Navigating the world of business invoicing can sometimes feel like trying to crack a secret code. But don’t worry—today, we’re diving into one of the most common payment terms you’ll encounter: Net 30.

Whether you’re a seasoned business owner or just getting started, understanding Net 30 is key to keeping transactions smooth and financial relationships healthy. In this guide, we’ll break down what Net 30 really means, why it’s beneficial, and how you can effectively write it on your invoices.

Understanding Net 30

Definition and Explanation

Navigating the business world can sometimes feel like a journey through an exotic land, where terms like “Net 30” sprout from every financial corner. But let’s break it down, step by step, to make this concept as friendly and approachable as your favorite cup of coffee.

So, what exactly is Net 30? At its essence, Net 30 is a form of trade credit – a handshake agreement between a buyer and a seller that says, “Hey, you’ve got 30 days to pay for these goods or services.” It’s a clear communication tool stating that the buyer has 30 days from the date the invoice is issued to settle up. Think of it as a little financial breathing room – kind of like borrowing a cup of sugar from a neighbor with the promise to return it soon, creating trust and flexibility in business transactions.

The “net” part assures that the full amount is due without any deductions unless specified, and the “30” tells the buyer precisely how many days they have to pay. It’s a clear-cut way of setting expectations – no riddles, just straight talk.

Benefits for Buyers and Sellers

Let’s dive into the benefits of using Net 30. Believe it or not, this little term packs quite a punch for both buyers and sellers, ensuring everyone gets their fair share of advantages.

For Buyers:

1. Enhanced Cash Flow Management: Especially for small businesses or those dealing with seasonal variations in cash flow, Net 30 provides a cushion. It’s like a little wiggle room for your finances, letting you focus on other important areas like rent or marketing before that payment deadline comes knocking.

2. Strategic Purchasing Power: Want to stock up on inventory without bleeding your financial reserves dry? Net 30 empowers buyers to make larger purchases, which can lead to savings through bulk buying or discounts.

3. Trust-Building: Opting for Net 30 can demonstrate your financial prudence and build trust with suppliers, setting the foundation for strong, lasting business relationships.

For Sellers:

1. Sales Growth Catalyst: Offering Net 30 terms can attract customers who value the flexibility, potentially opening the doors to a wider audience and boosting sales.

2. Customer Loyalty Builder: By offering trade credit, sellers signal they’re ready to work with customers, valuing their relationship and encouraging repeat business.

3. Closing Deal Helper: Sometimes, Net 30 can be the nudge needed to close a deal faster or secure a larger order, contributing to sustained business growth.

How to Write Net 30 on an Invoice

Putting Net 30 on your invoice might sound like a small detail, but it’s one of those small things that can make a big difference. Let’s break it down.

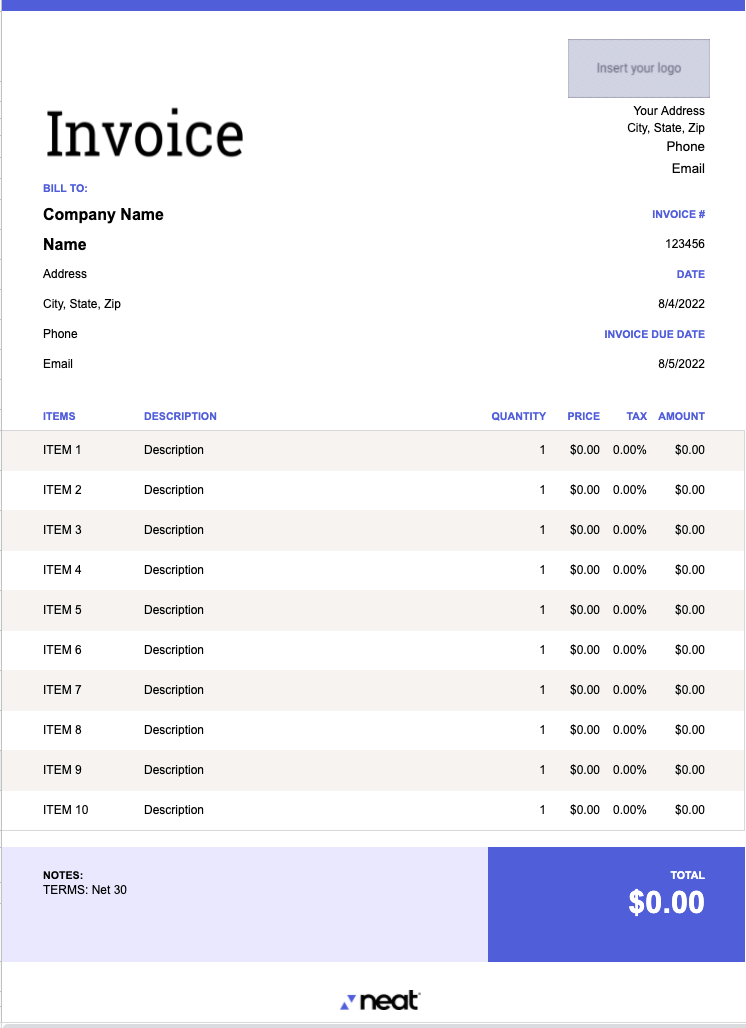

Payment Terms Section

The Payment Terms section is where the Net 30 magic happens. If your invoice doesn’t have this section, it’s time to give it one of its own homes, like a proud new wing in your invoice mansion. Ideally, this section should be easy to spot, perhaps cozied up near the total amount or the due date.

Here’s how to clearly state your terms:

– Simple Statement: “Net 30” doesn’t need to be buried in finance jargon; just write it plainly. You might even want to throw in a guiding line like “Payment due within 30 days from the invoice date” for absolute clarity.

Importance of Invoice Date

Mark this day like it’s your birthday because the invoice date is crucial in the Net 30 game. Not only does it kick off that 30-day countdown, but it also sets the clock ticking for when your payment is due. The date should be clear, maybe even highlighted, to ensure there’s no confusion about when the clock started.

Optional Details: Due Date and Additional Information

While including a meticulously calculated due date isn’t a must-do, it’s definitely a can-do if you want to go the extra mile. Consider jotting it down like this: “Due Date: [exact date]” to make it foolproof.

Providing additional intel in your invoice can also be a smart move. This is your opportunity to mention early payment discounts or lay out the consequences of late payments.

– Early Payment Discounts: Offer sweet incentives like “2/10 Net 30,” which translates to a 2% discount if paid within 10 days. It could speed up cash flow for you while giving buyers a reason to pay up faster.

– Late Fees: Adding a line about any interest or fees that kick in if the payment is late can encourage promptness. It’s like a polite yet firm reminder that timeliness matters.

Incorporating these elements creates transparency and alignment between buyer and seller. It reduces the chances of disputes and ensures everyone knows when payments are due and what the expectations are.

Common Variations and Best Practices

Beyond the world of standard Net 30, there are variations and best practices to consider that can further enhance your invoicing strategy:

– Net 30 EOM: This little tweak means payment is due 30 days after the end of the month in which the invoice was issued. For example, an invoice dated August 15th with Net 30 EOM terms would be due on September 30th.

– Seller’s Strategy: Remain crystal clear about your terms and address them openly. This makes sure everyone’s on the same page, preventing any last-minute “I didn’t know” scenarios.

In conclusion, understanding Net 30 and integrating it into your invoicing process can provide a solid foundation for smooth and successful business transactions. With each invoice, you’re building trust, setting clear expectations, and fostering good relationships with clients. So gear up, embrace Net 30, and watch your business thrive!

Common Variations and Best Practices

Understanding the flexibility that comes with net 30 payment terms can enhance their effectiveness in managing cash flows and maintaining positive business relationships. Let’s dive into some variations and best practices that can make these terms even more advantageous.

Net 30 EOM

“Net 30 EOM” stands for “Net 30 End of Month.” Essentially, this means that the payment is due 30 days after the end of the month in which the invoice was issued. This variation is particularly beneficial for sellers who want to provide a little extra time for payment while aligning due dates with monthly accounting processes.

– Example: If an invoice is dated August 15th and has “Net 30 EOM” terms, the payment would be due by September 30th.

This can simplify cash flow management for both parties. Buyers appreciate the additional margin to manage end-of-month expenses, while sellers can predict cash inflow more accurately by aligning payments with monthly closing dates.

Early Payment Discounts

Early payment discounts are fantastic incentives to encourage buyers to pay their invoices ahead of the due date. These discounts not only motivate prompt payments but also strengthen the relationship with buyers by rewarding their financial diligence.

– Common Structure: An example of early payment discounts is “2/10 net 30.” This translates to a 2% discount if the invoice is paid within 10 days, otherwise, the full amount is due in 30 days.

The benefits are twofold. Buyers can save money through discounts, and sellers secure quicker cash flow and reduce the likelihood of late payments. It’s a win-win scenario that promotes timeliness and financial prudence.

Late Fees

On the flip side, a mechanism to discourage late payments is the inclusion of late fees. Clearly defining these penalties on your invoice communicates the importance of adhering to agreed payment terms and protects your business from potential cash flow interruptions.

– Implementation: Specify any applicable penalties or interest charges within the payment terms section of your invoice. For example, stating that a 1.5% monthly interest will be charged on overdue balances.

Late fees serve as a deterrent against delayed payments while encouraging customers to prioritize settling their accounts on time. It’s crucial, however, to communicate these terms clearly to avoid misunderstandings and maintain goodwill with your customers.

Best Practices for Net 30 Invoicing

The key to successful net 30 term implementation lies in transparency and clear communication. Ensure your invoices are precise and all relevant details are prominently visible:

– Payment Terms Section: This should be a dedicated part of your invoice, clearly stating “Net 30” terms and any additional variations such as early payment discounts or late fees.

– Visibility of Invoice Date: This serves as the starting point for the 30-day payment period and is essential for calculating the due date.

– Optional Due Date: While not mandatory, including the exact due date can reduce confusion (e.g., “Due Date: September 29, 2024”).

Regular follow-ups and maintaining open lines of communication with your clients can further enhance the chances of timely payments, reinforcing the expectations set by your well-crafted invoice.

By implementing these best practices and variations, you can make net 30 terms work seamlessly for your business, catering to both your financial needs and those of your clients. These strategies not only optimize cash flow but also foster stronger, long-lasting business relationships.

Conclusion

Understanding and implementing Net 30 terms can be a game changer for both buyers and sellers. It offers a simpler way to manage finances, enhancing cash flow for buyers and providing a competitive edge for sellers. By adhering to key invoicing practices like clearly stating “Net 30” on your invoices, properly using invoice dates, and providing optional details like due dates or early payment terms, you empower smooth transactions.

Whether you aim to build stronger relationships or simply make financial processes easier, grasping the ins and outs of Net 30 is a worthwhile endeavor. With this invoicing guide and handy templates, embrace Net 30 as a pivotal part of your business strategy and watch your dealings become more streamlined and successful!

Frequently Asked Questions

How to write Net 30 terms on an invoice?

To write Net 30 terms on an invoice, include “Payment Terms: Net 30” in the payment section. This indicates that the buyer must pay the full amount within 30 days from the invoice date. The invoice date should be clearly visible to start the countdown. Adding a short clarification line helps avoid confusion.

What is the wording for 30 days payment terms?

The wording for 30-day payment terms should clearly state the deadline. You can write “Payment due within 30 days from the invoice date” or “Net 30: Payment is due 30 days after invoicing.” Both options communicate expectations clearly. This reduces misunderstandings and late payments.

What does 2% 10 Net 30 mean on an invoice?

The term “2% 10 Net 30” offers a 2% discount if payment is made within 10 days. If the discount period is missed, the full invoice amount is due. The final deadline for payment remains 30 days from the invoice date. This structure encourages faster payments.

How to professionally say “pay the invoice”?

To professionally request payment, use polite and respectful language. A common phrase is “Please submit payment for the invoice by the due date.” This wording is clear without sounding demanding. It helps maintain positive business relationships.

How to word payment terms on an invoice template?

Payment terms should be written clearly in a dedicated section of the invoice. A standard format is “Payment Terms: Net 30, due within 30 days from the invoice date.” This explains both the term and timeframe. Clear wording ensures transparency for both parties.

What is a good sentence for payment?

A good payment sentence should be direct yet courteous. “Please make the payment by the due date to avoid any late fees” works well. It communicates urgency without pressure. This encourages timely payment while remaining professional.