Net 30 Early Payment Discounts

In the fast-paced world of business transactions, managing cash flow effectively is vital. One tool that provides substantial benefits for both buyers and sellers is the “Net 30 early payment discount.” This strategy not only boosts financial health but also strengthens business relationships.

Let’s unpack what makes Net 30 arrangements so appealing and how early payment discounts can lead to savings for buyers and improved cash flow for sellers. This collaborative approach transforms straightforward invoicing into a clever financial tactic.

Understanding Net 30 Payment Terms

Definition and Purpose

In the bustling world of business-to-business (B2B) transactions, understanding payment terms like Net 30 is crucial. At its core, Net 30 means the buyer has a 30-day window from the invoice date to pay the full amount due. This concept plays a vital role in financial management by striking a balance between giving buyers enough time to sort their cash flow and ensuring sellers receive payment in a timely manner.

Net 30 terms are popular because they offer flexibility and clarity. Buyers can forecast their cash needs without feeling pressured, while sellers provide a trustworthy short-term credit, potentially increasing their customer base. Importantly, everyone needs to be on the same page regarding when the 30-day countdown begins, as it starts from the invoice date.

Advantages for Buyers and Sellers

For buyers, Net 30 provides breathing room to manage finances effectively. It allows them to align their outflows with revenue cycles, optimizing cash flow and working capital. This makes it easier to plan expenses and allocate resources appropriately.

Sellers, on the other hand, benefit by attracting more customers through flexible payment terms, which can lead to enhanced sales possibilities. Despite these advantages, there are risks involved. Late payments can stress a seller’s finances, which is why some might implement late fees to encourage timely payments. Sellers must also assess the credit risk of buyers to ensure that their financial interests are protected.

The Concept of Early Payment Discounts

Explanation of Early Payment Discounts

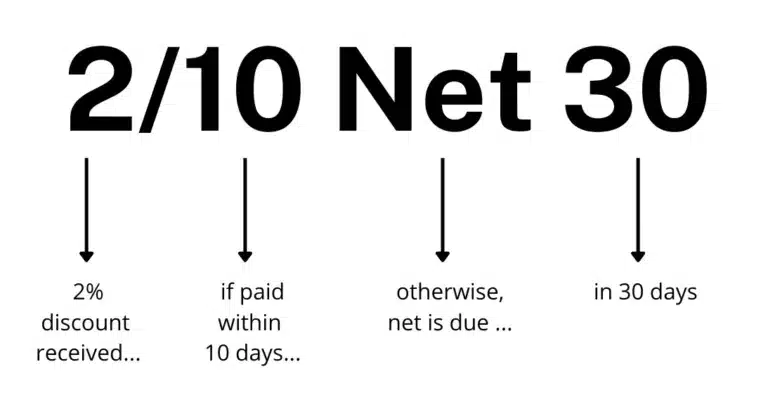

Now, let’s dive into the concept of early payment discounts—an attractive proposal for faster payments. It’s a strategic maneuver where sellers offer a small discount to buyers who pay their invoices well before the Net 30 deadline. Typically, it might look like “2/10, net 30”, meaning a 2% discount is on the table if the invoice is settled within 10 days.

How Early Payment Discounts Work

These discounts create a win-win situation. Buyers dip into savings with these early bird specials, slicing off a chunk of the cost, while sellers see their cash flow improve significantly. This expedited cash influx equips sellers to seize new opportunities and manage expenses more efficiently.

Common Discount Structures

Outside the classic 2/10 net 30 structure, there are other creative options. Companies might offer a 1/15 net 30—a 1% discount if paid within 15 days—or even a dynamic discounting system, where the earlier a payment is made, the greater the discount. This flexibility can cater to diverse buyer needs and further solidify seller-buyer relationships.

Early payment discounts are more than just cost-cutting tactics—they’re also relationship builders that encourage timely payments and foster goodwill between businesses.

Benefits for Sellers

- Accelerated Cash Inflow

- Reduced Collection Costs

- Strengthened Customer Relationships

1. Accelerated Cash Inflow

One of the biggest perks for sellers offering early payment discounts is the accelerated cash inflow. When buyers settle their bills ahead of the standard 30-day term, sellers experience a swift cash boost.

This quick injection of funds not only stabilizes the seller’s cash flow but also positions them to grab unexpected business opportunities, invest in new inventory, or simply cover day-to-day expenses without stress. It’s like having a financial cushion that lets businesses breathe easier.

2. Reduced Collection Costs

Chasing down payments can be both time-consuming and expensive. By offering early payment discounts, sellers incentivize buyers to pay sooner, naturally cutting down on the need for tedious collection efforts.

Fewer pending invoices mean less administrative work and lower collection costs, freeing up valuable resources for sellers to focus on what matters most—growing their business. Imagine less time on the phone chasing payments and more time getting things done!

3. Strengthened Customer Relationships

Offering early payment discounts is more than just a financial strategy—it’s a relationship builder. By providing this incentive, sellers show flexibility and understanding of their customers’ financial needs, which can foster a feeling of goodwill.

This gesture can enhance trust and loyalty, encouraging buyers to return and even recommend the seller to others. Over time, these strengthened relationships can lead to stable, long-term partnerships that benefit all parties involved.

Benefits for Buyers

- Cost Savings

- Enhanced Creditworthiness

- Strategic Cash Flow Management

1. Cost Savings

For buyers, the most immediate and appealing benefit of early payment discounts is the cost savings. Not only do they pay less for the same products or services, but these small percentages quickly add up, especially for businesses making large or frequent purchases. Ultimately, these savings can improve the bottom line, making early payment discounts a financially savvy decision.

2. Enhanced Creditworthiness

Seizing early payment discounts isn’t just good for the pocketbook—it’s also good for credit scores. When buyers consistently meet early payment terms, they demonstrate financial responsibility, which can enhance their creditworthiness over time.

This improved credit profile might unlock better terms, such as lower interest rates or increased credit limits, providing further financial leverage and opportunities for growth.

3. Strategic Cash Flow Management

By integrating early payment discounts into their financial strategy, buyers can master the art of cash flow management. Timing payments to coincide with discount offers allows buyers to optimize their cash flow effectively, ensuring that money is available when it’s most beneficial.

This proactive approach can enhance resource allocation and support strategic financial planning, making sure buyers always have a clear view and handle on their financial health.

Variations in Discount Models

When it comes to early payment discounts, one size doesn’t fit all! Let’s dive into some popular discount models and see how they can serve different business needs.

1/15 Net 30

Imagine getting a 1% discount if you pay your invoice within 15 days, otherwise, you have the regular 30 days to settle the bill. This is the crux of the 1/15 Net 30 model. It’s a gentle nudge that urges buyers to speed up their payment cycle slightly without drastically impacting their cash flow, resulting in a manageable compromise for both parties.

3/7 Net 45

Taking it up a notch, we have the 3/7 Net 45 model, where a 3% discount is offered if the payment is made within 7 days. Otherwise, buyers get a more extended period of 45 days to pay the full amount. This model can be very appealing for buyers capable of quick payments but who also appreciate the flexibility of a longer payment term if necessary.

Dynamic Discounting

Dynamic discounting adds a modern twist by offering a sliding scale discount. In this model, the earlier a payment is made, the greater the discount. It’s a win-win for both buyers who may have varying financial abilities each month and sellers looking to maintain a smooth cash flow. This flexibility encourages even quicker payments, allowing businesses to tailor deals to their specific financial situations.

Role of Technology

Let’s face it; technology is transforming the way we conduct business, and it’s no different when it comes to managing early payment discounts.

Early-Payment-Discounts-business

Automation of Processes

With automation, gone are the days of manually tracking every invoice. Technology can streamline invoicing, including calculating discounts and sending them to clients automatically. This reduces the workload and lets businesses focus on more strategic tasks, increasing productivity overall.

Error Minimization

It’s easy for mistakes to crop up with manual entry, especially when dealing with numbers and dates. However, with technological solutions, the chances of human error decline significantly. Automated systems ensure accuracy in discount calculations, ensuring buyers and sellers are precisely on the same page.

Efficiency Enhancement

By harnessing the power of modern software, businesses can track due dates, send payment reminders, and facilitate seamless transactions, all in real-time! This heightened efficiency not only saves time but also enhances the clarity and speed of communication between buyers and sellers. Ultimately, this leads to a smoother transaction process, keeping everyone happy and informed.

Incorporating these technological tools and discount models can make early payment discounts an even more attractive and feasible option for various businesses.

Strategic Considerations

When it comes to mastering Net 30 early payment discounts, strategic considerations are key in ensuring that both buyers and sellers truly benefit from the arrangement. Let’s dive into some essential aspects that need attention.

Importance of Clear Communication

Clear communication forms the backbone of any successful business transaction. For early payment discounts to work effectively, both parties need to be on the same page regarding the terms. Sellers should ensure that the discount details are simply laid out in invoices, contracts, and any other relevant communications.

Buyers, on the other hand, must confirm they understand the conditions to prevent late payments that could negate the opportunity for savings or lead to additional costs.

Cash Flow and Planning

Managing cash flow is pivotal for both buyers and sellers. Buyers should evaluate their financial standing and make plans to take advantage of early payment discounts without stressing their budget or compromising other obligations.

Similarly, sellers benefit from a steady stream of cash flow thanks to early payments, allowing them to manage their operations smoothly. Planning ahead ensures both sides can seize opportunities as they arise, fostering a proactive rather than reactive business model.

Importance of Transparent Pricing

Maintaining transparent pricing is vital for building trust and nurturing long-term relationships with customers. Even when factoring in discounts, sellers should uphold fair pricing to ensure buyers feel valued and respected.

Transparent pricing shows integrity, encouraging buyers to take advantage of early payment opportunities while strengthening the partnership between the two parties. By focusing on these strategic considerations, businesses can utilize Net 30 early payment discounts to create a win-win scenario for all involved.

Conclusion

In conclusion, Net 30 early payment discounts offer a strategic edge in the world of business transactions. They transcend beyond just saving money; they embody a collaborative spirit that supports both buyers and sellers.

For sellers, these discounts mean faster cash flow and minimized resources spent on collections. For buyers, they bring significant savings and a boost in financial reputation.

By emphasizing clear communication and strategic planning, businesses can effectively incorporate these discounts. Technology can further streamline the process, allowing efficiency and accuracy to take center stage.

As both parties work together with these mutual benefits, Net 30 early payment discounts ultimately pave the way for financial health and strengthened business relationships, ensuring a win-win for everyone involved.