There is nothing quite like starting a new business. It’s an exhilarating time, filled with creativity and anticipation, along with just a little bit of nervous energy. As much as you are excited to start your new business, don’t forget the thing that will ground your dreams: a good financial foundation. When it comes to a financial foundation, even the best ideas can falter without the proper planning and groundwork. In this blog, we are going to help you set-up some financial structure to help you not just survive, but to thrive, during the long haul. We’ll cover the basic principles of budgeting and savvy financial planning to give your business a solid foundation.

What is the Purpose of a Financial Foundation?

Similar to constructing a solid structure without a steady foundation, running a new business without a financial foundation is risky. Financial foundations assist in establishing clarity and confidence during your startup’s early days. Financial Foundations provide benchmarks for your financial decisions, and help prepare you for the cyclic nature of business. With a strong foundation, you can devote attention to creativity rather than the small timetable of commerce.

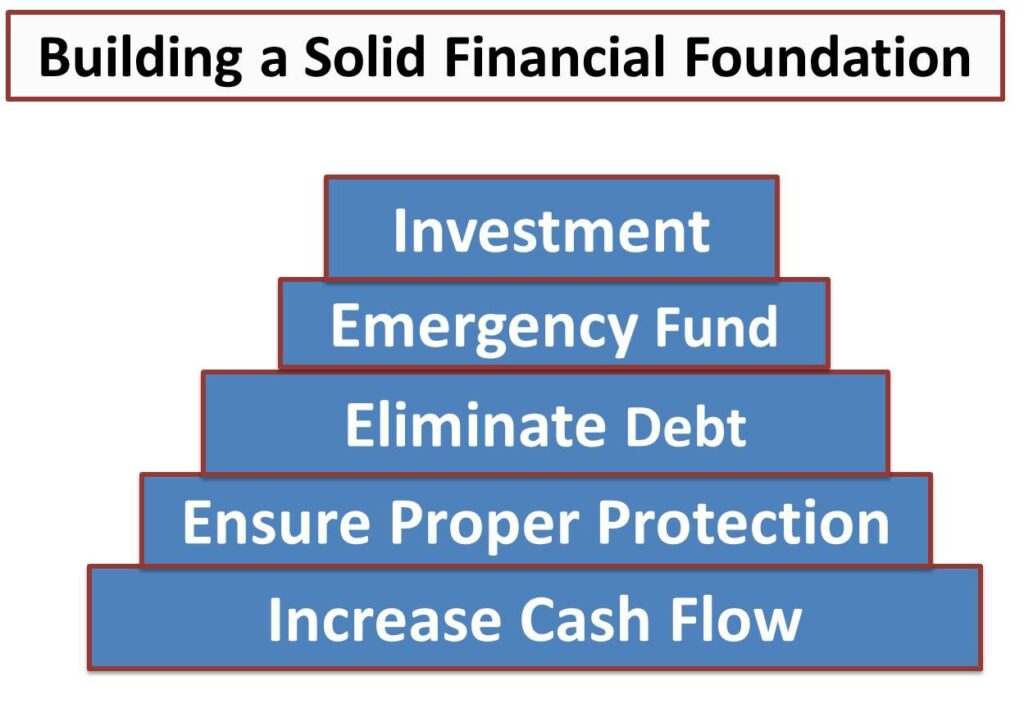

Steps to Build a Solid Financial Foundation

Understand Your Startup Costs and Budget

To begin, you need to know exactly what is involved in getting your business off the ground. Identifying what will be your startup costs can be a very involved exercise and can include the following running themes, but is not specifically limited to, before you opening or providing your products or services:

– Equipment and supplies

– Licensing and permits

– Market and audience exposure

– Office space or utilities

Once you have a thorough analysis of these things, it instills an easier form of budgeting and making your capital available. A budget will enforce a method for you examine costs and allocations associated with your business development to mitigate over spending.

Separate Personal and Business Finances

Merging personal and business finances is one of the most common mistakes that new entrepreneurs make. A strong financial foundation is based on distinguishing between personal accounts and business finances. Keeping your personal and business finances separate will easily alleviate accounting and tax complications, and it will help you to look more credible in the eyes of bankers and investors. You should begin by opening a business bank account and utilizing that account for all business purchases.

Build a Strong Cash Flow Strategy

Cash flow is the lifeblood of any organization. Even profitable organizations can operate in the red without it. A cash flow plan is a plan of action related to a healthy cash flow development that allows for timely billing, collection of payments, and consideration in spending. Here are some suggestions:

– Clearly establish payment terms for clients.

– Review financial statements frequently to observe trends.

– Implement automations for billing and collections.

Plan for Funding and Capital

Despite the best careful planning, there are occasions when a start-up will need additional money to grow or to weather unforeseen expenses. This is why it is so important to have a plan for funding. When first starting out, even if it seems far in the future, it is a good idea to research and think through alternative ways of funding your business.

– Bootstrapping

– Angel investors

– Venture capitalist

– Small business loans.

You will have a clear idea of what each option means and when you hand to jump when the opportunity is there to continue growing your business forward.

Implement Accounting and Financial Tools

In modern times, manual bookkeeping is a relic of the past. Using secure accounting software can save you time, minimize errors and allow you to view your business’s finances in real-time. Many of these tools such as QuickBooks, Xero or Wave can help you keep track of expenses and income, generate financial reports and help you ensure you’re in compliance with tax regulations. These tools will also provide the information necessary for you to make decisions regarding the financial health of your company.

Protect Your Business Financially

Safeguarding your business from financial risk is as important as branding and marketing your business. Here are a few ways to help protect your financial condition.

– Get Insured: Business insurance can protect yourself by covering potential liabilities or loss and protecting your possessions.

– Establish an Emergency Fund: Having some cash set aside to address unexpected problems is always helpful.

– Review Contracts: Ensure all business contracts are completely understood and make sense legally in order to minimizing disputes.

By proactively protecting your business, you are minimizing potential risk and can focus on growing your business. Establishing a strong financial foundation is daunting, but you are now on your way to making your business more than just a business dream. Remember that every little step you take towards establishing a solid foundation is just one more step to success for yourself and your business long-term.

Tips for Long-Term Financial Stability

Building a strong financial foundation is just the beginning of your business journey. Ensuring long-term financial stability needs careful planning and management. Here are some essential tips to keep your finances on track:

Create an Emergency Fund

Consider one day waking up to realize that your key client stopped ordering or an unforeseen major expense has disrupted everything. A solid emergency fund can serve as financial runway in these unfortunate situations. Try to build up three to six months’ worth of operating costs in a separate account or liquid account. This reserve will allow you to take care of the unexpected expenses without derailing your business activities.

Negotiate Vendor and Supplier Terms

Having a good relationship with your vendors and suppliers can result in favorable pricing and financial opportunities for your business. Invest time in building a relationship, and be comfortable negotiating terms. Whether valuing an extended payment period, bulk ordering discounts, or cheaper shipping, saving money means more money to invest back into your business.

Track Key Financial Metrics

Monitoring your business finances closely involves more than just reviewing income and expenses. Focus on key financial indicators—cash flow, profit margin, and return on investment, for example. Recording those indicators often offers valuable insight into the overall health of your business and allows you to make informed decisions.

Avoid Unnecessary Debt

Though borrowing may be advantageous, particularly when growing, try to limit yourself to only the debt that is necessary and manageable. Stick to what you really need and can afford to repay. Always evaluate the potential positives and negatives before moving forward with taking debt, while ensuring that any borrowed dollar is directly related to growth and/or achieving a strategic purpose.

Implement Cost-Control Measures

Cutting expenses is crucial to keeping a healthy bottom line. Look into automating what you can, or consider alternative energy-efficient solutions, or even review your service contracts to see if you can get a chance for better rates. Even little savings help, and accumulate to provide resources for important investments.

Regularly Review Financial Goals

Your company is changing and your financial goals should change with it. Take a bit of time out of every quarter to assess and revise your financial goals. Are you still on track? Do you want to change course? Each quarter you will be able to make sure you are still aligned with your current financial goals, as well as your long-term goals.

Leverage Tax Benefits

Knowing tax benefits could improve your financial position substantially. Consultation with a tax advisor can help you determine opportunities for credit, deduction or other qualifying incentives your business can claim—reducing your tax liability and keeping you on the right side of the government.

Conclusion

Establishing and upholding a solid financial foundation is critical to the success of your new business, and these tips for sustainable stability support this objective in the long run. A little planning today can go a long way for your business moving forward and in some cases, keeping expenses to a minimum could trump all other factors for the success of your business. Stay aware, be proactive, and your business will be set for stability and growth for many years ahead. Let’s face it, a solid financial footing is not about navigating life; it’s about thriving in life! So be specific about your goals, pay attention to those metrics regularly, and truly be prepared to watch your business grow!

FAQs Questions

Why is a financial foundation important for a new business?

Having a solid financial foundation is essential to achieving expansability and longevity of your new business. It leads to effective management of cash flow, facilitates strategic planning, and creates a safe haven if challenges arise. Also, a strong financial footing can encourage you to make and follow through on important investments and other economically-influenced decisions to create an expansion oriented business that will grow sustainable over the long haul.

How do I calculate startup costs effectively?

To properly calculate your startup costs, you will want to document every expense necessary to get your new company up and running, including equipment, supplies, marketing, and operating expenses. Next, make a detailed budget and use your prior experience or industry averages to estimate your costs. Be sure to include a line item for any contingency or unanticipated expenses. This type of planning will reduce the element of surprise and make you feel more confident in your finances to get started.

What is the 10 5 3 rule in finance?

The 10 5 3 rule is an easy framework for gauging average returns on various investment types. It suggests that you may expect a 10% return from stocks, a 5% return from bonds, and a 3% return from savings accounts. These are averages and can be greater or less, but they provide a simple way of comparing investment opportunities and judging potential sources of income for your business.

What is the 7% rule in finance?

In finance, the 7% rule commonly implies the idea that an investment will double in worth about every ten years with a steady annual return of 7%. The 7% rule of thumb demonstrates the effect of compounding interest as an investment factor and the significance of time in making investment decisions. Knowing the 7% rule of thumb can help you to think strategically in your financial planning for your business and future financial security.

What is a good income to expense ratio for a business?

Different industries will have different views on what “good” income to expense ratios will look like, but in general it is held that you want to a ratio of at least 2:1. This means you want to be generating at least $2 of income for every $1 of expense. Maintaining good control on expenses while maximizing revenue is a sure way of maintaining a profitable financial health for your business.

How can I protect my business financially?

To protect your business financially, consider the following steps:

– Insurance: Obtain appropriate insurance to cover liabilities and risks.

– Reserve Funds: Build an emergency fund for unexpected expenses or downturns.

– Diversify Income Sources: Reduce reliance on one income source by expanding your offerings.

– Regular Reviews: Conduct regular financial reviews to identify and address any issues proactively.

These measures help safeguard against financial uncertainties and strengthen the resilience of your business.