Introduction to Building Business Credit with Net 30 Vendors

Hello, young entrepreneur! Want to take your business game to the next level? Improve your credit score? Well, you have come to the right place.

Learning how to build business credit with Net 30 vendors is essential for setting a strong base for your financial future, and these vendors can be your secret weapon! Net 30 vendors offer an excellent opportunity to enhance your business credit with the flexibility of a 30-day payment term.

In this blog, learn how to harness the power of Net 30 vendor accounts with these simple steps to better business financing. Now, let’s dive in!

Understanding Business Credit

It is quite unimaginable to talk about building a business successfully without giving prominence to the place of business credit.

Business credit, much like personal credit, has to do with influencing your ability to secure financing, negotiate better loan terms, and grow your enterprise sustainably. Let’s explore why business credit is important and then discuss what influences your business credit score.

The Importance of Business Credit for Growth and Sustainability

Business credit is much more than just a number; it is a major resource that can fuel your company’s expansion and ensure longevity. Strong business credit allows you to:

– Access funding: With either a line of credit, a loan, or leasing, businesses having good credit scores often find obtaining finance easier, and at better terms.

– Better Terms of Negotiation: With a good credit profile, you may be able to negotiate lower interest rates or obtain better terms on agreements with suppliers and service providers.

– Protection of Personal Assets: Business credit separates your personal and business finances, reducing the risk to your personal wealth in case your business faces financial troubles.

– It establishes credibility: as many lenders, vendors, and even potential partners will consider a business with good credit more legitimate and reliable.

Key Factors that Influence Business Credit Scores

Just like personal credit, several factors contribute to your business credit score. Understanding these elements can help you maintain or improve your standing with creditors:

Payment History: Timely Payments and Avoiding Defaults

Your good history of making payments is at the heart of a decent credit score. Creditors want to know that you pay bills on time. Late payments, missed payments, or defaults will seriously dent your credit rating. Here is how to keep a stellar payment history:

– Pay Early or On Time: Set reminders or automate your payments so that it’s guaranteed that bills are settled in time.

– Communicate with Creditors: If one is experiencing a cash flow crunch, one should call his creditors before the due date so that one does not miss the payment. Many of them will work out a temporary accommodation if one is proactive.

Credit Utilization: Keeping Debt Levels Manageable

Credit utilization is the amount of credit in use at any time, calculated as a percentage of the total credit available. High credit utilization is often a sign of financial stress and negatively impacts your score. Ways you can keep your utilization rate low include:

– Whittle Down Credit Usage: Spend less than 30% of the credit limit issued to you on any line of credit.

– Paying Down Balances: Pay more than the minimum due each month on credit balances to keep utilization at bay.

– Requesting Credit Line Increases: If used wisely, a higher credit limit will improve your utilization ratio by increasing the total available credit.

Credit History Length: Establishing a Track Record

Your credit history length can considerably affect credit scores. The longer your credit history, the more information is available regarding how you handle debt. For maximum impact, focus on the following:

– Maintaining Old Accounts: Just because you may not actively use every credit account, it is often a good idea to keep them open to preserve your length of credit history.

– Building Relationships Earlier: The earlier one starts building credit, the more time his or her history will have to develop.

Credit Mix: Diversifying Your Credit Sources

Having various types of mixtures of vendor accounts, credit cards, and loans will work to the benefit of your business credit score. This diversity showcases how capable you are at dealing with different obligations related to credit. How to Diversify Credit Sources:

– Seek different types of credit: Mix revolving credit, such as credit cards, with fixed loans, such as installment loans or lease payments.

– Utilize Vendor Accounts: Applying for net 30 accounts can add diversity and power to your profile, so long as they report your payment history to business credit bureaus.

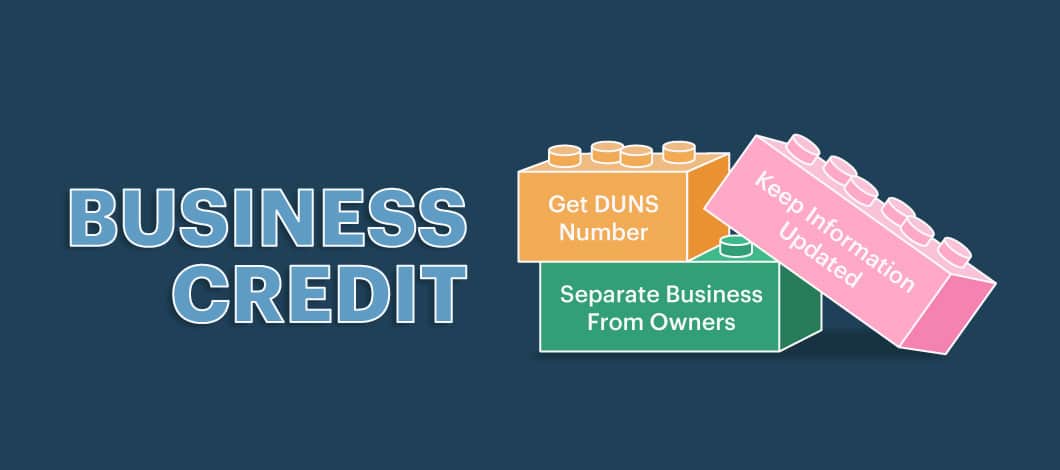

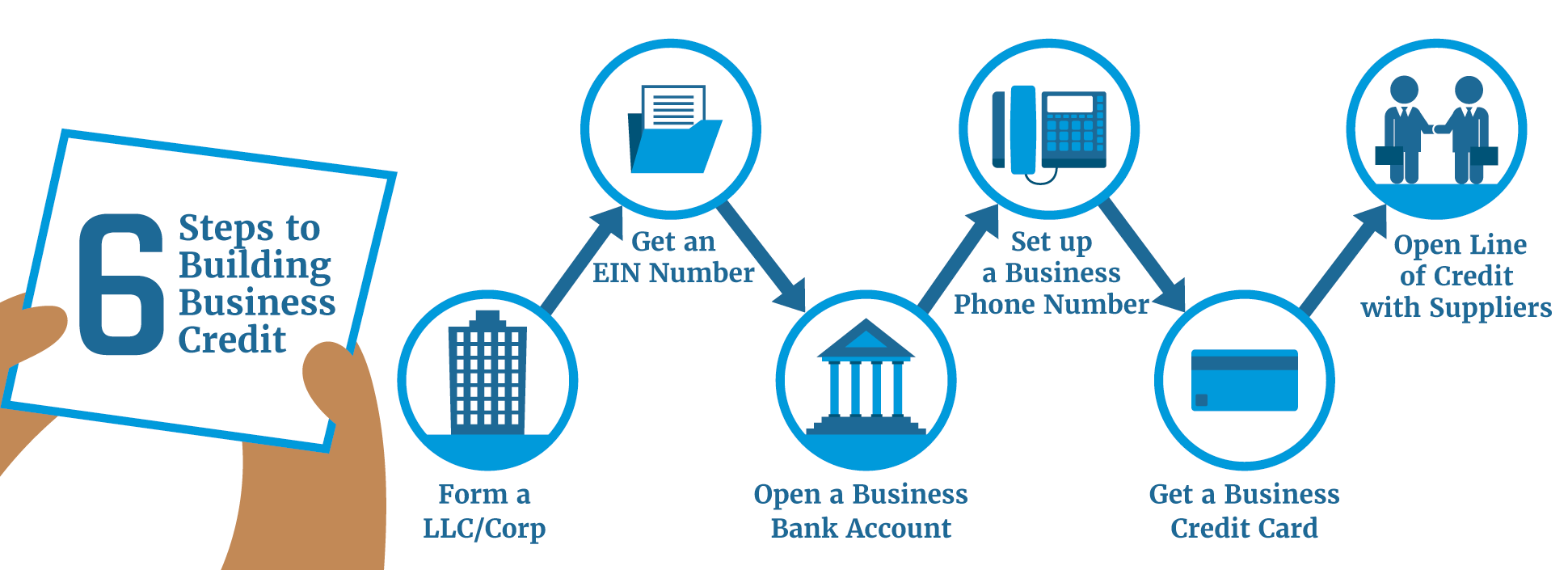

Steps to Establish Business Credit

Now that we understand what influences business credit, let’s look at the steps you can take to build a robust credit profile for your business.

Obtaining an EIN and Registering Your Business

An EIN from the IRS is like a Social Security number for your business. Here’s why it’s important:

Tax Purposes: It’s required for most business tax filings.

Opening Financial Accounts: Required when opening a business bank account or applying for business licenses.

Establishing Business Identity: Helps formally separate your business finances from personal ones.

Take the time to register your business with the appropriate state agencies. This provides official recognition of your operation and lays the groundwork for building business credit.

Opening a Business Bank Account and Maintaining Good Standing

Having a separate business bank account is very important in building business credit and keeping clear records of your finances. Benefits will include, but are not limited to:

– Simplified Accounting: Separates the business and personal transactions for easier bookkeeping.

– Professionalism and Credibility: It shows legitimacy to clients and vendors.

– Access to Financial Products: It makes getting business loans and credit products easier, especially those tied strictly to your business.

Remember to keep this account in good standing by not allowing overdrafts, making regular deposits of working capital, and keeping accounts receivable under control.

Applying for Net 30 Accounts with Reputable Vendors

Mastering Net 30 accounts allows businesses to buy now and pay for the invoice in 30 days, and they are a source of short-term credit. Used responsibly, these accounts are an excellent way to establish business credit:

– Develop Trade References: Find quality vendors that report to business credit bureaus.

– Manage Cash Flow: Balance your purchases so you can reliably meet payment schedules.

– Demonstrating Creditworthiness: Regular, timely payments on net 30 accounts create a history of good credit behavior.

Utilizing Business Credit Cards Responsibly

Business credit card rewards and conveniences are the same as personal cards but with added features applicable to business needs. Here’s how to use them wisely:

– Choose Wisely: Select cards that offer rewards or cash-back programs that benefit your specific business expenses.

– Monitor Usage: Avoid maxing out limits by tracking and minimizing expenses on your cards.

– Pay the full balance on time: Pay your card balances in full each month, as long as you can, since interest fees add up fast.

By showing responsible behavior in using credit cards, you can considerably improve your business credit score.

Monitoring Your Business Credit Reports Regularly

Careful monitoring of your business credit reports ensures they reflect accurate, up-to-date information. This habit can help:

– Identify Discrepancies: Regular checks let you find and fix mistakes before they can affect your creditworthiness.

– Track Progress: Regular monitoring of reports helps you see if your credit-building strategies are working.

– Prepare for Financing: You will be positioning your business for financing when new opportunities open their doors to you.

There are a number of agencies which offer business credit reports you can tap into for information, such as Experian Business, Equifax Small Business, and Dun & Bradstreet.

Building business credit with net 30 vendors and other responsible financial behaviors isn’t just about securing loans or enticing investors; it’s about empowering your business to thrive, adapt, and succeed in the long run. By thoughtfully managing each component of your business credit profile, you’ll build a robust foundation for your company’s growth and sustainability. Happy credit building!

Managing and Maximizing Net 30 Accounts

Once you have established your business credit and have set up net 30 vendor accounts, it is time to manage those accounts for continued growth and financial health for your business. Managing your net 30 accounts requires attention to detail and some proactive strategies that ensure you optimize your credit building. We are going to look at best practices for timely payments, monitoring your credit profile, and scaling vendor accounts below.

Making Timely Payments

Paying your invoices on time helps build and maintains good business credit. That goes hand-in-hand with bettering your credit score and developing trust between you and your vendor. Here are some methods to ensure you never miss the due date:

Set Reminders: Utilize digital tools like calendar applications or project management software to set reminders when due dates are approaching. This habit helps you keep track of multiple invoices with ease.

Automate Payments: Whenever possible, set up automatic payments for your vendor accounts. Automation reduces the chances of missing a payment and is a real time-saver when managing several accounts.

Maintain a Payment Schedule: Invoicing on a regular basis keeps you disciplined. For instance, set aside one particular day each week to make all outstanding payments. This will help manage the work of payments and reduce lots of stress.

Budget Wisely: Always ensure that your business accounts hold enough funds for paying your invoices. Put a tight watch on your cash flow projections and prioritize funds for the payment of due amounts to your vendors.

Communicate with Vendors: If you find yourself in a situation where meeting a payment deadline is going to be difficult, proactively communicate with your vendor. They may extend a grace period or work out a payment plan since they will want to continue to do business with you.

Monitoring Your Credit Profile

Keeping tabs on your business credit profile is an important aspect of managing and maximizing your net 30 accounts. You will be able to monitor discrepancies and understand your current credit standing. Here’s how you monitor your credit profile effectively:

– Review Credit Reports: Obtain your business credit reports from major agencies like Dun & Bradstreet, Experian Business, and Equifax Business. Understand how your payments are being reported to ensure you identify and dispute inaccuracies quickly.

– Check for Errors: Everything from misreported late payments to merged accounts with another business can happen. If you find something wrong, get it corrected as soon as possible with the credit reporting agency, so that it doesn’t affect your credit score over time.

– Understand the Credit Rating Factors: Understand the important factors that decide your business credit score. In this way, you understand how to go ahead and manage debt and expand your vendor relationships intelligently.

– Watch the Important Ratios: Keep a check on credit utilization and debt-to-income ratios for a healthy profile of credit. Low credit utilization usually equates to a better credit score.

– Credit Monitoring: You could invest in credit monitoring software or services. These give real-time alerts whenever there is any change in one’s credit profile. It also sends notifications regarding key updates about newly reported payments or inquiries and helps to stay ahead of possible issues.

Strategies for Scaling Vendor Accounts

As your business grows, scaling your vendor accounts can provide additional resources and financing flexibility. Expanding your list of net 30 vendors strategically can further enhance your business credit. Here are some strategies for scaling effectively:

– Diversify Your Vendors: Choose a variety of vendors across different industries for more robust credit references. A diverse credit profile can demonstrate your business’s stability and reliability to future lenders.

– Better Terms: Once you have had a good track record of timely payments with a vendor, negotiate for better terms, longer payment windows, or discounts.

– Gradual Expansion: Never establish too many vendor accounts at once. Gradually expand as your business grows and as your financial capacity expands. This helps you avoid overextension, which may lead to management problems and can strain your cash flow.

– Develop Strong Relationships with Vendors: to ensure the opportunity for special offers, better terms, and even expanding credit lines over time.

– Vendor Impact: Analyze how each vendor account impacts business operations and financing. Work to expand the relationship that brings a lot of value to the achievement of business goals.

– Stay Informed: Keep abreast of market trends and find new vendors that better suit the changing needs of your business. Being proactive about finding new vendors will help you stay competitive and keep your credit options flexible.

A mix of discipline, strategic planning, and proactive communication will together help you maintain and maximize net 30 accounts. You will be able to pay on time, keep tabs on your credit profile, grow your vendor relations so that ultimately these accounts become a strong helper in business growth and also keep your outlook of credit quite healthy. Through these strategies, these net 30 accounts have the potential of becoming very potent in your armoury of financing your business.

Conclusion

Building business credit using net 30 vendors is one such step that helps you set your business for years to come. Consistently getting goods from such vendors and keeping on time with the repayments-that’s laying a good basis for the credit health of your business, thereby opening doors to possible financing options later.

Remember:

– Whichever vendor you choose, ensure they report to the credit bureaus.

– Keep checking on your credit regularly in order to keep tabs on your progress.

– Pay all bills on time to maintain a good credit profile.

By following these steps, you’re investing in your business’s financial stability and growth. Start today and watch your business credit thrive!