Running a business well often depends on one main thing: cash flow. Think of cash flow as the main thing that keeps your business alive, moving money in and out all the time. Managing this movement of money well can mean the difference between doing really well and just getting by. Even businesses that make money can have problems if they don’t manage their cash flow well.

In this blog, we’ll look at some important ways to manage cash flow that can help your business grow over time. We’ll share useful tips, simple strategies, and important ideas to help you understand and manage your business money better. It’s time to take control of your cash flow and set your business up for steady growth and success.

Importance of Cash Flow Management for Business Success

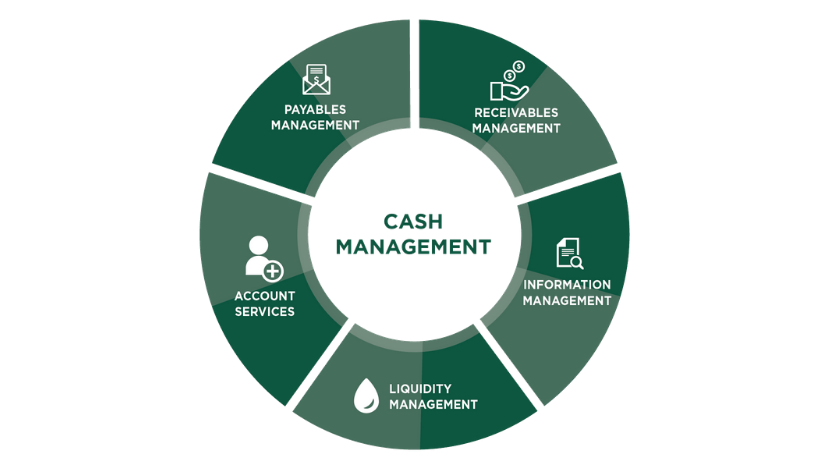

Managing cash flow is very important for a business’s money matters. It helps the business handle its daily tasks, deal with unexpected costs, and take advantage of chances to grow. But why is managing cash flow so important for business success? Let’s look at how understanding cash flow, its lasting effects, and solving common problems can help a business succeed and grow.

Understanding Cash Flow Versus Profit

To start, it’s important to know the difference between cash flow and profit. Even though these two terms are often talked about together in money matters, they are not the same thing. Profit is what you have left after you take away your costs from your income. It looks nice on paper but doesn’t show the full picture of your finances. Cash flow, on the other hand, is like the lifeblood of your business—it shows how money moves in and out of your business and affects your ability to handle your immediate and future financial needs.

Think about this: Your business might show a big profit on your income report. But if customers take a long time to pay their bills, you could run short of cash and have trouble paying your suppliers or workers. Basically, profit doesn’t mean you have cash right away. That’s why knowing your cash flow is more important for your business to stay alive and well day by day.

The Role of Cash Flow in Business Sustainability

Cash flow is essential for keeping a business running. It makes sure everyone gets paid, from employees to investors, and keeps the business operating smoothly. Positive cash flow allows for timely payments of expenses and investments, making the business stronger during tough times like economic challenges or sudden problems.

Being sustainable means having enough money to meet current needs, but it also involves planning for the future. A smart business uses cash flow to invest in growth, such as improving equipment, offering new services, or reaching more customers. In short, good cash flow management turns challenges into chances for long-term success and growth.

Common Cash Flow Challenges

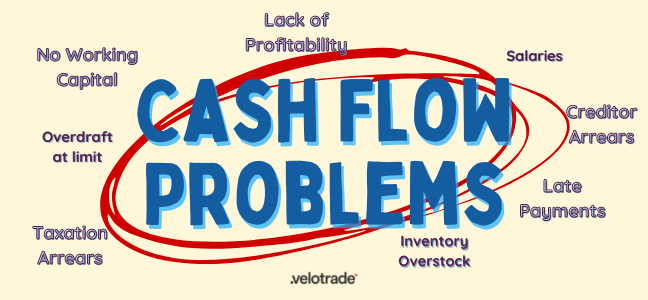

All businesses deal with money problems, and knowing about them is a big part of solving them. Here are some common issues:

– Slow Customer Payments: When customers take a long time to pay, it messes up your money flow and makes it hard to manage your resources.

– Too High Sales Expectations: If you expect too much in sales and don’t reach those numbers, you might run out of money.

– Not Enough Money for Costs: Unexpected expenses can catch you off guard if you don’t plan for them.

– High Fixed Costs: Things like rent and utilities can use up money that you need for other parts of your business.

– Bad Inventory Control: Having too much or too little stock can cause problems with money and sales.

Catching these problems early helps you make plans to avoid them, so your business can stay strong and grow.

Key Cash Flow Management Strategies

Now that you know why managing cash flow is important, let’s look at ways to keep it strong and steady. Here are some helpful tips for managing your business’s cash flow:

Budgeting and Financial Planning

Budgeting helps you manage your money well and focus on what’s important for your business. It involves setting spending limits based on what you expect to earn and spend, controlling your expenses, and avoiding unnecessary spending.

– Make a Clear Budget: Begin by listing all your financial details, such as fixed costs (like rent), variable costs (like supplies), debt payments, taxes, and possible unexpected expenses.

– Monitor Your Budget: Regularly check if your actual spending matches your budget. Look for differences and make changes when needed.

– Be Flexible: A budget that’s too strict can be just as bad as not having one. Be ready to adjust your budget when your business needs or market conditions change.

Think of your budget as a financial guide, helping you reach your goals without making risky financial mistakes.

Cash Flow Forecasting Techniques

Forecasting helps businesses plan for future money needs and spot possible cash problems before they happen. By looking at expected money coming in and going out, companies can handle financial surprises better.

– Short-term Forecasting: Weekly or monthly cash forecasts show detailed cash movements, helping manage daily cash flow.

– Long-term Forecasting: Quarterly or yearly forecasts help understand future money needs and investment plans.

– Scenarios and Modeling: Create different scenarios (best, worst, and most likely) to prepare for various economic situations.

Remember, forecasting works well only if the data used is accurate and current. Good, up-to-date information is important for making reliable forecasts that lead to smart financial choices.

Efficient Accounts Receivable Management

Handling your accounts receivable is a simple way to improve your cash flow. It helps your business get paid quickly after making a sale.

– Define Clear Credit Rules: Giving credit is normal, but you need clear rules to avoid late payments. Write agreements that explain payment rules clearly and follow them strictly.

– Send Invoices Right Away: Give invoices to clients as soon as you deliver goods or services. Late invoices mean late money coming in.

– Keep in Touch Regularly: Create a system to remind clients about payment deadlines. Friendly and regular reminders can help you get paid faster.

– Provide Discounts for Early Payments: Business clients might pay sooner if you offer discounts for early payments. This benefits both you, by getting your money faster, and your customers, by giving them a good deal.

Good accounts receivable management isn’t just about asking for payments. It’s about creating a system where business deals are done quickly and dependably, so you always have enough money to run your business smoothly.

To sum up, a solid plan for managing money, using smart cash flow methods, can really improve a business’s financial situation. If done well, these plans can help solve money problems, find chances to grow, and lead to lasting success. Keep in mind, the aim isn’t just to handle money, but to control it perfectly!

Practical Tips for Improving Cash Flow

Handling money well is very important for a business to stay healthy and grow. Here are some simple ways to make sure money keeps coming in and going out without problems.

Optimize Invoicing and Payment Processes

Making your invoicing and payment processes simpler is important for keeping money coming in regularly. Consider offering Net 30 accounts to provide payment flexibility and improve customer relationships. Here are some other ideas to try:

– Send invoices quickly: The faster you send invoices, the faster you can expect to be paid. Make it a habit to send invoices right after finishing a project or at set times.

– Explain payment rules: Clearly write the payment rules on every invoice. Make sure your clients know when payments are due and if there are any extra fees for late payments.

– Keep in touch: Create a system to remind clients about upcoming payment dates and gently remind them if payments are late. Consistent reminders can greatly reduce delays in payments.

Implement Online Payment Options

We live in a digital world, and allowing online payments can greatly help both you and your customers. Here are some advantages:

– Convenience: Online payments are easy for clients, which often encourages them to pay faster.

– Quick processing: Electronic payments are much quicker than traditional methods like checks, which helps improve cash flow.

– Safety: Make sure your payment systems are secure to protect your business and customer information, which builds trust and reliability.

Offer Early Payment Discounts

Encouraging your clients to pay early can be good for both sides. You get your money sooner, and they save a bit. Here’s how to use early payment discounts well:

– Basic discount plan: Give a small discount for invoices paid within a specific time. For example, offer a 2% discount if they pay within 10 days.

– Show the savings: Clearly write on the invoice how much they can save if they pay early to encourage them.

– Check the results: Keep an eye on whether the discount actually helps get payments faster. This will help make sure it improves your cash flow.

Control Expenses and Negotiate Better Rates

Managing your spending is just as important as managing your income. Here are some tips to help you control costs:

– Check your spending regularly: Look at your business expenses often to find ways to save money without lowering quality or efficiency.

– Talk to your suppliers: Don’t be afraid to ask your suppliers for better prices. They might give you discounts, especially if you’ve been a good customer for a long time.

– Know your fixed and variable costs: Understand what you spend on things that stay the same (fixed costs) and things that change (variable costs). Look for ways to reduce these costs when needed. This includes things like utilities, rent, and other regular expenses.

Diversify Income Streams

Depending on just one way to make money can be dangerous, especially if something unexpected happens. It’s important to spread out your options:

– Try new places: Think about selling your things or services in other areas or to different groups of people to get more buyers.

– Add extra things: Look at what your customers want that you don’t already offer and start providing those things.

– Work with others: Join with other businesses to make new things or services together that can help you earn more money.

Build an Emergency Fund

An emergency fund is like a safety net for your money, helping you handle sudden problems without hurting your business:

– Set a savings target: Try to save enough to cover three to six months of your business costs.

– Save regularly: Add a little bit to your emergency fund every time, even if it’s not much. It will grow over time.

– Keep it separate: Store your emergency money in a different account from your usual business funds, so you don’t use it by mistake.

Common Cash Flow Mistakes to Avoid

Avoid common cash flow pitfalls that can hinder your business growth by understanding effective cash flow management strategies and carefully considering different types of business financing.

Overestimating Revenue and Underestimating Expenses

Being positive is simple, but true success comes from being practical. Thinking you’ll make more money than you really will and not considering all the costs can cause big problems:

– Make practical plans: Use past information and current market studies to guess how much money you’ll make. Don’t think you’ll earn more than you probably will.

– Watch out for extra costs: Be aware of hidden or unusual expenses that might not be clear at first but can add up over time.

Ignoring Seasonal Fluctuations

Many companies don’t make the same amount of money or spend the same amount every month. Not paying attention to these changes can cause money problems:

– Know your business pattern: Learn about your industry’s ups and downs and be ready for times when you’ll have more or less money coming in.

– Prepare in advance: Save up and plan for slower months, so you can handle the quiet times without worrying about money.

Not Monitoring Cash Flow Regularly

Monitoring your cash flow is very important to find problems early. Here’s why checking it regularly is helpful:

– Prevent big problems: By checking your cash flow often, you can catch small issues before they become big ones.

– Better choices: Having the latest cash flow information helps you make smarter decisions about spending or expanding your business.

– Use helpful tools: Think about using special financial software to keep track of your cash flow in real-time, giving you useful information and warnings when you need them.

By using these tips and avoiding common mistakes, your business can have strong and steady cash flow, which helps you succeed in the long run. Managing your money isn’t just about doing math—it’s about making sure your business can handle challenges and keep growing.

Conclusion

Managing cash flow well is very important for keeping a business strong and successful. By using good cash flow strategies, you can keep track of your finances and make smart choices about your business’s future. Remember to plan and watch your cash flow regularly, talk to the people involved, and spend money carefully. With these steps, you’ll help your business stay financially stable and have a better chance of doing well in today’s competitive market.

Frequently Asked Questions

How can small businesses manage cash flow effectively?

Small businesses can manage cash flow by tracking income and expenses regularly, sending invoices on time, and controlling spending. Using flexible payment terms like Net 30 also helps balance incoming and outgoing cash. Regular cash flow reviews prevent shortages and surprises.

How can Net 30 terms improve cash flow for small businesses?

Net 30 terms give businesses extra time to pay suppliers while collecting customer payments. This reduces upfront cash pressure. It helps businesses keep money available for daily operations and unexpected expenses.

Do Net 30 terms affect cash flow?

Yes, Net 30 terms do affect cash flow because payments are received 30 days after invoicing instead of immediately. During this period, businesses still need to cover expenses like payroll and operating costs. Planning ahead helps avoid cash shortages.

How often should businesses review their cash flow?

Cash flow should be reviewed weekly or at least bi-weekly. Regular monitoring helps catch issues early and prevents missed payments. It also supports better financial decision-making.

What is the biggest cash flow mistake small businesses make?

The most common mistake is not tracking cash flow regularly. Many businesses focus on profit instead of actual cash flow. This can lead to shortages even when sales look strong.