Unlock financial flexibility, strengthen vendor relationships, and accelerate your business growth with Net 30 accounts—especially through The CEO Creative’s tailored solutions.

Quick Takeaways

|

What Are Net 30 Accounts (And Why You Should Care)

If you’re wondering, “What are Net 30 accounts?” you’re not alone.

Put simply, Net 30 accounts are vendor credit lines that allow businesses to buy products or services now and pay later—within 30 days.

How Net 30 Works:

- You order supplies (design, packaging, digital tools, etc.)

- Your vendor delivers the goods or service

- You pay the invoice within 30 days

- The vendor (if they report) sends your payment history to business credit bureaus

- This builds your business credit profile—without needing a personal credit score or a business loan.

Why Net 30 Accounts Are a Game-Changer for Small Businesses

Entrepreneurs and creatives often face a major challenge:

Funding growth without draining capital.

That’s where Net 30 accounts for business shine.

Here’s What You Get:

- No Interest, No Hassle – You get 30 days to pay. No hidden fees.

- Credit Building – Payments are reported to bureaus like Dun & Bradstreet and Equifax.

- Cash Flow Flexibility – Delay payments while investing in sales, marketing, or inventory.

- Startup Friendly – No personal credit check or revenue minimums (with the right vendors).

- Credibility – Lenders, suppliers, and partners trust businesses with strong trade references.

Who Should Use Them:

- New businesses with little or no credit history

- Creatives looking to fund product launches or campaigns

- Founders preparing for future loans or funding rounds

- Digital-first businesses scaling without outside capital

The CEO Creative: More Than Just Net 30

The CEO Creative doesn’t just offer credit—it delivers an ecosystem for creative business growth.

Why We’re Different

| Feature | The CEO Creative Advantage |

| Net 30 Account | Up to $5,500 in vendor credit |

| Credit Reporting | Yes – to Dun & Bradstreet & Equifax |

| Personal Guarantee | Not required |

| Approval Time | Under 5 minutes |

| Business Tools | Branding, marketing, coaching, and more |

| Security | Cloudflare-protected, secure platform |

| Audience | Creative professionals, entrepreneurs, and startup founders |

Our mission: Empowering creators and leaders with practical tools, actionable strategies, and credit that builds real momentum.

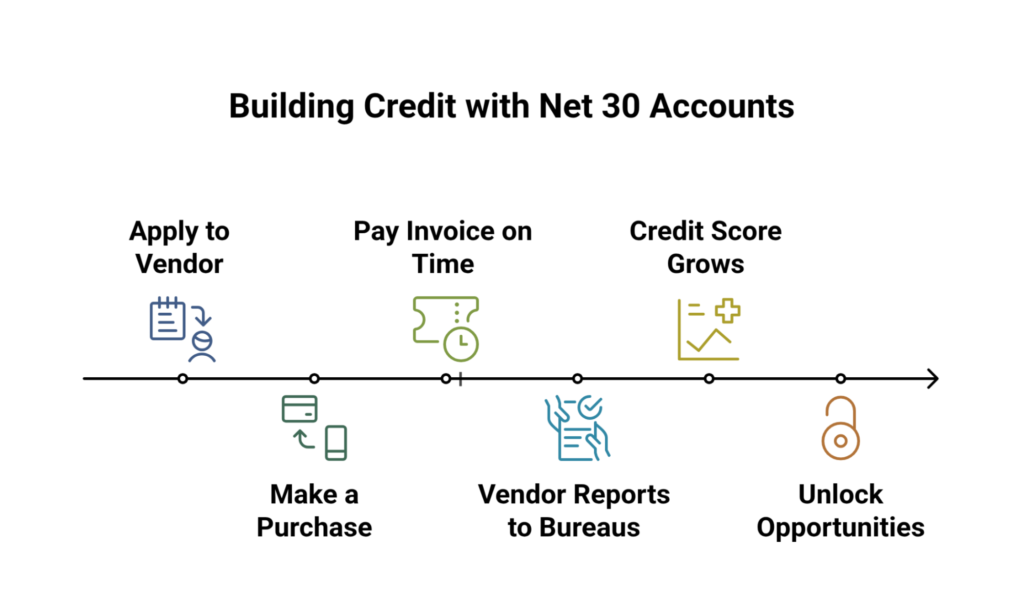

How Net 30 Accounts Build Credit Fast

When used correctly, Net 30 accounts are one of the fastest ways to build business credit, especially for businesses starting from zero.

Here’s the Process:

You don’t need years of bank loans or complex financing to build credit—just consistent, smart vendor payments.

Real Example: Branding + Credit in One Move

Let’s say you’re launching a skincare line.

You need:

- Product packaging

- Custom logos

- Social media templates

- E-commerce setup

- Flyers for your launch

With The CEO Creative’s Net 30 account:

- You order everything today

- Pay nothing upfront

- Get 30 days to pay—while your first customers roll in

- Your on-time payment builds your business credit profile

It’s business growth and brand elevation—without sacrificing cash flow.

Tips to Maximize Your Net 30 Accounts

Using a Net 30 account isn’t just about paying late—it’s about paying smart.

Do This:

- Start with 2–3 Net 30 accounts (including The CEO Creative)

- Only work with vendors who report to bureaus

- Pay early to build trust (and increase future credit limits)

- Track all due dates (automate alerts in your calendar or CRM)

Avoid This:

- Late payments (can damage your credit score)

- Choosing vendors that don’t report (wasted effort)

- Applying to 10+ vendors in one month (raises flags)

Net 30 Vendor Comparison Table

| Vendor Name | Reports to Credit Bureaus | PG Required? | Max Credit | Extra Services |

| The CEO Creative | D&B + Equifax | No | $5,500 | Branding, Marketing, Tools |

| Uline | D&B | Sometimes | Varies | No |

| Quill | D&B | No | $500–$1,000 | No |

| Summa Office | No | No | $2,000 | No |

The CEO Creative is the only Net 30 vendor combining credit, creative support, security, and speed in one place.

Final Word: Smart Credit Starts Here

Net 30 accounts are more than just delayed payments—they’re a smart way to build credit, manage cash flow, and grow your business. For entrepreneurs and creatives, they offer fast access to credit without personal risk. With The CEO Creative, you get more than a vendor—you gain a partner offering expert guidance, creative tools, and real credit-building power to support long-term success.

Ready to Grow? Your Credit Journey Starts Here

Apply for your Net 30 account with The CEO Creative in under 5 minutes.

Get up to $5,500 in credit. No personal guarantee.

Just real, actionable growth.

Frequently Asked Questions (FAQs)

1. What are Net 30 accounts for business?

Vendor accounts that let you pay within 30 days, interest-free, while building your business credit score.

2. Can Net 30 accounts really build credit?

Yes, Net 30 accounts build business credit by providing a payment history to business credit bureaus that demonstrates:

- Responsible credit management

- Opening up opportunities for better terms and financing in the future

When a business makes timely payments on Net 30 invoices, it establishes a positive track record that helps improve its credit score with agencies like Dun and Bradstreet and Equifax. For example, The CEO Creative reports to credit bureaus to help businesses build credit.

3. Are Net 30 accounts good for new businesses?

Absolutely. They’re often the first credit accounts many startups open to build credit history, which is crucial for securing future favorable terms and loans.

4. What happens if I miss a payment?

You may incur late fees or penalties as specified in the invoice or agreement. Late payments can damage your credit score and your vendor relationship. Always pay early or on time.

5. How fast can I build credit using Net 30 accounts?

You can expect as little as 60–90 days, depending on payment frequency and vendor reporting schedules. Ensure to focus on maintaining responsible financial habits by making all payments on time.