| Summary: BNPL and Net 30 are transforming payments in the USA, offering interest-free flexibility and boosting cash flow. They help businesses build credit, improve supplier ties, and attract customers. With accessible credit lines and innovative features, they support startups and SMEs, driving growth and preparing them for future financial trends. |

In recent years, the USA has seen a significant shift toward more flexible consumer financial services, particularly through the rise of Buy Now, Pay Later (BNPL) and deferred payment systems. These options have not only transformed the landscape of retail but are also offering expanded payment options that are forging new paths in how consumers handle and strategize their financial planning.

With a sharp focus on convenience and adaptability, Buy Now, Pay Later business supplies offer a modern twist on traditional credit, enabling purchasers to acquire goods instantly but pay over time under conditions that typically eschew the high interest associated with conventional credit cards.

This comprehensive guide explores the myriad facets of BNPL, its impact on both consumers and businesses, and the broader implications for the economy.

Understanding Buy Now, Pay Later Business Supplies and the World of Deferred Payment

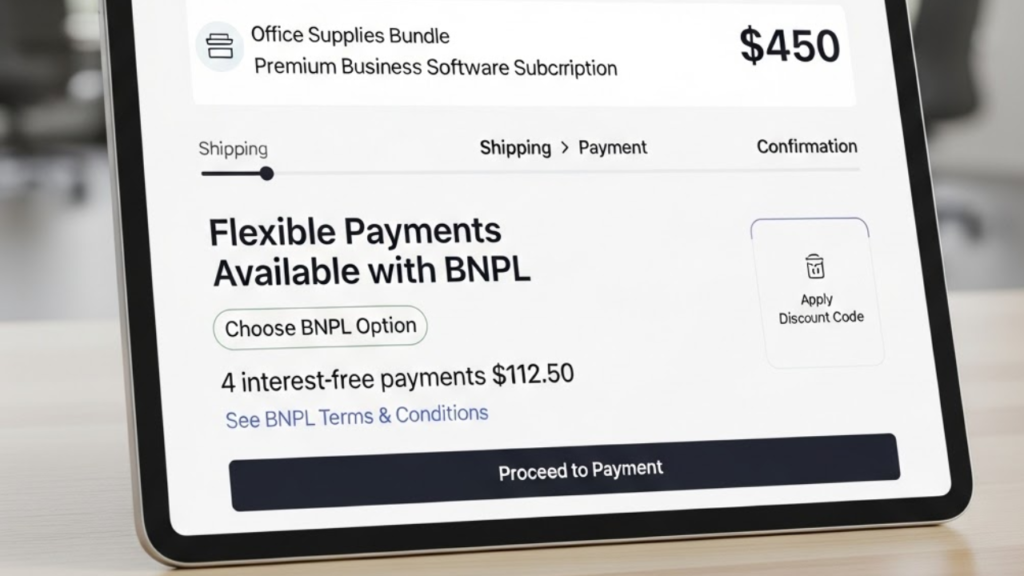

Buy Now, Pay Later is fundamentally a short-term financing model that allows consumers to break down a purchase into smaller, manageable parts that can be paid over time, often interest-free if the repayments are timely. Deferred payment, in general, refers to any arrangement where payment for goods or services is delayed until a later date.

This appealing alternative to traditional credit specially caters to budget-conscious buyers, enhancing their purchasing power without the immediate financial strain.

The process starts at the point of sale—both offline and online—where consumers opt for Buy Now, Pay Later business supplies as their preferred payment method. Swift credit assessment processes, which frequently tap into alternative data sources rather than just conventional credit scores, determine eligibility, frequently allowing for immediate purchase approvals with minimal initial payments.

The allure of this system is manifold: it promises financial inclusivity by providing a credit alternative to those with suboptimal credit scores, it incorporates seamlessly into digital shopping experiences, and by dividing payments, it aids consumers in maintaining a balanced budget without accruing significant debt.

However, despite its benefits, BNPL is not a panacea for financial management but a tool that should be used judiciously within broader financial planning strategies.

The Meteoric Rise of BNPL in the USA

The adoption of BNPL schemes has skyrocketed in the USA, shifting the payment option from a niche to a mainstream financial service within a few years.

This rapid growth can be attributed to a confluence of factors:

- Shifting Consumer Preferences: Younger generations, who prefer more flexible and transparent payment methods that complement their digital-heavy lifestyles and financial perspectives, find BNPL schemes particularly attractive.

- E-commerce Boom: The COVID-19 pandemic has drastically shifted shopping behaviors towards online platforms, where BNPL integrates smoothly, offering convenience that aligns well with remote shopping.

- Technological Advancements: Fintech innovations have propelled the functionalities of BNPL, enabling quick credit decisions, easy integration with e-commerce systems, and hassle-free automated repayments.

- Regulatory Landscape: Relative leniency in regulations has fostered growth in the BNPL sector, although future legislative changes remain a potential influence on its trajectory.

As BNPL becomes a bigger part of U.S. financial activities, its role is also expanding across diverse sectors, indicating its potential staying power and ever-growing relevance in the American economic sphere.

Concept and Mechanics of BNPL

Buy Now, Pay Later (BNPL) is a modern financial model allowing consumers to make purchases immediately and pay for them over time in installments.

This process often requires consumers to make an initial down payment, sometimes as low as zero, at the point of purchase—either online or in-store. The remaining balance is then divided into equal, scheduled payments.

What sets BNPL apart from traditional credit options is its expedited credit approval process, often bypassing traditional credit scores and utilizing alternative data for creditworthiness assessments.

This quick and straightforward mechanism enhances the shopping experience, making it a viable alternative to conventional credit systems, particularly appealing due to its generally interest-free nature, provided payments are made on time.

Benefits and Risks of Utilizing BNPL

The benefits of BNPL include enhanced budget management, as it allows consumers to spread out the cost of significant purchases, thereby avoiding the accumulation of high-interest debt—a common issue with traditional credit cards.

Moreover, the seamless integration of BNPL systems into e-commerce platforms offers a frictionless checkout process, improving the overall customer experience.

However, the risks associated with BNPL should not be overlooked. Despite its convenience, there is potential for consumers to overspend, as the allure of manageable installments can sometimes mask the total expenditure.

Additionally, failure to meet payment deadlines may result in penalties or damaged credit scores, where applicable. Consumers must use Buy Now, Pay Later business supplies wisely, ensuring they fully understand the terms and conditions to mitigate financial strain.

Net 30 Vendors: A Crucial Component of Deferred Payments

Role of Net 30 in Business Financing

Net 30 terms play a vital role in business financing, particularly for small and medium-sized enterprises (SMEs). By allowing businesses 30 days to pay for their purchases, Net 30 vendors provide them with much-needed breathing room to manage their cash flow more effectively.

This is especially beneficial for businesses that experience seasonal sales fluctuations. It helps those who need to stock up on inventory before peak periods without immediate financial pressure.

Net 30 also serves as a credit-building tool for businesses. Consistent and timely payments under these terms are often reported to commercial credit bureaus, helping businesses establish and improve their credit ratings. This, in turn, can open doors to more favorable loan terms from banks and other financial institutions in the future.

The CEO Creative: Innovations and Contributions

The CEO Creative has been at the forefront of transforming the Net 30 landscape by catering specifically to the unique needs of modern enterprises. Their approach combines flexibility with innovation, offering up to $5,500 in credit lines to businesses, which significantly eases the challenge of upfront costs.

With an annual membership fee of only $49, The CEO Creative makes this service accessible to a broader range of businesses, including startups and small ventures that typically struggle to secure traditional credit lines.

Moreover, The CEO Creative distinguishes itself by streamlining the credit approval process, not requiring a minimum credit score or personal guarantees, which democratizing access to business credit. Their wide range of products and services ensures that businesses from diverse sectors can find the tools and resources they need to grow and succeed.

Benefits of Net 30 for Small and Medium-sized Enterprises (SMEs)

Net 30 terms offer multiple benefits to SMEs that go beyond just improved cash flow:

- Flexibility in Financial Planning: Businesses can prioritize other urgent expenses before settling their invoices, reducing the stress on their financial operations.

- Enhanced Supplier Relationships: Regular, reliable use of Net 30 terms can lead to strengthened trust and possibly more favorable terms from suppliers in the future.

- Opportunity for Growth: By freeing up capital that would otherwise be tied up in immediate inventory costs, businesses can invest in growth opportunities such as marketing campaigns or new product lines.

The CEO Creative and BNPL: A Harmonious Partnership

Integrating BNPL with Net 30 Terms

Recognizing the shift towards more flexible payment solutions, The CEO Creative has adeptly integrated BNPL options into its Net 30 accounts. This innovative step allows businesses to offer their customers BNPL terms at the point of sale, which The CEO Creative manages by paying the merchants upfront while allowing the customers to pay over time. This integration not only adheres to evolving consumer preferences but also supports businesses in maintaining healthy cash flows.

Business Advantages of Adopting BNPL

Adopting BNPL can significantly impact businesses by:

- Boosting Sales: Offering BNPL as a payment option can attract a broader customer base, including those who prefer not to pay the full price upfront.

- Improving Customer Loyalty: The flexibility of BNPL can enhance customer satisfaction and lead to repeat business.

- Reducing Credit Risk: With The CEO Creative handling the BNPL accounts, businesses are shielded from the risks associated with non-payment.

The Future of BNPL and Deferred Payments

Potential Innovation and Market Growth

Expect more personalized BNPL platforms, incorporating AI-driven spending limits and real-time spending analytics. Market growth is expanding beyond retail, into sectors like healthcare, education, and travel, providing greater payment flexibility. Integration with cryptocurrencies and blockchain will further enhance security and transparency.

Challenges and Regulatory Considerations

As BNPL continues to grow, challenges around debt management and financial literacy arise. There is increasing demand for regulations that ensure clear disclosures of terms and conditions and cap late fees. Regulatory bodies are also looking to prevent predatory lending practices to ensure BNPL remains a tool for financial empowerment.

Integration with Other Financial Products

BNPL is expanding beyond retail into credit cards and personal finance apps, offering seamless experiences, improved budgeting, and incentivizing responsible usage with rewards.

Conclusion

The meteoric rise of Buy Now, Pay Later (BNPL) and deferred payment options like Net 30 has significantly shifted the financial landscape in the USA. These payment methods offer enhanced flexibility for consumers and provide businesses with crucial tools for cash flow management and customer acquisition.

The CEO Creative has led the way by integrating BNPL with Net 30, creating a harmonious transaction environment that benefits both vendors and consumers. This shift toward more adaptive, customer-centered financial solutions is transforming contemporary commerce, offering businesses and consumers alike greater financial flexibility and empowerment.

The future of BNPL and deferred payments is bright, and businesses that adopt these innovative solutions will be well-positioned to thrive in an increasingly flexible financial landscape.

Frequently Asked Questions (FAQs)

1. How does deferred payment differ from traditional credit?

Deferred payment refers broadly to any arrangement where payment is delayed to a later date. Unlike traditional credit cards that charge interest, many deferred payment options like BNPL and Net 30 terms offer interest-free periods and simplified approval processes.

2. What are the eligibility criteria for businesses to qualify for BNPL and Net 30 accounts?

Businesses typically qualify for BNPL and Net 30 accounts based on creditworthiness, business age, revenue, industry type, legal compliance, and payment history. Providers may require financial documentation and prioritize stable, responsible businesses with positive credit and vendor relationships.

3. How do BNPL and Net 30 impact a business’s working capital management?

BNPL and Net 30 improve working capital management by freeing up cash flow. They allow businesses to acquire goods or services immediately but delay payments, enabling better liquidity, smoother cash flow cycles, and more flexibility to invest in growth or cover operational expenses.

4. Can BNPL be used for wholesale or bulk business purchases?

Yes, BNPL can be used for wholesale or bulk business purchases if the BNPL provider supports larger transaction amounts common in B2B sales.

![Buy Now, Pay Later & Deferred Payment for Business Supplies [A USA Guide]](https://theceocreative.com/wp-content/uploads/2024/05/fff0c45c1b47efc62ec742cfd6c49a32_22_16_23_12_05_2024.jpeg)