Terms

Definition and Explanation

Imagine you’ve just received an invoice and see the words “Net 30” printed alongside the total amount due. What exactly does that mean? In the world of business, especially. In B2B transactions, “Net 30” is a common payment term indicating that the buyer has 30 calendar days from the invoice date to pay the seller.

It acts as a short-term credit arrangement where businesses can take advantage of a grace period for payments. This means you have a month to gather the funds and make payments for the goods or services received. It’s like getting a little breathing room before diving into your financial obligations!

Calendar Days vs. Business Days – Critical Clarification

Many businesses mistakenly assume that Net 30 counts business days rather than calendar days. This common misunderstanding often leads to late payments and penalties costing hundreds of dollars annually, worsening cash flow problems.

According to the U.S. Small Business Administration (SBA), Net 30 payment terms use calendar days, including weekends and holidays, unless otherwise specified. For example, an invoice dated Friday, January 10, would have a due date of Monday, February 9. Accurately applying this distinction helps avoid costly payment delays and supports better financial management.

Explanation:

- Net 30 = 30 calendar days (NOT business days)

- Includes weekends and holidays

- Example: Invoice Friday, January 10 → Payment Due Monday, February 9 (includes weekend)

- Practical Impact: Payment must arrive by day 30, even if day 30 falls on a weekend

Why It Matters:

- Missing this distinction leads to late payments

- Late payments damage a credit score

- Vendors may stop offering Net 30 terms.

- Early payment discounts get missed due to confusion.

Comparison with Other Payment Terms

Net 30 isn’t the only player in town. There are numerous other payment terms that businesses might encounter. For instance, you might come across Net 10, Net 15, or Net 60, where the respective numbers signify the days allowed for payment. There are also terms like COD (Cash on Delivery), demanding immediate payment upon receipt, or PIA (Payment in Advance), where payment is required before any goods or services are delivered.

Each of these terms offers different levels of flexibility and risk, and choosing the right one often depends on your business’s cash flow needs and industry standards.

The Advantages of Net 30 for Buyers

The allure of Net 30 terms is not just in getting some extra time to settle invoices. Let’s see how these terms can actually work wonders for buyers.

Improved Cash Flow Management

Net 30 terms can significantly boost cash flow management. By allowing payments to be deferred, businesses have an opportunity to use the income generated from the goods or services to pay off the invoice. This can be particularly beneficial during periods when cash on hand is tight, allowing companies to juggle their finances more strategically.

Enhanced Purchasing Power

When businesses aren’t forced to pay immediately, it enhances their purchasing power. The ability to delay payment opens the door to making larger or more frequent purchases. With Net 30, businesses experiencing seasonal revenue changes can take advantage of the lull to invest in inventory or other resources necessary for future growth.

Strengthened Supplier Relationships

Building and maintaining robust relationships with suppliers is crucial. By adhering to Net 30 terms, buyers can demonstrate financial stability and reliability. This can foster trust and develop goodwill, paving the way for negotiations on even better terms in the future. Suppliers often appreciate the commitment shown through timely payments, which can lead to more favorable deals or concessions down the road.

Incorporating Net 30 terms into your payment strategy is like skillfully managing a juggling act—keeping balls in the air long enough to create financial balance and growth.

Whether it’s strengthening your cash flow, boosting your ability to purchase more, or fostering stronger ties with your suppliers, Net 30 terms could be just what your business needs to stay financially healthy while paving the way for future success. So, why not give it a try and see how it works magic for your business?

The Advantages of Net 30 for Sellers

Net 30 terms are not just a perk for buyers; they bring a wealth of advantages to sellers as well. By offering a small credit period, sellers can tap into opportunities that might otherwise remain out of reach.

Increased Sales and Competitive Edge

Offering Net 30 terms can significantly widen your potential customer base. Imagine capturing the interest of businesses that might not have the ready cash for an upfront payment.

By allowing a grace period, sellers can position their offerings as more accessible, potentially increasing sales. This flexibility gives you a distinct competitive edge against other businesses that require payment upfront. Moreover, by accommodating customer needs, you set yourself up as a preferred choice, nudging out the competition.

Customer Loyalty and Retention

Net 30 terms can do wonders for fostering long-term relationships with customers. Extending a line of credit shows that you trust them to fulfill their financial commitments, nurturing a sense of loyalty. This trust can pave the way for repeat business. When customers feel valued and understood, they are more likely to stick around and choose your business when they need related products or services in the future.

Improved Cash Flow Forecasting

While the payments might be delayed, they are not unpredictable. With a clear payment schedule laid out by the Net 30 terms, sellers can anticipate cash inflow, making it easier to plan and allocate resources effectively. Knowing when payments are due aids in budgeting and ensuring the business can smoothly sail through the financial ebbs and flows. Some sellers might even offer early payment discounts to encourage quicker payments and boost cash flow.

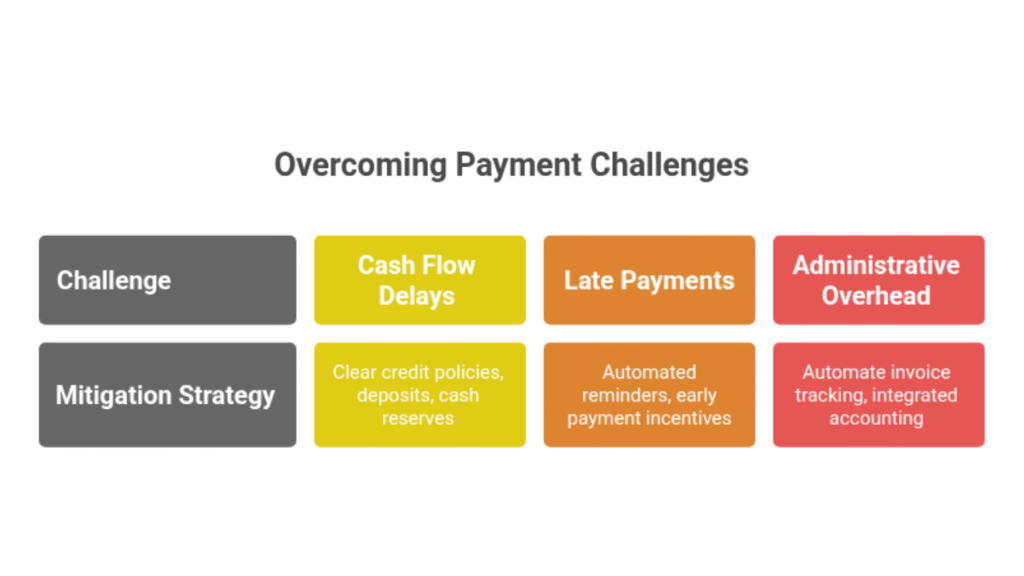

Navigating the Challenges of Net 30

As rosy as Net 30 might seem, it’s essential to be prepared for the challenges it brings. Being proactive and strategic in addressing these concerns can make all the difference.

Cash Flow Concerns for Sellers

One of the primary challenges is the strain on cash flow. Since payments are delayed, sellers might face periods where they lack liquid assets to cover immediate expenses. This can be particularly tough for smaller businesses that don’t have large cash reserves to fall back on. Careful financial planning and maintaining a cushion for emergencies will be crucial.

Risk of Late Payments

It’s possible that some buyers might not adhere to the 30-day payment window, leading to disruptions in cash flow. Late payments necessitate additional efforts in chasing down money owed, creating potential financial setbacks. It’s vital to establish clear payment policies and have contingency plans, such as setting up reminders for clients or considering penalties for late payments.

Administrative Overhead

Managing the Net 30 terms involves more than just waiting for payments. Keeping track of invoices, reminding clients of upcoming due dates, and following up on delayed payments can add a layer of administrative work. Fortunately, tools like accounting software or specific Net 30 calculators can streamline these tasks, reducing the overhead and freeing up time to focus on core business activities.

By understanding these challenges and tackling them head-on, businesses can not only reap the benefits of offering Net 30 but also keep potential pitfalls at bay.

Challenges and How to Overcome Them

- Cash Flow Delays – Delayed payments can strain the seller’s finances. Mitigate this by establishing clear credit policies, requiring deposits when appropriate, and maintaining cash reserves.

- Late Payments – Set up automated reminders and consider early payment incentives to encourage timely settlements, reducing the risk of late collections.

- Administrative Overhead – Automate invoice tracking and payment follow-ups with dedicated tools or integrated accounting software to minimize manual effort and errors.

Variations and Nuances of Net 30 Terms

When it comes to payment terms, Net 30 is just the tip of the iceberg. A variety of nuances and alternative terms can adapt the traditional Net 30 framework to better fit different business needs and strategies.

2/10 Net 30 Explained

One popular variation you might encounter is 2/10 Net 30. This clever twist offers a win-win situation for both buyers and sellers. Here’s how it works: if the buyer pays within 10 days of receiving the invoice, they can enjoy a 2% discount on the total amount. If they don’t take the discount, the full payment is due within 30 days as usual. This setup incentivizes buyers to pay early to save a bit of money, while sellers benefit from quicker cash inflow.

Different Net Terms (Net 15, Net 60, etc.)

Net terms come in various flavors that specify different payment periods, like Net 15 or Net 60. These numbers indicate the timeline (in days) by which payment should be made from the invoice date. So, Net 15 means payment is due within 15 days, whereas Net 60 extends this period to 60 days. These alternatives provide flexibility to better match the cash flow requirements for both parties depending on industry norms or the credit standing of the buyer.

Custom Terms and Arrangements

Flexibility is key in business, and sometimes unique situations call for personalized payment arrangements. Custom terms might include extended payment periods, split payments, or mixed terms where part of the payment is made upfront. Such arrangements result from negotiations and are tailored to meet the specific cash flow needs and business strategies of both parties.

Determining Payment Due Dates: The Role of Net 30 Calculators

Knowing exactly when payments are due is crucial for smooth business operations. While calculating these dates manually is possible, using a Net 30 calculator can save time and reduce mistakes.

Manual Calculation vs. Using a Calculator

Calculating payment due dates manually involves simply adding 30 days to the invoice date. Sounds simple, right? However, when you’re juggling numerous invoices or complex terms like early payment discounts, errors can easily creep in. Enter the Net 30 calculator—a tool that streamlines this process, ensuring accuracy and efficiency by factoring in minutiae that are easy to overlook.

Features of Net 30 Calculators

Modern Net 30 calculators come with a suite of handy features:

– Automatic Exclusions: They can automatically exclude weekends and holidays, adjusting the due date if it falls on such days.

– Discount Calculations: They handle discounted payment terms like 2/10 Net 30, computing both the possible discount and the full payment due date.

– Batch Processing: Some calculators support multiple invoice entries, giving you a complete snapshot of all upcoming payment obligations.

How to Use a Net 30 Calculator

Ready to calculate due dates in a jiffy? Here’s a quick guide:

- Find a Trustworthy Calculator: Plenty of free options are available online, or you might find one bundled with your accounting software.

- Input the Invoice Date: Enter the date when the invoice was issued.

- Select Payment Terms: Indicate whether it’s Net 30, 2/10 Net 30, or another variation.

- Hit Calculate: Let the calculator do its magic, adjusting for any applicable conditions like weekends.

Review and Record: Double-check the results and log them for future reference to ensure timely payments.

By integrating these calculators into your financial toolkit, you can master the art of payment scheduling, thus supporting your business’s cash flow needs and maintaining strong supplier relationships.

Top Net 30 Vendors

Venturing into the world of Net 30 terms requires aligning with vendors who not only offer such terms but also shine in customer satisfaction and service efficiency. One standout vendor that has garnered attention in the realm of Net 30 arrangements is The CEO Creative. This company is lauded for its flexible payment plans and a user-friendly platform, making financial transactions smooth and hassle-free.

The CEO Creative is known for its penchant for transparent communication, which means you can expect no hidden fees or last-minute surprises. On top of that, their process for implementing Net 30 terms is crafted with thoughtfulness to accommodate businesses of all shapes and sizes. This dedication to supporting business growth positions them as a trusted partner for seamless financial transactions.

Partnering with top-notch vendors like The CEO Creative ensures that businesses can fully utilize the advantages of Net 30 terms, allowing them to focus on growth while maintaining healthy relationships with their suppliers.

Using a Net 30 Terms Calculator

Manual due date calculations often lead to errors. A Net 30 Terms Calculator:

- Accepts the invoice date and payment terms.

- Adds 30 calendar days, adjusting for weekends/holidays.

- Shows exact due dates with discount deadlines.

- Supports batch processing for multiple invoices.

- Allows setting reminders.

Common mistakes avoided include counting business vs. calendar days and forgetting discount deadlines.

When Should You Pay Your Net 30 Account?

- Take the early discount (e.g., pay by Day 10 for 2/10 Net 30) to save on invoices.

- Pay by Day 30 if no discount applies, ensuring payments are processed a few days early.

- Avoid late payments to prevent fees and credit damage.

Paying on the 30th day counts as on time if the vendor receives the payment that day; however, paying 2-3 days early is advisable to allow for processing.

What Happens If You Don’t Pay On Time?

Late payments lead to fees, loss of credit privileges, and damage to credit scores (40-100+ point drops with one late payment). This negative record can remain for seven years, affecting future credit and vendor relations.

How Does Net 30 Affect Your Credit Score?

On-time payments increase your credit score gradually over months, while late payments cause immediate damage. A good Net 30 payment history can save thousands annually in loan interest through better rates.

Other Payment Terms

When it comes to payment terms, Net 30 is just the tip of the iceberg. A variety of nuances and alternative terms can adapt the traditional Net 30 framework to better fit different business needs and strategies.

| Term | Meaning | Due Date | Typical Use |

| Net 15 | Pay within 15 days | 15 calendar days | Fast payment agreements |

| Net 30 | Pay within 30 days | 30 calendar days | Standard B2B term |

| Net 45 | Pay within 45 days | 45 calendar days | Larger project contracts |

| Net 60 | Pay within 60 days | 60 calendar days | Enterprise accounts |

| COD | Cash on delivery | Upon delivery | New or high-risk customers |

| 2/10 Net 30 | 2% discount if paid in 10 days | 10 or 30 days | Encourage early payment |

| EOM | Pay at the end of the month | End of invoice month | Simplify bookkeeping |

Tips for Successful Net 30 Implementation

Successfully managing Net 30 terms involves more than just agreeing to the terms. It’s about creating a robust system that ensures you both fulfill your obligations and reap the benefits of this payment structure.

- Use automated reminders via calendars or accounting software linked to payment schedules.

- Maintain clear, documented communication with your vendors on payment terms.

- Batch process invoices in payment calculators to manage due dates efficiently.

- Review outstanding payments regularly to avoid lapses.

Below are some key strategies to make your Net 30 experience more fruitful.

Clear Communication with Suppliers

The foundation to any successful Net 30 implementation is clear and concise communication. Begin by ensuring that every invoice clearly states the terms: the payment due date, potential discounts for early payment, and any penalties for late payment. Setting these expectations upfront reduces misunderstandings and builds trust with suppliers. It’s equally important to maintain an open line of communication, so if any issues arise, they can be promptly addressed. This approach will not only improve the business relationship but may also result in more favorable terms in the future.

Timely Payments and Tracking

One of the top tips for mastering Net 30 is to ensure timely payments. This not only avoids late fees but also bolsters your creditworthiness and sustains goodwill with suppliers. You can set reminders or utilize systems that alert you to upcoming due dates. Tracking payments meticulously helps avoid missed deadlines and safeguards your reputation as a reliable payer.

In situations where cash flow becomes challenging, reach out to your suppliers proactively. Discuss potential solutions, such as partial payments or modified terms. Most suppliers appreciate honesty and will work with you to find a feasible pathway forward.

Utilizing Accounting Tools

Effective utilization of accounting tools is a game-changer in managing Net 30 terms. Today’s accounting software can automate many of the processes that would otherwise consume time and increase the risk of human error. These tools can manage invoice dates, calculate payment due dates, and even include early payment discounts.

They provide a comprehensive view of your financial obligations and help ensure no payment dates slip through the cracks. By automating these processes, your team can focus on more strategic activities, thereby optimizing financial operations and paving the way for sustained growth.

Embracing these tips ensures that Net 30 terms become a strategic asset in your business toolkit, giving you an edge in managing cash flow and supplier relationships with finesse.

Beyond Net 30: Exploring Other Payment Terms

In the business landscape, understanding payment terms beyond Net 30 can significantly impact financial management and supplier relationships. While Net 30 remains popular, companies often need a variety of options to meet diverse business needs. Let’s dive into some of these alternatives.

COD and PIA Explained

When it comes to Cash on Delivery (COD), payment is expected at the time the product or service is delivered. This method is especially useful for smaller transactions or for dealing with new customers whose payment reliability is unknown. COD minimizes the risk for the seller but may put pressure on customers to ensure funds are readily available at delivery.

Payment in Advance (PIA), on the other hand, requires the buyer to pay before receiving the goods or services. This term is usually leveraged by sellers to mitigate risk. While it ensures the seller is paid upfront, it can be less appealing to buyers who prefer holding onto their cash until they receive what they are paying for.

Exploring Net 10, Net 15, Net 45, Etc.

Besides Net 30, businesses also use other “Net” terms that specify varying credit periods. For instance, Net 10 and Net 15 require payments within 10 or 15 days respectively, appealing to sellers who prefer quicker repayment cycles. In contrast, terms like Net 45 or Net 60 extend the repayment window, providing buyers with more time. These variations give flexibility to tailor payment terms based on factors such as industry standards, buyer negotiation, or credit evaluations.

EOM and Other Payment Arrangements

End of Month (EOM) is a payment term where the invoice is payable at the end of the month regardless of when it was issued. This can simplify financial record-keeping, as payments align uniformly each month. Other custom arrangements may include partial payments at various intervals, which can be tailored based on negotiation and specific business requirements. These arrangements allow businesses to align payments with their operational cycles and cash flows.

The Future of Net 30 and Payment Terms

As the world becomes increasingly digital, payment terms are evolving, offering new possibilities and efficiencies to businesses. Here’s a peek into what the future might hold:

Real-Time Payments and Dynamic Discounting

With the advent of real-time payment systems, transactions can occur instantly, which might change the need for traditional extended credit terms like Net 30. Alongside this, dynamic discounting allows buyers and sellers to negotiate payment discounts based on the exact timing of payment. This creates a win-win scenario where buyers can save money and sellers can receive funds faster, enhancing the fluidity of cash flow for both parties.

AI-Powered Credit Assessment

Bright prospects also loom with AI stepping into credit assessments. Machine learning technologies can provide a more refined credit analysis, quickly and accurately evaluating the risk factors associated with extending credit terms. This can help sellers in making informed decisions and reduce the risk of defaults through better-bounded credit limits or adjusted payment plans tailored to different buyers.

Blockchain-Based Smart Contracts

Perhaps the most transformative could be the implementation of blockchain-based smart contracts. These self-executing contracts with terms written into code can automate and secure payment processes, ensuring conditions are met before payments are released. Reduced administrative tasks and minimized disputes are just a couple of the potential advantages, making business transactions smoother and more reliable.

The future awaits, brimming with innovations that promise to reshape the landscape of payment terms. Staying informed and adaptable will be key to leveraging these opportunities for ongoing success in the ever-evolving business world.

Risks and How to Mitigate Them

Buyers:

- Risk missing discounts and paying penalties.

- Mitigate with reminders and disciplined budgeting.

Sellers:

- Risk cash flow gaps and unpaid invoices.

- Mitigate with credit checks and setting payment reserves.

Choosing the Right Net 30 Calculator

Look for calculators that:

- Use calendar days, including weekends and holidays.

- Automatically calculate discounts like 2/10 Net 30.

- Support batch invoice processing.

- Integrate reminders.

- Offer integration with accounting software.

The CEO Creative’s calculator provides these features seamlessly integrated with their Net 30 account program.

Enroll Now to get instant access to a calculator built for real-world B2B needs, with automated reminders and discount tracking built in.

Conclusion

Net 30 terms, alongside other payment options, are indispensable tools in the world of B2B transactions. They help businesses not just keep their cash flow in check, but also forge strong relationships with suppliers and customers. By understanding how to calculate payment due dates accurately, utilizing Net 30 calculators effectively, and choosing the right payment terms that fit your unique business needs, you can unlock greater financial control and growth opportunities.

For businesses both big and small, mastering the complexities of payment terms is a stepping stone to financial stability. The tools and insights provided by Net 30 calculators allow for a streamlined and error-free payment process, which is crucial for maintaining smooth operation. Staying informed and being proactive in your payment management ensures that your business can thrive in the competitive marketplace.

Remember, the key to success is balancing payment flexibility with financial prudence. By doing so, you’re setting up your business not just for survival, but for sustainable prosperity in the long term.

Net 30 terms and payment due date calculators are essential tools for maintaining healthy cash flow and vendor relationships. When used wisely—including taking early discounts and paying on time—they can save your business significant money and build strong credit. The CEO Creative’s integrated calculator simplifies this process by accurately determining due dates and discount deadlines, helping you avoid mistakes and penalties.

Ready to take control of your payment schedule? Use our easy Net 30 Terms Calculator today and make every due date work for your business growth.

Contact Us Now to speak with a financial operations specialist and set up your custom Net 30 account—no setup fees, no hidden terms. Get started today and turn payment delays into growth opportunities.

Frequently Asked Questions (FAQs)

1. Is Net 30 business days or calendar days?

Net 30 counts 30 calendar days, including weekends and holidays.

2. How do you calculate Net 30?

Add 30 calendar days from the invoice date; use a calculator for accuracy.

3. What does 2/10 Net 30 mean?

2% discount if paid within 10 days; full payment due in 30 days.

4. What happens if you pay late?

Late fees, credit damage, and vendor distrust follow; avoid them by paying early.

5. Does Net 30 affect your credit score?

Yes, on-time improves it; late payments damage it for years.

5. When should you pay your Net 30 invoice?

Pay by discount period if available; otherwise by day 30, ideally a few days early.