Introduction

In the business realm, nurturing solid client connections is absolutely essential. A great way to do this is by offering clear payment terms, such as Net 30 invoicing. This approach not only aids in sustaining a healthy cash flow for your business but also fosters trust with your clients. When your customers have a clear understanding of when payment is due, it reduces any potential confusion and boosts their overall satisfaction. By adopting Net 30 payment terms, you’re essentially creating a mutually beneficial scenario that strengthens your relationships and streamlines operations for all parties.

Understanding Net 30 Invoicing

In the business realm, invoicing goes beyond simply requesting payment; it’s a nuanced interplay of potential earnings and flourishing connections. A widely favored payment term aiding this process is Net 30 invoicing. What precisely is it, and how is it employed across various sectors? Let’s explore and uncover these details!

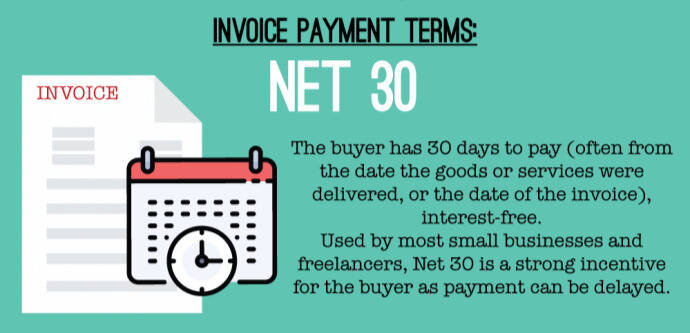

What is Net 30 Invoicing?

Net 30 invoicing is a common payment term that businesses use when sending out invoices. It means that the full payment is due within 30 days from the date the invoice was issued. So, after your client gets the invoice, they’ve got 30 days to pay up. It’s a straightforward yet effective concept: give your clients a fair amount of time to pay without slowing down your own cash flow.

This approach isn’t just about the 30-day timeframe; it’s about fostering trust and showing your clients that you value their partnership by giving them some flexibility. Companies that offer Net 30 terms often position themselves as thoughtful and dependable partners, which can lead to new opportunities and partnerships.

Common Usage in Various Industries

Net 30 invoicing is widespread across various sectors, serving as a standard practice in numerous industries:

– Manufacturing: In the manufacturing world, suppliers and producers frequently use Net 30 invoices. This approach lets their customers sell their stock before the payment is due, ensuring a smooth production flow and keeping all players in the supply chain happy.

– Wholesale and Retail: Whether it’s a small family-owned store or a large retail chain, extending Net 30 terms can make transactions run more smoothly. Businesses can stock up on products without the pressure of immediate payment.

– Creative and Professional Services: Freelancers, marketing agencies, and design studios adopt Net 30 invoicing to build lasting client relationships and promote repeat business. Clients welcome the flexibility of having extra time to manage their finances.

Benefits of Net 30 Invoicing for Businesses

Implementing Net 30 terms can bring multiple benefits to businesses, ranging from improved cash flow management to enhanced client relationships. Let’s look more closely at these advantages.

Improving Cash Flow Management

One of the key advantages of using Net 30 invoicing is how much it helps with managing your cash flow. It might seem odd to wait longer for payments, but it really can benefit your business in many ways:

– Steady Income Stream: When you set clear payment deadlines, you create a more predictable income flow. Knowing precisely when payments will come in makes it easier to handle expenses and plan for future investments.

– Smoother Inventory Control: For sectors like manufacturing and retail, knowing exactly when payments will arrive can make buying inventory and planning production schedules much more efficient.

Extending credit does have its risks, but with the right systems, it can also improve your cash flow. By checking your clients’ creditworthiness and using automated invoice reminders, you can further reduce these risks.

Building Client Trust and Loyalty

For a business to thrive, it’s absolutely essential to build strong, lasting relationships with your clients. Offering Net 30 invoicing can really help with this:

– It shows you’re flexible and understanding: Giving clients a bit of breathing room with payment terms demonstrates that you understand their financial situations. This builds trust and loyalty, making them feel valued.

– It encourages repeat business: When clients trust you, they’re much more likely to keep coming back. Knowing they can rely on you and that you’re mindful of their payment needs makes them want to continue doing business with you.

Ultimately, using Net 30 invoicing sends a message that your business cares about its clients and is focused on building long-term relationships rather than just making a quick profit.

Enhancing Professional Image

Offering Net 30 invoicing can do more than just help your cash flow and customer relationships; it can also make your business look more professional. Here’s the breakdown:

– Get Ahead of the Game: These days, everyone’s fighting for business. By letting customers pay within 30 days, you’re giving yourself a leg up on the competition that demands payment upfront. Customers naturally gravitate towards businesses that give them a little financial flexibility.

– Show You’re Serious and Reliable: Companies that offer Net 30 terms often come across as more established and dependable. It tells clients that you’re financially sound enough to offer credit, which builds trust.

Plus, it demonstrates that you’re managing your business effectively. It shows your cash flow is strong enough to handle invoices that are paid a bit later, sending a message of confidence to both your current and future clients.

To wrap things up, offering Net 30 terms on your invoices is about much more than just when you get paid. It’s a smart move that can improve your cash flow, make your clients happier, and show that you’re a serious, professional business. Using Net 30 invoicing strategically isn’t just about getting paid on time; it’s about laying the groundwork for lasting success in your business. As you figure out how to make Net 30 work best for your company, you’ll definitely see the positive results!

Implementing Net 30 Invoicing in Your Business

Giving the Net 30 invoicing method a try could really shake things up for your company. It’s a clever move that can improve your cash flow, show your clients you trust them, and help you build stronger, long-lasting connections. But, just like any other business plan, you need to carefully plan how to use it. Let’s look at the important steps you need to take to smoothly add Net 30 invoicing to how your business works.

Setting Clear Payment Terms

Alright, let’s dive in! Good communication is absolutely key. Spelling out your payment terms nice and clear helps everything go smoothly. By setting up Net 30 as your go-to payment option, you’re basically telling clients they’ve got 30 days from when they get the invoice to pay up. Here’s how to be super clear about it:

– Get Those Terms Out There Early: Pop your Net 30 terms into contracts and quotes right from the start. That way, clients know what to expect and there’s less chance of anyone getting confused later on.

– Lay Out the Late Payment Stuff: It’s not the most enjoyable part, but you gotta be upfront about what happens if payments are late. This means letting clients know about things like extra interest charges or possibly pausing services until they pay.

– Keep It Easy to Understand: No need to make your invoices sound like a law book. Use simple, everyday language that your clients can get their heads around, no problem.

Communicating Effectively with Clients

Getting paid on time is as much about talking to your clients as it is about crunching numbers. Keeping in touch regularly helps build trust and makes sure everyone’s on the same page. Here are some ideas to make your communication really effective:

– Give a Heads-Up: A friendly reminder about when payments are due can make a big difference. Think about sending a quick, gentle email reminder a week before the due date, just to keep it on their radar.

– Take the Initiative: Don’t wait if an invoice is overdue. Late payments can easily be forgotten, and a kind word might be all it takes.

– Keep the Conversation Going: Let your clients know they can always ask you questions or share any worries they have. Make sure they have your contact details and that you get back to them quickly – it shows you’re easy to reach and that you mean business.

Using Invoicing Software for Efficiency

Using invoicing software can be a real game-changer for handling your Net 30 payment terms. A good invoicing tool can make the whole process much smoother, save you a ton of time, and help you avoid mistakes. Here’s why you might want to think about using it:

– Automated Invoices: You can set up invoices to automatically go out to your regular clients, which means less manual work for you.

– Tracking and Reporting: You can easily see who’s paid and who still owes you money, giving you a much better picture of your cash flow.

– Integration with Other Tools: Lots of invoicing programs can connect seamlessly with your accounting software, so all your financial information is in one place and easy to keep track of.

Potential Challenges and Solutions

Like any road, the path to effective Net 30 invoicing isn’t always bump-free. Anticipating potential challenges and preparing proactive solutions can help ensure your journey is as smooth as possible.

Dealing with Late Payments

Late payments can really mess with your cash flow, but don’t sweat it! There are ways to handle this common problem pretty well:

– Flexible Payment Plans: Giving clients a payment plan with some structure can help them out if they’re having trouble making deadlines.

– Written Reminder System: Set up a reminder system that starts friendly and gets a bit more formal if needed.

– Enforce Late Fees: This might feel a bit awkward, but sticking to your late fee policy can push people to pay on time in the future.

Customizing Terms for Different Clients

While a typical Net 30 policy is suitable for lots of people, adjusting the terms to accommodate different clients’ requirements can be advantageous:

– Tailored Payment Agreements: Certain clients might need payment schedules that align with their unique cash flow demands. Being adaptable can foster a stronger, more trusting connection.

– Incentives for Early Settlement: Motivate clients to pay promptly by giving them a discount when they settle their invoices ahead of time.

– Evaluate Client Dependability: Figure out which clients are responsible enough to be given longer payment periods based on how reliably they’ve paid in the past. Clients with a solid track record might be grateful for, say, a 45-day payment window.

Balancing Flexibility and Firmness

Finding the right mix between being adaptable and standing your ground can be a challenge, but it’s essential for healthy professional connections. Here’s how to do it:

– Understand Your Limits: Clearly define how far you can bend and communicate any non-negotiables in a way that’s both firm and friendly.

– Keep Things Steady: It’s fine to make exceptions every now and then, but staying consistent is crucial for fairness and maintaining a professional demeanor.

– Put Your Clients First: Always try to see things from your clients’ perspective, but make sure your business’s needs aren’t forgotten. By showing you’re willing to collaborate, you can build lasting loyalty.

By using these tactics, bringing Net 30 invoicing into your business can be smooth sailing. This method doesn’t just improve your cash flow; it also helps create strong relationships based on openness and trust. Think you’ll give it a shot? Your business – and your clients – will probably be grateful you did!

Highlight on The CEO Creative

If you’re looking for a company that makes Net 30 invoicing effortless, look no further than The CEO Creative. They’ve really made a name for themselves by offering businesses creative solutions and top-notch service, especially when it comes to simplifying payments and fostering better client relationships. Let’s explore what sets The CEO Creative apart in the realm of Net 30 invoicing.

What is The CEO Creative?

The CEO Creative isn’t just any company; it’s a vibrant force that empowers businesses to reach their full potential using clever financial strategies. They provide a wide array of services specifically tailored to fuel business expansion, and one of their most notable features is Net 30 invoicing. By giving clients transparent and easy-to-handle payment terms, The CEO Creative enables them to sustain a healthy cash flow and cultivate business connections built on trust.

How Do They Do It?

The CEO Creative makes invoicing a breeze, and here’s how:

– Effortless Invoicing: The CEO Creative uses a super intuitive invoicing system. It’s designed to be easy to use, so sending and keeping track of invoices is simple. Businesses can easily monitor payments and follow up on any that are overdue, all with just a few clicks.

– Payment Terms That Fit You: They know that every business is different. That’s why The CEO Creative creates payment terms that are customized to each client’s specific needs. This personal approach makes sure the invoicing process is always smooth and effective.

– Building Trust with Clarity: For The CEO Creative, transparency is key to building trust. They make sure their payment terms are crystal clear, with no hidden surprises. This helps businesses build stronger relationships with their clients, leading to fewer headaches and a better chance of long-term partnerships.

With The CEO Creative, you’ll never be left hanging thanks to their outstanding customer support. Their team is always on hand to help out, sorting any invoicing problems super fast so you can get back to focusing on what really matters – running your business.

Benefits of Partnering With The CEO Creative

Working with The CEO Creative brings a whole bunch of advantages, all of which lead to stronger business connections and a brighter financial picture:

– Better Cash Flow: With The CEO Creative’s efficient Net 30 invoicing, businesses can enjoy a more stable cash flow. This financial stability makes it easier to plan ahead, invest in growth confidently, and avoid those pesky cash flow problems.

– Stronger Client Relationships: The CEO Creative’s focus on clear payment terms builds trust with clients. When clients know what to expect, they feel respected and are more likely to stick around for the long haul.

– Less Administrative Hassle: The CEO Creative’s simplified invoicing system takes a lot of the administrative weight off business owners’ shoulders. With less time spent chasing invoices, you can focus more on growing your business and keeping clients happy.

A better reputation: When a company handles its finances responsibly, it looks good to everyone. Showing that they’re dependable and open about their money helps businesses earn trust in their field, which can bring in more customers and chances to grow.

Apply Now!

Thinking about shaking things up and revolutionizing your business’s invoicing? The CEO Creative makes it a breeze with their super simple application. Getting set up with their Net 30 invoicing services is a straightforward, user-friendly process, designed to have you up and running in no time, so you can start reaping the rewards.

Step-by-Step Application Process

1. First Steps: Get in touch with The CEO Creative via their website or give them a call on their customer service number. You’ll get to chat with one of their helpful team members, who’ll give you a feel for how easy their process really is.

2. Application Time: Next, you’ll need to fill out a quick application form. This just asks for some basic details about your company and your finances. This helps The CEO Creative understand your business a bit better, so they can adjust their services to suit what you need.

3. Application Review: After you submit your application, they’ll take a quick look at it. Thanks to their efficient system, you won’t be left hanging for ages. Most applications are usually reviewed within just a few business days.

4. Welcome Aboard and Getting Started: Once your application is approved, it’s time for onboarding! The CEO Creative team will be right there with you, helping you set up your own personalized invoicing system. They’ll make sure everything is set up in a way that works best for you.

Let’s Get Those Invoices Out! Now that everything’s ready to go, you can start using The CEO Creative’s Net 30 invoicing system. Go ahead and send those invoices, feeling good about it, because you’ve got a team behind you that’s totally invested in your success.

Why Choose The CEO Creative?

Choosing The CEO Creative as your partner means you’re picking someone dedicated to helping your business succeed and stay financially sound. They really shine in a few key areas:

– They’ve Got the Experience: The CEO Creative has a solid track record of helping businesses flourish. They’re known for their invoicing solutions that really work, and they’ve been doing it for years.

– They Put You First: They really focus on what you need. Their whole process is built around giving you the best experience possible. They take the time to understand your business and come up with solutions that fit just right.

– Always There for You: The CEO Creative isn’t the type to just disappear after setting things up. They’re in it for the long haul, providing ongoing support and keeping their systems up-to-date so you always have the latest and greatest.

When businesses decide to go with The CEO Creative, they’re doing more than just upgrading their invoicing game. They’re also paving the way for stronger, more fruitful connections with their clients. Think you’re ready to get the ball rolling now? Get in touch and discover how The CEO Creative can help you achieve your goals with smooth, effective Net 30 invoicing.

Conclusion

Implementing Net 30 invoicing could be a great advantage for both your company and your customers. Setting out transparent payment terms, such as Net 30, can lead to more robust business connections and greater trust from your clientele. These terms are not only beneficial in managing cash flow more smoothly but also convey a professionalism that clients value.

Thus, if your goal is to improve your business interactions and guarantee punctual payments, think about adopting Net 30 terms. Your customers, and ultimately your financial health, will probably be grateful!