Have you ever wondered how online shopping keeps evolving to make our lives easier? Enter Buy Now Pay Later (BNPL), a game-changer in the world of e-commerce. It’s all about simplifying transactions for shoppers and supercharging business growth.

In this blog, we’ll break down what BNPL is, how it’s changing online shopping, and what it means for you. Join us on this journey to discover the power of BNPL and how it’s shaping the way we shop and do business online.

Brief Overview of Buy Now Pay Later (BNPL)

BNPL empowers customers to purchase items and pay for them in convenient installments, typically devoid of interest charges. The game-changing feature is that products are shipped immediately, regardless of payment completion. BNPL transcends being merely a payment option; it’s a financial tool that:

- Bridges the gap between desire and affordability.

- Provides customers with a flexible spending approach.

- Alleviates the upfront payment burden, enhancing the overall shopping experience.

Impact of BNPL on the E-commerce Landscape:

BNPL has solidified its place on the e-commerce map, acting as a catalyst for online sales. It not only augments conversion rates by reducing shopping cart abandonment but also elevates customer loyalty and retention by optimizing the shopping experience. It’s a fact – the smoother the checkout process, the higher the chances of customers returning for more. In sum, BNPL revolutionizes your online store’s shopping experience, propelling it toward increased sales and unparalleled business growth.

Understanding ‘Buy Now Pay Later

Although the concept of ‘Buy Now Pay Later’ seems straightforward – enabling customers to buy a product immediately and pay for it over several installments – its impacts on business are multifaceted and profound.

Evolution and Growth of BNPL:

BNPL isn’t a wholly new concept; it revives earlier layaway plans and credit systems with a modern, digitized twist. While the idea has been around for some years, its recent surge in popularity, especially among millennials and Gen Z shoppers, can be attributed to greater spending flexibility, improved financial management, and shifting consumer attitudes towards traditional credit.

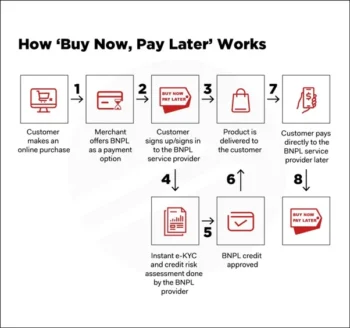

How does it work?

Most BNPL services are exceedingly user-friendly. During the checkout process, customers opt for the BNPL option instead of traditional credit/debit card payments. The BNPL service provider typically breaks down the total cost into smaller, interest-free installments payable over time. This zero-interest feature makes it an appealing choice for buyers.

Industry sectors benefiting from BNPL:

BNPL’s inherent flexibility has led to its adoption across diverse industry sectors. From e-commerce stores to brick-and-mortar retailers, from fashion brands to consumer electronics, companies in various fields have found that offering BNPL options significantly amplifies sales volume and enhances customer retention. By broadening access to products and services, BNPL is quietly reshaping entire industries and propelling growth.

Business Potential of ‘Buy Now Pay Later:

We live in an era where instant gratification is paramount. The ability to buy and enjoy goods and services now while deferring payment appeals immensely to consumers. This concept fuels the business potential of ‘Buy Now Pay Later,’ paving the way for substantial profits.

Increasing e-commerce sales with BNPL

Harnessing the power of Buy Now Pay Later to boost e-commerce sales doesn’t require rocket science. By offering BNPL, you provide customers with the convenience of spreading their payments without incurring interest charges. This choice alleviates the stress of immediate payment and can lead to:

- Increased willingness to purchase.

- Higher average purchase values.

- Enhanced customer loyalty, resulting in repeat business.

Higher customer retention with BNPL

BNPL not only supercharges your e-commerce sales but also plays a pivotal role in retaining your hard-earned customers. This strategy fosters customer loyalty by:

- Offering transparency with no hidden fees, thereby instilling trust in your customers.

- Enhancing customer satisfaction through a seamless checkout process.

- Providing customers with a compelling reason to return since they can afford to buy now and pay later.

Advantages of Integrating ‘Buy Now Pay Later

BNPL isn’t just a trendy novelty; it’s an effective tool that offers a myriad of benefits to both entrepreneurs and customers.

Benefits to Entrepreneurs:

First and foremost, entrepreneurs who implement BNPL witness a substantial increase in e-commerce sales. This model introduces a flexible payment option that encourages larger basket sizes and higher conversion rates. Furthermore, it cultivates customer loyalty, directly stemming from BNPL’s customer-friendly approach. Entrepreneurs also leverage BNPL to remain competitive by offering a cutting-edge, consumer-preferred payment method.

- Boost in e-commerce sales.

- Potential for greater customer loyalty.

- A competitive edge.

Benefits to Customers

Conversely, customers adopting BNPL relish the freedom of paying over time without incurring extra costs if payments are made on schedule. This system provides psychological comfort to consumers, alleviating the immediate ‘payment pain’ often associated with large purchases. Essentially, BNPL offers a smarter way to budget.

- Deferred payments.

- Elimination of immediate ‘payment pain.

- Facilitates better budgeting.

How to Implement ‘Buy Now Pay Later in your Business

Implementing BNPL in your business isn’t overly complex, but it requires careful consideration. Here’s a roadmap to get you started.

Selecting the right BNPL provider

First and foremost, you need to choose a BNPL provider that can effectively cater to your business needs. You’d want a provider with a reputable track record trusted by customers. The provider should also offer seamless integration with your checkout process, ensuring a smooth journey for your customers. Don’t forget to evaluate their customer service, as you or your customers might need to reach out to them in case of queries or issues.

Understanding the fee structure

BNPL providers typically operate on commission-based models. Therefore, you’ll want to fully understand the fee structure. Shoppers will pay for their purchases over time, but usually, the BNPL provider will pay you upfront, deducting their fee. This fee typically constitutes a percentage of the sale. Agreeing on this rate from the outset is crucial for your financial planning.

Rollout strategy for implementation

Finally, it’s time for implementation. Plan the rollout of this new method carefully. Ensure your customer service team is adequately trained, update your website and marketing materials to highlight this new payment option, and contemplate a soft launch to gather feedback from a smaller audience before a full-scale launch. This approach will ensure a smooth transition and allow you to rectify any issues early in the process.

By following these steps, you’re now prepared to harness the potential of ‘Buy Now Pay Later’ and witness your business flourish!

Realizing your Business Potential using ‘Buy Now Pay Later

While the concept of BNPL might appear somewhat intimidating initially, it’s certainly worth exploring. Businesses worldwide are realizing their potential through innovative strategies like BNPL, propelling e-commerce sales to unprecedented levels.

Case Studies of Successful BNPL Implementation

Take, for instance, global fashion giants ASOS and ZARA. They have seamlessly integrated BNPL into their e-commerce platforms. The result? Not only an exponential increase in sales but also a significant boost in customer retention. An Australian-based online homeware retailer, Temple & Webster, also witnessed a staggering 150% increase in sales within a year of launching their BNPL facility.

In a nutshell, BNPL:

- Amplifies e-commerce sales.

- Enhances customer retention.

- Maximizes revenue.

Measuring Your Success with BNPL

But how do you measure success with BNPL? Tracking consumer behavior, analyzing sales data, and assessing customer loyalty can provide a clear picture of the return on your BNPL investment. Remember, success isn’t just about an immediate increase in sales; it’s also about building lasting customer relationships.

Future of Buy Now Pay Later

The future of Buy Now Pay Later appears exceptionally promising, with a trajectory hinting at increased popularity and acceptance among both consumers and retailers.

Predicted Trends in BNPL

Analysts forecast several potential trends in the BNPL space:

- Increased customer adoption rates: As customers become more familiar with BNPL, we can anticipate a surge in the number choosing this payment method.

- Greater regulatory oversight: Due to the rapid growth of BNPL, financial regulators may increase their involvement to ensure customer protection.

- More integration with mainstream finance: Traditional financial institutions might opt for partnerships with BNPL providers, propelling BNPL into the realm of mainstream finance.

Staying Competitive in the Evolving E-commerce Marketplace with BNPL

Incorporating BNPL into your e-commerce platform is essential to maintain competitiveness. It enhances the customer experience by offering payment flexibility, potentially leading to higher conversion rates and customer retention. Furthermore, it caters to millennials and Gen Z customers who increasingly favor alternative finance solutions. Ultimately, staying abreast of such advancements is key to not just surviving but thriving in the rapidly evolving e-commerce landscape.

In summary, ‘Buy Now Pay Later’ plays a transformative role in accelerating your business growth. It’s a game-changer because:

- BNPL boosts e-commerce sales by making expensive items and bulk purchases more affordable and enticing for your customers.

- It fuels customer retention by enhancing the user experience with convenient checkout options.

- BNPL drives customer loyalty with flexible payment schemes, making your business their preferred shopping destination.

As a cutting-edge credit option, BNPL turns your business potential into a tangible reality.

Final Thoughts and Call to Action for Entrepreneurs

With a promising outlook for ‘Buy Now Pay Later’ in the e-commerce arena, entrepreneurs should harness this dynamic tool to expand their customer base and propel their sales to new heights. Always strive for customer-friendly payment alternatives to enhance customer satisfaction and retention. Don’t just aim for earnings – aspire to evolve and achieve significant growth with your business. Entrepreneurs, the ‘Buy Now Pay Later’ wave to success is here. Dive in!