Introduction

Hey there, fellow business aficionados! We’re about to dive into a fascinating subject that could revolutionize the way you handle your office expenditures: Net 30 invoicing. Ever heard of “Buy Now, Pay Later” (BNPL) and assumed it’s just for personal shopping splurges? Well, think again! Net 30 invoicing is essentially your own personal BNPL, but it’s tailored specifically for business brilliance. Joining forces with insights from The CEO Creative, we’ll uncover how this system can give you a competitive advantage for all your office essentials. So, grab yourself a coffee, and let’s jump right in!

Understanding Net 30 Invoicing

In the rapidly changing landscape of business finance, knowing the resources available to you is essential. A key tool, especially significant in B2B (business-to-business) dealings, is Net 30 invoicing. For companies aiming to handle their office requirements effectively without causing a financial burden, Net 30 emerges as a clever option. But what is Net 30 invoicing exactly, and how does it stack up against the widely recognized consumer Buy Now, Pay Later (BNPL) services? Let’s explore this further!

Definition and Mechanics of Net 30

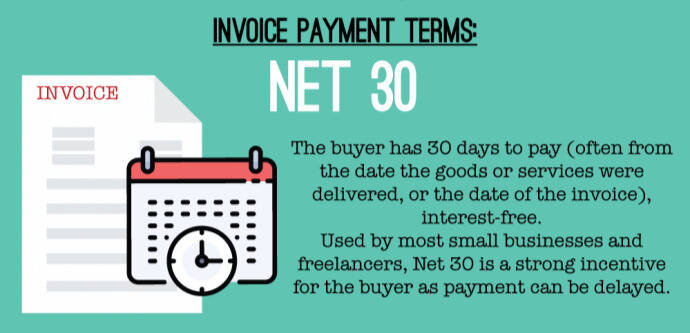

“Net 30 invoicing” might seem like a bunch of financial gobbledygook, but it’s actually pretty simple when you boil it down. “Net 30” is just an agreement between a buyer and a seller, where the buyer gets a grand total of 30 days to pay for the stuff they bought or the services they received. It’s basically a type of short-term credit from suppliers, which lets businesses keep their cash flow in check while making sure everything runs like clockwork.

Here’s the usual way it plays out: Your company picks up some office supplies, equipment, or services—let’s say you’re re-upping on essential printing supplies or getting some fancy new network hardware to keep your office humming along at peak efficiency. The vendor hands you an invoice with “Net 30” on it, and bam, your business now has 30 days from when that invoice was dated to cough up the dough. You’ll find this setup a lot in business-to-business deals, giving companies the wiggle room they need to keep their working capital nice and liquid.

Net 30 in a Nutshell:

– A Little Breathing Room: Companies get a full 30 days to settle up, giving them some financial wiggle room.

– Pay Later, Not Now: Unlike shelling out cash or swiping a card, the bill isn’t due right away.

– Building Trust: It helps foster stronger, lasting connections with suppliers, since it’s based on a mutual understanding.

Comparison with Consumer BNPL Models

Ever used one of those “Buy Now, Pay Later” deals at your go-to online shop? You know, the ones that let you snag those cool new kicks now and not stress about the payment until later? Well, let’s see how that compares to something called Net 30 when it comes to these easy-peasy payment options.

So, for everyday shoppers, Buy Now, Pay Later services like Klarna or Afterpay are pretty handy. They let you spread out the cost of your shopping over a little bit of time. If you stick to their payment schedule, it’s usually interest-free, which is great for managing your money. But, these are usually meant for quick, smaller buys, not so much for big-ticket items or business expenses.

On the other hand, Net 30 invoicing is tailored for businesses. Here’s why it’s a better option for handling office requirements:

– Scaling the business: Unlike consumer BNPL, Net 30 caters to the larger transaction sizes typical in B2B transactions. If you need to furnish a newly enlarged office, Net 30 offers the financial cushion needed for significant buys.

– Nurturing relationships: While consumer BNPL is centered around individual purchases, Net 30 helps cultivate lasting connections with vendors. It’s about establishing trust, where suppliers are comfortable offering credit and businesses relish the leeway this provides.

– Streamlined accounting: Easy bookkeeping is essential for efficient office management. Net 30 neatly fits with financial reporting timelines, making the reconciliation process much smoother.

The Role of Net 30 Invoicing in Office Management

Office management involves a complex balancing act of keeping operations efficient while managing finances prudently. Net 30 invoicing plays a pivotal role in this delicate dance, offering solutions that blend convenience with strategic financial oversight.

Streamlining Office Expenditures

For any business, keeping office expenses in check is a must. The beauty of Net 30 invoicing is how it simplifies purchasing. Let me explain how it can make your office management a breeze:

1. Smoother buying: With the freedom that Net 30 offers, your procurement team can snap up what they need right away, without being held back by tight budget limitations.

2. Smart spending: It lets businesses stock up on supplies, often snagging some great discounts, all without that immediate financial hit. This can really add up to big savings down the line.

3. No more last-minute dashes: Ever been in that bind where the printer runs out of ink just before a huge deadline? Thanks to Net 30, offices can plan ahead and order supplies in a timely manner, avoiding those frantic, eleventh-hour rushes and the extra cost of rush shipping.

4. Inventory control: It empowers businesses to maintain optimum inventory levels, reducing the likelihood of overstocking or stockouts, both of which can disrupt office operations.

Enhancing Cash Flow Management

Cash flow is the lifeblood of any business, regardless of size. Improving cash flow management is crucial for sustainability and growth, and that’s where Net 30 payment terms become especially important.

– Flexible payment timing: Delaying payments by 30 days allows businesses to handle their cash more strategically. They can better match their income and expenses, ensuring there’s always enough cash available to cover operational needs.

– Strategic growth opportunities: With enhanced cash flow, companies can allocate funds towards growth initiatives, such as hiring new employees, investing in technology, or expanding into new markets.

– A safety net for financial challenges: Net 30 serves as a financial buffer, offering a cushion to manage unexpected costs or emergencies without jeopardizing the office’s financial health.

Case Study: Success Stories from The CEO Creative

The CEO Creative has been at the forefront of demonstrating just how transformative Net 30 invoicing can be for office management. Let’s take a look at some real-world success stories from businesses that have leveraged these strategies:

Case Study 1: A Tech Firm’s Smooth Expansion

A tech company that wasn’t too big and wasn’t too small was getting ready to grow by adding a new office. Juggling the needs of their current office while getting the new one off the ground was tricky, and money was a bit tight. The thought of having to buy all the new computers, office supplies, and furniture they needed was pretty overwhelming. They teamed up with The CEO Creative, and using their Net 30 invoicing option, they were able to spread out their purchases over time.

Here’s what happened:

– Smarter money management: They managed to get the new office up and running without dipping into their savings.

– Better deals with suppliers: They built stronger connections with their vendors, which got them some good prices and made sure their orders got filled quickly.

Case Study 2: Retailer’s Bulk Procurement win

A retail business frequently encountered issues with their inventory, either having too much stock or not enough, which resulted in missed chances to make sales. When they started using Net 30 invoicing through The CEO Creative’s platform, they could buy lots of inventory at once without having to pay for it all upfront.

Here’s what happened:

– They got better at managing their inventory: They were able to keep up with what customers wanted without having loads of extra stuff taking up space.

– Their finances became more predictable: Their payment schedules matched up better with when they made sales, which took off some of the financial pressure.

Case Study 3: Marketing Agency’s Financial Agility

A marketing agency often faced challenges due to clients’ irregular payment schedules. However, by utilizing Net 30 invoicing through The CEO Creative, they were able to keep their operations running smoothly, even while waiting for payments.

This approach led to:

– Steady Operations: Eliminating project hold-ups caused by pending client payments.

– New Growth: The agency could now allocate resources towards expanding their range of services.

These examples highlight the effectiveness of Net 30 invoicing, powered by The CEO Creative, as a valuable resource for B2B transactions. They demonstrate how businesses can flourish with smart financial planning and beneficial partnerships. For those managing office operations, the benefits are evident, ensuring both efficiency and strong financial health.

In the fast-paced world of business we see today, adopting a tried-and-true method like Net 30 invoicing is about much more than simply settling accounts. It’s about smartly allocating your assets, forging rock-solid bonds with your suppliers, and gaining a crucial advantage over others in your field. If you’re an ambitious entrepreneur eager to grow your workspace or an experienced manager dedicated to keeping your processes running smoothly, leveraging the B2B benefits of Net 30 invoicing could be the game-changer you need.

You’re doing more than just running an office; you’re laying the groundwork for lasting expansion and triumph. That’s why now is the perfect time to uncover the Net 30 edge with The CEO Creative. Because your office truly deserves the finest!

The B2B Advantage of Net 30 Invoicing

Steering through the complexities of business-to-business (B2B) dealings can feel like a real journey, particularly when you’re at the helm of an office, striving to keep operations running like a well-oiled machine. One approach that truly shines in its ability to revolutionize office management and refine your workflow is Net 30 invoicing. The team at The CEO Creative, well-versed in the art of business success, has highlighted Net 30 invoicing as a key advantage for numerous companies. Let’s explore why this could be your optimal “Buy Now, Pay Later” (BNPL) solution.

Building Vendor Relationships

Running a thriving business hinges on strong relationships, and Net 30 invoicing is a great way to forge and maintain them with your vendors. Let me explain how:

– Building Trust and Dependability: Choosing Net 30 terms sends a clear message to your vendors that you value a trustworthy partnership. Consistently meeting payment deadlines proves you’re dependable, and this can result in your vendors going the extra mile for you, potentially even offering better rates down the line.

– Keeping the Lines of Communication Open: When you’ve built a solid relationship, you’re not just another customer; you become someone they’re invested in helping. This means they’re more inclined to be flexible with your requests and might even give you a heads-up on new and improved products or services.

– Growing Together: A healthy vendor relationship is a two-way street. As your business expands, so does theirs. This kind of mutually beneficial partnership creates opportunities for both of you to flourish and work on exciting new ventures in the future.

When you build strong relationships with your vendors, you’ll be among the first to know about the latest office products, breakthroughs, and special offers. This can give your business a competitive edge. By using Net 30 invoicing, you position yourself as the ideal customer that vendors are eager to work with.

Improving Credit Terms and Flexibility

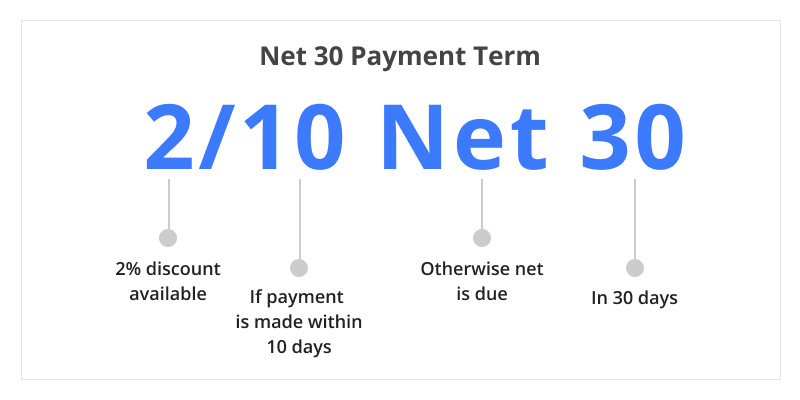

Alright, let’s dive into one of the major financial advantages of using Net 30 invoicing: it can really help you get better credit terms and give you more financial breathing room.

– Boosting Your Creditworthiness: If you’re religious about paying those Net 30 invoices on time, you’ll likely see a noticeable jump in your credit score. Think of each on-time payment as a pat on the back. A solid credit score gives you way more power when you’re trying to strike deals with new suppliers.

– Gaining More Cash Flow Control: Not having to shell out cash right away means you can use that money for other important things in your business. Maybe you want to pour some funds into marketing or update your office tech – Net 30 gives you that flexibility.

– Making it Easier to Get Funding: When you’ve got a history of paying on time, borrowing money or getting more credit becomes a much smoother process. Lenders and banks are always happy to see a business that’s smart with its money, and using Net 30 invoicing helps you build that kind of track record.

Imagine having the flexibility to make strategic decisions without being tied down by immediate payment demands. That’s a game-changer for any business looking to scale its operations.

Strategic Planning for Future Growth

Successful businesses are always looking to the future, and with a tool like Net 30 invoicing, you can plan ahead with greater ease and confidence.

– Predictable Expenses: Knowing precisely when payments are due allows you to forecast expenses accurately. This predictability is crucial when mapping out your company’s growth trajectory.

– Efficient Budget Allocation: With predetermined payment schedules, you can allocate budgets effectively across various departments. Ensuring adequate resources are available for critical projects can be the difference between thriving and simply surviving.

– Long-Term Strategic Initiatives: You know those big projects that require substantial initial investment? With Net 30 terms, you can spread out your expenses, making it easier to embark on ambitious strategic initiatives. Who doesn’t love a great business expansion story?

– Always Ready for Surprising Chances: Think about it, those golden business chances tend to show up out of the blue. If you’ve got some breathing room in your budget and solid relationships with your suppliers, you’ll be all set to jump on those chances without skipping a beat.

Net 30 invoicing is more than just a payment term; it’s a powerful tool that can give your business a real boost. It’s about forging strong, lasting connections, improving your financial stability, and laying the groundwork for expansion down the line. Teaming up with a firm like The CEO Creative opens doors to a world of possibilities, ensuring your office requirements are handled expertly, so you can dedicate your energy to what you excel at: expanding and driving innovation within your field. Why not consider giving Net 30 invoicing a shot? Your office (and your bottom line) will definitely appreciate it!

Conclusion

Dealing with the ins and outs of running an office can really throw you for a loop, but Net 30 invoicing stands out as a fantastic option for companies looking to get the perks of “buy now, pay later” services. Teaming up with The CEO Creative means your business can run more smoothly and keep money coming in at a steady pace, all without sacrificing quality or how well things get done. Check out what you’ll get:

– More freedom: You’ve got a full 30 days to settle your invoices.

– Better cash flow: You can put your money towards other important things.

– Easier processes: Billing is a breeze, no complicated stuff to worry about.

Picture this: your business gets the support it needs, and your finances aren’t stretched to the limit. That’s what having Net 30 invoicing does for your B2B operations. With The CEO Creative on your side, this isn’t just wishful thinking—it’s what your business can really expect. Jump on board with this stress-free way of doing things and move towards cleverer office management right now!