Building solid business credit isn’t just smart—it’s essential.

Whether you’re a fresh startup or a growing company, your business credit score can unlock serious perks: better loan terms, higher credit limits, and trusted vendor relationships. So, which is the easiest way to start building that financial foundation? It’s Net-30 payment terms. In 2025, leveraging Net-30 accounts is more than a strategy—it’s a power move. These terms let businesses buy what they need now and pay for it later, usually within 30 days. This method helps manage cash flow and shows that the business can pay its bills on time. In this blog, we’ll break down how you can use net 30 accounts to build business credit. Let’s begin!

Understanding Business Credit

In the world of finance, business credit might seem complicated, but it’s actually quite simple. Think of business credit as a report card for your company. It demonstrates how effectively your business can borrow money and repay it on time, much like your personal credit score. The stronger your business credit, the more reliable your business looks to lenders and suppliers. A strong business credit score can unlock many opportunities, such as:

✅ Access to loans for expansion or equipment

✅ Better payment terms from suppliers

✅ Stronger financial reputation, especially in competitive industries

How Business Credit Differs from Personal Credit

It’s easy to confuse business credit and personal credit, but they serve different purposes and operate in distinct ways. Here’s a quick table to understand the difference easily:

| Aspect | Business Credit | Personal Credit |

| Linked to | Your business’s Employer Identification Number (EIN) | Your Social Security Number (SSN) |

| Purpose | Measures your business’s ability to borrow and repay money | Measures an individual’s ability to manage debt and payments |

| Impact on Personal Finances | Does not affect your personal credit score if kept separate | Affects your personal finances directly |

| Credit Reporting Agencies | Reported by business agencies like Dun & Bradstreet, Experian Business, Equifax Business | Reported by personal credit agencies like Experian, TransUnion, and Equifax |

| Ownership | Business credit is separate from personal finances | Personal credit is tied directly to your individual financial habits |

| Loan and Credit Access | Helps secure business loans, supplier credit, and trade credit | Used for personal loans, credit cards, and mortgages |

| Approval Criteria | Focuses on business operations, payment history with vendors, and financial stability | Based on individual payment history, income, and debt-to-income ratio |

| Risk | Protects your personal assets when business credit is used separately | Can impact personal financial stability and assets |

What’s the Importance of Business Credit?

1. Accessing Loans and Credit

A good business credit score is a key factor in securing financing. Lenders rely on your business credit to evaluate how financially reliable your company is, which can significantly impact loan approval:

- Better Loan Terms: A strong business credit score increases your chances of getting financing at lower interest rates, saving you money in the long run.

- Bigger Loans: Rather than using your personal credit for business financing, a solid business credit score allows lenders to assess your company’s financial health directly, opening the door to larger loans for investments such as new equipment, hiring, or business expansion.

2. Attracting Investors and Partners

Investors and potential business partners seek companies with a strong financial reputation. A robust business credit report demonstrates that your business is reliable and financially stable, increasing your chances of:

- Securing Investments: Investors are more likely to put their money into businesses that are trustworthy and have a track record of paying bills on time.

- Building Partnerships: Strong business credit makes potential partners more comfortable, giving your company an edge in negotiations and creating more opportunities for growth.

3. Negotiating Favorable Terms with Suppliers

Having solid business credit can also give you a significant advantage when negotiating payment terms with suppliers:

- Better Payment Options: Suppliers often offer better terms, such as Net 30, Net 60, or even Net 90 plans, for companies with strong credit, giving your business more time to pay for goods or services.

- Improved Cash Flow: Extended payment terms help maintain healthy cash flow, which is vital for managing day-to-day operations and allocating resources to other areas like marketing and growth.

- Discounts and Offers: A positive credit relationship with suppliers can also lead to discounts or special offers, reducing long-term costs and contributing to financial stability.

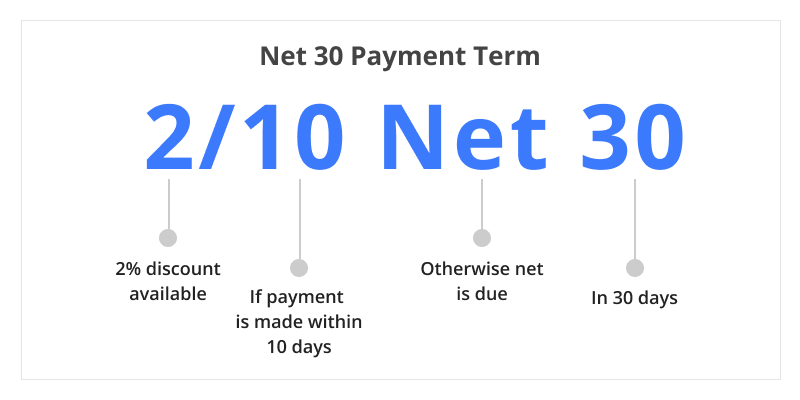

What is Net 30 for Business Credit Accounts?

The concept of Net 30 for business credit is straightforward: the seller gives you goods or services, and you, as the buyer, agree to pay the amount due within 30 days. These accounts are vital for establishing your business credit as they show your ability to manage debt and make timely payments. If used correctly, these terms can greatly improve your company’s reputation and financial health.

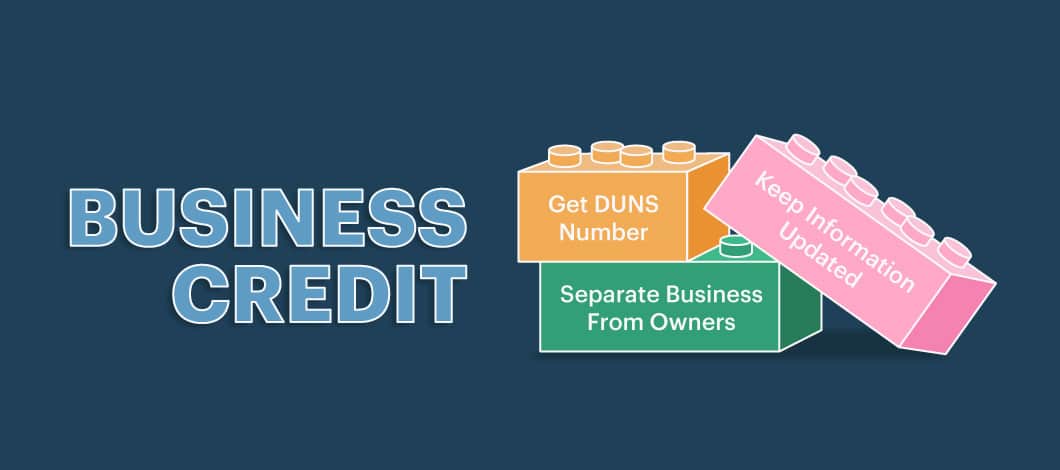

How to Build a Business Credit Net 30 Account?

Building business credit with Net 30 accounts is a strategic way to establish a solid financial foundation. Here’s how you can do it effectively:

1. Choose the Right Net 30 Vendors

✅Select vendors that offer Net 30 terms and report payments to business credit bureaus (e.g., Dun & Bradstreet, Experian, Equifax).

✅Start with suppliers who are easy to qualify for, even if your business is new.

2. Open a Net 30 Account

✅ Apply for Net 30 accounts with the vendors you’ve chosen.

✅ Provide required business details, including your EIN (Employer Identification Number), business name, and address.

3. Make Timely Payments

✅ Ensure you pay your bills on time (within 30 days) to build a positive payment history.

✅ Timely payments are crucial to improving your business credit score.

4. Monitor Your Credit

✅ Regularly check your business credit reports to track your payment history and ensure accuracy.

✅ Keep an eye on how your payments impact your business credit score.

5. Expand as Your Business Grows

✅ As your credit history improves, consider applying for additional Net 30 accounts with other vendors.

✅ Gradually expand your credit relationships to further enhance your business credit profile.

How Net 30 Terms Impact Your Business Credit

Let’s take a closer look at how this works!

Positive Impact of Timely Payments

Paying your bills on time might seem simple, but it can make a big difference for your business credit. When you regularly pay your bills within the 30-day period, you’re building a good payment history. This not only helps improve your credit score but also shows future lenders and suppliers that you’re reliable and can be trusted.

Here’s how paying on time can help:

✅ Better Creditworthiness: Paying on time shows your business is dependable, which can lead to better loan terms and conditions.

✅ Higher Credit Limits: As your credit score improves, lenders may offer you a higher credit limit or more flexible payment options.

✅ Stronger Business Relationships: Suppliers and creditors appreciate timely payments, which can help build trust and lead to better deals and opportunities.

✅ Faster Approval for Future Credit: With a proven record of on-time payments, future credit applications may be processed more quickly, saving you time in the approval process.

Negative Impact of Late or Missed Payments

On the other hand, not paying within the 30-day net terms can harm your business credit. Late or missed payments are warning signs that can seriously lower your credit score. Here’s how late or missed payments can impact you:

✅ Credit Score Falls: Even one late payment can make your credit score drop, sometimes by a lot.

✅ Higher Interest Rates: Lenders may think you’re risky, which could mean you’ll pay more interest on loans in the future.

✅ Less Trust from Suppliers: Suppliers may doubt your ability to pay, which could lead to more stringent payment terms or even refusal to extend credit to you in the future.

What are the Factors That Influence Your Business Credit Score?

Knowing what affects your business credit score is very important!

Business credit scores are different from personal credit scores and are based on specific factors. Here are some of the main things that influence your business credit score:

– Payment History

Just like your personal credit, how your business pays its bills is a key factor in deciding if it’s trustworthy. Paying creditors and suppliers on time regularly helps build a good credit history. Businesses that pay their bills on time are seen as more reliable by lenders and suppliers.

- Impact on Credit Score: A good payment history can greatly improve your credit score. On the other hand, late or missed payments can hurt it.

- Helpful Tip: Keep track of payment deadlines and make sure to pay on time to improve and maintain your credit score.

– Credit Utilization

Credit utilization is the amount of debt you have compared to your total credit limit. If you keep your credit utilization low, it demonstrates that your business doesn’t rely too heavily on credit, which helps improve your credit score.

- Best Ratio: Try to keep your credit usage below 30% to boost your business credit score.

- Helpful Tip: Check your credit limits regularly and manage your spending to maintain a healthy credit usage level.

– Length of Credit History

The length of time your business has used credit is very important for your credit score. A longer credit history usually shows that you have more experience managing credit, which is a good sign for lenders.

- Why it matters: Lenders prefer businesses with a history of handling credit well, as it indicates their experience and stability.

- Helpful Tip: You can’t speed up time, but keeping old credit accounts open can help make your credit history look longer.

– Credit Mix

Having a mix of different types of credit (loans, credit lines, etc.) shows that your business can handle various financial responsibilities.

- Why Variety Helps: Using different forms of credit can boost your score, as long as you manage them properly.

- Helpful Tip: Only take on new types of credit if they fit your business needs and financial plans.

– Company Size and Industry

The size and type of your business can also affect your credit score. Big companies typically have more resources to maintain a good credit rating, while smaller businesses may be perceived as riskier. Also, some industries are considered more stable than others.

- Industry Perception: If your industry is seen as high-risk, you might face more checks or stricter conditions.

- Helpful Tip: Regardless of the size or industry, maintaining accurate financial records and presenting strong growth can enhance how others perceive your business and positively impact your credit score.

How to Access Your Business Credit Report

Checking your business credit report is simpler than you may expect, and it’s an important step to monitor your financial status. Here’s a quick guide to help you get started:

– Pick a Credit Reporting Company

- Business credit reports are created by a few different companies, unlike personal credit reports.

- Some well-known ones include:

- Dun & Bradstreet

- Experian

- Equifax

- It’s a good idea to get reports from all three, as each may provide different details about your business’s credit status.

– Share Your Business Details

- To get these reports, you’ll need to give some basic information about your business, such as:

- Business name

- Business Address

- Employer Identification Number (EIN)

- This helps make sure you’re getting the right report for your company.

– Buy Your Credit Report

- Business credit reports usually aren’t free, but they are a good investment.

- Each company offers different types of reports and subscription plans, so look around to find what works best for your needs and budget.

– Check the Report for Mistakes

- After you get your report, read it carefully.

- Look for any mistakes or incorrect information that could negatively impact your score. If you find any, contact the agency to fix them.

Understanding Your Credit Score and Ratings

Once you have your report, the next step is to understand what it all means.

Business credit scores and ratings might seem complicated at first, but if you break them down, they become easier to understand.

| Credit Score | Provider | Range | What It Measures | What a High Score Means |

| Paydex Score | Dun & Bradstreet | 0 – 100 | Focuses on your payment history. | A score above 80 indicates your business pays on time or early. |

| Intelliscore Plus | Experian | 1 – 100 | Predicts the likelihood of your business falling behind on payments. | A higher score means your business is more trustworthy and less likely to default. |

| Equifax Business Credit Risk Score | Equifax | 101 – 992 | Measures the risk of late payments. | A higher score indicates lower risk and a better financial reputation. |

Tips for Building and Maintaining Good Business Credit

Creating and keeping a strong business credit score doesn’t happen quickly!

Creating and maintaining good business credit with net 30 payment terms requires careful financial management and strategic planning. Here are some helpful tips to guide you toward excellent business credit.

-

Pay Your Bills On Time

Paying your bills on time is crucial for maintaining a strong business credit profile. It clearly reflects that your business is trustworthy and dependable.

Here are some tips to make sure you pay your bills on time:

✅ Set up automatic payments to avoid forgetting to pay.

✅ Write down when payments are due and set reminders so you don’t miss them.

✅ Discuss payment terms with suppliers if you’re experiencing difficulties with cash flow.

-

Keep Your Credit Utilization Low

Another important way to maintain a good business credit score is by managing your credit utilization effectively. This means making sure you don’t borrow too much compared to the credit you have available.

Here’s how you can do this:

✅ Whenever you can, try to pay more than the minimum amount due on your credit cards.

✅ Regularly review your expenses and identify and eliminate any unnecessary costs.

✅ If your credit providers trust your business and view it as low-risk, consider asking for higher credit limits.

-

Monitor Your Credit Report Regularly

Regularly reviewing your credit report helps you stay ahead of potential problems.

Here’s why and how you should do it:

✅ Errors can happen, and they might hurt your credit score. By checking your report regularly, you can correct mistakes promptly.

✅ Looking at your credit report regularly helps you notice any suspicious activity, so you can act fast if something’s wrong.

✅ Being aware of your current credit score means you’re ready if you need to apply for a loan or take advantage of a business opportunity.

✅ Setting reminders or signing up for a credit monitoring service can help you keep track of any changes to your credit report.

-

Diversify Your Credit Mix

Having different types of credit in your business’s credit mix can make your business look more trustworthy to lenders. Think of a diverse credit portfolio like a balanced diet – it shows your business can handle different financial products, which improves your credit profile.

Here’s how you can add variety to your credit:

✅ Combine various credit solutions, such as term loans, lines of credit, and credit cards.

✅ Establish credit relationships with various suppliers or banks to build a more comprehensive credit history.

✅ While unsecured credit is more common, secured credit can sometimes offer better terms and help diversify your credit profile.

Wrapping It Up!

Creating and maintaining good business credit through Net 30 business credit payment terms is a crucial way to ensure your business remains financially healthy.

By learning how these terms work and using them smartly, you can boost your credit score and create new chances for your business. With steady, careful management of your credit, your business can thrive in 2025 and beyond.

FAQs

- What Exactly Is a Net 30 Account for My Business?

A Net 30 account is a type of business credit agreement that allows businesses to purchase goods or services and pay within 30 days, helping with cash flow management and building your business credit.

- Is a Net 30 Account Considered a Line of Credit?

A Net 30 account can be considered a form of credit because it enables a business to purchase goods or services and pay for them within 30 days.

- What Does the Net 30 Timeframe Mean?

The Net 30 timeframe means that payment for goods or services is due 30 days after the invoice is issued, giving businesses time to manage their cash flow before paying.

- How Can I Apply for a Net 30 Account?

To apply for a Net 30 account, choose a vendor offering this payment term, submit your business information (such as your EIN), and request credit. Approval depends on your business’s creditworthiness.

- What Are the Costs Associated with a Net 30 Account?

Net 30 accounts typically don’t have an upfront cost. However, if payments are not made within 30 days, late fees or interest charges may apply.

- How Many Net 30 Accounts Should My Business Have?

Start with 1 or 2 Net 30 accounts to establish your credit. As your business grows, you can expand your relationships with additional vendors to build a stronger credit profile.