How to Choose the Best Business Financing Options

Every business, whether it’s just starting out or already expanding, will need extra money at some point. However, with so many options for getting this money, it can be hard to pick the right one. It’s important to find a way to fund your business that matches what you need and where you want to go. Knowing about these options can help you make better choices. Let’s explore the different business financing options available to get money for your business and how to pick the best one for your specific situation.

Understanding Different Types of Business Financing

Finding the right way to fund your business can sometimes feel like trying to solve a puzzle. There are many choices, so it’s important to understand the different ways to get money for your business to find the best one for you. There are two main types of business funding: debt and equity.

Debt Funding means borrowing money that you have to pay back over time, usually with extra money called interest. Examples are bank loans, credit lines, and credit cards. With this option, you keep full control of your business because the people lending you money don’t own any part of it.

Equity Funding means selling part of your business to investors in exchange for money. Common ways to do this are through angel investors, venture capitalists, and crowdfunding. This can lower your debt, but you’ll have to share control of your business and its profits with the investors.

Another option is called Hybrid Financing, which mixes parts of both debt and equity, like convertible debt. Every choice has its own advantages and disadvantages that work better in different situations. Let’s look more closely at one of the most common types: traditional bank loans.

Traditional Bank Loans

Bank loans are a common and traditional way for businesses to get money. If you need a large amount and want a clear repayment plan, they can be a great choice. Banks provide different types of loans designed to meet various business needs, such as buying equipment, growing your business, or improving your cash flow.

Pros and Cons of Bank Loans

Knowing the advantages and disadvantages of bank loans can help you make a smart choice.

Advantages:

– Better Rates: Bank loans usually have lower interest rates than credit cards or personal loans.

– Regular Payments: Banks often give you fixed monthly payments, which makes budgeting and planning easier.

– Tax Help: The interest you pay on bank loans might be tax-deductible, which could lower your taxable income.

– Many Choices: Banks offer different loan options for various business needs and reasons.

Disadvantages:

– Strict Rules: Banks often have tough rules for who can get a loan, which can be hard for new or smaller businesses to meet.

– Slow Process: Applying for a loan can take a long time and involve a lot of forms, which can slow down getting the money you need.

– Need for Collateral: Many bank loans need something valuable (like property) to secure the loan, which can be risky if you can’t pay it back.

– Personal Risk: Banks might ask for personal promises, meaning your personal belongings could be at risk if the business can’t pay back the loan.

Qualifying for a Bank Loan

Getting a bank loan can sometimes be difficult, but knowing what banks want can help you get approved. Here’s what banks usually check:

– Good Credit: A high credit score is important. Banks want to see that you’ve borrowed money responsibly and paid it back on time.

– Strong Plan: A clear business plan that explains how you’ll use the money and grow your business can help your chances.

– Financial Details: Banks often ask for detailed financial reports, like balance sheets, income statements, and cash flow predictions, to understand your business’s financial health.

– Assets for Security: Many loans need something valuable (collateral) to secure the loan, so be ready to show what you can use as backup.

– Experience: Banks might look at how much experience your team has in the industry or running a business.

Getting a bank loan can seem overwhelming, but it can be helpful if you meet the requirements and can handle the debt. Remember, the goal is not just to get any loan—it’s to find the right loan for your business.

By learning about different types of financing and the details of traditional bank loans, you’re already making a smart choice. Make sure to consider all the advantages and disadvantages, and prepare well (with the right documents and plan) to increase your chances of approval. The perfect loan for your business is out there; you just need to be patient and keep trying to find it.

SBA Loans

When you need money for your business, SBA loans are often seen as a good choice. The U.S. Small Business Administration (SBA) doesn’t give out money itself. Instead, it works with banks and other groups to provide loans that the government helps to back. This makes it safer for the lenders, and it can lead to better loan terms for you!

Types of SBA Loans

There are different types of SBA loans, each made for specific business needs:

– 7(a) Loan Program: This is the SBA’s most common loan program. It allows for many uses, such as getting extra money, buying equipment, or paying off old debt. The biggest loan you can get is $5 million.

– CDC/504 Loan Program: This program helps businesses buy things like land or machines to grow their business. It’s good for expanding or improving your business location.

– Microloans: These are small loans, up to $50,000, perfect for new or small businesses that need less money. They can be used for many business needs but not for paying off old debt.

– Disaster Loans: If your business is affected by a declared disaster, these loans give you money to help recover from the damage.

SBA Loan Requirements

To get an SBA loan, remember these important points:

– Business Size: Your business must be considered small by SBA rules, which are different for each industry.

– Business Type: Some businesses, like those focused on speculation, lending, or illegal activities, are not allowed to apply.

– Personal Credit Score: While SBA loans are more flexible, having a good credit score can help you get approved.

– Business Financial Records: You need to show detailed records of your income and expenses to prove your business is doing well financially.

– Collateral: This provides extra security for the lender. The type and amount of collateral depend on the loan program you choose.

Applying for an SBA loan requires a thorough process, but it can be a great financing choice due to its low interest rates and extended repayment periods.

Lines of Credit

If you want more freedom to use money when you need it, a business line of credit might be perfect for you. Unlike a regular loan that gives you a set amount all at once, a line of credit lets you borrow what you need, up to a set maximum.

How Business Lines of Credit Work

Here’s a basic explanation of how they work:

– Credit Limit: You’re given a set amount you can borrow, like a credit card.

– Use Money When Needed: Want to pay employees or take advantage of a business chance? With a line of credit, you can quickly get the money you need.

– Interest and Repayment: You only pay interest on the money you borrow, not the full limit, and you only repay what you’ve used.

– Renewable Funds: After you pay back what you borrowed, your credit limit goes back to the original amount, making it great for regular financial needs.

Secured vs. Unsecured Lines of Credit

When considering a business line of credit, it’s important to know the difference between secured and unsecured options:

– Secured Line of Credit: This type requires collateral, like property or inventory. Because the lender has less risk, these often come with higher borrowing limits and lower interest rates.

– Unsecured Line of Credit: This type doesn’t need collateral, so it’s easier to get, but it usually has lower borrowing limits and might have higher interest rates. It’s a good choice if you don’t have assets to use as collateral.

The choice between the two depends on your business’s financial situation and how much risk you’re comfortable with. Secured lines may offer better terms, but if you don’t have collateral, an unsecured line is a good option.

In the end, whether you’re looking at SBA loans for structured financing or lines of credit for flexible cash flow, understanding your options fully helps you pick the best financing option for your business.

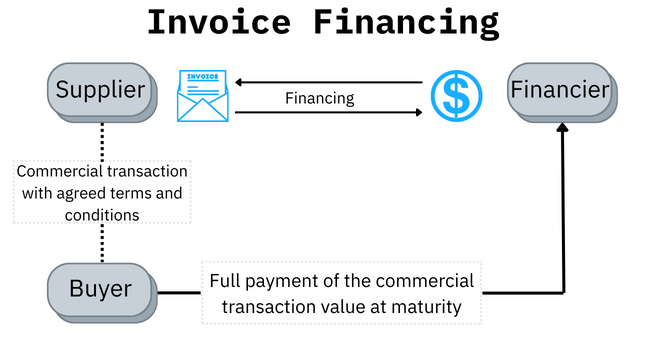

Invoice Financing

Picture this: You finish a big project and send an invoice to your client, but you won’t get paid for another 60 days. In the meantime, your bills are starting to add up. That’s when invoice financing, or accounts receivable financing, can help like a superhero for your money problems. It lets businesses borrow money based on what customers owe, which helps keep things running smoothly. However, there are some important details to keep in mind when it comes to invoice financing.

Recourse vs. Non-Recourse Factoring

When dealing with invoice financing, you’ll often hear about ‘recourse’ and ‘non-recourse’ factoring. Each has its own features, and knowing the difference is important for choosing the best option for your business:

– Recourse Factoring: In this type of factoring, your business sells its invoices to a financing company, but you remain responsible for any unpaid invoices by your customers. If a client doesn’t pay, you must repay the factoring company. This option usually costs less because it reduces the lender’s risk, but it could strain your company’s cash flow if payments aren’t made.

– Non-Recourse Factoring: In this option, the factoring company takes on the risk of unpaid invoices. If a customer doesn’t pay, the financing business covers the loss. This can provide reassurance, but it often costs more. Also, non-recourse agreements might have conditions that remove this protection if the non-payment is due to a disagreement or financial problems with the customer.

Deciding between recourse and non-recourse factoring depends on how much risk you’re willing to take and how dependable your customers are.

Costs of Invoice Financing

When looking into invoice financing, it’s important to understand the costs involved to make a good decision. Here’s what you should know:

– Factoring Fees: This is usually a percentage of the invoice amount. It can be between 1% and 5%, depending on the company you work with, how many invoices you finance, and how reliable your clients are. Be careful of extra charges, like transaction or service fees, to avoid unexpected costs.

– Interest Rates: Some invoice financing works like a loan, where you pay back the money you borrowed plus interest. This can be cheaper for short-term needs but gets more expensive if you keep it for a long time.

– Benefits of Early Payment: If your customer pays sooner than expected, you might save money on fees. But it’s crucial to know how your factoring company deals with early payments. Some may reduce the fees, while others might still charge the full amount.

Remember, while saving money is important, the improved cash flow and the ability to manage the time between getting paid can make invoice financing a good option for many businesses.

Merchant Cash Advances

Let’s look at something a little different: Merchant Cash Advances (MCAs). This option is especially useful for businesses such as retail stores and restaurants that regularly receive payments through credit cards. With an MCA, a funding company provides you with a large amount of money upfront, and you pay it back by giving them a portion of your daily credit card sales.

The Basics of MCAs

Unlike traditional loans, Merchant Cash Advances (MCAs) don’t require fixed monthly payments. Instead, you pay back a percentage of your daily credit card sales until the advance is fully repaid. This can help businesses manage their cash flow better during slower times, as payments change based on sales.

Advantages:

– Fast Approval: You can usually get money in just a few days, and you don’t need to meet strict rules like with regular loans.

– Adjustable Payments: How much you pay changes based on how well your business is doing.

Disadvantages:

– More Expensive: The fees can lead to high interest rates, making this a costly choice.

– Daily Withdrawals: Taking money from your daily sales every day can make it harder to manage your business expenses.

MCAs can be a good option if you need money quickly and expect your sales to be high, but you should think carefully about the costs.

Costs Involved in MCAs

Merchant Cash Advances (MCAs) might seem appealing because they’re easy to get, but it’s important to know how they work:

– Factor Rates: Instead of using interest rates like loans, MCAs use a factor rate—usually between 1.2 and 1.5. This rate shows the total amount you’ll repay, which is calculated by multiplying it with the money you borrow.

– Cost Considerations: Be aware that these factor rates can lead to much higher costs than regular loans when converted to an annual percentage rate (APR), sometimes over 100%.

When thinking about MCAs, businesses need to decide if getting quick cash is worth the higher borrowing costs.

Choosing the right financing for your business means balancing your immediate needs with your long-term financial well-being. By learning about different options—like invoice financing or merchant cash advances—you’ll be better prepared to make smart choices that fit your business goals.

Comparing Interest Rates and Repayment Terms

When picking the best ways to fund your business, it’s important to understand interest rates and repayment plans. Different loans have different terms, and knowing these details can save you a lot of money over time.

Understanding APR and Fees

Let’s start by discussing Annual Percentage Rate (APR). APR is the yearly cost of borrowing money, shown as a percentage. It includes not only the interest rate but also any extra fees, such as origination fees, processing fees, or admin charges. This number is important because it shows you the total cost of the loan.

For example, if you’re comparing two loans—one with a low interest rate but high fees, and another with a slightly higher interest rate but lower fees—the APR helps you figure out which one is actually cheaper. Make sure to look for any hidden costs that could increase the total cost of the loan. Also, ask about any penalties for paying off the loan early, as these could affect your choice.

Short-Term vs. Long-Term Financing

A key thing to think about when picking the right way to borrow money is deciding if short-term or long-term borrowing works better for your business.

– Short-Term Borrowing: This kind of borrowing is usually for immediate needs, like buying stock or fixing something urgently. Short-term loans often cost more in interest but are paid back faster, so you can be debt-free sooner. This is good for businesses that expect to get more money quickly.

– Long-Term Borrowing: This is better for bigger expenses, such as buying equipment, vehicles, or starting new projects. These loans usually have lower interest rates but take longer to pay back. This type of borrowing is best for projects that will make money over many years.

The main thing is to think about what’s best for your business and how much money you have. Decide if it’s better to pay back more money quickly or if it’s smarter to spread the payments out over a longer time. This will help you make the right choices.

Making Informed Decisions for Your Business’s Financial Needs

Selecting the right financing option isn’t only about interest rates. It’s also about making smart choices that match your business objectives and financial position. Follow these steps to help you make the best decision and pick the right option for your business.

Assessing Your Financial Situation

Before you start looking at all the different loan choices, first take a moment to check your current financial situation. This means looking at how much money your business is making and spending, any debts you already have, and how much money you expect to make in the future.

– Cash Flow: How much money is coming in and going out each month? Are there times when you might not have enough to pay back a loan?

– Current Debts: What debts does your business already have? Will taking on more debt make it harder for your business to run well?

– Future Income: Are you expecting a big increase in income that could help you pay back more loans?

By understanding your financial situation clearly, you can figure out how much you can borrow and which loan options are best for you.

Developing a Business Plan

A strong business plan isn’t just for making investors or lenders happy. It’s a guide for how your business will grow and do well. Your business plan should clearly show your goals, how much money you think you’ll make, and how you’ll use the money you borrow. Lenders usually like a detailed business plan because it shows you’re serious and know how to use the money well.

When making your business plan, include important parts like:

– Business Goals: What do you want to do with this money? Do you want to grow your business, make new products, or start selling in a new place?

– Money Plans: Show how you think your money will go and how you’ll pay back loans. Include the best, worst, and most likely ways things could go.

– How You’ll Use the Money: Be clear about what you’ll do with the money. Whether it’s for buying new tools or having more money to work with, being specific is important.

By matching your financing choices to a carefully planned strategy and your current financial situation, you can make better decisions and pick the best business financing option that helps your business grow and succeed.

Best Business Financing Options for Small Businesses

Finding the right way to fund your business can feel overwhelming, especially for small businesses and new companies. There are many options to choose from, and picking the best one for your needs is very important. Let’s look at some of the top ways small businesses can get the money they need.

Microloans

Small loans are getting more and more common for small businesses that need a small amount of money to start or to cover a short-term financial need. These loans are usually provided by non-profit groups or government offices, such as the Small Business Administration (SBA), to help new businesses and owners who need less money.

– Amount: Usually between $500 and $50,000, which is perfect for smaller costs or starting expenses.

– Purpose: Often used for daily business needs, buying stock, or purchasing equipment.

– Requirements: Usually less strict about credit scores and collateral than regular bank loans, making them easier for new entrepreneurs who don’t have a strong business credit history yet.

Equipment Financing

Every company needs tools to work, like computers, machines, or trucks. Equipment financing helps businesses buy or rent these tools without using all their money.

– How it works: Usually, the equipment itself is used as security for the loan, so you don’t need extra assets.

– Advantages: Lets you keep your money flowing and avoid big upfront payments by spreading the cost over time.

– Things to think about: Make sure the equipment will still be useful during the loan period. You don’t want to end up paying for old or useless technology.

Different Types of Business Loans for Startups

New businesses often struggle to get traditional financing due to a lack of financial history. However, there are alternative options available, such as building credit with net 30 vendors, and exploring these loan types:

– Term Loans: These are simple loans with a set plan for paying them back. They’re good for big investments or growing the business and usually have lower interest rates.

– Business Credit Cards: These give you a flexible amount of money you can use for different costs. If used carefully, they can help build your business’s credit, but they often have high interest rates if you don’t pay the full amount each month.

– SBA Loans: These are supported by the government and offer small businesses low interest rates and long time to pay back. However, they can be hard to get because they have strict rules about who qualifies.

Choosing the best way to get money for your business is very important for its growth and success. By knowing about these choices, you’re already on the right path to making a smart decision that matches your business plans and financial needs.

Conclusion

At the end of the day, picking the right business financing options comes down to knowing what your business really needs and doing some research. Think about things like how much money you need, the interest rates, how you’ll pay it back, and how flexible the options are. This will help you find a plan that fits your goals for growing your business. Don’t hurry—take your time to look at all your choices. Remember, the right financial support can help your business succeed, so choose carefully!