Introduction

In the fast-paced realm of custom printing, efficiency reigns supreme. We’re going to delve into a crucial payment method known as Net 30, which is elevating The CEO Creative’s services. Picture this: a payment approach that offers clients some breathing room while simultaneously enhancing your business’s cash flow—a true win-win, wouldn’t you agree? That’s exactly what Net 30 payment terms deliver—a smooth method for improving business processes and nurturing enduring client relationships. Let’s uncover how this strategy is transforming The CEO Creative’s custom printing strategy.

Understanding Net 30 Payment Terms

Diving into the realm of payment strategies might feel a bit intimidating, but don’t worry! We’ll explore it together and reveal how Net 30 payment terms can be a hidden advantage for businesses like The CEO Creative, particularly in the custom printing field.

Definition and Explanation

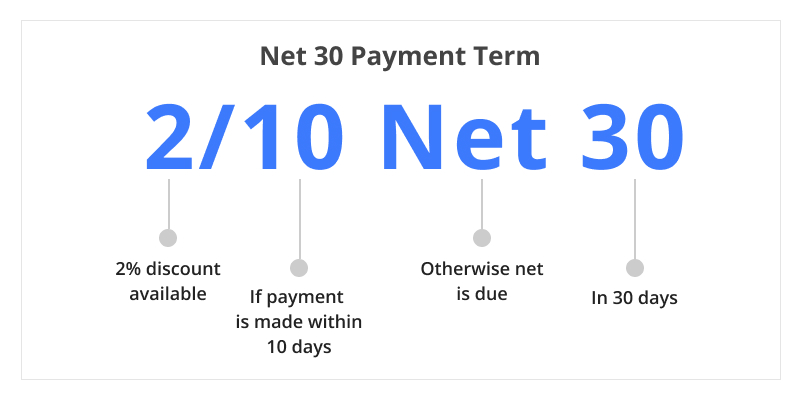

Net 30 payment terms are a usual way of doing things in the business world, where a customer gets a bill and needs to pay it within 30 days. It’s like a gentle nudge saying, “Hey, you’ve got a month to take care of this.” The idea’s pretty straightforward, isn’t it? But don’t let that simplicity fool you—this payment setup is a real powerhouse for fostering trust and dependability between businesses and their customers.

Let me break it down for you: You, as the business owner, hand over a product or service to your customer. You give them an invoice that lays out what you sold or did, how much it costs, and when the payment is due. With Net 30 terms, the due date is exactly 30 days after you hand them the invoice. This handy little timeframe gives your customers some flexibility while making sure your cash flow keeps moving smoothly.

Common Applications in the Industry

Net 30 payment terms are like a go-to dish that’s perfect for any event. They’re suitable for all sorts of industries—whether it’s retail, wholesale, manufacturing, or services. These terms are really versatile and have a big part in lots of different fields. In custom printing, like at The CEO Creative, they’re especially common because they’re just so practical and fair.

Agencies that handle graphic design, all the way up to huge manufacturers, benefit from the flexibility of Net 30. It lets them work with everyone from brand new startups to huge, established companies. Bigger businesses often like these terms because they fit well with their own payment schedules, while smaller companies appreciate the extra time it gives them to sort out their finances.

The Benefits of Net 30 for The CEO Creative

Integrating Net 30 terms into the financial structure of The CEO Creative is akin to adding rocket fuel to its engine. Let’s explore just how these terms elevate operations across the board.

Streamlining Financial Operations

In the spotlight of business finance, you’ll find cash flow management, and Net 30 terms are ready to make that spotlight shine brighter. By giving customers 30 days to settle up, it sets a clear schedule for when the money will come in. This regular rhythm lets The CEO Creative handle their finances with real skill.

With payments spaced out and easy to anticipate, businesses can map out their money matters with a lot more confidence. This means unexpected financial curveballs are few and far between, leading to smarter planning. Whether it’s snagging the latest tech, broadening the menu of services, or just keeping up with the bills, a steady cash flow makes things run more smoothly and builds a healthier financial future.

Plus, using invoicing software that’s designed for Net 30 terms is a smart move for The CEO Creative. It can take care of payment reminders and follow-ups automatically, which means less paperwork and more time for the team to focus on what they do best – being creative.

Enhancing Client Relationships

Doing good business is really all about building strong relationships, and offering Net 30 terms is like a touch of magic when it comes to keeping a solid foundation with clients. When The CEO Creative provides these flexible payment options, it sends a message of trust and partnership, really boosting client satisfaction and loyalty.

Just think—giving clients extended payment terms makes it so much easier for them to manage their budgets without the strain of immediate payment pressures. This can be especially important for smaller businesses or startups working with The CEO Creative. By showing that you understand and support their financial timelines, The CEO Creative not only wins their business but also makes a name for itself as a company that truly cares.

These improved client relationships often turn into repeat business, fantastic referrals, and a reputation that speaks for itself in the custom printing world. It’s a win-win: your clients get the flexibility they need, while your business enjoys the perks of their loyalty and word-of-mouth marketing.

Improving Business Efficiency

Efficiency is key to the success of any business, and for The CEO Creative, Net 30 payment terms are the secret ingredient that boosts it. Let me explain how:

– Less Administrative Hassle: Using Net 30 terms simplifies invoicing and payment processes, making life easier for the administrative team. Plus, automation tools can take care of payment reminders and follow-ups, freeing up staff to focus on other important tasks.

– Stronger Bonds with Suppliers: Just like clients, suppliers appreciate a bit of flexibility. By offering Net 30 terms, The CEO Creative can foster goodwill and build stronger relationships. Staying on top of payments can also lead to better deals and services from vendors.

– More Strategic Financial Planning: Predictable cash flow, thanks to Net 30, allows The CEO Creative to plan finances with greater confidence. This makes it easier to make smart decisions about where to invest, how to allocate resources, and when to seize growth opportunities.

– Enhanced Creditworthiness: A business that consistently manages its financial obligations responsibly builds a positive credit profile. This standing is beneficial when seeking funds for expansion or investments, as financiers prefer working with organizations known for timely payments and sound financial practices.

Offering Net 30 payment terms isn’t just about following tradition; it’s a smart decision that supports steady growth and builds strong relationships. By using this payment method, The CEO Creative is taking its personalized printing services to a higher level of effectiveness and customer happiness. No matter if you’re a small new business or a big industry leader, think about using this strategy to make your operations smoother, improve your connections with clients, and help your business thrive.

Implementing Net 30 in Custom Printing Services

Stepping into the world of custom printing as a business owner, you’re probably thrilled at the prospect of turning your creative ideas into real-life products. But blending artistic flair with smart business know-how isn’t always easy. Figuring out payment terms, for example, can feel like a real headache, which is exactly why using Net 30 payment terms might just become your new best friend.

Challenges and Solutions

Offering Net 30 terms, which gives clients a month to pay invoices, can be super helpful, but it also comes with some challenges. Let’s talk about some of these common problems and how you can handle them smoothly:

1. Cash Flow Woes

– Problem: Waiting around for payments can really squeeze your cash flow, making it tough to pay for everyday things or jump on new chances.

– Fix: Think about starting an emergency fund to protect your finances during those waiting periods. This fund acts like a safety net, ensuring you can cover your necessary expenses while you wait for the money to come in.

2. The Risk of Clients Not Paying

– The Problem: There’s always a chance that customers might be late with their payments, or even not pay at all.

– Fix: Before giving customers 30 days to pay, do a really good check on their background. Checking their credit or asking for a deposit upfront can help lower these risks.

3. The Hassle of More Paperwork

– The Problem: Keeping track of invoices, due dates, and payment chasers piles on the admin work.

– Fix: Use accounting software to make invoicing and reminders automatic. These tools can make things run smoother, cut down on mistakes, and make sure you follow up on time.

If you handle these issues the right way, you’ll see that using 30-day payment terms can work well for your custom printing business.

Best Practices for Seamless Integration

Seamlessly incorporating Net 30 payment terms into your business operations requires thoughtful preparation and steady execution. To help you navigate this shift, here are some recommended practices:

Set Up Well-Defined Policies:

* Develop thorough guidelines that spell out your payment terms, including due dates and any late payment fees.

* Make sure to explain these policies to your clients clearly from the start to prevent any confusion.

Nurture Robust Client Relationships:

* Establish trust with your clients by keeping communication channels open. Address their questions quickly and be upfront about deadlines and what you expect.

* Creating positive relationships can motivate clients to meet payment deadlines more reliably.

Set Up a Smart Tracking System:

* Use some good accounting software. This way, you can keep a close eye on your invoices and their due dates, so nothing falls through the cracks. Automation is your friend here.

* Set up automatic payment reminders. This isn’t about being pushy; it’s a friendly nudge to clients, helping them remember those upcoming deadlines.

Sweeten the Deal with Early Payment Perks:

* Think about giving a little discount to clients who pay early. It’s a nice way to say thanks, and it can really help your cash flow. Plus, it encourages clients to get those payments in on time.

If you put these ideas into action, you’ll be well on your way to a smoother, more dependable payment process. This is a win-win for you and your clients.

Case Study: Success Stories at The CEO Creative

The CEO Creative isn’t just a standout in the world of custom printing; they’re also a great example of how using Net 30 payment terms can seriously boost a business’s efficiency. Let’s dive into how they pulled it off:

First, a Bit of Doubt:

At first, The CEO Creative was a little nervous about using Net 30 terms. They had some worries, naturally, about keeping their cash flow steady and whether clients would pay on time. But, they realized that giving their customers more flexible payment options was a big deal, so they decided to give it another look.

Smart Moves They Made:

* Before letting new clients have credit, they started doing really thorough credit checks.

* They set up a super-efficient invoicing system using online tools, which made sure bills went out quickly and accurately.

Results That Truly Shine:

* Smarter Cash Flow: The CEO Creative crafted a customized plan for handling incoming payments, which kept money flowing smoothly and fueled their growth.

* Closer Client Bonds: By giving clients 30 days to pay, The CEO Creative showed they truly care about their customers, leading to stronger loyalty and more repeat business.

What Clients Are Saying: Many clients have publicly praised The CEO Creative for their flexibility and understanding. They’ve specifically pointed out that the payment terms have made running their own businesses much easier.

This success story makes it clear that when done right, offering Net 30 terms can be a real win-win, boosting both customer happiness and overall business success.

Having witnessed the power of Net 30 payment terms to truly revolutionize your operations, it’s time to take that crucial next step. For those of you at the helm of a custom printing business or any venture where creativity is key, adopting Net 30 could be the innovative leap forward that propels your company to new heights.

This is your chance to really cultivate trust and forge those strong, enduring bonds with your clients, all while keeping a tight rein on your cash flow. It’s important to understand that adopting this payment approach goes beyond simply offering credit; it’s about enriching your entire business environment.

Feeling inspired to raise your business to a whole new level? Connect with seasoned industry professionals or consult with financial advisors who can craft a bespoke strategy that aligns perfectly with your unique requirements. You might also want to look into specialized software, like accounting programs, that can automate and streamline your billing procedures, ensuring everything is perfectly organized and free of unnecessary complications.

The CEO Creative’s experience with Net 30 payment terms is truly inspiring, illustrating how, when used wisely, these terms can elevate a business to great heights of efficiency and customer happiness. Why not learn from their example and start your own journey towards success?

By adopting Net 30 as a fundamental part of your payment approach, you can ensure your business doesn’t just survive, but truly flourishes!

Conclusion

Offering Net 30 payment terms has been a real game-changer for The CEO Creative’s custom printing services. By giving clients a clear payment schedule, the company has seen improvements in its cash flow and built stronger client relationships. This clever move has made operations more efficient and helped the business grow.

– Customers are more loyal: Clients love the flexibility and it builds trust.

– Better cash flow management: Knowing when payments will come in makes financial planning easier.

– Stronger partnerships: It leads to long-term work with clients who rely on this reliability.

Using strategic payment terms like this is a smart way to improve service and get ahead in the custom printing world! Why not try offering Net 30 and see how it benefits your business?