Creating and keeping good business credit is important for any successful company. Just like personal credit, business credit shows how financially healthy and trustworthy a company is. A good way to build and improve this credit is by using net-30 payment terms. These terms let businesses buy what they need now and pay for it later, usually within 30 days. This method helps manage cash flow and shows that the business can pay its bills on time. Here’s how you can use net-30 payment terms to improve your business’s financial health.

Understanding Business Credit

Definition and Importance of Business Credit

In the world of finance, business credit might seem complicated, but it’s actually quite simple. Think of business credit as a report card for your company. It shows how well your business can borrow money and pay it back on time, similar to your personal credit score. The stronger your business credit, the more reliable your business looks to lenders and suppliers.

Why is this important? A good business credit profile can open doors to opportunities that help your business grow. For example, if you need a loan to expand or want to work with suppliers who offer better payment terms, strong business credit can make that happen. It acts as a key, giving your business access to financial tools and services that might not be available to those with weak or no credit history. Additionally, it boosts your business’s reputation, which is especially important in competitive industries.

How Business Credit Differs from Personal Credit

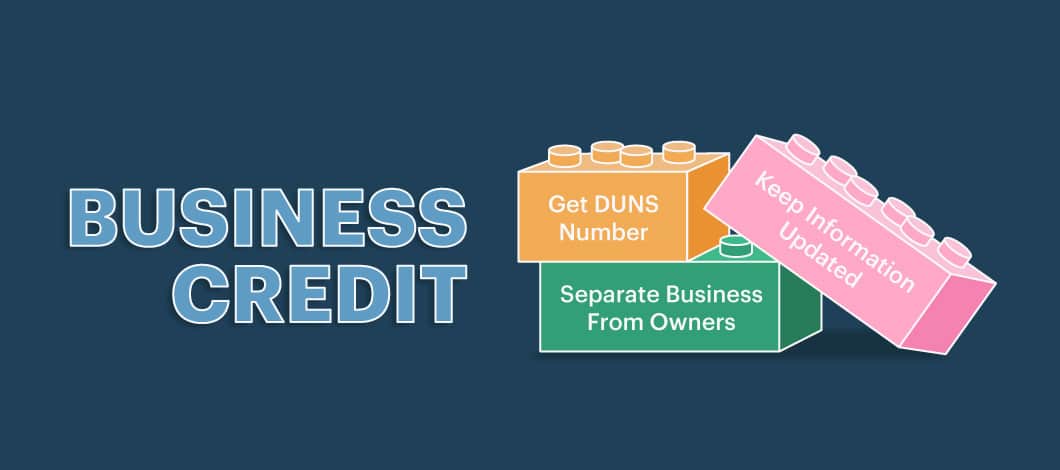

It’s easy to mix up business credit and personal credit, but they are used for different things and work in different ways. Your personal credit shows how you handle borrowing and paying back money as an individual. On the other hand, business credit looks at your company’s finances separately, without considering your personal money habits.

A big difference is that business credit is linked to your business’s Employer Identification Number (EIN), not your Social Security Number. This separation is important because it helps protect your personal finances. If your business has a good credit score, you might be able to get funding without needing to personally guarantee it. This means you’re less personally responsible, and your business can rely on its own financial reputation.

Also, business credit has its own records and reports provided by credit agencies like Dun & Bradstreet, Experian Business, and Equifax Business. These reports might focus more on business-related details, like trade lines and relationships with suppliers, instead of personal borrowing habits.

The Importance of Business Credit

- Accessing Loans and Credit

- Attracting Investors and Partners

- Negotiating Favorable Terms with Suppliers

1. Accessing Loans and Credit

If you’ve ever tried to get a loan or credit, you know that your credit score can make a big difference in whether you’re approved. The same goes for businesses. Having a good business credit score can greatly improve your chances of getting financing. Without a strong business credit score, lenders might see your business as risky, which could lead to higher interest rates or even being turned down.

Building good business credit can also help you get bigger loans. Instead of using your personal credit, which might limit how much you can borrow based on your own finances, business credit lets lenders look at your company’s financial health directly. This could mean access to larger loans, which can help with big investments like buying new equipment, hiring more employees, or expanding to new places.

2. Attracting Investors and Partners

Investors and business partners want to work with companies that not only offer a great product or service but are also in good financial shape. A strong business credit report is a key way to show that your company is reliable and financially stable.

When investors see that your business is a safe bet because you always pay your bills on time and handle your money well, they are more likely to invest in you. Likewise, potential partners will feel more confident working with you if they know your company is financially strong.

Additionally, having excellent business credit can give you an advantage in negotiations. Whether you’re trying to attract new investors or build partnerships, a good credit score can help you get better deals and strengthen your position.

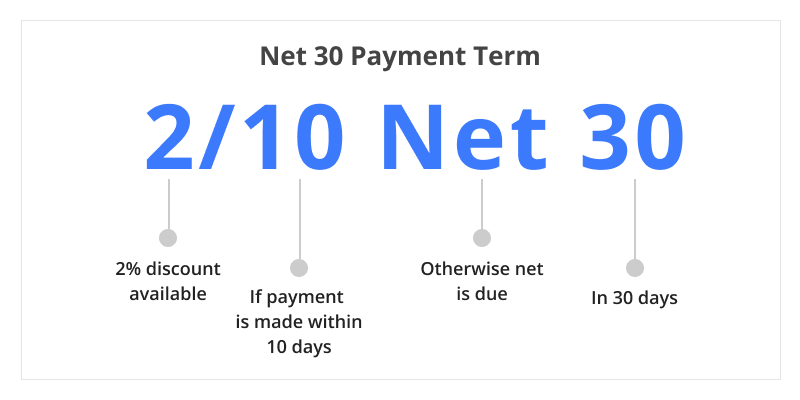

3. Negotiating Favorable Terms with Suppliers

Getting good deals with suppliers can be tricky, but having strong business credit can really help. Suppliers often look at a company’s credit to see if it’s trustworthy before agreeing to payment terms. A good credit score can lead to better payment options, like net-30, net-60, or even net-90 plans, which can be a significant advantage when it comes to leveraging the benefits of Net-30 payment terms. What does this mean? It means you get more time to pay your bills, which can really help your cash flow.

Good payment terms with suppliers give your business time to sell your products or services before you have to pay for the supplies. This extra time is important for keeping your cash flow steady, which is crucial for any business. With better cash flow, your company can spend money on other things like marketing, improving your products, or hiring more people.

Also, keeping a good credit relationship with your suppliers can lead to discounts or special offers that help reduce your costs in the long run. This isn’t just about saving money right now; it’s about making sure your business stays financially healthy for the future.

In short, it’s very important to understand and keep your business credit strong. It’s like the financial foundation that helps your business in many ways, like getting loans, attracting investors, and dealing with suppliers. By working on building and maintaining your business credit, you’re not just making things easier for your business today—you’re also helping it succeed in the future.

How Net-30 Terms Impact Your Business Credit

In the world of business finance, net-30 payment terms can be very important for building your business credit. The concept is straightforward: the seller gives you goods or services, and you, as the buyer, agree to pay the amount due within 30 days. If used correctly, these terms can greatly improve your company’s reputation and financial health. Let’s take a closer look at how this works!

Positive Impact of Timely Payments

Paying your bills on time might seem simple, but it can make a big difference for your business credit. When you regularly pay your bills within the 30-day period, you’re building a good payment history. This not only helps improve your credit score but also shows future lenders and suppliers that you’re reliable and can be trusted.

Here’s how paying on time can help:

– Better Creditworthiness: Paying on time shows your business is dependable, which can lead to better loan terms and conditions.

– Higher Credit Limits: As your credit score improves, lenders may offer you a higher credit limit or more flexible payment options.

– Stronger Business Relationships: Suppliers and creditors appreciate timely payments, which can help build trust and lead to better deals and opportunities.

In short, paying your bills on time can really boost your business credit and open up more opportunities!

Negative Impact of Late or Missed Payments

On the other hand, not paying within the net-30 terms can hurt your business credit. Late or missed payments are warning signs that can seriously lower your credit score. Here’s how they can harm you:

– Credit Score Falls: Even one late payment can make your credit score drop, sometimes by a lot.

– Higher Interest Rates: Lenders may think you’re risky, which could mean you’ll pay more interest on loans in the future.

– Less Trust from Suppliers: Suppliers might doubt your ability to pay, which could lead to tougher payment terms or even refusing to give you credit later.

Sticking to payment deadlines is very important to avoid these problems and protect your business’s financial health.

Factors That Influence Your Business Credit Score

Knowing what affects your business credit score is very important. Business credit scores are different from personal credit scores and are based on specific factors. Here are some of the main things that influence your business credit score:

Payment History

Just like your personal credit, how your business pays its bills is a key factor in deciding if it’s trustworthy. Paying creditors and suppliers on time regularly helps build a good credit history. Businesses that pay their bills on time are seen as more reliable by lenders and suppliers.

– Impact on Credit Score: A good payment history can greatly improve your credit score. On the other hand, late or missed payments can hurt it.

– Advice: Keep track of payment deadlines and make sure to pay on time to improve and maintain your credit score.

Credit Utilization

Credit utilization is the amount of debt you have compared to your total credit limit. If you keep your credit utilization low, it shows that your business doesn’t depend too much on credit, which helps improve your credit score.

– Best Ratio: Try to keep your credit usage below 30% to boost your business credit score.

– Helpful Tip: Check your credit limits often and control your spending to keep your credit usage at a good level.

Length of Credit History

The length of time your business has used credit is very important for your credit score. A longer credit history usually shows that you have more experience managing credit, which is a good sign for lenders.

– Why it matters: Lenders prefer businesses that have a history of handling credit well because it shows they are experienced and stable.

– What you can do: You can’t speed up time, but keeping old credit accounts open can help make your credit history look longer.

Credit Mix

Having different types of credit shows credit rating agencies that you can manage various kinds of credit, like loans and credit lines. A balanced mix of credit can help improve your business credit score by showing that you can handle different credit types responsibly.

– Why Variety Helps: Using different forms of credit can boost your score, as long as you manage them properly.

– How to Add Variety: Only take on new types of credit if they fit your business needs and financial plans.

Company Size and Industry

The size and type of your business can also affect your credit score. Big companies usually have more resources to keep their credit in good shape, while smaller businesses might be seen as riskier. Also, some industries are considered more stable than others.

– Industry Perception: If your industry is seen as high-risk, you might face more checks or stricter conditions.

– Optimization Tip: No matter the size or industry, keeping good financial records and showing strong growth can help improve how others see your business and boost your credit score.

In short, building and keeping strong business credit means understanding and managing these different factors. By paying attention to how you pay bills, how much credit you use, your credit history, the types of credit you have, and the nature of your business, you can set your company up for financial success. Take advantage of net-30 terms and manage your credit wisely, and you’ll see your business credit improve!

Monitoring Your Business Credit Report

It’s really important to regularly check your business credit report if you want to build and keep a strong business credit history, especially if you’re utilizing Net 30 terms. Understanding your credit situation and implementing the best practices for using Net-30 payment terms can help you make smart decisions to improve it and prevent any unexpected problems in the future.

How to Access Your Business Credit Report

Checking your business credit report is simpler than you may expect, and it’s an important step to monitor your financial status. Here’s a quick guide to help you get started:

– Pick a Credit Reporting Company: Business credit reports are created by a few different companies, unlike personal credit reports. Some well-known ones include Dun & Bradstreet, Experian, and Equifax. You might want to get reports from all three, as they can have different details.

– Share Your Business Details: To get these reports, you’ll need to give some basic information about your business, such as your business name, address, and Employer Identification Number (EIN). This helps make sure you’re getting the right report.

– Buy Your Credit Report: Business credit reports usually aren’t free, but they are a good investment. Each company offers different types of reports and subscription plans, so look around to find what works best for your needs and budget.

– Check the Report for Mistakes: After you get your report, read it carefully. Look for any mistakes or wrong information that could hurt your score. If you find any, contact the agency to fix them.

By doing this, you make sure you have a clear and correct understanding of how your business is doing.

Understanding Your Credit Score and Ratings

Once you have your report, the next step is to understand what it all means. Business credit scores and ratings might seem complicated at first, but if you break them down, they become easier to understand.

– Paydex Score: This score, which goes from 0 to 100, is provided by Dun & Bradstreet. It mainly looks at your payment history. A score above 80 means you pay your bills on time or even early.

– Intelliscore Plus: This score, created by Experian, ranges from 1 to 100. It predicts how likely it is that your business will fall behind on payments. A higher score means your business is more trustworthy when it comes to credit.

– Equifax Business Credit Risk Score: This score also predicts the chance of late payments. It ranges from 101 to 992, and higher scores are better.

It’s important to know these ratings because they affect your chances of getting loans, better interest rates, and business partnerships. Your scores show how trustworthy your business is financially, helping lenders and partners make smart choices.

Tips for Building and Maintaining Good Business Credit

Creating and keeping a strong business credit score doesn’t happen quickly. You need a clear plan and a dedication to forming good practices. Here are some helpful tips to guide you toward excellent business credit.

Pay Your Bills On Time

Paying your bills on time is very important for keeping your business credit in good shape. Late payments are a major warning sign for lenders and can hurt your credit score a lot. Here are some tips to make sure you pay your bills on time:

– Use Automatic Payments: Set up automatic payments to avoid forgetting to pay.

– Keep Track of Due Dates: Write down when payments are due and set reminders so you don’t miss them.

– Talk to Suppliers: If you’re having trouble with cash flow, try to work out better payment terms with your suppliers.

Paying bills on time not only helps your credit score but also shows that your business is trustworthy and dependable.

Keep Your Credit Utilization Low

Another important way to keep your business credit in good shape is by managing how much credit you use. This means making sure you don’t borrow too much compared to the credit you have available. Here’s how you can do this:

– Watch and Control Spending: Keep an eye on your expenses regularly and reduce any unnecessary costs when you can.

– Ask for Higher Credit Limits: If your credit providers trust your business and see it as low-risk, they might increase your credit limits. This can help lower your credit usage, as long as you don’t spend more just because you have more credit available.

– Pay Off Your Balances Completely: Whenever you can, try to pay more than the minimum amount due on your credit cards.

Keeping your credit usage low shows lenders that your business handles credit well, which is key to improving your credit score.

Monitor Your Credit Report Regularly

Keeping an eye on your credit report regularly helps you stay ahead of any possible problems. Here’s why and how you should do it:

– Find Mistakes Quickly: Errors can happen, and they might hurt your credit score. By checking your report often, you can fix mistakes right away.

– Spot Fraud Early: Looking at your credit report regularly helps you notice any suspicious activity, so you can act fast if something’s wrong.

– Know Your Credit Score: Being aware of your current credit score means you’re ready if you need to apply for a loan or take advantage of a business opportunity.

Setting reminders or signing up for a credit monitoring service can help you keep track of any changes to your credit report.

Diversify Your Credit Mix

Having different types of credit in your business’s credit mix can make your business look more trustworthy to lenders. A mix of credit shows that your business can manage various credit types well. Here’s how you can add variety to your credit:

– Use Different Credit Options: Combine different credit solutions like term loans, lines of credit, and credit cards.

– Work with Multiple Lenders: Build credit relationships with different suppliers or banks to create a broader credit history.

– Mix Secured and Unsecured Credit: While unsecured credit is more common, secured credit can sometimes offer better terms and help diversify your credit profile.

Think of a diverse credit portfolio like a balanced diet – it shows your business can handle different financial products, which improves your credit profile.

In short, creating and keeping good business credit with net-30 payment terms requires careful money management and smart planning. By regularly checking your credit, paying bills on time, using only a small part of your available credit, and having different types of credit, your business can have a strong credit profile. This helps you reach your current financial goals and sets you up for long-term business success.

Conclusion

Creating and keeping good business credit using net-30 payment terms is an important way to make sure your business stays financially healthy. By learning how these terms work and using them smartly, you can boost your credit score and create new chances for your business.

– Better Relationships: Paying on time helps build trust with suppliers.

– More Cash Flow: Managing credit well gives you more money to grow your business.

– Easier Access to Loans: A good credit score can help you get better loan deals.

By being steady and careful with your credit, your business can grow and succeed with confidence.