Running a business well involves managing your money carefully, and managing cash flow is a big part of that. You might have waited a long time for payments and felt like your cash flow might run out..isn’t it frustrating?

Therefore, Net 30 payment terms can help with this by making your finances smoother. By allowing customers 30 days to pay their bills, you can better manage the money you’re owed and maintain a steady flow of cash.

So, let’s understand the seven reasons why Net 30 could become your go-to payment method.

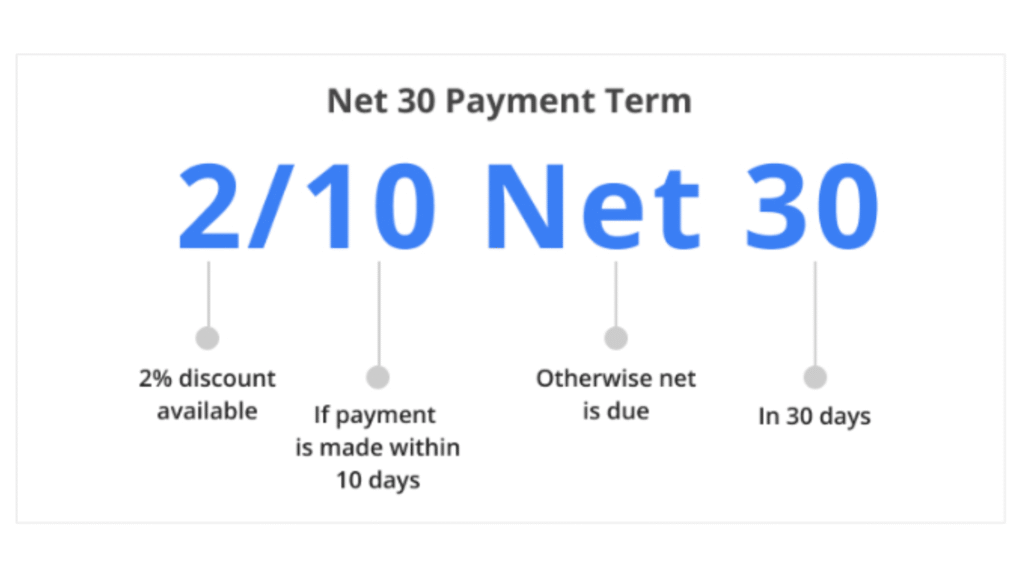

Payment terms are the conditions under which a seller will complete a sale. Typically, these terms specify when the seller will receive funds and when the buyer will receive goods or services. One popular type of payment term is NET30. So what is NET30? Simply put, the term NET30 indicates that the full amount a customer owes is payable within 30 days of the invoice date or goods receipt. In this model:

- The supplier extends credit to the buyer, promoting trust and building strong business-to-business relationships.

- The buyer gains a grace period to manage their finances before disbursing payment.

Advantages of Incorporating NET30 Payment Terms

Let’s delve deeper into these seven advantages that make NET30 Payment Terms an essential tool for your business’s financial success:

Benefit 1: Enhanced Cash Flow Management

The first and perhaps the most palpable advantage of the NET30 term is the enhancement of cash flow management. By extending a 30-day credit period, businesses can better manage their cash inflows and outflows.

This ensures efficient allocation of financial resources, allowing them to pay for investments, expenses, and to cover other commitments without worrying about unforeseen shortfalls. In essence, it grants you a grace period to synchronize your cash cycle.

Benefit 2: Strengthening Supplier Relationships

Value-based relationships are pivotal for a prosperous business. Offering NET30 payment terms reflects mutual trust, respect, and understanding between you and your suppliers. This not only helps in strengthening your existing supplier relationships but also aids in building new ones. After all, having suppliers who are willing to give you 30 days’ credit is indicative of their faith in your business.

Benefit 3: Enhanced Buying Power

What happens when your suppliers have faith in your business? Increased buying power! This is another benefit of incorporating NET30 payment terms. Suppliers are more likely to offer their best prices, and more flexible deals and may even prioritize you over competitors. The increased buying power lets you invest in better products and services, directly influencing your business’s competitiveness and profitability.

Benefit 4: Credit Terms Flexibility

With NET30 terms, businesses have the flexibility to set more accommodating credit terms, depending on their financial situation. These flexible terms can be used to attract and retain clients or to negotiate more favorable deals with suppliers. Such flexibility can support businesses during times of financial stress, resulting in smoother operations.

Benefit 5: Reduced Risk of Bad Debt

Bad debt can be a nightmare for any business. However, with NET30, the chances of encountering bad debt are significantly reduced. This is because the 30-day window allows businesses to scrutinize and verify their clients’ payment behavior, getting a clearer picture of their financial stability, which can assist in assessing their creditworthiness. If a customer habitually defaults or delays, you can take necessary measures to mitigate the risk.

Benefit 6: Overall Business Financial Health

Incorporating NET30 payment terms contributes positively to your overall business health. Beyond improving cash flow and reducing debts, it promotes efficient capital allocation, robust supplier relationships, and sound credit management – all of which are critical for a healthy financial future. By adopting solid practices like NET30, you lay the foundation for sustainable, long-term growth.

Benefit 7: Improved Credibility with Vendors and Suppliers

Last but certainly not least, adopting NET30 payment terms can enhance your business’s credibility. Delivering on your commitments within the agreed timeframe is a genuine reflection of your reliability. This, in turn, increases faith in your operations, making you an attractive buyer to current and potential vendors and suppliers.

Differences between NET30 and Other Credit Terms

| Payment Term | Meaning | Advantages | Disadvantages | Best For |

| Net 10 | Payment is due within 10 days | Seller gets money faster | Less flexible for buyers; may discourage some clients | Businesses needing quick cash flow or working with reliable, fast-paying clients |

| Net 30 | Payment due within 30 days | Balanced option; widely accepted; works well for many businesses | Seller waits longer than Net 10 but not as long as Net 60 | Standard choice for most B2B transactions and long-term partnerships |

| Net 60 | Payment due within 60 days | Buyer gets more time to pay | Seller waits much longer for payment; risk of cash flow issues | Large corporations with strong cash reserves, businesses aiming to attract big clients |

| COD (Cash on Delivery) | Payment is required at the time of product delivery | Seller gets instant payment; no collection risk | May scare off buyers who prefer flexible terms | Small businesses, online sellers, or high-risk transactions where upfront payment security is needed |

How to Successfully Incorporate NET30 Terms in Your Business?

Several variables must be considered when incorporating Net 30 payment terms into your business. A strategic approach might include:

- Evaluating your company’s existing financial structure: A thorough analysis will reveal if it is robust enough to handle late payments without financial strain.

- Ensuring in-depth communication with your vendors: Ensure they’re on board with the NET30 terms and understand the reasoning behind them.

- Investing in reliable software for managing accounts receivable can help streamline payment schedules.

What to Consider When Setting NET30 Terms with Vendors

When negotiating NET30 terms with vendors, there are a few key factors that should be addressed:

- Explicit negotiation: Clearly express the terms and conditions, leaving no room for ambiguity.

- Consider the credibility of the vendors: Completing a vetting process to ensure the vendors’ reliability will reduce the risk of delayed payment.

- Documenting all agreed-upon terms: A properly documented agreement helps avoid future disputes.

By paying attention to these points, adopting the Net 30 payment terms can be beneficial in achieving a steady cash flow.

Conclusion

Using Net 30 payment terms in your business plan can help you manage your finances more effectively. By giving customers 30 days to pay their bills, you ensure they pay on time, avoid late fees, and foster better relationships with them.

- Better control over when you get paid

- Easier planning for your spending

- Optimize your invoicing process

- Happier customers

This approach helps create a more secure financial situation, which supports your business’s future growth and success.