| Summary:

Net 30 accounts allow businesses to purchase goods or services and pay within 30 days, improving cash flow and credit. These terms benefit businesses by providing more time to manage expenses, strengthening vendor relationships, and building credit. Properly managing these accounts can enhance financial stability and foster growth. |

Struggling with cash flow? You’re not alone. Many small businesses face the same challenge. But what if you could buy now and pay later—without interest?

Enter Net 30 accounts.

Net 30 accounts are an underutilized yet powerful tool for managing cash flow, building business credit, and strengthening relationships with suppliers.

Think of it as a trade credit system where you can purchase products or services and pay within 30 days, giving you more time to generate revenue before the bill comes due.

But how do they work, and why should you care about understanding the Net 30 accounts? Here, we’ll break down the basics of Net 30 accounts, reveal how they benefit your business, and show you exactly how to set one up. Whether you’re a new business owner or a seasoned pro, this simple tool can unlock big financial benefits.

Ready to take control of your business’s cash flow? Let’s dive in.

What Is A Net 30 Account?

A Net 30 account is a form of trade credit in which a business can acquire products or services immediately and defer payment for 30 days from the invoice date. This arrangement is prevalent in B2B transactions across various industries, including wholesale, retail, construction, and professional services.

The term “Net 30” breaks down as follows:

- “Net” means the total amount owed, the final figure after discounts.

- “30” indicates the payment deadline in days.

For instance, if you receive an invoice dated July 1st with Net 30 terms, the full payment is due by July 31st, including weekends and holidays, as it uses calendar days. Some suppliers offer incentives like “2/10 Net 30,” meaning you can deduct 2% from the invoice if paid within 10 days, or pay the full amount within 30 days.

How Net 30 Payment Terms Work?

Net 30 payment terms are a standard practice in business transactions, offering buyers and sellers a clear payment structure. Here is a breakdown of how it works:

- Agreement Terms: The buyer and seller agree that payment for goods or services provided is due 30 days after delivery or the invoice date. This arrangement helps ensure clarity and avoids confusion about payment expectations.

- Delivery of Goods or Services: The seller delivers the agreed-upon products or services, marking the start of the 30-day payment window.

- Issuance of Invoice: After the delivery, the seller issues an invoice specifying the payment due date, 30 days from the invoice date. If applicable, the invoice may also include early payment discounts, such as “2/10 Net 30,” which indicates a 2% discount if payment is made within 10 days.

- Payment Deadline: The buyer is expected to pay by the 30-day mark. Timely payments are crucial to maintain healthy business relationships and ensure a good credit rating.

Net 30 terms benefit businesses as they allow time to manage cash flow effectively, enabling a balance between receiving payments from clients and fulfilling payment obligations to others.

Who Uses Net 30 Accounts?

Net 30 payment terms are widely used across industries due to their flexibility. Here’s a breakdown:

| Industry | How Net 30 Helps? |

| Wholesale | Facilitates bulk purchases, helping retailers manage inventory without upfront costs. |

| Retail | Allows stocking shelves without depleting cash, aligning payments with sales revenue. |

| Construction | Syncs material and subcontractor payments with project milestones and client payments. |

| Professional Services | Enables accountants, lawyers, and consultants to bill clients with flexible payment cycles. |

| Technology | Supports software or hardware purchases for enterprises with longer procurement processes. |

| Healthcare | Manages costs for medical equipment and pharmaceuticals while maintaining supplies. |

These industries benefit from the best business Net 30 accounts by aligning payments with revenue cycles, making financial management smoother.

Benefits Of Net 30 Accounts For Your Business

1. Improvement of Cash Flow Management

Businesses often find it challenging to balance the payments and incoming revenue. This is where having a Net 30 arrangement can make a big difference. With a bit more time on payment deadlines, companies aren’t under so much pressure to pay up right away after buying something.

More Time To Manage Cash

When businesses use Net 30, they can match what they spend on their day-to-day operations with the money they get from their customers. This means they’re less likely to run into problems because they’re short on cash, which is helpful when sales are slow.

Easier Planning

Knowing how cash is going to flow in and out makes it easier for businesses to predict their financial situation and make plans for the future, like investing in new things or expanding, without straining their budget.

Less Worry About Bills

Extra time to pay allows businesses to spread out operational costs like wages and rent, creating a more manageable financial schedule.

2. Stronger Vendor Relationships

Building and maintaining good relationships with suppliers is essential for long-term success. Offering or receiving Net 30 terms can help establish trust and reliability between businesses and their vendors.

Building Trust

Consistently paying on time demonstrates your business’s reliability, strengthens your supplier relationship, and increases the likelihood of long-term partnerships.

Better Negotiating Terms

When your business is known for paying on time, it may open the door to better terms with suppliers, such as discounts, favorable pricing, or more flexible arrangements.

Opportunities For Growth

A strong partnership with suppliers can lead to exciting opportunities for both sides, such as exclusive product access or new business ventures.

3. Improved Business Credit

Using Net 30 terms wisely can have a positive effect on your business’s credit profile, helping you build a stronger financial standing over time.

Boosting Your Credit Score

Paying on time with your Net 30 terms can significantly improve your company’s creditworthiness. When these timely payments are reported to credit bureaus, your business credit score can increase, making it easier to get loans or additional credit down the line.

Financial Stability

A good credit score shows financial responsibility, which is attractive to potential lenders and partners and can help you access better financing options when needed.

Increased Opportunities

A solid credit profile can open doors for larger projects, new business relationships, and more capital to invest in future growth.

In short, by taking advantage of Net 30 payment terms, businesses can streamline their finances, strengthen relationships with vendors, and build a solid credit history. This flexibility not only improves short-term cash flow but also sets the foundation for long-term growth and success.

How To Set Up A Net 30 Account?

What Are The Eligibility Criteria For Net 30 Accounts?

Before applying for a Net 30 account, it’s important to ensure your business meets the typical requirements. Here’s what lenders generally look for

Eligibility Criteria For Business

|

What Are The Steps To Apply For A Net 30 Account?

Once you’ve confirmed you’re eligible, it’s time to get the ball rolling on your Net 30 account application. Here’s what you need to do:

Step 1: Choose the Right Supplier: Look for vendors that offer Net 30 terms and align with your business needs.

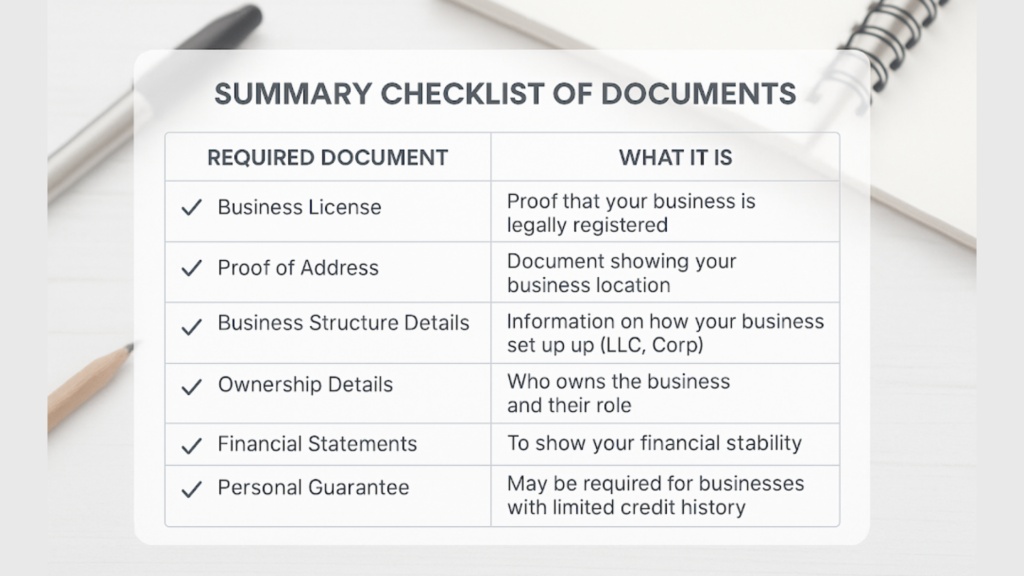

Step 2: Prepare Your Documents: Here’s a checklist of the documents you’ll likely need to provide:

- Business license

- Proof of business address

- Details about your business structure (e.g., LLC, Corporation)

- Ownership information

Step 3: Fill out the Net 30 Application: Complete the supplier’s application form with

- Your business name

- Contact information

- Estimated monthly spending

Step 4: Share Financial Information: Provide financial statements or a personal guarantee (sometimes) to assure the supplier of your ability to make timely payments.

Step 5: Review the Terms: Carefully read the terms and conditions before submitting the application. Pay attention to the following things:

- Late payment interest rate

- Early payment discounts

Step 6: Submit Your Application: Submit the completed application and required documents to the supplier.

Step 7: Wait for Approval: Getting approval may take a few days or weeks. Be prepared to provide additional information if requested.

Step 8: Start Using Your Net 30 Account: Once approved, you can make credit purchases and enjoy the 30-day payment period.

Common Mistakes To Avoid With Net 30 Accounts

Avoid these pitfalls to maximize Net 30 benefits:

- Opening Too Many Accounts: Multiple accounts can strain cash flow. Start with one or two suppliers.

- Missing Payment Deadlines: Late payments incur fees and harm credit. Use reminders or automation.

- Ignoring Terms Changes: Suppliers may update terms; review statements regularly.

- High Credit Utilization: Keep usage below 30% to maintain a healthy credit profile.

- Missing Early Payment Discounts: Pay early if cash flow allows to save money (e.g., 2% off with “2/10 Net 30”)

Conclusion

Net 30 accounts are a strategic tool for managing cash flow, building business credit, and fostering supplier relationships. By setting them up wisely and avoiding common mistakes, you can enhance the financial health of your business. Start exploring Net 30 options with suppliers today to unlock these benefits.

Frequently Asked Questions

1. What is a Net 30 account?

A Net 30 account allows businesses to buy goods or services and pay within 30 days, aiding cash flow and credit building.

2. What’s the difference between Net 30 and other terms?

Net 30 offers 30 days to pay, unlike Net 10 (10 days) or Net 60 (60 days), depending on your needs.

3. How does a Net 30 account build credit?

Timely payments reported to credit bureaus improve your business credit score, easing access to financing.

4. Can new businesses get Net 30 accounts?

Yes, some suppliers offer terms to new businesses, often with a personal guarantee or stricter terms.

5. What happens if I pay late?

Late payments may lead to fees, interest, and credit damage, affecting supplier relationships.