Introduction: The Financial Edge of Net 30 Invoicing

Picture this: You’re at the helm of a company, always on the lookout for clever ways to make the most of every single dollar. Well, that’s exactly what The CEO Creative is up to with Net 30 invoicing—they’re using it as a clever tactic to keep their office supply costs in check! Now, you might be wondering, what exactly is Net 30 invoicing? It’s simply when a business lets its customers take up to 30 days to settle their invoices. This handy financial strategy doesn’t just help spread out those pesky expenses; it also brings a bunch of perks to the table, like:

– Smoother cash flow

– Sharper budgeting skills

– Tighter financial planning

Given its ability to make managing cash a breeze, it’s really no surprise that savvy businesses like The CEO Creative are jumping on this bandwagon. Let’s take a closer look at how this all works and why it’s causing such a stir in the business world!

Understanding Net 30 Invoicing

Keeping tabs on your spending can feel like a real balancing act, particularly when you’re trying to monitor office supplies while also ensuring your company’s money situation stays strong. A clever strategy that loads of businesses use is something called Net 30 invoicing. It might sound like typical finance jargon, but don’t let that scare you off! Let’s dive in and explore why it’s such a great tool for businesses like The CEO Creative.

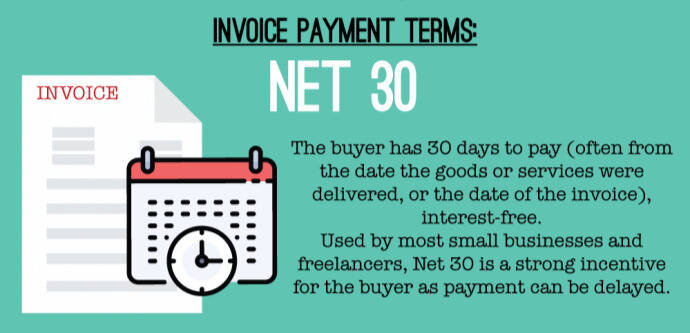

Definition and Basics of Net 30 Terms

Okay, let’s break it down before we get into the nitty-gritty. Net 30 invoicing is basically a system where a buyer gets 30 days to pay an invoice from the date it’s issued. Think of it as a kind of financial cushion, giving businesses some extra time to get their finances in order. Picture this: you’ve just received a delivery of awesome new office furniture for your team. Instead of needing to pay right away, you’ve got a full 30 days to settle the bill.

This approach is really helpful for customers because it helps them keep their cash flow steady and even plan their finances better. Instead of rushing around to find the money immediately, a business can time its outgoing payments to match when money is coming in, making the whole experience feel much more under control.

The Role of Net 30 in Cash Flow Management

Alright, let’s explore how Net 30 invoicing can seriously boost your cash flow management. First off, keeping your cash flow in the green is vital for any business—think of it as the lifeblood that keeps everything running smoothly! By using Net 30 terms, companies aren’t pressured to pay up immediately. This breathing room guarantees you’ve always got enough cash readily available to cover your daily expenses.

Picture this: your business is bringing in money steadily, but customer payments arrive a bit erratically. Net 30 comes to the rescue here, filling in those financial gaps. It makes sure your suppliers get paid when they should, without eating into the cash you need for your day-to-day. Essentially, this invoicing method acts like a safety net, guarding businesses against temporary cash shortages. This allows for more strategic planning and helps you steer clear of cash flow problems.

How Net 30 Enhances Vendor Relationships

A key but often overlooked benefit of Net 30 terms is how it strengthens relationships with vendors. It’s like a trust-building exercise between businesses and their suppliers. When companies stick to the agreement and pay within 30 days, they earn the trust and respect of their vendors.

This trust pays off in the long run, giving companies more leverage in negotiations, potentially securing better terms, and even earning discounts for early payments. Vendors value prompt payments, and this can blossom into enduring partnerships, resulting in a network of reliable suppliers. For a company like The CEO Creative, nurturing these strong vendor connections is crucial for keeping supply chains smooth and getting the best office supplies at the most competitive prices.

The CEO Creative’s Approach to Office Supply Savings

Moving on, let’s talk about how The CEO Creative successfully applies Net 30 invoicing to optimize their office supply expenses. They’ve truly turned this financial tool into a cornerstone of their savings strategy.

Implementing Net 30 for Office Supplies

Over at The CEO Creative, they’ve adopted a really smart approach to handling their invoices with something called Net 30. Basically, they’re all about picking suppliers who are already on board with this payment method and can reliably meet their office needs. They specifically choose vendors who understand Net 30.

This clever strategy lets The CEO Creative hold off on payments for a full 30 days, giving them more flexibility with their cash. This way, they can reinvest that money back into the business without having to scramble for funds the second supplies show up. It’s all about keeping that cash flow nice and healthy.

Plus, they’ve got a system in place to stay on top of things. They use accounting software that gives them a heads-up before deadlines, so they always pay on time. This keeps their vendors happy and maintains a strong, trusting relationship.

Case Study: Office Supply Expense Reduction

Let’s dive into a real-world example of how The CEO Creative’s strategy played out. Before they started using the Net 30 payment method, they were constantly dealing with thin profit margins and a cash flow that was often stretched to its limit. Having to pay suppliers right away after getting an invoice really put a strain on their finances, leaving them with barely any cushion for surprises or new investments.

But things changed considerably once they switched to Net 30. For instance, there was a time they needed to buy some crucial digital gear for the office, and they had to do it on a really tight budget. Thanks to their 30-day payment window, they were able to time the purchase perfectly with the money coming in from a project that had just wrapped up. This clever timing meant they didn’t have to fork over interest fees or make drastic cuts in other areas of their budget.

This one simple change led to a significant decrease in their quarterly office supply costs. Throughout the year, the savings were apparent not only in the reduced dollar amount but also in less financial strain and more predictable expenses, both of which are incredibly beneficial for any expanding company.

Lessons Learned from The CEO Creative’s Strategy

Alright, so what did The CEO Creative learn from their experience using Net 30 invoicing? They picked up some valuable insights that any business could find useful:

– Find vendors you can really rely on: Building solid relationships with vendors who can offer Net 30 terms is super helpful. When trust and transparency flow both ways, it can lead to better terms and maybe even some extra perks down the line.

– Stay super organized and keep track: It’s absolutely essential to keep track of your invoices in an organized way. Setting up automated reminders can help you stay on top of payment deadlines, so you don’t miss out on the benefits of Net 30.

– Time your payments to match your income: Smartly using that payment extension to sync it up with when money is coming in can really take the pressure off your cash flow and make your finances run more smoothly.

– Always review and tweak if needed: Regularly checking how well your payment terms are working and adjusting vendor agreements as needed keeps your strategy effective and adaptable to your evolving business needs.

To wrap things up, The CEO Creative has cleverly transformed Net 30 invoicing from a mere cash flow management instrument into a powerful method for developing budget-friendly office supply tactics. By nurturing strong relationships with suppliers, meticulously organizing their finances, and cleverly optimizing their cash flow, they’ve built a solid foundation that gives them a financial leg up in a tough market. Therefore, if you’re a veteran business owner or just embarking on your entrepreneurial journey, you might want to think about how Net 30 invoicing could boost your company’s financial well-being and longevity.

Net 30 Invoicing: A Broader Financial Strategy

In the fast-paced business world, each choice we make impacts our financial health. Many concentrate only on increasing sales, but wise business owners understand that the key often lies in managing costs effectively and employing sound financial tactics. This is where Net 30 invoicing becomes useful. You might be thinking, “Isn’t Net 30 just a way to delay payment for things like office supplies?” And you’d be right. However, let’s explore further how this financial approach can benefit your business in broader ways.

Financial Optimization Beyond Office Supplies

When it comes to making the most of your finances with Net 30 invoicing, office supplies are really just a small part of the bigger picture. Imagine this: Net 30 isn’t simply about purchasing staplers and pens with a payment delay. It’s a way to improve your cash flow, giving you the chance to put money back into your business right away.

– Inventory Management: For businesses that depend on keeping inventory, Net 30 invoicing can be a lifesaver. It lets you stock up on the things you need without using your available cash immediately. Whether it’s raw materials, finished products, or essential tools, you can maintain a consistent supply without an immediate cash flow problem.

– Vendor Relationships: Building trust with your vendors is essential. When you use Net 30 terms effectively, vendors see that you’re reliable. You pay on time, even if it’s on a delayed schedule, building a stronger connection and possibly even getting better prices in the future.

– Marketing Spending: Are you itching to launch a bigger marketing push, but your budget’s feeling a little tight right now? Net 30 could be your answer! It lets you dive into marketing today, using the funds you have on hand, and gives you a full 30 days to settle those bills. This might just be the boost your brand needs to break into a wider audience.

Managing Risks and Benefits

Like any financial tool, using Net 30 invoices has its ups and downs. To really make the most of it, you need to understand these pros and cons. Once you do, you’ll be better equipped to make smart choices for your business.

Here’s the good stuff:

– Better Cash Flow: Getting a 30-day extension on payments means your business keeps more money in the bank. This extra cash can be a lifesaver for surprise costs or for jumping on opportunities that could help your business grow.

– More Flexibility: Having that extra time to pay gives you some breathing room to get your finances in order, making sure you’ve got the money you need for the important day-to-day stuff.

– Fuel for Growth: Using Net 30 can free up cash to put towards growing your business, whether that’s hiring more people or developing new products.

Potential Downsides:

– Racking Up Debt: Businesses need to be super careful. If they aren’t, they can easily end up with a mountain of debt. Having a solid game plan for how to pay it back is absolutely essential.

– Reliance on Suppliers Being Flexible: Let’s face it, not every supplier is going to be okay with giving you 30 days to pay. This can definitely limit how often you can use this payment method.

– Getting Hit with Late Charges: Missing that 30-day payment window means you’ll likely get stuck with extra fees. That’s why it’s so important to stay organized and be on top of your payments.

When businesses play it smart and weigh these risks against the perks, Net 30 invoicing can be a seriously useful way to keep their finances in good shape and ensure they’re set up for the long haul.

Future Financial Planning with Net 30

Net 30 invoicing isn’t just a quick fix; it’s a fundamental building block for your future financial strategy. As you chart the course for your business, consider how consistently using Net 30 can contribute to lasting financial stability and expansion.

– Predicting Your Budget: Knowing exactly when payments will come in allows for much more accurate financial forecasting. This naturally leads to better budgeting and more strategic decision-making.

– Being Investment-Ready: When you have more cash on hand, you’re better equipped to jump on promising investment opportunities that pop up unexpectedly.

– Growing Your Business: Eyeing new markets or locations for your business? Utilizing Net 30 to optimize your finances can make you more prepared to take on new challenges without as much financial strain.

Integrating Net 30 invoicing into your long-term financial strategy isn’t simply about delaying expenses; it’s about developing a plan that promotes both resilience and adaptability—qualities that are essential in a constantly changing market.

Apply Now!

Want to unlock the advantages of Net 30 invoicing for your business? Getting started is probably simpler than you imagine. First things first, get in touch with your suppliers and chat about the option of setting up a Net 30 account. Be upfront about your plans and show you’re serious about making payments on time.

– Have a Chat with Your Suppliers: Not every supplier will shout about it, but loads of them are happy to talk about payment terms. Go in with confidence and a solid plan.

– Sort Out Your Internal Processes: Make sure you’ve got a strong system for handling invoices and payments. This will make managing your money a breeze and help you avoid any slip-ups.

– Make Sure Your Team’s in the Know: You can’t do it all alone! Your team needs to be clued up on your new financial approach and why hitting deadlines is so crucial.

The brilliance of Net 30 invoicing lies in its versatility, catering to all sorts of businesses, be it a bustling online marketplace, a classic storefront, or an innovative tech venture. When you strategize and adopt Net 30 effectively, you’re handing your business a real financial advantage—one that fuels expansion and secures lasting triumph.

So, what are you waiting for? Embrace Net 30 invoicing and observe how your office supply expenditures evolve into a goldmine of cost reduction and monetary efficiency. Your company’s future self will definitely be grateful!

Conclusion: Achieving Savings and Agility with Net 30

Net 30 invoicing is a powerful tool for managing office supply costs. It gives businesses extra time to pay their bills, allowing them to better control their cash flow. This means they can use their money where it’s needed most, without the pressure of immediate payments.

Using this approach, businesses can experience:

– A stronger financial position

– Greater flexibility to deal with unforeseen expenses

– Better connections with suppliers

Therefore, when blending imaginative ideas with wise financial moves, The CEO Creative demonstrates that Net 30 invoicing isn’t merely about bill payments—it’s about unlocking opportunities and securing lasting growth.