Offering Net-30 payment terms, which allow customers 30 days to pay their bills, can be a great way to increase sales and build better relationships with customers. However, giving customers credit also comes with risks, especially the chance of late payments affecting your cash flow.

To use Net-30 terms successfully, you need to plan carefully and have a clear process in place to get the most benefits while reducing the risks. This detailed guide will take you through every important step, from checking if your business is financially ready and setting up credit rules to managing invoices and dealing with late payments effectively.

By following this step-by-step plan, you can confidently implement Net-30 payment terms, attract more customers, and build long-term loyalty while keeping your cash flow strong.

Understanding How to Implement Net-30 Payment Terms

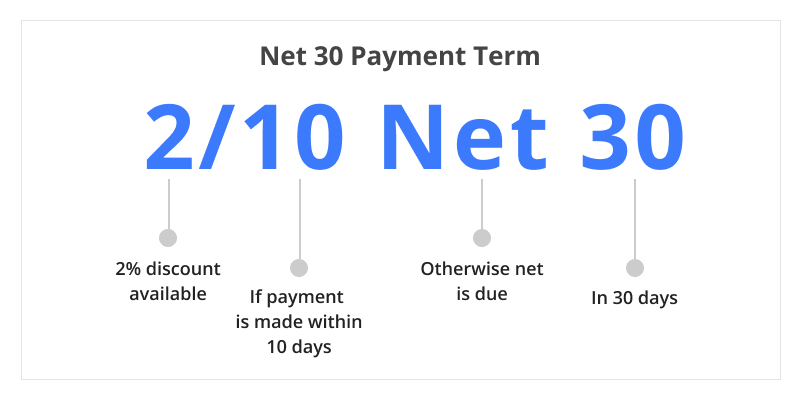

Net-30 payment terms are a standard way of billing in business, giving customers 30 days to pay after they get an invoice. It’s basically a credit agreement that can help build good relationships with clients by giving them some financial breathing room. The term “Net-30” usually means:

– Net: The full amount that needs to be paid.

– 30: The number of days the customer has to make the payment.

Using Net-30 terms helps businesses handle their cash flow better while allowing clients to organize their money without feeling rushed to pay right away.

Communicating Net-30 Terms to Customers

It’s very important to explain your payment terms in a simple way to make sure transactions go smoothly and payments are made on time. Your clients and customers should easily understand what Net-30 means and how it impacts their dealings with you. Here’s how you can do that:

Clear and Concise Language on Invoices

When you’re setting up Net-30 payment terms, your invoice needs to be clear and straightforward. Using simple and direct language on your invoices helps avoid any misunderstandings about when payment is expected.

– Show the Due Date Clearly: Make sure the payment due date stands out on the invoice. You can write something like “Payment Due 30 Days from Invoice Date” or specify a date, such as “Payment Due by November 30, 2023,” to make it easy for the customer to understand.

– Explain Net-30 Terms: Add a short note explaining what Net-30 means, like “Net-30: Payment is due 30 days after the invoice date.” This is especially useful for clients who may not be familiar with business payment terms.

– Add Your Contact Info: Make sure your contact details are easy to find on the invoice. This way, if the customer has any questions, they can quickly get in touch with you for clarification.

Setting Expectations Upfront

Setting clear expectations from the start is key to keeping client relationships strong and making sure payment rules are followed.

– Talk About It Early: When you’re finalizing a service agreement or project contract, make sure to discuss payment terms. Explain why sticking to Net-30 terms is important to keep cash flow smooth for both sides.

– Put It in Writing: Include the payment details in your contracts or agreements. Make sure both parties sign or verbally agree to these terms to avoid any issues later.

– Send Friendly Reminders: As the payment deadline gets closer, send polite reminders. Automated reminders can be especially useful for clients who might forget, so the invoice doesn’t get overlooked.

Negotiating Net-30 Terms with Suppliers

Running a business often involves managing relationships with both customers and suppliers. Getting good Net-30 payment terms from suppliers can help improve your cash flow and build stronger partnerships. Let’s look at how to handle this effectively.

Strategies for Reaching Mutually Beneficial Agreements

Negotiations don’t have to feel like a fight. When done thoughtfully, they can turn into teamwork where both sides end up happy.

– Understand What the Supplier Needs: Take time to learn about your supplier’s financial situation and any challenges they face. This can help you suggest terms that work for them while still helping your business.

– Focus on Building a Long-term Relationship: Show that you’re in it for the long haul. Suppliers value customers who provide consistent business, and this can lead to more flexible payment options, like Net-30.

– Show You’re Reliable: Prove that you’re trustworthy. Share your track record of paying on time or provide references to reassure the supplier that you’re dependable.

– Be Flexible: Stay open to different ideas. If Net-30 isn’t an option at first, consider other solutions like discounts for early payments or paying in batches, which might work better for the supplier.

Building Strong Supplier Relationships

Having a good relationship with your suppliers is key to running a successful business. Here’s how you can build and maintain these important connections:

– Stay in Touch: Keep talking to your suppliers regularly, not just when there’s a problem. Regular updates and check-ins can build trust and make it easier to work together.

– Say Thank You: A small gesture of thanks can make a big difference. Whether it’s a simple note or recognizing their contribution to your business, showing appreciation can strengthen your relationship.

– Share Your Thoughts: Give helpful feedback to your suppliers. By sharing your ideas and suggestions, you can help them improve and meet your needs better, which makes your partnership stronger.

– Meet in Person: Go to industry events where you can meet your suppliers face-to-face. Personal meetings can create a stronger connection than just emails or phone calls.

When done correctly, using Net-30 payment terms can help balance your business finances and improve relationships with both customers and suppliers. Clear communication and smart negotiations are essential. By building a solid foundation, you’ll create stronger partnerships and a healthier cash flow system.

Managing Net-30 Accounts

Using Net-30 payment terms is a great way to improve your business’s cash flow, but it needs careful management to work well. To keep your Net-30 accounts in order, you need a good plan that combines accurate tracking with the use of modern tools. So, get ready and let’s look at how to handle your Net-30 accounts the right way.

Tracking Payments and Deadlines

The most important thing when handling your Net-30 accounts is keeping track of payments and deadlines. When you use Net-30 terms, you’re giving your clients 30 days to pay for what they’ve bought. While this seems simple, it can get confusing to remember who owes what and when if you don’t manage it well. Here’s how to stay organized:

– Create a System: Use a spreadsheet or a calendar app to record each invoice, the date it was sent, and when it’s due. This overview will help you stay on track.

– Set Up Payment Reminders: Schedule reminders for when payments are due. Sending a friendly reminder a week before and on the due date can help your clients remember and keep your cash flow steady.

– Watch Payment Habits: Notice how your clients pay. Some might always pay on time, while others might often pay late. Spotting these patterns can help you deal with problems before they get worse.

– Act Fast on Missed Payments: Contact the client right away if they miss a payment deadline. The sooner you reach out, the faster you can fix the problem and remind them of the importance of keeping to the agreed terms.

By keeping a close eye on payments and staying in touch with your clients, you stay in control of your money and can make smart choices to keep your business financially strong.

Utilizing Accounting Software for Efficiency

In today’s tech-driven world, using accounting software can completely change how you handle Net-30 accounts. This type of software makes tracking easier and automates many tasks that used to be done by hand, saving you time and cutting down on mistakes. Here’s how accounting software can help you work more efficiently:

– Automatic Invoicing: Many accounting tools can send invoices automatically, so you never forget to bill your clients. You can even set up invoices to go out regularly without needing to do it manually.

– Instant Payment Updates: These systems give you real-time information on when clients pay. You’ll know right away when a payment comes in, helping you plan your finances better.

– Easy Financial Reports: With built-in analytics, you can create reports that show payment patterns, unpaid invoices, and cash flow trends with just a click. This information helps you make smarter financial decisions and plan for the future.

– Third-Party Integrations: Most accounting software can connect with other tools, like CRM systems and payment platforms, to make the client billing process smoother and faster.

Choosing the right accounting software can reduce the hassle of managing Net-30 accounts and help you implement the best practices for using Net-30 payment terms. This allows you to focus on growing your business while keeping your invoicing and credit terms in order. With better organization, you can maintain a steady cash flow and optimize your payment policies, making everything much easier to handle.

Conclusion

Using Net-30 payment terms can really help your business. To maximize the benefits, it’s important to know how to implement Net-30 payment terms effectively. By giving your clients more time to pay, you build stronger relationships and handle your money better.

Make sure to:

– Explain your payment rules clearly.

– Send invoices on time.

– Keep track of your accounts.

If you follow these steps, your business will run more smoothly, and your clients will be happier. The secret is to stick to your payment rules—if you do, you’ll see good results!

![How to Implement Net-30 Payment Terms [A Complete Guide]](https://theceocreative.com/wp-content/uploads/2024/12/How-to-Implement-Net-30-Payment-Terms-A-Step-by-Step-Guide.jpg)