In the dynamic realm of business, where financial stability and cash flow are paramount, Net 30 accounts emerge as a critical tool for achieving sustained growth. These accounts not only optimize cash flow by allowing businesses 30 days to settle invoices, but they also play a crucial role in building business credit.

Among the myriad of vendors offering Net 30 accounts, The CEO Creative distinguishes itself by providing a holistic approach designed to fuel small business growth.

With its streamlined application process, comprehensive product offerings, and a clear emphasis on building business credit, The CEO Creative offers a unique edge to businesses looking to leverage Net 30 accounts for long-term success.

Understanding Net 30 Accounts For New Business

Definition of Net 30 Accounts

Net 30 accounts are a form of trade credit offered by vendors to their clients, giving them the flexibility to pay for goods or services within 30 days from the invoice date without incurring any interest.

This type of account is a prevalent method of business-to-business (B2B) transactions, allowing companies to manage their inventory and operational expenses more efficiently.

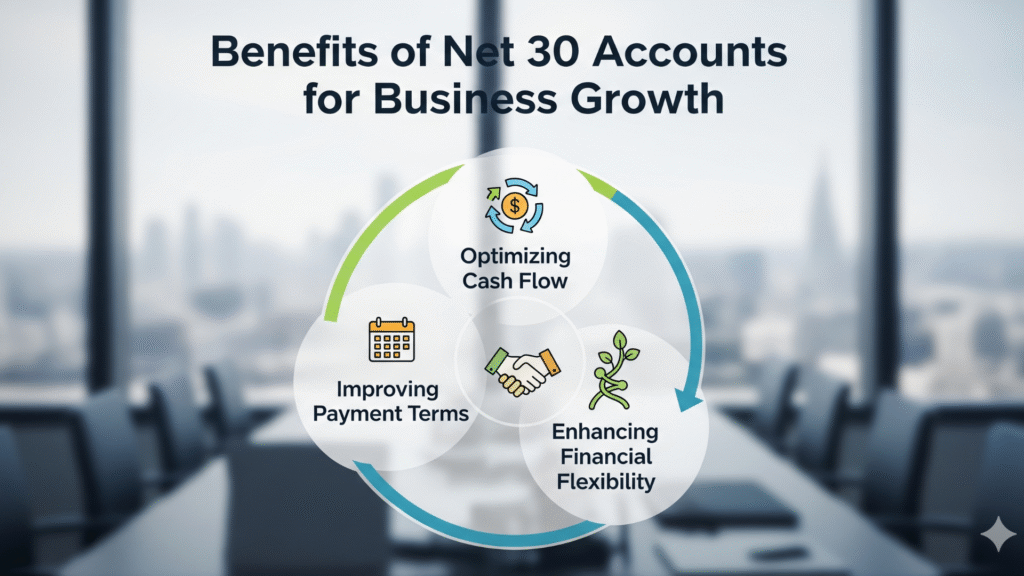

Optimizing Cash Flow

One of the most significant benefits of utilizing Net 30 accounts is the optimization of cash flow. This advantage allows businesses to maintain operations without the need to immediately liquidate assets or use funds that could be allocated elsewhere for growth initiatives.

For small and medium-sized enterprises (SMEs) in particular, where cash flow can often be unpredictable, Net 30 accounts provide a buffer that enables smoother financial management.

Businesses can leverage this period to sell the inventory, collect receivables from their customers, or invest in marketing efforts to generate additional sales, thereby creating a cycle that promotes sustained business growth.

- Keeping cash in the business longer to tackle unexpected expenses

- Using the credit period to generate sales revenue from the purchased goods

- Reinvesting savings or revenue into growth opportunities before payment is due

Improving Payment Terms

By offering or negotiating Net 30 accounts, businesses can significantly improve their payment terms, leading to stronger supplier-client relationships. For suppliers, extending Net 30 terms to trusted clients can increase loyalty and order frequency, contributing to higher sales volumes.

On the customer side, having the ability to defer payments for 30 days helps in better budgeting and financial planning. Furthermore, consistent and timely payments under these terms can enhance a business’s creditworthiness, opening the door to more favorable terms or credit lines in the future. This creates a virtuous cycle where improved payment terms contribute to greater financial stability and growth for both parties involved.

Enhancing Financial Flexibility

Net 30 accounts play an essential role in enhancing a business’s financial flexibility. This flexibility is crucial for navigating the unpredictable ebbs and flows that characterize the business world. With the breathing room provided by Net 30 terms, companies can allocate resources more strategically without being hindered by immediate payment deadlines. This can mean the difference between seizing a timely opportunity and missing out due to a lack of readily available funds. Additionally, financial flexibility allows businesses to better withstand market fluctuations and economic downturns by having the capacity to adjust operations and manage expenditures more effectively.

- Inventory management without immediate cash outlay

- Ability to explore new market opportunities with lower upfront costs

- Improved capacity to absorb and recover from financial setbacks

Net 30 accounts, when utilized strategically, can be a powerful tool in fostering business growth. By extending the time businesses have to pay for their purchases, these accounts help optimize cash flow, improve payment terms, and enhance financial flexibility. This trio of benefits lies at the heart of why Net 30 accounts are invaluable for companies looking to expand and thrive in today’s competitive marketplace.

The CEO Creative Advantage: Going Beyond the Basics

While the benefits of Net 30 accounts are universally recognized, The CEO Creative elevates the experience by fine-tuning its offering to address the nuanced needs of modern businesses directly. Their approach provides a distinct competitive advantage.

Unmatched Efficiency

The CEO Creative prioritizes efficiency at every step. From a streamlined online application process to clear invoicing and flexible payment options, they minimize the administrative headache often associated with credit accounts. This efficiency translates to more time and resources you can allocate toward core business activities.

One-Stop-Shop for Business Resources

Diversity in product offerings sets The CEO Creative apart. By sourcing everything from office essentials to specialized tools and marketing materials through a single vendor, businesses can drastically reduce the complexity and time investment required to manage multiple supplier relationships. This consolidation not only simplifies logistics but also potentially leverages better pricing and service due to the volume of business.

Credit Building as a Core Focus

Understanding the critical role that building a strong credit profile plays in small business growth, The CEO Creative actively supports this objective. They are consistent in reporting on-time payments, an effort that can significantly impact your credit score positively. Additionally, their commitment to guiding businesses in credit optimization practices demonstrates a genuine interest in their customers’ success, extending beyond mere transactions.

A True Partnership Approach

The CEO Creative distinguishes itself through a partnership-based business model. Their team goes beyond the conventional vendor-client dynamic, actively engaging with businesses to understand their unique challenges and goals. This approach ensures that the benefits of Net 30 accounts are fully leveraged, aligning financial strategies with broader business objectives to maximize growth potential.

The Competitive Edge

In a competitive landscape, the ability to swiftly adapt, invest in opportunities, and maintain robust operations is indispensable.

The CEO Creative’s Net 30 accounts serve as a strategic asset, enhancing businesses’ financial agility, credit standing, and operational capabilities. This competitive edge is crucial for businesses aiming to scale efficiently and sustain long-term success.

Tips for Effective Management of Net 30 Accounts

Managing Net 30 accounts efficiently is paramount for maintaining a healthy cash flow and building strong supplier and customer relationships. By implementing effective strategies, you can ensure that these accounts serve as a tool for growth, rather than a source of financial strain.

# Monitoring Payment Deadlines

To avoid missed payments and potential penalties, it is crucial to keep a vigilant eye on payment deadlines. This involves setting up a systematic process to track when payments are due from customers and to suppliers. A few tips include:

- Creating a calendar dedicated to tracking all Net 30 payment deadlines.

- Sending out reminders to customers a week before their payment is due, and then again a few days before the deadline.

- Review this calendar weekly to prioritize collections and payments for the coming week.

This proactive approach helps ensure timely payments, maintain a positive cash flow, and good relationships with both clients and vendors.

# Establishing Clear Terms and Conditions

Clarity in terms and conditions of Net 30 accounts prevents misunderstandings that could lead to delayed payments or disputes. Here’s how you can establish clear terms:

- Clearly outline the payment terms, any potential late fees, and the process for resolving disputes in all contracts and invoices.

- Ensure that your employees, especially those in sales and finance, understand these terms so they can explain them to clients and suppliers.

- Consider offering incentives for early payment to encourage clients to settle their accounts promptly.

This transparency not only builds trust but also significantly reduces the likelihood of late payments, contributing to smoother cash flow management.

# Utilizing Accounting Software

Leveraging technology can significantly streamline the management of Net 30 accounts. Modern accounting software offers features designed for this very purpose, such as:

- Automatic tracking of invoices and payments, alerting you to upcoming due dates.

- Integration with email systems to automate reminders for payment to customers.

- Real-time financial reporting to monitor your company’s cash flow health at a glance.

By harnessing these tools, businesses can reduce the manual effort required to manage Net 30 accounts, freeing up time and resources to focus on growth-driving activities.

Conclusion

Implementing Net 30 accounts within your business framework can significantly enhance your company’s operational efficiency and flexibility in handling finances.

By offering a 30-day cushion to manage payments, these credit terms not only improve your relationship with suppliers and clients but also ensure a smoother cash flow. This strategic approach to finance helps in maintaining a healthy balance between payable and receivable accounts, ultimately fostering a conducive environment for business growth.

Moreover, Net 30 accounts also serve as a tool for effective cash flow management. They provide the necessary leverage for businesses to negotiate better deals, invest in growth opportunities, and manage unexpected expenses without straining their budgets.

By carefully selecting vendors that offer favorable terms and managing your accounts efficiently, you can leverage credit as a powerful ally for your business expansion.

In conclusion, adopting Net 30 accounts is a strategic move for any business seeking to improve its financial health and gain a competitive edge in the market. This approach not only optimizes cash flow but also supports sustainable business growth by providing a strategic advantage in financial management.