Introduction to Building Business Credit with Net 30 Accounts

Hi there, small business owners! Ready to boost your business by creating strong business credit? If you’ve only been using your personal credit score, it’s time for a change. Good business credit can open doors to more financial options, helping your company grow without putting your personal credit at risk. One great way to start is by using net 30 accounts. But first, what are Net 30 accounts? These accounts let you buy things now and pay for them within 30 days. Stay with us as we explain easy steps to improve your credit score, including building business credit with Net 30 accounts, and grow your business wisely!

Understanding Business Credit

Business credit is like a reliable friend who helps you when you’re working to start, expand, or save your business. It’s an important tool for companies, but not everyone knows exactly what it means. Let’s explain it simply!

Definition and Importance

Business credit is a way to show how reliable a company is when it comes to managing its money. It’s similar to personal credit scores, but it applies to business dealings. This credit rating helps banks, suppliers, or other financial groups see how well your business handles its debts and financial responsibilities.

You might wonder why this is important. First, good business credit can help you get better loan options with lower interest rates. Just as a high personal credit score can get you a great deal on a car loan, strong business credit can give you better loan terms or even help you qualify for business services. It also helps keep your personal and business finances separate, which is important for protecting your personal assets.

Basically, learning about and taking care of your business credit can be one of the best things you do for your company’s future success and financial well-being. By having good credit, you show suppliers and banks that your business is dependable and worth trusting. This can help with money flow issues, as it might let you get bigger credit limits and more time to pay your bills.

Impact on Financing and Terms

Building strong business credit can greatly affect your chances of getting loans and the conditions you’ll receive when discussing them. Here’s why:

– Easier Access to Loans: With a strong business credit history, you can more easily get approved for loans and credit lines. Banks check your business credit score to decide if you’re a good risk; the higher your score, the more likely they are to lend to you. This can provide your business with the money it needs to grow, buy new equipment, or handle financial difficulties.

– Better Loan Conditions: Good credit doesn’t just help you get loans; it can also lead to better loan terms. You may get lower interest rates and more flexible repayment options, which can save your business money over time.

– Better Business Deals: Suppliers and vendors usually check your credit score to decide what kind of deals they’ll give you. If you have a good credit score, you might get discounts and longer time to pay. This helps your cash flow because you have more time to pay your suppliers.

– Business Independence: By making sure your business has its own credit, you don’t have to use your personal money or credit when you need funds. This keeps your personal and business finances separate, which makes running your business and managing your personal money easier.

Knowing how business credit affects these areas shows why it’s important to manage and build it. This leads us to our next topic: using net 30 accounts as a way to improve your business credit.

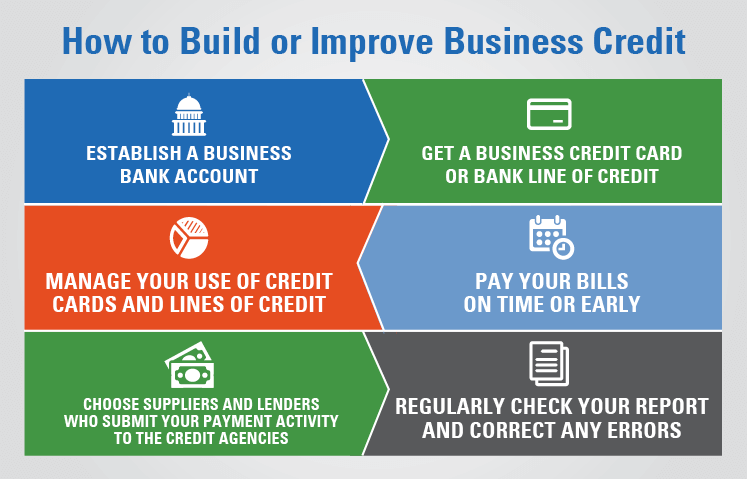

Best Practices for Using Net 30 Accounts to Build Credit

Now that we understand what business credit is and why it’s important, let’s look at one of the best ways to build it: net 30 accounts. These accounts allow you to pay for purchases 30 days after getting the bill, which gives you a good amount of time to manage and improve your cash flow while also strengthening your credit. However, simply opening net 30 accounts isn’t enough—you need to use them carefully.

Making Timely Payments

One of the easiest and most important things you can do to build your business credit with net 30 accounts is to pay on time. Being punctual isn’t just nice—it’s really good for your credit score.

– Create a Plan: Set up a regular payment schedule. You can do this by setting reminders for due dates or using accounting software that tells you when payments are coming up. The goal is to pay your bills before the 30 days are up.

– Know the Rules: Different suppliers might have different rules, even if they all use net-30. Make sure you understand exactly when and how you need to pay to avoid missing deadlines and hurting your credit.

– Pay Early If You Can: While paying on time is enough, paying early might sometimes get you a good note on your credit report. This way of doing things not only keeps you from being late but can also show that you run your business well.

– Talk to Your Suppliers: If you can’t make a payment on time, let your suppliers know. It’s usually better to ask for a small extension than to pay late without saying anything. This shows that you’re professional and reliable.

Paying on time for net 30 accounts doesn’t just make your suppliers happy. It also helps build your business credit over time, showing lenders and creditors that you’re dependable and good at managing money.

Monitoring Credit Reports

Keeping track of your business credit reports is another important way to use net 30 accounts well. You don’t want all your efforts and timely payments to be forgotten, do you? Here’s why checking your reports is helpful:

– Regular Reviews: Like with your personal credit report, check your business credit reports often. This makes sure all the information is right and that your good payment history is being recorded correctly.

– Fix Mistakes Quickly: Sometimes, payments might not be reported properly or old information could still be affecting your score. Quickly contact the credit bureaus to fix these mistakes and keep your record clean.

– Monitor Progress: Checking your progress regularly helps you see how much you’ve improved over time. Watching your business credit score get better can be encouraging, showing that your hard work is working. Also, you’ll notice patterns and make smarter choices about what to do next to improve your credit.

– Keep an Eye on Score Changes: If your credit score changes a lot, it’s important to understand why and, if needed, look into it more. This information can be very helpful when you’re trying to get a loan or talking with a big supplier.

Keeping track of your credit report helps you manage your business’s credit better. It’s an easy, forward-thinking step that lets you make smart decisions and quickly fix any mistakes or problems that could hurt your business credit.

By learning about business credit and using net 30 accounts carefully, you’re not only making good financial decisions but also building a strong base for your business’s future. This can help you get better loan options, work on better terms with suppliers, or just feel more confident. Good credit management can really make a big difference. So start today, and see your business credit—and your company—grow!

Steps to Building Business Credit with Net 30 Accounts

Ready to start building your business credit and aim high? Great! Let’s begin this journey with some simple steps to make it happen.

Establish a Business Entity

To start, you should create a proper business structure. This is important because it keeps your personal money separate from your business money, which helps build a strong business credit history. Here’s what you need to do:

– Pick Your Business Type: The most common options are sole proprietorship, partnership, limited liability company (LLC), and corporation. Each has its own advantages and disadvantages, but forming an LLC or a corporation is usually the best choice for building business credit since it protects your personal assets and makes lenders see your business as more trustworthy.

– Register Your Business: After choosing your structure, register your business with your state. This makes your business officially recognized and lets you operate under your business name.

– Obtain a Business License: Depending on your industry and where you’re located, you may need a business license or permit to legally start your business.

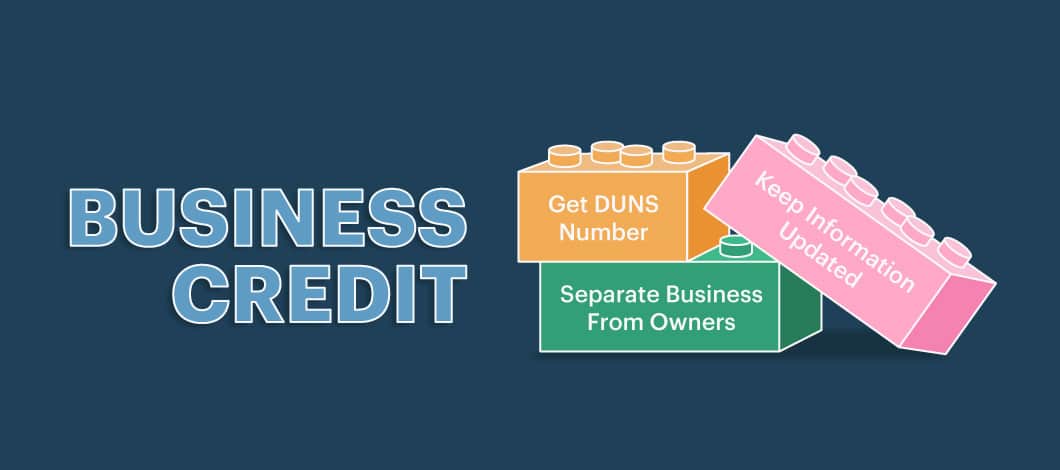

Register with Business Credit Bureaus

Okay, you’ve set up your business and have your EIN—what comes next? You need to register your business with business credit agencies. This step is important because these agencies keep track of your business credit reports and scores, just like personal credit agencies do for individuals. Here’s how to do it:

– Begin with Dun & Bradstreet: Get a D-U-N-S Number from Dun & Bradstreet. It’s free and works as a special code for your business in the credit world. Once you have it, your business can start building a credit history.

– Check out Experian and Equifax: These big agencies also track business credit, but registering with them might happen automatically when you open accounts or get credit lines.

– Keep an Eye on Your Credit: Regularly review your business credit reports from these agencies to make sure the information is correct and current. Mistakes can hurt your credit score, so stay careful.

Common Mistakes to Avoid When Building Credit with Net 30 Accounts

You’re making progress in building your business credit, but let’s slow down for a moment to look at some common mistakes. Trust me, avoiding these will save you from a lot of trouble later on.

Overspending and High Credit Utilization

Even though those new net 30 accounts might seem like a great way to get more supplies, it’s important to be careful:

– Be Careful with Spending: If you use too much of your credit, it can make lenders think you’re having money problems. Try to use less than 30% of your credit limit. This helps lenders see you as responsible.

– Plan Your Spending: Stick to your business budget and only buy things you’re sure you can pay back by the time your bill is due.

– Keep an Eye on Your Credit Limit: Check your credit limit often and watch for any changes. If your limit goes down, it could affect how much credit you’re using and hurt your credit score.

Late Payments and Defaulting

Let’s be honest—late payments can really hurt your business credit, especially when you’re just starting out:

– Pay on Time: Missing even one payment can lower your credit score a lot. To prevent this, set reminders for when payments are due, or even better, set up automatic payments.

– Talk to Your Lenders: If you run into money problems, contact your lenders right away. Many are open to helping you by changing the terms or giving you some temporary help.

– Have a Backup Plan: Having an emergency fund can make a big difference. It gives you something to rely on when business is slow, so you can keep making payments.

Building business credit doesn’t happen overnight, but by taking these steps and avoiding common mistakes, you can speed up the process and establish a strong credit reputation for your business. Keep in mind that building credit is more like a long-term effort than a quick fix. With time and effort, you can improve your business credit score and open the door to better financing options and growth opportunities for your company. So, start building a solid foundation, steer clear of mistakes, and see your business succeed!

Tips for Establishing Business Credit

Building business credit is very important for your company’s success and growth. It can help you get better loan options and give you a backup for unexpected costs. Here are some helpful tips to get you started on the right track.

Separating Personal and Business Finances

An essential part of building business credit is keeping your personal and business money apart. Here’s why this is important and how you can do it:

– Better Understanding: Keeping your finances separate helps you see how well your business is doing, which is important for making good decisions.

– More Trust: When lenders see that your business accounts are well-organized, they trust you more and are more likely to give you loans and better credit conditions.

To effectively separate your finances:

1. Set Up a Separate Business Bank Account: Begin by creating a business checking account. This is a simple but very important step to help you manage your money better.

2. Apply for a Business Credit Card: Use a business credit card only for work-related costs. This helps improve your credit score and keeps your personal and business spending separate.

3. Monitor Your Spending: Use accounting tools to record all business transactions. Keeping everything in order will make it easier to handle your money and file your taxes.

Obtaining an EIN and Registering Your Business

Before you apply for net-30 accounts or business credit, make sure your business is officially registered and has an Employer Identification Number (EIN). Understanding the benefits of Net 30 accounts can help you make informed decisions about your business finances.

– EIN (Employer Identification Number): Think of your EIN as a Social Security number for your business. It’s needed for taxes, hiring employees, and applying for business credit. You can easily apply for an EIN online on the IRS website.

– Register Your Business: Ensure your business is legally recognized in your state. This means choosing a business type (like an LLC, corporation, or sole proprietorship) and completing the required paperwork. Check your state’s rules, as they can be different.

Doing these legal steps not only protects you but also shows creditors that your business is trustworthy and real.

By completing these basic steps, you’re making good progress toward establishing strong business credit. Keep in mind that patience and staying consistent are important. By keeping your personal and business finances separate and making sure your business is legally set up, you’re creating a strong foundation for financial success.

Conclusion

Building business credit using net 30 accounts might feel challenging at first, but it can greatly help your small business over time. By getting net 30 accounts, paying bills promptly, and regularly checking your credit reports, you can improve your credit scores and gain access to more funding options. Remember, staying patient and consistent is important. Begin with the steps provided, and see your business credit grow. With these actions, you’ll create a strong foundation for future expansion and financial success.