| Summary:

Net 30 payment terms help small businesses manage cash flow and ensure steady income. Key practices include accurate invoices, clear payment terms, flexible options, and prompt invoicing. Automation reduces errors, while effective communication and quick resolution of disputes preserve client relationships and guarantee timely payments. |

Is your business struggling with cash flow issues and late payments?

Many small businesses face this challenge, and understanding why Net 30 invoice payment terms are important can help you tackle them.

By offering clients 30 days to pay, you keep a steady income while improving your billing efficiency.

These terms not only help ensure timely payments but also strengthen your relationships with clients, allowing for better trust and smoother transactions.

Implementing Net 30 terms can significantly reduce the stress of chasing overdue invoices, streamline your invoicing process, and help you focus on growing your business. When done right, Net 30 invoicing helps you manage accounts receivable more effectively, boosting your financial stability.

Here, we’ll explore practical steps for using Net 30 payment terms, from creating accurate invoices to automating reminders and resolving disputes quickly.

What Are the Best Practices for Effective Net 30 Invoice Payment Terms?

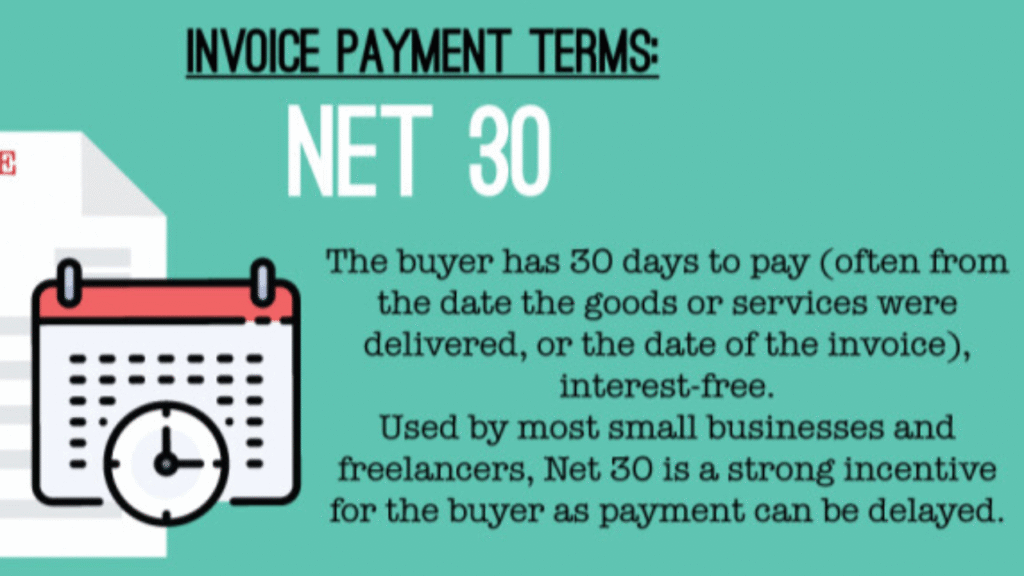

Net 30 invoicing is a standard payment method in business deals. It means the customer has to pay the bill within 30 days of receiving it. This system is helpful, especially for small businesses that need to manage their money well. However, it’s important to follow good practices to keep things running smoothly. Let’s look at some of these practices.

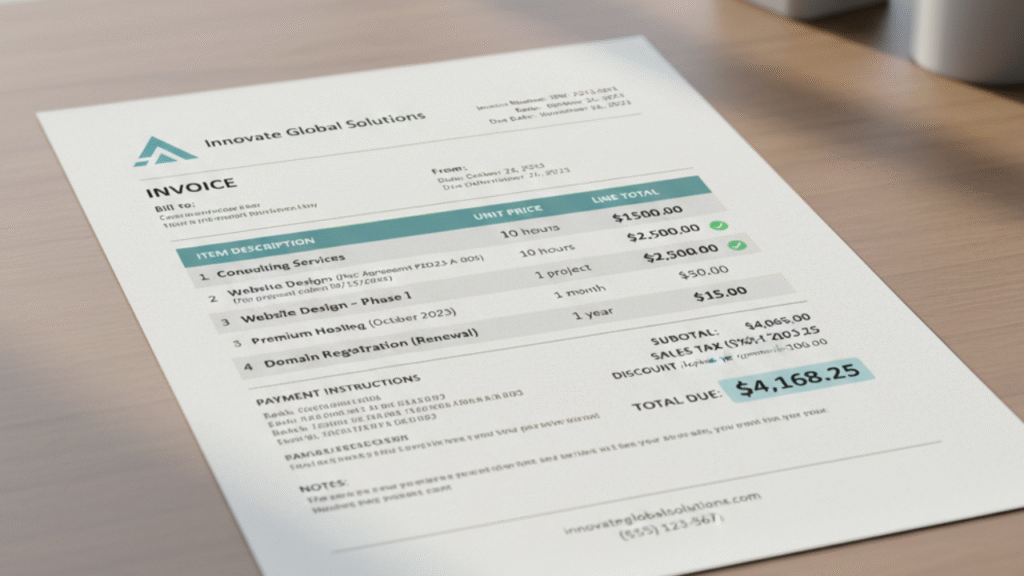

1. Creating Accurate and Detailed Invoices

The first step to successful Net 30 invoicing is creating accurate and detailed invoices. This might seem obvious, but small mistakes can cause big problems. If an invoice is incorrect, it can lead to arguments and late payments, which hurt your cash flow.

- Verify amounts and calculations: Make sure the invoice shows the correct amounts, quantities, and descriptions of what you provided.

- List each charge clearly: Break down every cost and explain what it’s for so your customer knows exactly what they’re paying.

- Refer to previous agreements: If you and your client talked about specific terms or goals, mention them in the invoice to avoid confusion.

A clear and error-free invoice shows clients you’re on top of things—and keeps both you and your customers stress-free when it comes time to pay!

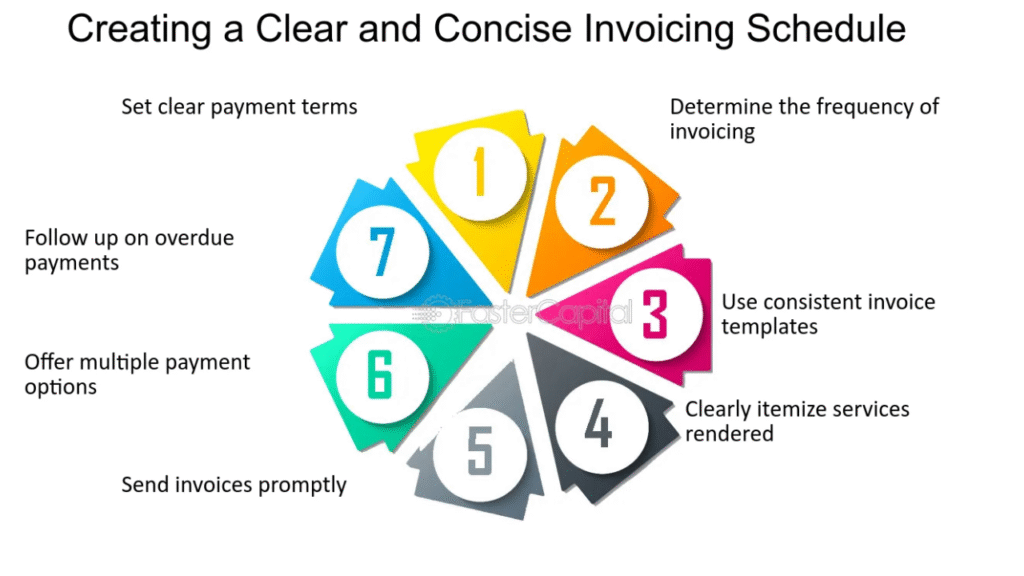

2. Sending Invoices Promptly

A key part of Net 30 invoicing is ensuring that invoices are sent out promptly. Managing accounts receivable and keeping a good cash flow depend on timely actions.

- Create a routine: Make a regular schedule for sending invoices, whether it’s every week, every two weeks, or after each project is finished.

- Use automated tools: Think about using invoicing software that can handle the process automatically and send reminders, so no invoice is sent late.

- Keep track of payments: If you don’t get paid by the due date, follow up actively. A polite reminder can help maintain your relationship with the client and ensure you get paid.

Invoicing is not just about sending a bill; it’s also about showing your clients that you are professional and reliable.

How to Create a Clear and Concise Invoice?

Creating a simple and clear invoice is important for successful Net 30 invoicing, as it helps prevent confusion and makes it quicker for payments to be made.

3. Using a Professional Invoice Template

One of the simplest ways to maintain clarity and professionalism is by using a pre-made invoice template. A well-designed template, like a Net 30 payment terms template, can save you time and make sure all important details are included.

- Pick the right template: Choose a template that matches your brand’s style and includes all the fields you need.

- Adjust it to fit your needs: Feel free to modify the template to better suit your business, but keep it easy to read and understand.

- Maintain consistency: Using the same format for all your invoices helps your clients easily recognize and handle your billing.

Using professional templates makes your invoicing process smoother and ensures your invoices always look neat and professional.

What are the Benefits of Using a Premade Invoice Template?

1. Saves Time and Ensures Consistency

Using a premade invoice template is like having a pre-built structure that just needs a few details added. Here’s why it saves a lot of time:

- Reuse and Save: Once you create your first invoice template, you can use it again and again. You don’t have to start from scratch every time you need to bill a client.

- Simplified Process: The template already has spaces for all the important information, like the client’s name, the amount owed, and payment details. This makes filling out an invoice fast and simple.

This not only saves you time but also keeps your invoices looking consistent. When all your invoices have the same format, it shows a professional and organized image to your clients. Consistency helps build trust and makes it easier for clients to handle your invoices.

2. Reduce Errors and Improve Professionalism

Making an invoice from the beginning can sometimes cause mistakes. These mistakes might be small, like a spelling error, or big, like wrong math. Ready-made templates can help a lot to avoid these problems:

- Automatic Calculations: Many templates have built-in formulas that automatically figure out totals, taxes, and discounts, which lowers the chance of math mistakes.

- Necessary Information: Templates usually have all the important parts, so you don’t forget things like invoice numbers or payment details.

Using a ready-made invoice template not only reduces mistakes but also makes your business look more professional. The neat and organized look of a template shows clients that you are reliable and good at what you do, making your business seem trustworthy and well-run.

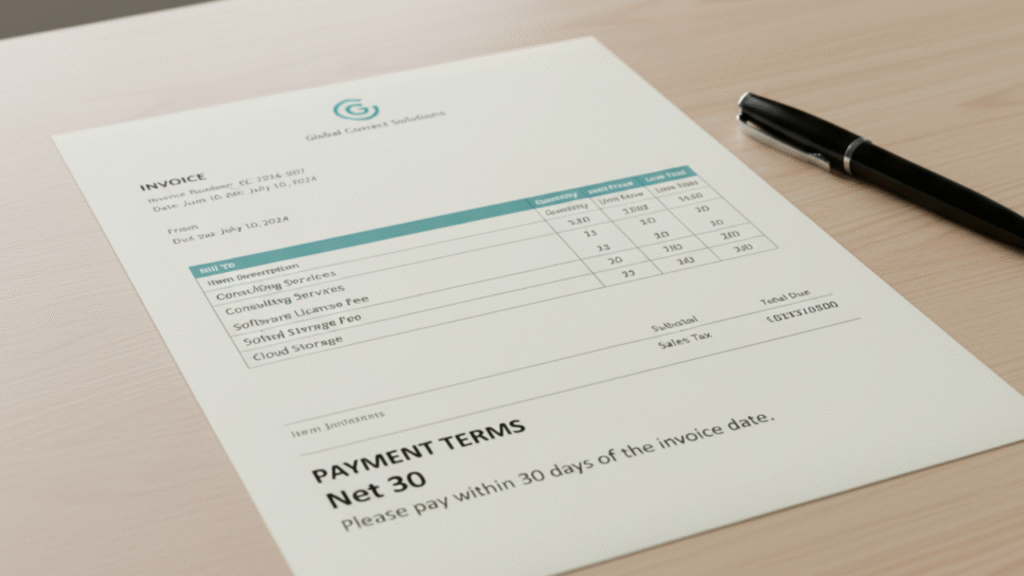

4. Including Essential Information on Invoices

A clear invoice has all the important information that helps a client pay quickly.

- Business info: Put your business name, address, contact details, and logo so it’s easy to recognize.

- Client info: Clearly write the name and address of the person or company you’re billing, along with their contact details.

- Invoice number and date: Give each invoice a unique number and include the date it was made. This helps both you and the client keep track of payments.

- Itemized list: Show a list of what you sold or the services you provided, with descriptions, amounts, and prices.

- Total amount and payment terms: Clearly show the total amount they need to pay and remind them of the 30-day payment term on the invoice.

Using these parts will make your invoice easy to understand and follow, making the payment process smoother.

To put it simply, using Net 30 invoicing effectively needs careful attention, consistency, and good communication. By making sure your invoices are accurate, detailed, and easy to understand, and sending them out on time, you help make payments happen smoothly and build strong relationships with your clients. Keep in mind that a well-made invoice is more than just asking for money—it’s a chance to show your professionalism.

Setting Payment Terms

Setting payment terms well is important for keeping cash flow healthy and building good relationships with clients. Let’s look at two key parts of this process.

5. Clearly State Net 30 Terms on Invoices

It’s important to clearly state your payment terms—such as Net 30—on every invoice. Here’s how to do this well:

- Make it Stand Out: Put the payment terms in a noticeable spot on the invoice, maybe in bold or a bigger font, so they are easy to see.

- Simple Explanation: Consider adding a short note: “Net 30 means payment is needed within 30 days of the invoice date.” This can prevent confusion and make expectations clear.

Clear payment terms lower the risk of misunderstandings and help you get paid on time, keeping your money flow steady.

6. Offering Different Payment Options

Here are some options to think about:

- Traditional Methods: Accepting checks can still be useful for some business deals, so don’t forget this old-school choice.

- Digital Payments: Think about using popular online options like PayPal, credit cards, or bank transfers for faster and easier payments.

- Modern Solutions: Today, tools like Stripe, QuickBooks, and other online invoicing platforms can work well with your invoicing system, making payments simpler for clients.

Giving clients a choice of payment methods can lead to faster payments because they’re more likely to pay quickly if they can use their favorite method. It also shows that you’re flexible, which can make customers happier and help build better relationships.

Using simple invoice templates and setting clear, flexible payment options can greatly simplify your invoicing and enhance cash flow management. This will make your business operate more smoothly, and clients will value the professionalism, creating a beneficial situation for everyone.

7. Automating Invoicing

Automating your invoicing process can greatly improve how you handle Net 30 payment terms. Using technology not only saves time but also lowers the risk of mistakes, making your accounts receivable more dependable and efficient. Let’s look at how you can make your invoicing smoother and manage your accounts better.

Use Invoicing Software to Streamline Processes

Invoicing software is a great tool for small businesses that want to make their billing process easier. There are many different options to choose from, so you can find one that works best for your needs. Here’s how invoicing software can help:

- Saves Time: Instead of creating and sending invoices by hand, the software can do it automatically. Most programs have templates that you can customize and use again, which makes the whole process faster.

- Reduces Mistakes: Doing calculations for invoice amounts, taxes, and discounts by hand can lead to errors. The software takes care of these calculations, making sure everything is correct and helping you keep a good relationship with your clients.

- Keeps Track of Payments: Invoicing software can show you which invoices have been paid and which ones are still waiting. This helps you manage your money better and quickly remind clients about overdue payments.

- Offers Understanding: Many invoicing tools have dashboards and reports that help you see how well your business is doing financially. You can track which clients are paying late and change your plans based on this information.

Selecting the right invoicing software can greatly boost your business’s productivity and better manage your cash flow.

8. Setting Up Automatic Payment Reminders

One of the biggest challenges in using Net 30 payment terms is making sure clients pay on time. Sending automatic payment reminders is a good way to keep your accounts receivable healthy. Here’s how to do it:

- Adjust Reminder Timing: Set up reminders based on how your clients usually behave. Some might need a reminder a week before the due date, while others might need regular reminders starting two weeks ahead.

- Make Messages Personal: Even though reminders are automated, adding a personal touch can help maintain good client relationships. Use their names and mention any past interactions to show they are more than just an invoice number.

- Provide Clear Payment Details: Make it simple for clients to pay by including clear payment instructions or links to online payment options in your reminders.

- Track Client Reactions: Watch how clients react to your reminders. If a client contacts you with questions or says they will pay soon, record this in your system to prevent extra follow-ups.

By creating a system for automatic reminders, you can probably boost timely payments, making it easier to manage your cash flow.

9. Managing Disputes

Even with the best practices, disagreements can still happen. It’s important to deal with them quickly and professionally to keep good customer relationships and make sure money keeps coming in regularly. Let’s look at some good ways to handle these disagreements.

Communicating Effectively with Customers

Effective communication is crucial when conflicts arise. Here’s how to manage it:

- Listen First: Give your customer the chance to fully express their concerns. Listening not only helps you grasp the issue but also shows your dedication to solving it.

- Stay Calm and Professional: Maintain a friendly and professional tone, even if the customer is angry. This can help ease tension and lead to a productive discussion.

- Clarify and Confirm: Summarize what you’ve heard to make sure you understand the problem correctly, and verify any details that need clarification. This shows your readiness to work towards a solution.

- Offer Solutions: Present possible fixes and be willing to consider the customer’s ideas. Aim for a solution that works for both sides, showing your dedication to keeping a good business relationship.

By using these communication methods, you’re more likely to settle disagreements peacefully and maintain strong customer connections over time.

10. Resolving Payment Issues Promptly

Quickly resolving payment problems can stop disagreements from getting worse and make your business run better. Try these steps:

- Check the Agreement: Go back to the original agreement and the terms you talked about at the beginning. Knowing what each side agreed to can clear up confusion.

- Look into Issues Fast: If there’s a problem with the product or service, check it out right away. Acting quickly shows your customer that you care about their problem.

- Keep Records: Write down all conversations, agreements, and solutions. This information can be very helpful if problems come up again or if you need to go to court.

- Offer Payment Options if Needed: Sometimes, a customer might really have trouble paying. Giving them a different payment plan can show you’re being fair and help you get paid eventually.

- Get Legal Help When Necessary: If you can’t solve a problem through usual methods, you may need to talk to a lawyer. This should be your final option, but it’s important for protecting your business.

Quickly and effectively dealing with disagreements helps keep customers and makes your business more financially stable. Using these methods ensures smoother business operations and successful use of Net 30 payment terms.

Conclusion

Using Net 30 invoice payment terms can greatly benefit your small business. By improving your invoicing process, you can boost your cash flow and build better relationships with clients. The main thing is to stay organized, talk clearly with clients, and keep a close eye on payments.

- Clearly explain payment expectations from the start

- Send invoices on time

- Manage the cash flow process

- Follow up on late payments to keep your finances healthy

If you follow these steps, you’ll build trust with clients and keep a steady flow of money coming in.

Frequently Asked Questions (FAQs)

1. How to invoice with Net 30 terms?

To invoice with Net 30 terms, you must include “Net 30” or “Net 30 days” in the payment terms section of your invoice and send it after delivering goods or services.

2. How do I set up Net 30 payment terms for my business?

To set up Net 30 terms, clearly state payment due within 30 days on invoices, offer flexible payment options, track payments, and send timely reminders to ensure on-time payments and smooth cash flow.

3. How can you make sure clients pay on time under Net 30 terms?

Clearly state the terms in contracts, send clear and easy-to-understand invoices, use invoicing software for automatic reminders, offer early payment discounts, and perform credit checks on new clients.

4. How do you handle disputes regarding invoices or payments under Net 30 terms?

To handle disputes under Net 30 terms, communicate promptly and professionally with the client. Listen to their concerns, verify the details, offer solutions, and document all interactions. If unresolved, consider legal help.

5. What does net 7 payment mean?

Net 7 payment term means the buyer must pay the invoice amount within 7 days from the date of receiving the goods or services.