Running a business can be thrilling, but dealing with money matters can be tough. A Net-30 credit card is a useful tool that can make this easier. Basically, it lets businesses pay their bills within 30 days without extra charges. This extra time can really help with managing money. It’s great because you get what you need and have a clear plan for paying it back. Here’s why Net-30 credit cards could be perfect for your business:

- Better Money Management: The 30-day period helps keep your money safe.

- Easier Planning: Having a clear payment plan makes budgeting simpler.

- Stronger Credit: Paying on time can improve your business’s credit score.

Keep an eye out as we explain more about how these cards can change how you manage your business finances!

Understanding Net-30 Credit Cards

Companies sometimes find the idea of credit a bit confusing. But with the right information, it can be simple. Let’s look at what Net-30 business credit cards are and why they might be a good option for your business.

Definition and Basics

Net-30 business credit cards are a way for businesses to buy things now and pay for them later. With these cards, companies have 30 days to pay off what they owe without any extra charges. It’s a simple idea that helps businesses manage their costs and gives them some extra time to handle their money.

Here’s a simple explanation of how they work:

- Quick Buying: Businesses can make purchases they need right away.

- 30-Day Limit: Companies have 30 days to pay back what they owe.

- No Extra Fees (if paid on time): As long as the bill is paid within 30 days, there are no extra costs.

These cards are especially helpful for regular business expenses, small stock orders, or when businesses need a little extra time between paying suppliers and getting money from sales. For example, you can stock up on essential office supplies with Net 30 terms through trusted vendors.

How Net-30 Terms Work

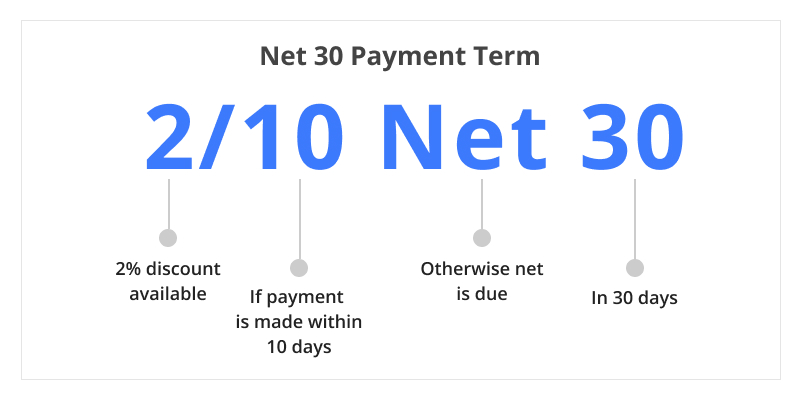

Understanding how Net-30 terms work is important for managing your business’s money well. “Net-30” means you need to pay the full amount within 30 days of getting an invoice. This is a promise to pay what you owe at that time.

Here’s how it works step by step:

- Buy Goods or Services: You use the credit card to purchase what your business needs, just like a regular card.

- Get an Invoice: You’ll usually receive an invoice on the day of your purchase, showing a Net-30 payment term.

- Pay the Invoice: You then have 30 days to pay this invoice.

If you don’t pay within 30 days, you might face extra fees or interest rates similar to those on regular credit cards. So, paying on time is important for keeping your finances healthy.

For example, you can buy custom drinkware like mugs and tumblers for your office, which can be paid off using Net 30 terms without extra costs.

Comparison with Other Credit Terms

Companies usually come across different payment terms like Net-60, Net-90, or even Net-10. Here’s a simple explanation of how Net-30 compares to these options:

- Net-10: This is good for clients who want to pay quickly, often with a discount for early payment, but it can cause cash flow problems.

- Net-60/Net-90: These give more time to pay, which can be helpful for flexibility, but often involve higher interest rates or stricter credit checks.

Net-30 offers a middle ground, giving enough time to handle payments without causing financial stress or adding extra interest. It is ideal for managing regular purchases like branding materials without overwhelming cash flow.

How They Differ from Regular Credit Cards

Net-30 credit cards may look like regular credit cards at first, but they have important differences that make them better for businesses.

- No Interest: Unlike regular credit cards that charge high interest, Net-30 cards don’t charge interest if you pay on time.

- Flexible Limits: Regular credit cards have fixed spending limits, which can be a problem. Net-30 cards often let you change the limit based on how well you pay or are linked to specific invoices.

- Business Focus: Regular cards can be used for personal or business expenses, but Net-30 cards are made just for business, helping you manage and track costs better.

For businesses needing to maintain a professional appearance, you could use Net-30 terms to buy custom apparel like polo shirts or hoodies, making branding simple and budget-friendly.

Benefits of Net-30 Credit Cards for Businesses

Exploring the reasons why a business should use Net-30 credit cards reveals numerous advantages, including their role in cash flow optimization strategies. These cards can significantly improve financial health and support growth by providing greater flexibility and control over expenses.

Improved Cash Flow Management

A steady flow of money is very important for a business to do well. Net-30 credit cards give businesses 30 extra days to pay, which helps them manage their money better by giving them more time to pay after they get goods or services.

Here are some advantages:

- Matching Payments: You have time to collect money from customers before you need to pay your bills.

- Keeping Money Available: Businesses can keep cash for important needs or unexpected costs while still paying suppliers.

- Making Payments Easier: Large expenses can be split into smaller, easier payments, so you don’t use up too much money at once.

For instance, purchasing tech gear or office supplies upfront and paying later can free up cash for other operational needs, reducing financial stress.

Building a Strong Credit Profile

Using a Net-30 for business credit regularly can help your business in more ways than just saving money.

- Building Credit History: Making payments on time helps create a good credit history, which is important for getting loans later.

- Improving Credit Score: If you pay your Net-30 bills regularly, it gets reported to business credit agencies and can raise your business credit score.

- Improving Supplier Relationships: Having a good record of paying on time helps build trust with suppliers, which might lead to better credit terms in the future.

| NOTE: You can use business templates to help manage your finances and make informed decisions about how to allocate funds. |

How Businesses Can Obtain Net-30 Credit Cards

Obtaining a Net-30 credit card can be a major boost for your business. The process may seem complicated at first, but don’t stress—we’ll guide you through it step by step. Here’s how you can add this important financial tool to your business.

Identifying Potential Vendors

To apply for a Net-30 credit card, you first need to find companies that offer these payment terms. Here’s how to do it:

- Search Online: Look for businesses and banks that provide Net-30 terms. Start with websites of big office supply stores, wholesalers, or industry-specific suppliers. Various vendors also offer office supplies with Net 20 payment options, which is ideal for small business needs.

- Use Business Directories: Check directories like Dun & Bradstreet to find companies known for offering credit accounts.

- Ask Around: Talk to people in your business network. Ask colleagues or local business groups for recommendations on trustworthy vendors with good credit terms.

- Check Vendor Lists: Look for online lists that already have a collection of vendors offering Net-30 accounts, often organized by industry.

After finding some possible vendors, check their reputation and terms. Read reviews or testimonials to make sure they are reliable and easy to work with.

Meeting Eligibility Requirements

Once you’ve found the right suppliers, the next step is to make sure your business meets their requirements. Each supplier will have different rules, but here are some common ones you’ll probably come across:

- Business Type: Your business needs to be registered as an LLC, corporation, or partnership. If you’re a sole proprietor, it might be harder, but don’t worry—some suppliers work with sole proprietors too.

- EIN (Employer Identification Number): Most suppliers will ask for an EIN, which is like a Social Security number for your business and is given by the IRS.

- Business Bank Account: It’s important to have a separate bank account for your business to keep track of its money.

- Ability to Pay: While your personal credit might be considered, some sellers check if your business can pay its bills. Creating a credit history for your business can really help with this.

- Business Age: New businesses may have a harder time getting approved right away. Some sellers want to see that a business has been operating for at least six months to a year.

- Payment History: Sellers might ask for information about your past payments to other suppliers. This shows how reliable you are in paying on time.

If there are any requirements you don’t meet, take steps to fix them. This could include registering your business, opening a business bank account, or starting to build your business credit score.

Application Steps and Approval Process

Now that you’re ready with your eligibility, it’s time to apply! If you are wondering how to set up Net 30 terms for your business. Here’s a simple guide to help you through the application and approval process:

- Collect Important Information: Before starting your applications, make sure you have all the necessary information, such as your business registration papers, EIN number, bank account details, yearly income, number of workers, and trade references.

- Complete the Applications: Each company will have its own application form, which can be online or on paper. Take your time to fill them out carefully, making sure all the information you provide is up-to-date and correct.

- Send Extra Documents: Some companies might need extra documents, like your bank statements, proof of your business address, or tax papers. Have these ready to speed up the process.

- Review and Wait for a Decision: After you send in your application, the vendor’s credit team will look at it. This process can take anywhere from a few days to a few weeks, depending on the vendor.

- Check In: If you don’t hear back within a reasonable time, don’t hesitate to follow up. This shows you’re interested and can sometimes help speed up the process.

- Confirm the Terms: When your application is approved, carefully check the credit terms. Make sure you understand the Net-30 terms, which include your payment schedule and any fees or penalties for late payments.

- Begin Using the Credit: Once your account is set up and the terms are clear, you can start using the credit. Be responsible with your spending to build a good credit history.

Keep in mind, being patient and well-prepared is important. Collect all the necessary information beforehand and understand each part of the process to make things easier and less stressful. With your Net-30 credit card, you’re already making progress toward better cash flow and financial freedom for your business.

Conclusion

In today’s busy business environment, Net-30 credit cards can be very helpful. They let you pay your bills in 30 days, which helps you manage your money better and deal with costs without feeling too much pressure right away. Here’s a simple summary of why they could be great for your business:

- More Time to Pay: You get 30 days to pay your bills, which is useful when money is tight.

- Better Money Control: You can spend now and pay later, avoiding sudden money problems.

- Stronger Business Credit: This helps you build a good credit history, which can lead to more opportunities.

Think about using Net-30 credit cards as part of your financial plan and see how they can improve your business’s financial situation. Remember, the right tools can help your business succeed in a very competitive market! Ready to get started? Look for Net 30-eligible office supplies and start building your business credit today.